If you’re an S corporation owner, you need to run payroll for yourself. Part of S Corp ownership is listing yourself as an employee to pay yourself a salary. But, how do you run S Corp payroll? And, what do you need to know about the process before you write yourself your first paycheck?

What is an S Corp?

Before discussing how to run payroll for an S Corp owner, let’s briefly recap what an S Corp is. An S corporation is a business that has the benefits of a typical corporation business structure—without double taxation. Shareholders pay income taxes on their earnings, but the business itself does not pay income tax.

Unlike salaries, shareholder distributions are not subject to FICA tax. So, the business itself also does not pay Social Security and Medicare taxes on the distributions given to shareholders.

But, members of the S Corp cannot legally receive all of their income from the business as distributions if they perform work for the company. All shareholders who work for the business must receive a salary because the IRS considers them employees.

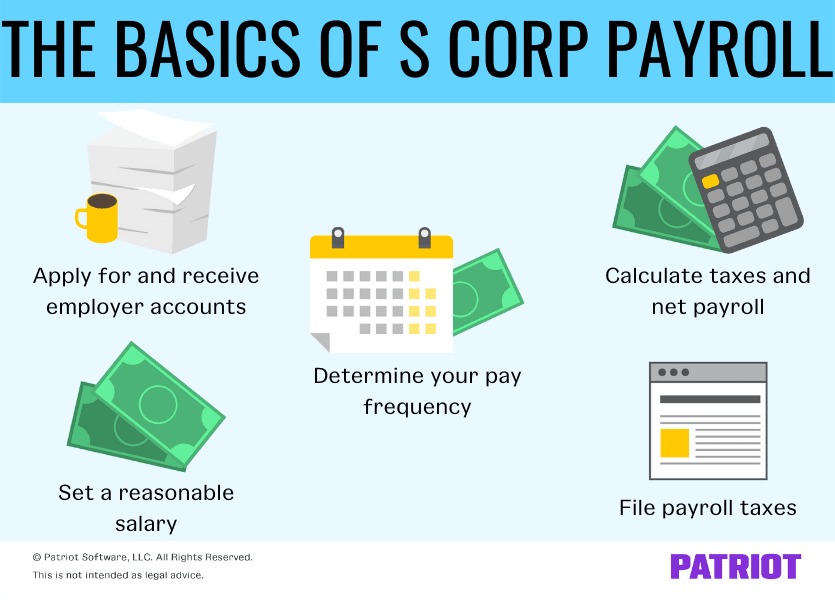

The basics of single owner S Corp payroll

Now that you know why shareholders must receive a salary from an S Corp, let’s take a look at how to pay working shareholder owners a salary and S Corp payroll requirements. Payroll for S Corp owner is very similar to how other businesses process payroll for standard employees.

1. Apply for and receive employer accounts

Before running S Corp owner payroll, owners must apply for and receive Employer Identification Numbers (EINs) and other employer accounts.

Before processing payroll for the shareholder:

- Apply for a Federal Employer Identification Number (FEIN)

- Register with the state for a state tax ID and unemployment insurance account

- Get an Electronic Federal Tax Payment System (EFTPS) account

- Find and set up workers’ compensation*

- Create a new hire reporting account

*Check with your state to determine if you must purchase a workers’ compensation policy if your business has only one employee.

2. Set a reasonable salary

The IRS requires S Corps to pay shareholders a reasonable wage amount for work performed for the business. The wages are separate from the amount of distributions, dividends, and other compensation shareholders receive.

How do you determine a reasonable salary for yourself or other shareholder-employees? Research what comparable companies pay their employees. To compare salaries, look at:

- Physical location

- Work performed

- Industry

- Business size

The Bureau of Labor Statistics (BLS) website reports wage data by area and occupation for business owners to use. And, you can search for similar businesses using your North American Industry Classification System (NAICS) code to search wage data for your specific industry.

Remember that the wages paid to employees must be for services performed for the business. So, shareholder-employees must receive reasonable compensation in the form of taxable wages for all work.

Do not include dividends, disbursements, or other forms of compensation in the shareholder’s salary (we’ll get to that later).

For more information on reasonable compensation, consult the IRS website.

3. Determine your pay frequency

Standard employees must receive wages on a consistent basis. And, so must shareholder-employees. But, employers must pay standard employees according to the state pay frequency laws where the employee works. Pay frequency laws tend to require more frequent pay periods for employees.

Shareholders, however, generally have more leniency with their pay frequency for their wages. For example, many S corporations pay shareholder wages annually, but you may choose to pay wages more frequently (e.g., quarterly) for tax reporting purposes.

According to Anthony Martin, CEO and Founder of Choice Mutual, pay frequency ties in with making sure you pay yourself enough, saying:

The frequency of S Corp payroll can be more flexible, especially when you’re the only owner. It can vary—some pay themselves once a week, while others extend it to once a year. You can change up how much to pay yourself since you have the option to use a big end-of-year bonus that can help you meet your reasonable salary amount (deemed by the IRS).

But, make sure you’re paying yourself an amount that resembles what others in similar industries, education, and work experiences are getting paid to comply with the IRS’ stipulation that you must pay yourself a reasonable amount. It can protect you from paying yourself too low.”

Check with your state before setting a pay frequency to ensure you remain compliant with state pay frequency laws.

4. Calculate taxes and net payroll

Like with payroll for standard employees, S Corps must calculate and deduct the following from an employee owner’s wages:

- Federal income tax

- Social Security tax

- Medicare State

- State income tax, if applicable

- Local taxes, if applicable

- State unemployment insurance, if applicable

And, the business must calculate and contribute employer taxes, including:

- Federal unemployment tax

- State unemployment tax

- Social Security tax

- Medicare tax

As a reminder, Social Security is 6.2% of an employee’s gross taxable wages paid by both the employer and employee. Medicare is 1.45% of gross taxable wages paid by both the employer and employee. Use Publication 15-T to determine the amount of federal income tax to withhold.

Consider using payroll software to calculate S Corp payroll taxes. The software automatically calculates FICA and federal income taxes based on the pay frequency entered.

5. File payroll taxes

Because shareholders are employees if they perform work for the business, S Corps must prepare and file payroll taxes.

Quarterly tax forms include:

- Form 941, Employer’s Quarterly Federal Tax Return

- State unemployment tax forms

- State income tax forms

And, the shareholder-employee may need to file Form 1040-ES, Estimated Tax for Individuals, to report estimated taxes on additional income not subject to income tax withholding.

Annual tax forms include:

- Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return

- Form 944, Employer’s Annual Federal Tax Return (in place of Form 941, if applicable)

The business must also prepare and distribute Form W-2, Wage and Tax Statement, to all shareholder-employees by January 31. And, file Form W-3, Transmittal of Wage and Tax Statements, to the Social Security Administration (SSA) by January 31 with copies of all Forms W-2.

Nonpayroll wages for S Corps

After setting the salary for shareholder-employees, S Corps also pay other forms of compensation to shareholders. Typically, S Corps refer to these forms of compensation as owners’ draws. But, the term “owner’s draw” encompasses different types of compensation, including:

- Dividends

- Disbursements

- Other forms of compensation in lieu of wages (e.g., housing allowance)

These forms of compensation are not subject to FICA tax because shareholders must pay tax on the funds themselves. Therefore, do not include these forms of payment in payroll for shareholder wages. And, do not include these payments on the shareholder’s Form W-2.

Instead, shareholders report all other forms of compensation on their annual Schedule K-1 (Form 1120-S), Shareholder’s Share of Income, Deduction, Credits, etc.