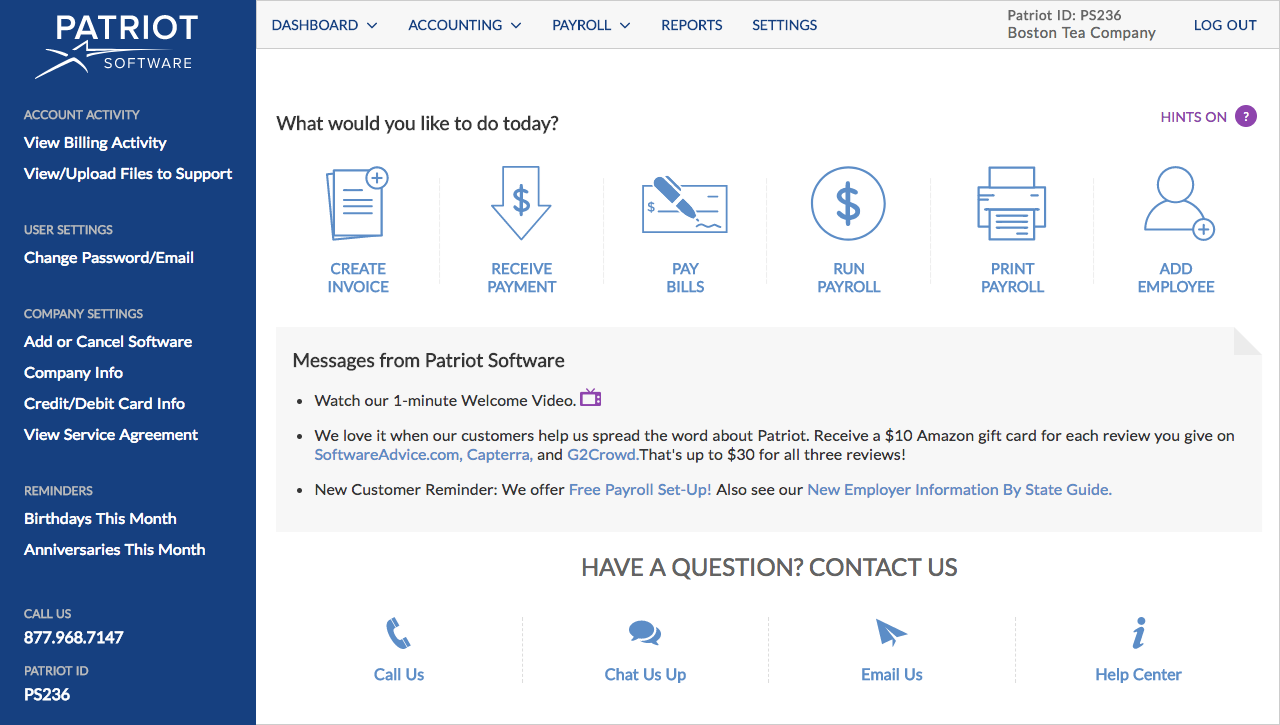

Payment Account Dropdown

October 13, 2022What do you get when you add a Payment Account dropdown to the Enter & Pay Bills page? Happy accounting software customers. OK, so maybe it’s not the most memorable riddle. But the time you save with our new enhancement could be. Our new dropdown lets you select the account you want to pay a bill from—all without having to leave the page.

Read More

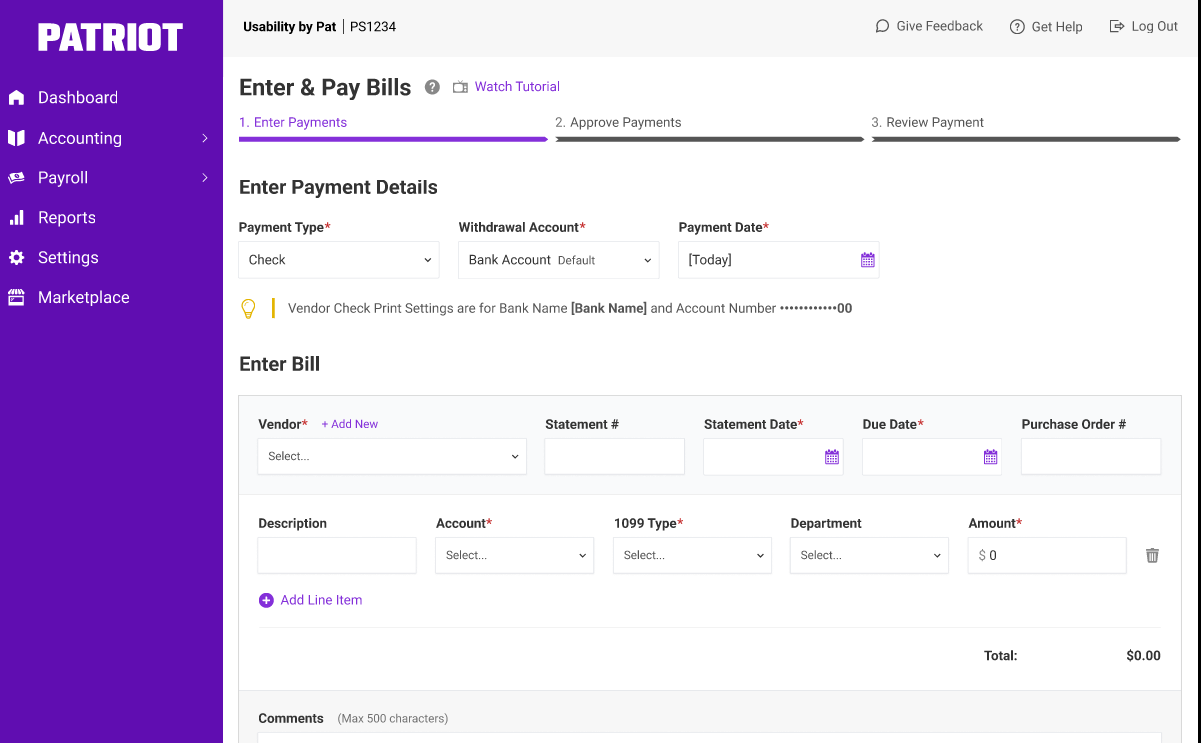

Deposit Account Dropdown

October 7, 2022You made the sale. You’ve gotten paid. And now, you’re recording it in your books. Shouldn’t recording it be the easiest part? We think so. And thanks to our new Deposit Account dropdown, it is. Our new dropdown lets you select the account your payments get deposited to. No more having to go to your settings to make the change—you can do it directly on the Customer Payment page! Fewer clicks = more time saved.

