As an employer, you’re in charge of paying your employees … and handling those pesky employment taxes. One of the taxes you need to calculate and withhold is a payroll tax known as FICA. What is FICA tax?

What is FICA tax?

FICA is a mandatory payroll tax equally split between employees and employers. Unlike federal income tax, FICA tax is a percentage of each employee’s taxable wages. It consists of two types of taxes: Social Security and Medicare. Part of the FICA percentage goes toward Social Security and the other part goes toward Medicare.

If you’re wondering What does FICA stand for?, it is short for Federal Insurance Contributions Act. But, what does insurance have to do with Social Security and Medicare?

Both Social Security and Medicare taxes are “insurance” taxes. Social Security includes the old-age, survivors, and disability insurance taxes. Medicare includes hospital insurance tax.

When you collect FICA tax from employees and pay the employer portion, you’re contributing to the Social Security and Medicare programs. These programs distribute benefits to eligible individuals who have paid into them, just like any other insurance program would.

How much is FICA tax?

Employers and employees each pay the FICA tax rate of 7.65%, which goes toward Social Security and Medicare taxes. Again, this rate is applied to each employee’s taxable wages. All in all, the IRS receives 15.3% on each employee’s wages for FICA tax.

You withhold 7.65% of each employee’s wages each pay period. And, you contribute a matching 7.65% for the employer portion.

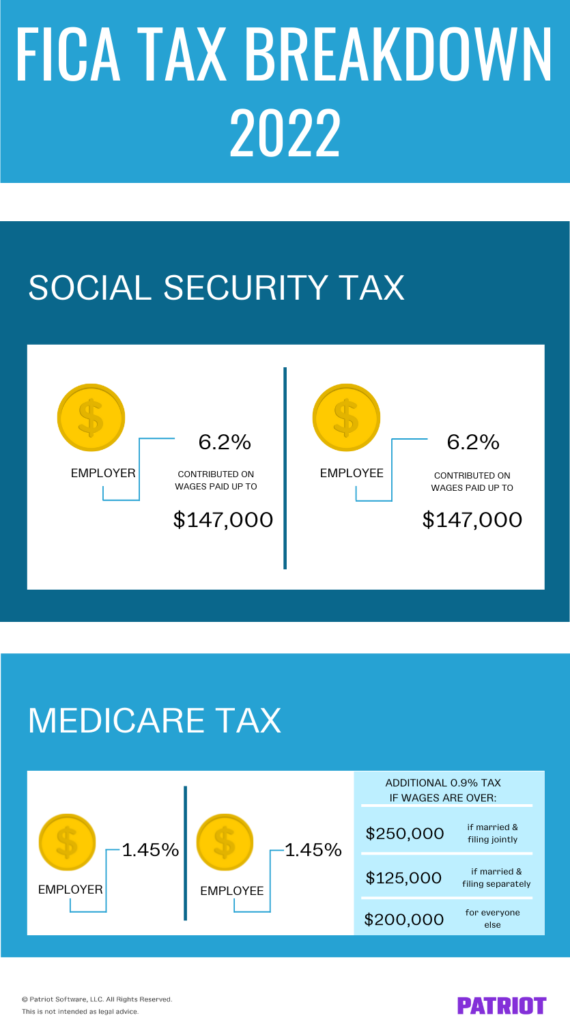

Of this FICA tax amount of 7.65%, 6.2% goes toward Social Security tax and 1.45% goes toward Medicare tax.

Take a look at the breakdown of FICA tax:

- Employee: 6.2% Social Security / 1.45% Medicare

- Employer: 6.2% Social Security / 1.45% Medicare

Social Security

Again, Social Security is 6.2% of an employee’s taxable wages. This rate provides funding aid for retirement, the disabled, and survivors of a deceased worker.

Let’s say you pay an employee $1,000 per pay period. Out of that paycheck, $62 goes toward Social Security tax ($1,000 X 0.062). You also contribute $62 for the employer portion.

The Social Security employee-employer tax isn’t infinite. There’s a Social Security wage base. If an employee earns above the wage base, stop withholding and contributing the 6.2% Social Security portion of FICA tax.