Read More

Retirement Plan Integration

October 4, 2022Everyone dreams of living life in their golden years—including your employees. But without a retirement plan, those golden years may be a little, well, less golden. That’s why we’re excited to announce that our integration with Vestwell, Patriot’s 401(k) partner, is now live in the software! Payroll customers can enjoy exclusive pricing and easy integration with Patriot and Vestwell. And, you may be eligible for tax credits that can almost entirely offset the cost of a new 401(k) plan. A win for you and your employees! Don’t wait to get started with Vestwell!

Read More

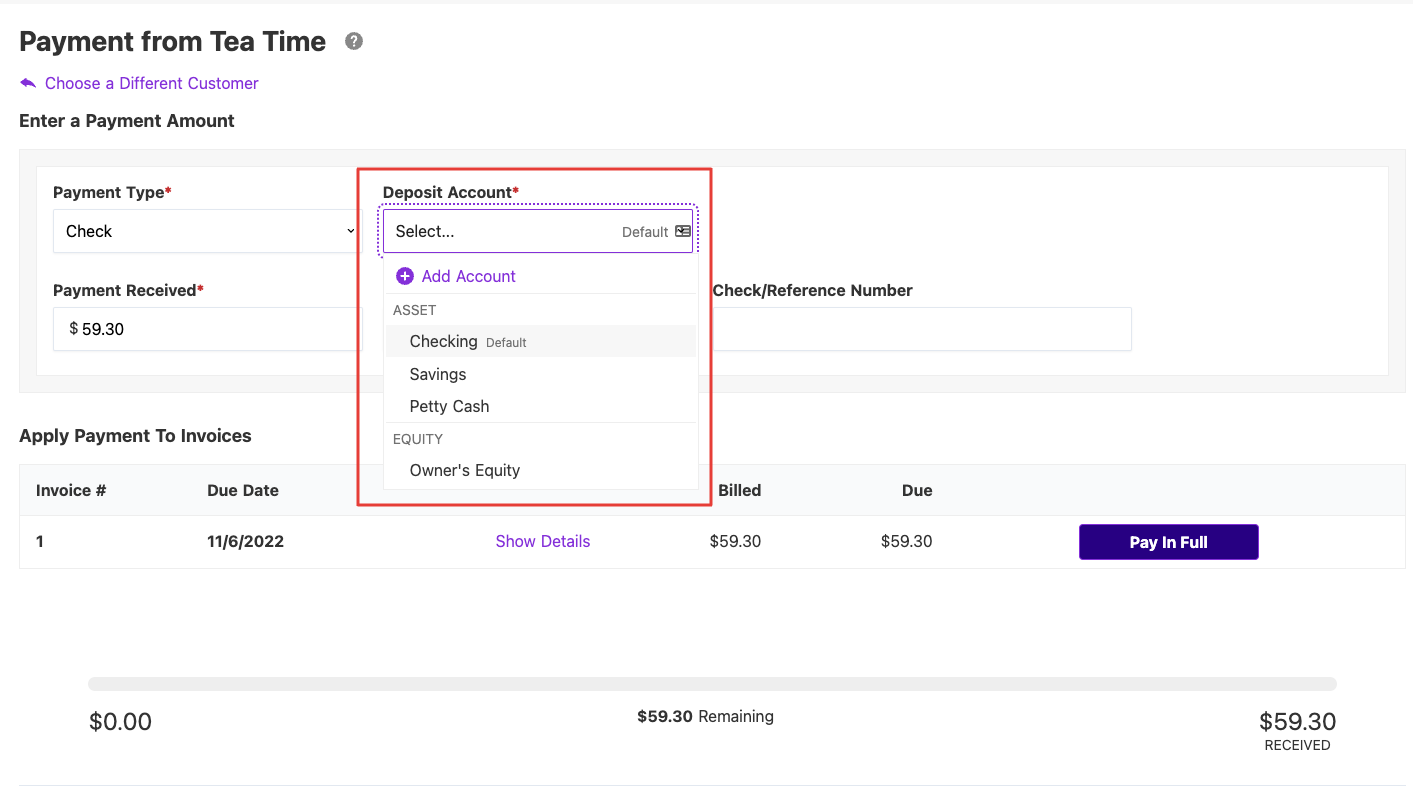

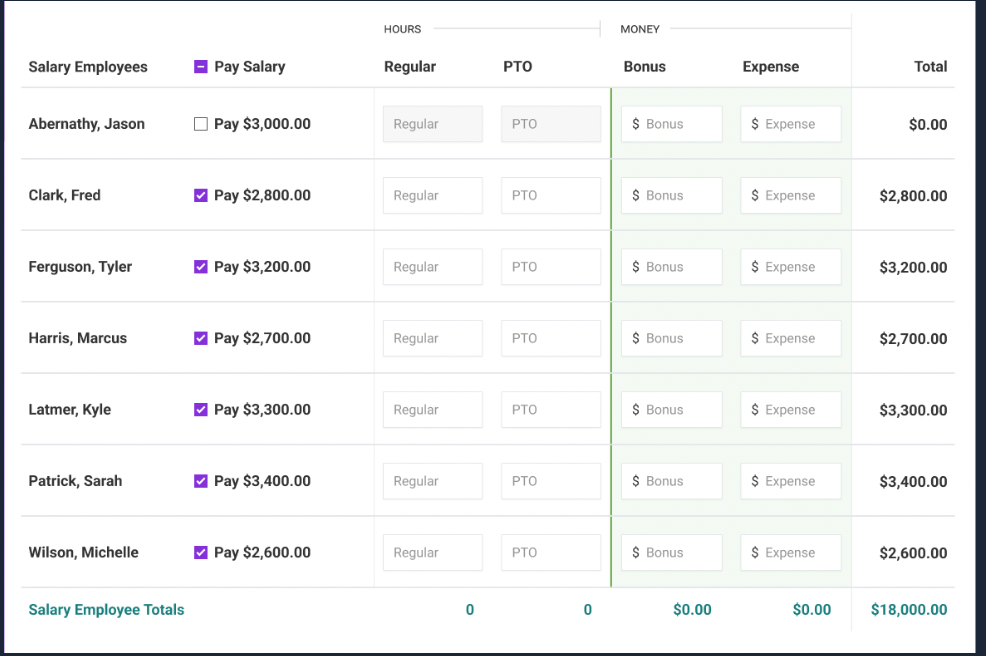

Select/Deselect All for Salary Employees

October 3, 2022Our payroll customers spend an average of three minutes running payroll (hooray!). But—we wondered—what can we do to make it even less? Enhance our selection controls when running a payroll? Precisely. Now, our customers can select and deselect salary employees to pay with just one click.

Read More

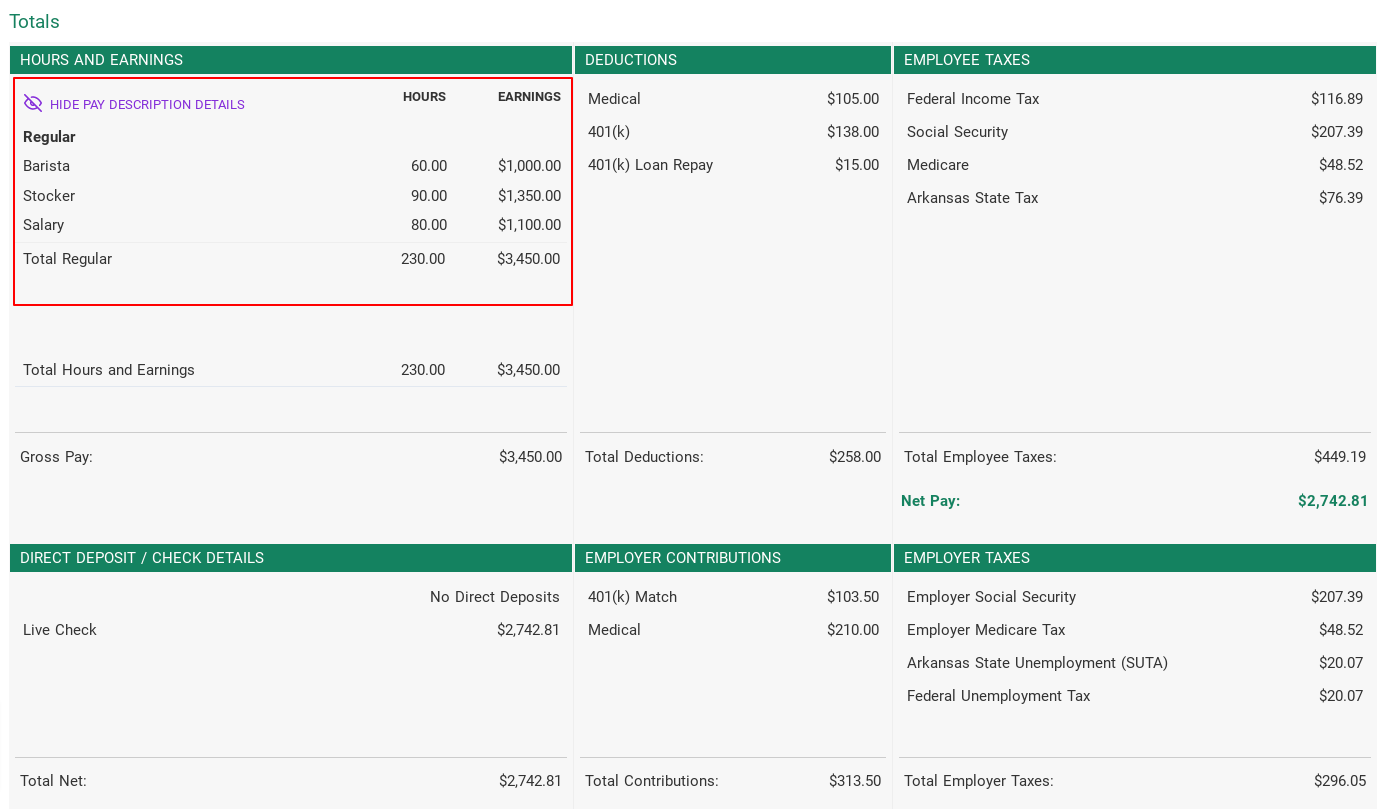

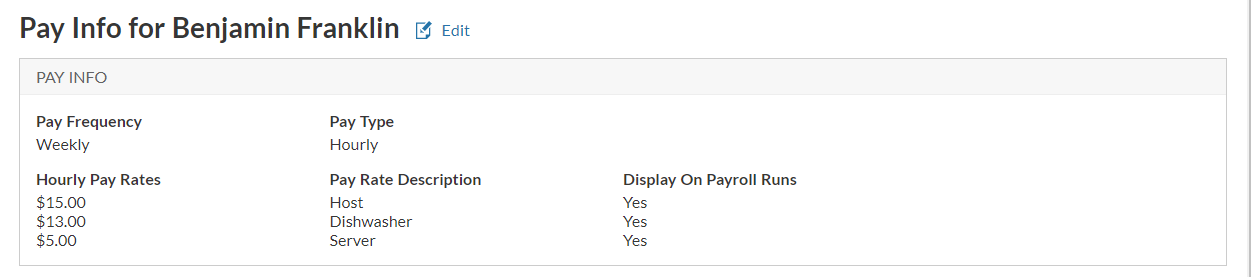

Pay Rate Description Break-out

September 29, 2022Do you have an employee who receives different pay rates for working different jobs? Ever wish you could see those pay rate descriptions front and center in your payroll reports? With our new updates to the Payroll Register report, you can.