For 2022, the wage base is $147,000. If you accidentally withhold Social Security tax past the wage base limit, refund your employee(s).

Medicare

Withhold 1.45% of an employee’s taxable wages for Medicare and contribute a matching 1.45%. Medicare tax provides aid for things like healthcare and hospice care.

For example, you would withhold $14.50 for Medicare tax from an employee’s wages if they earn $1,000 per pay period ($1,000 X 0.0145). And, you would contribute $14.50 for the matching employer portion.

Unlike Social Security, there is no wage base limit for Medicare tax. In fact, there’s an additional Medicare tax. The wage for this additional amount depends on the employee’s filing status:

- Single: $200,000

- Married filing jointly: $250,000

- Married filing separately: $125,000

The additional Medicare tax is 0.9% of an employee’s wages. If an employee’s wages are subject to the additional Medicare tax, withhold 2.35% (1.45% + 0.9%).

You do not need to match the additional Medicare tax. It is only for employees. But, you must keep paying the matching 1.45% portion.

FICA tax example

Let’s say you have three employees who all earn below the Social Security wage base and additional Medicare tax thresholds.

Use the table below to see how much you must withhold and contribute each pay period. And, take a look at your total tax deposit amount.

| Employees | Employee A | Employee B | Employee C |

| Taxable Wages Per Period | $1,000 | $2,000 | $2,200 |

| Social Security Tax – Employee (6.2%) | $62 | $124 | $136.40 |

| Medicare Tax – Employee (1.45%) | $14.50 | $29 | $31.90 |

| Social Security Tax – Employer (6.2%) | $62 | $124 | $136.40 |

| Medicare Tax – Employer (1.45%) | $14.50 | $29 | $31.90 |

| Total FICA Taxes to Deposit | $153 | $306 | $336.60 |

How to pay FICA payroll tax

After withholding FICA tax from employee wages and contributing the employer portion, it’s time to send it to the IRS.

Deposit and report the amounts before your employment tax due dates, which depend on what type of depositor you are. Employers are either monthly or semiweekly depositors.

Your depositing schedule depends on the total tax liability you reported during a four-quarter lookback period. Determine your depositing schedule annually before the beginning of each year.

Deposit FICA taxes along with federal income taxes. Deposit all employment taxes using the IRS’s Electronic Federal Tax Payment System (EFTPS). If you use a Full Service payroll, they will deposit the taxes on your behalf.

In addition to depositing FICA tax, you must report it on Form 941 or Form 944. What’s the difference between Form 941 vs. 944? Form 941 is a quarterly tax return form whereas Form 944 is an annual form. Only use Form 944 if the IRS tells you to.

FICA tax exemptions

Most people must pay Social Security and Medicare taxes. With most types of compensation, you are required to withhold FICA tax.

But, there are some instances where compensation is exempt from FICA tax. Here are some examples:

- Partner: Payments to general or limited partners of a partnership

- Retirement and pension plans: Employer contributions to a qualified plan

- Statutory nonemployees: Salespeople (e.g., direct sellers and qualified real estate agents) with a statutory nonemployee status

- Students: Some payments to students who are enrolled and regularly attending classes and performing services for qualifying schools

- Tips: Tip income of less than $20 per month

- Some nonresident aliens: Consult the IRS for a complete list of exempt nonresident aliens

For more information on FICA tax exemption, check out IRS Publication 15.

FICA vs. self-employment tax

Unless your business is incorporated, you pay self-employment tax on your wages instead of FICA tax. Self-employment tax is made up of Social Security and Medicare taxes, just like FICA.

The self-employment tax rate is equal to the total FICA amount that’s split between employers and employees.

Self-employment tax is 15.3% of your earnings. Social Security tax is 12.4%, and 2.9% goes to Medicare tax.

Like with FICA, the Social Security wage base and additional Medicare tax apply to self-employment tax.

Need help calculating FICA tax? With Patriot Software’s online payroll, you can put your calculator away. Run payroll with our easy three-step process, get free USA-based setup and support, and more. Try it for free today!

This article has been updated from its original publish date of May 15, 2012.

This is not intended as legal advice; for more information, please click here.