Read More

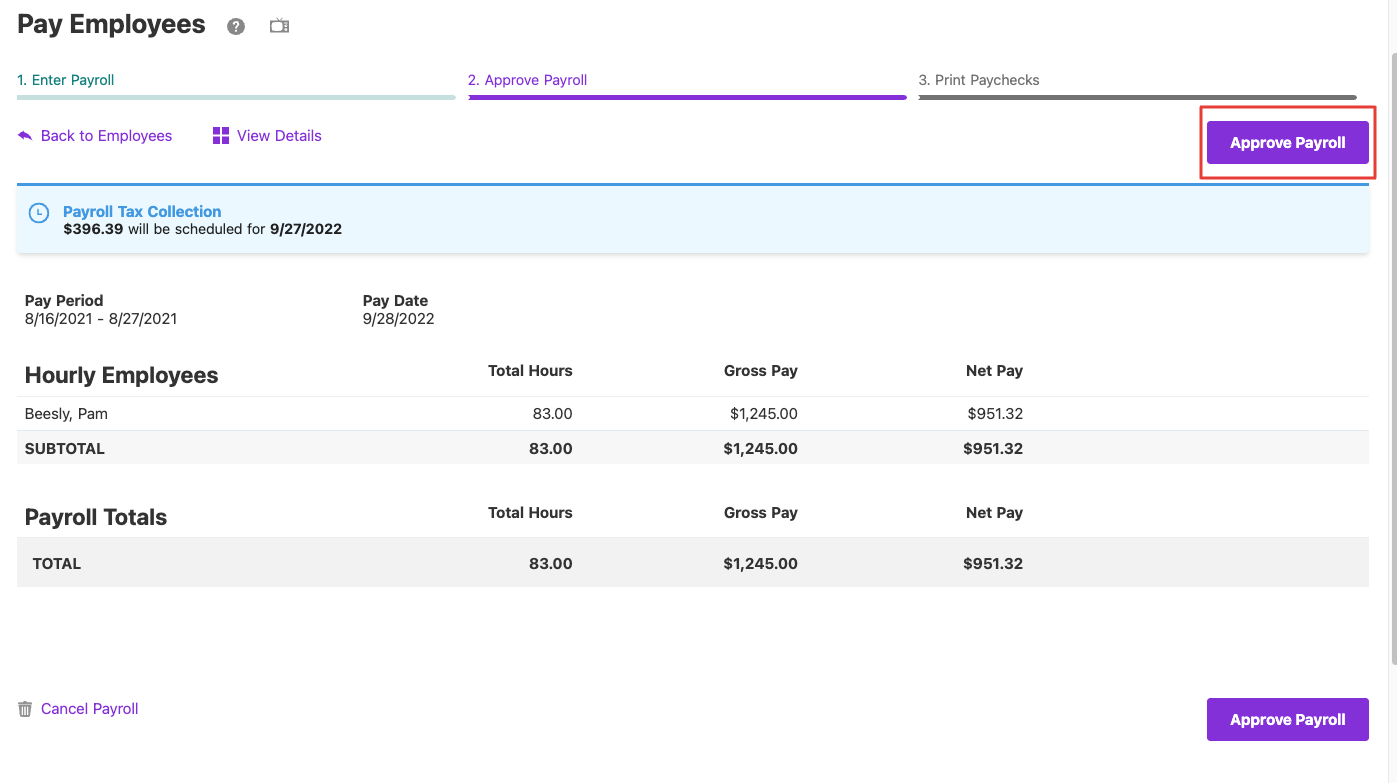

Approve Payroll Update

September 20, 2022To approve or not to approve? That is the question. But if you decide to approve, we’ve added another button at the top of the “Approve Payroll” (step 2) page to save you from scrolling down to the bottom. It’s the little things that shave off time from your tasks that make Patriot so user-friendly. We hope you like it!

Read More

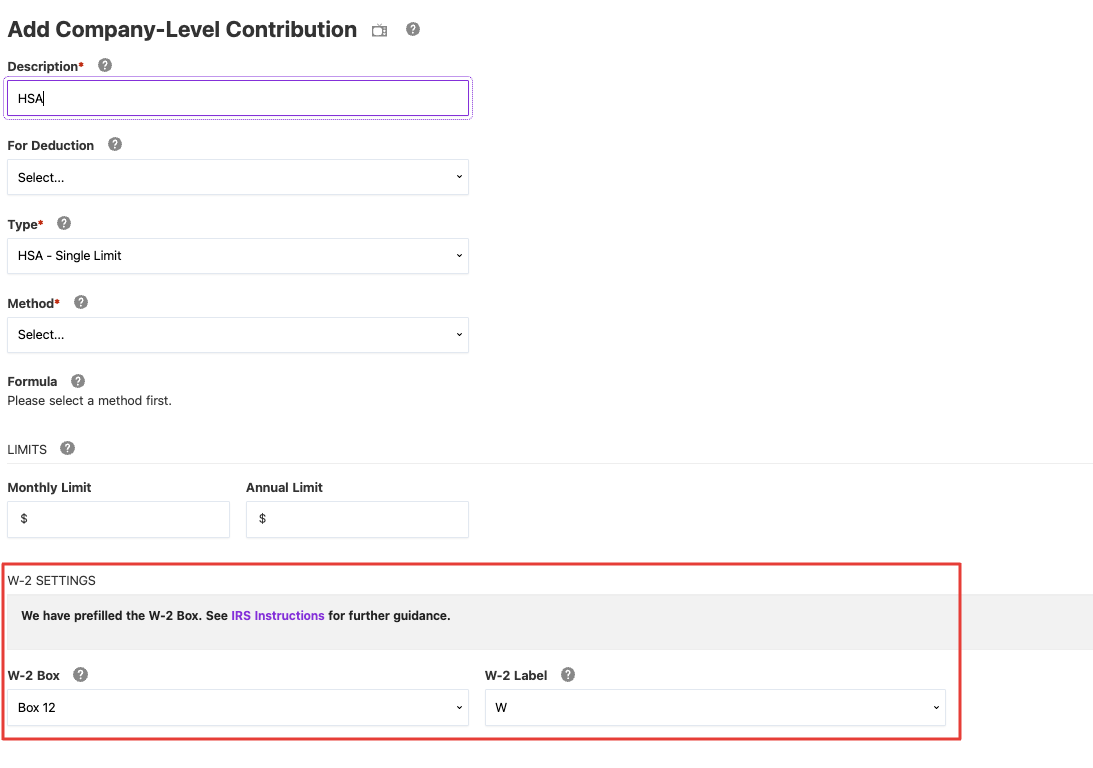

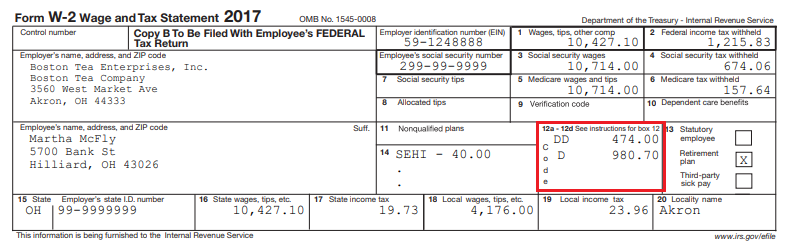

Contribution Labels and Boxes Prefilled

September 16, 2022W-2 labels and boxes got you feeling like you’ve got another mystery on your hands? We get it. W-2s are a bit confusing if you’re not schooled on IRS regulations. Sure, you could scour the IRS website to find the info you need, but you’re a business owner, not a part of the Scooby-Doo gang. That’s why we’re updating your company contributions to prefill the applicable W-2 box and label with known requirements. This is an enhancement to our previous feature release for prefilled labels and W-2 boxes for deductions and their corresponding contributions. Just another way Patriot helps you keep your time and money.

Read More

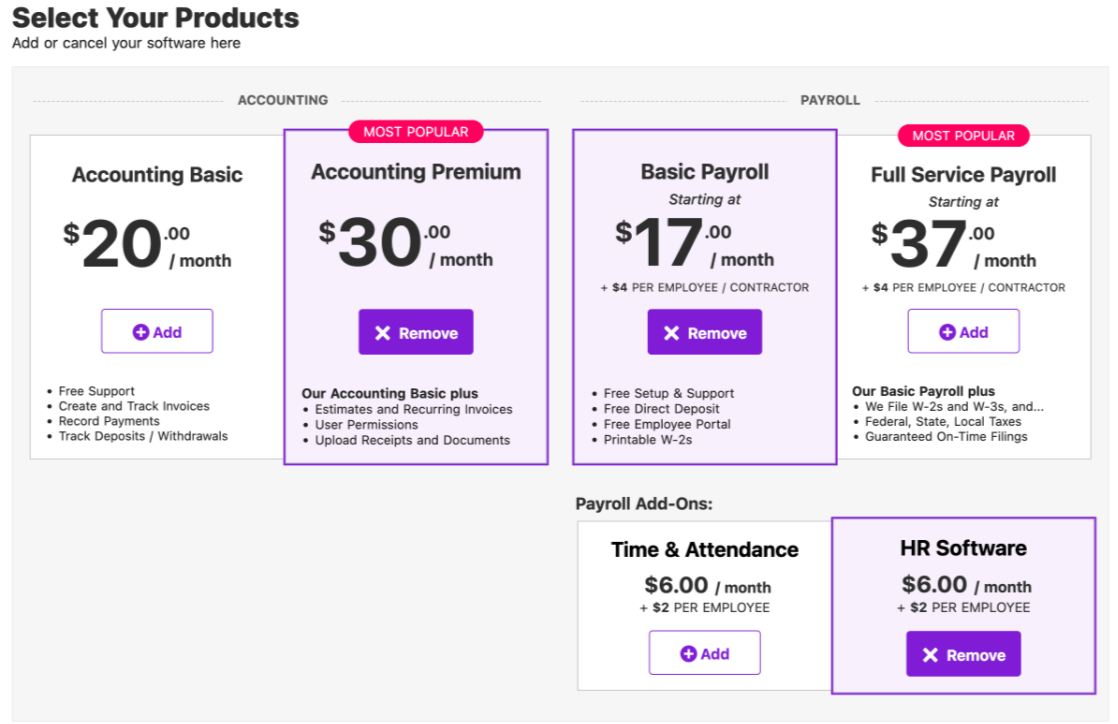

Add or Cancel Software Page Update

September 2, 2022Our Add or Cancel Software page just got a facelift. We’ve updated the interface to make it more user-friendly for our customers to add or remove software products. And new customers, we haven’t forgotten about you! We applied our new, user-friendly interface to our Pick Your Products page in the setup wizard, too.

Read More

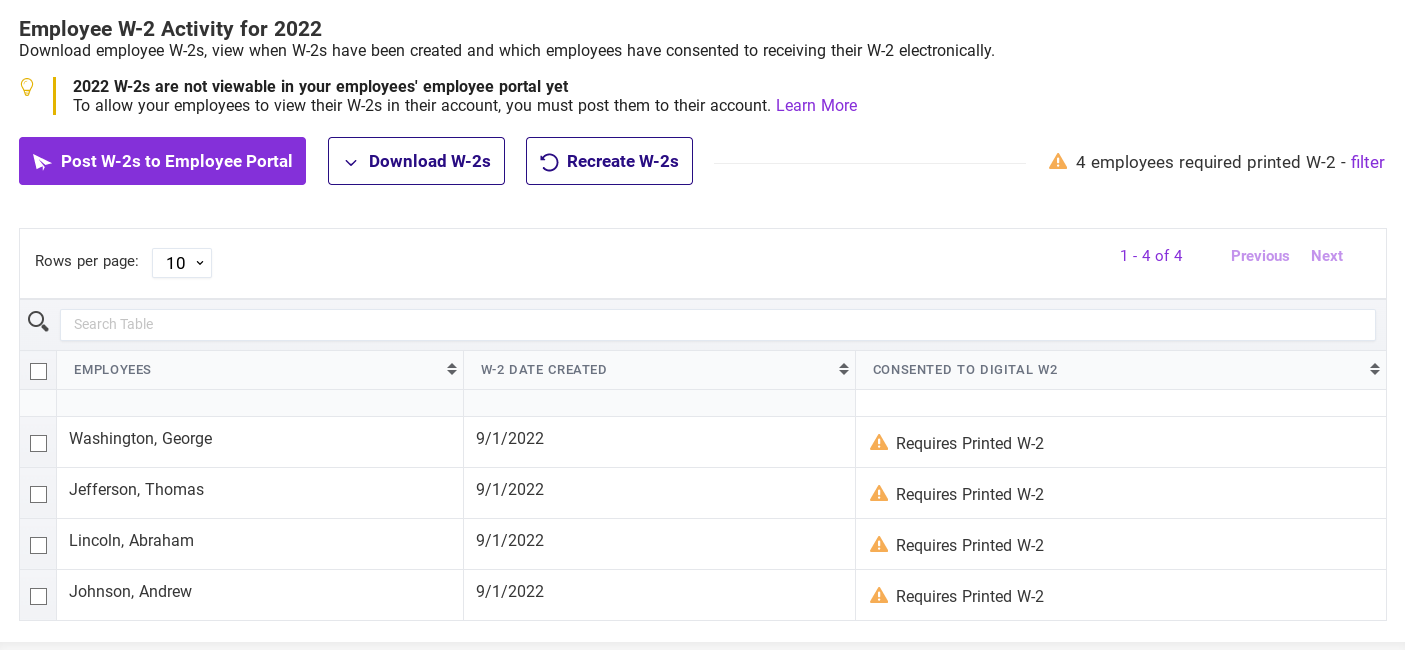

2022 W-2s Are Now Live

August 31, 2022Early birds, rejoice! 2022 Forms W-2 are now live in your payroll account, which means when your payrolls are finished for the year, you can print your W-2s right away. And to make things even easier, you can post to the employee portals if your employee has consented!

Read More

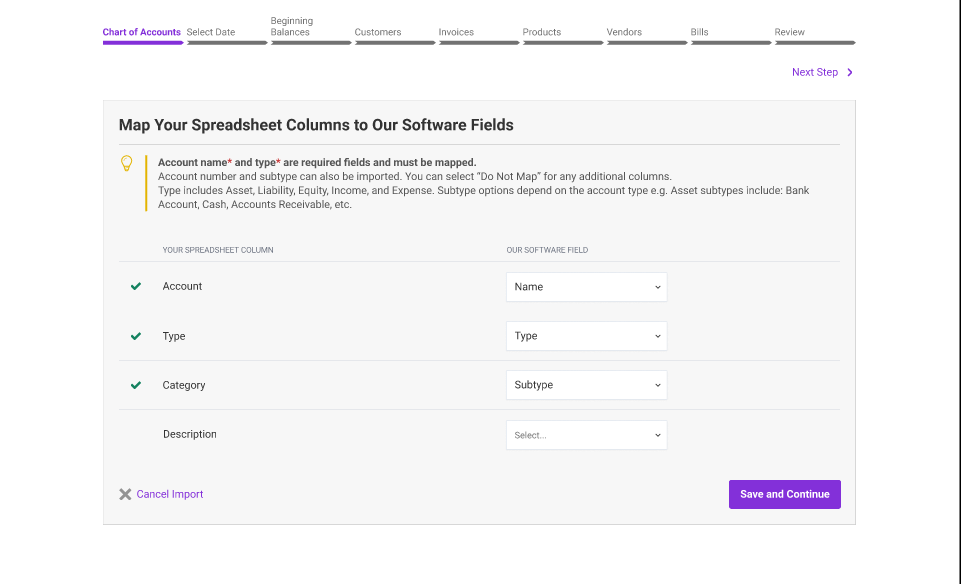

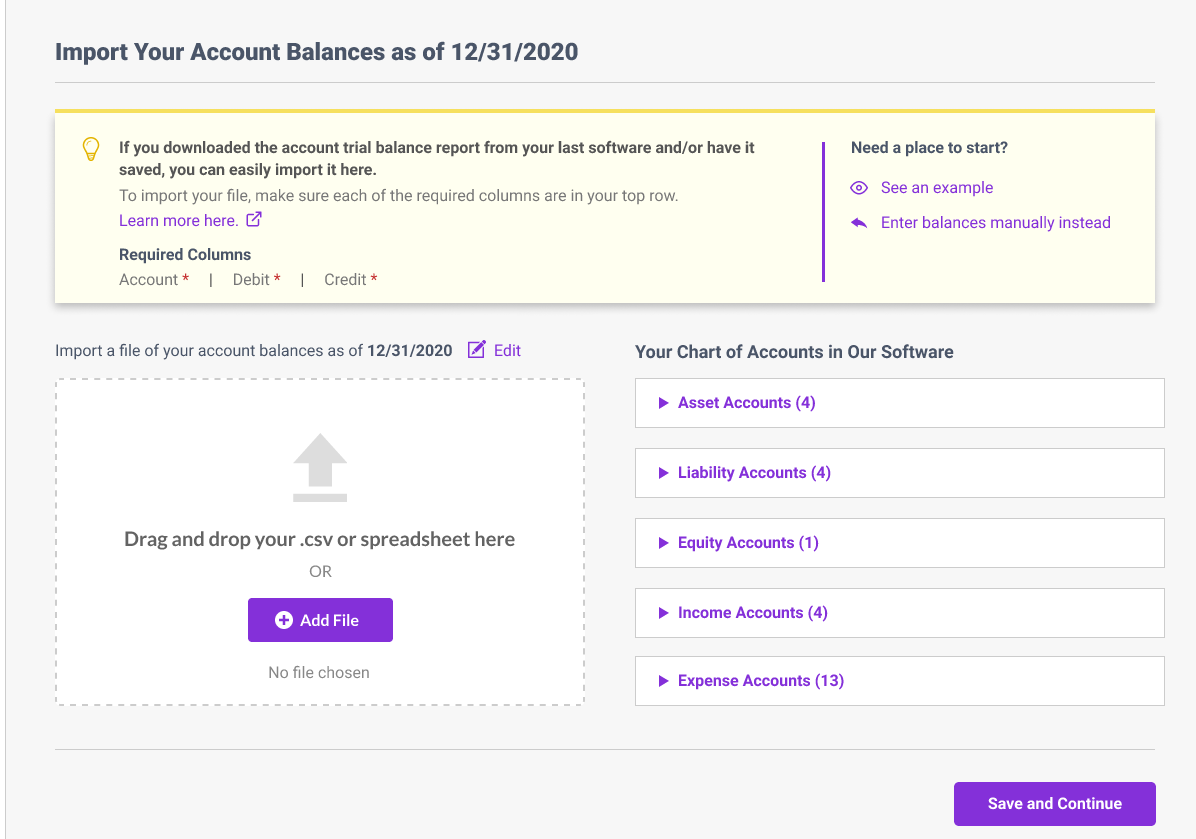

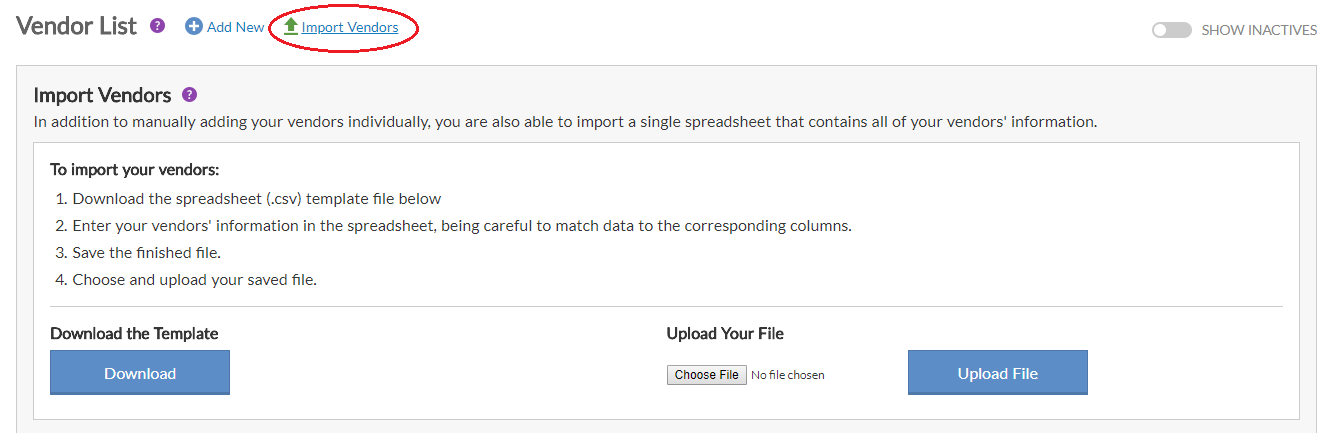

Chart of Accounts Import

March 28, 2022Switching from costly over-complicated accounting software just got easier. Now, new accounting users can import their Chart of Accounts in Patriot’s accounting software. The Chart of Accounts import, along with importing your vendors, customers, and trial balance, makes setting up Patriot accounting software a snap.

Read More

Dual-Ledger Accounting Now Patented

March 9, 2022Our Dual-Ledger Accounting has been granted a patent by the U.S. Patent and Trademark Office. So, you know what that means? Say goodbye to the days when you’d “duel it out” with your accountant. Patriot’s newly patented Dual-Ledger Accounting is here to save you from picking an accounting side. Enjoy the peace of quickly toggling between cash, modified cash, and accrual-basis accounting in your general ledger. Simply choose your preferred accounting method and see all of your transactions the way you want to—no “dueling” necessary.

Read More

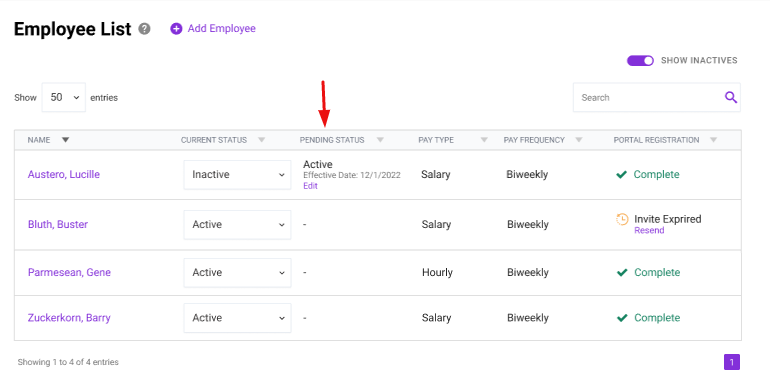

Employee Pending Statuses

January 24, 2022Love checking things off your “to-do” list? We made our newest HR software feature with you in mind. HR software customers can set employee future statuses with effective dates. The employee status changes automatically on the effective date. And, we’ll help you keep track of those employees with future status change with a Pending Status Report so you can put away those sticky notes.

Read More

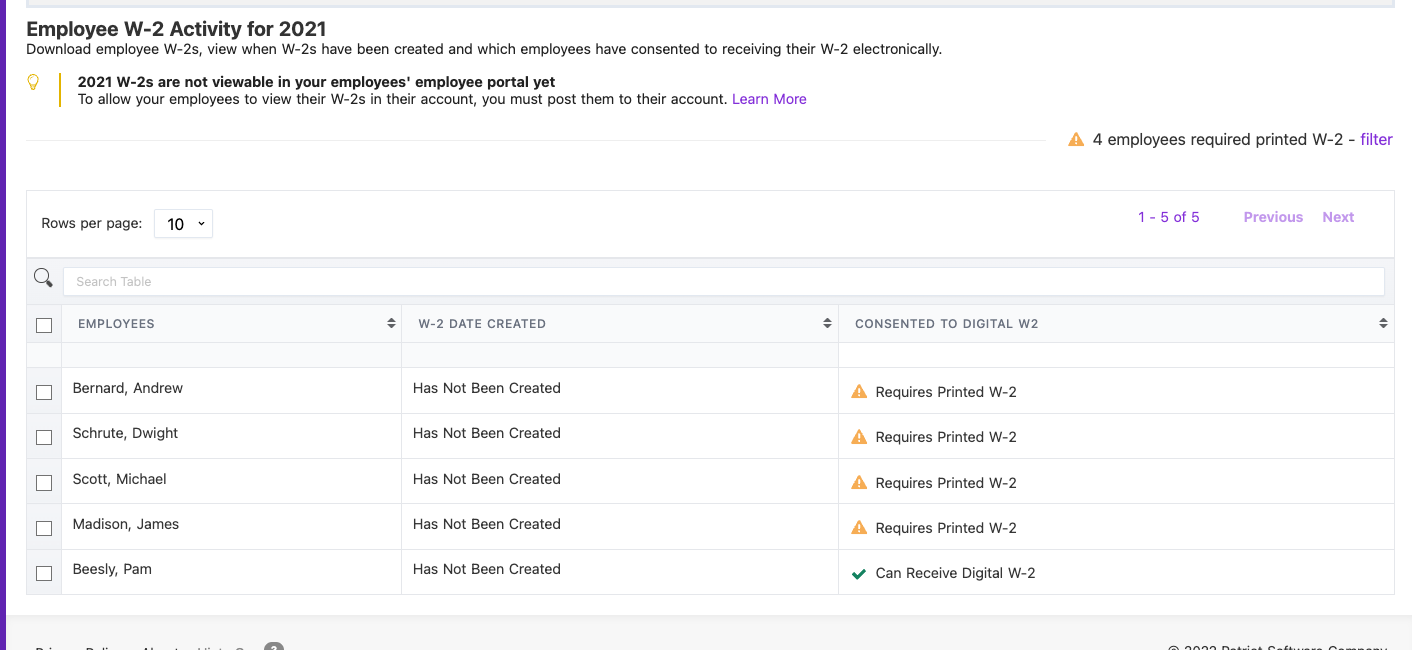

Improved W-2 Creation Process

January 4, 2022We’ve made creating W2’s even easier! First, we’ve optimized the W-2 creation so you can download in no time flat, (we’re looking at you large employers). We’ve given more visibility in employee W-2 errors so you can correct info before you hand them out to employees. To top it off, our Employee W2 report is now searchable and easier to filter who needs a W2, who has allowed for electronic W2s and who needs a paper copy.

Read More

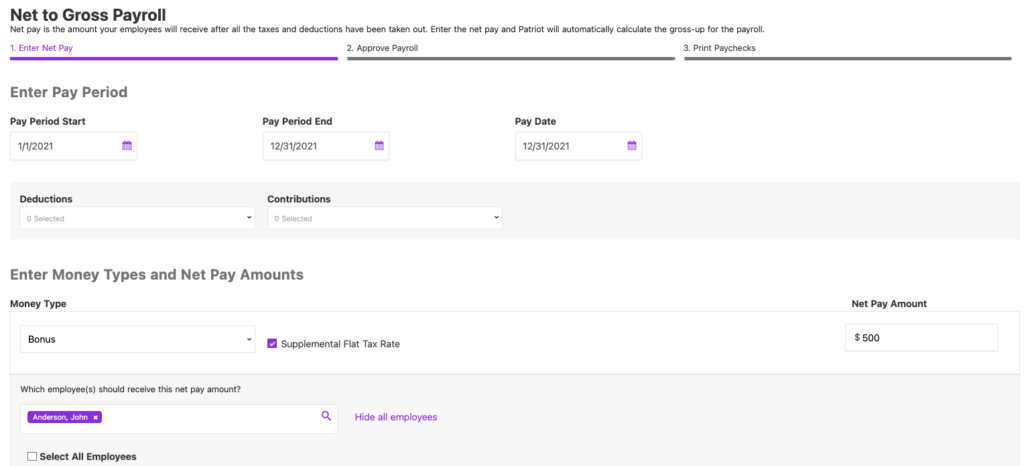

Net to Gross Payroll

November 23, 2021Put that Jelly-of-the-Month club form away. Paying bonuses to employees on your “nice list” is as easy as pie with our new Net to Gross Payroll tool.

We’re excited to have simplified bonuses and gift cards. You can enter the net pay or gift card amount your employees receive, and Patriot will “gross-up” the amount, so payroll taxes are calculated and deducted. Ready to make bonus day your employees’ favorite day of the year?

Read More

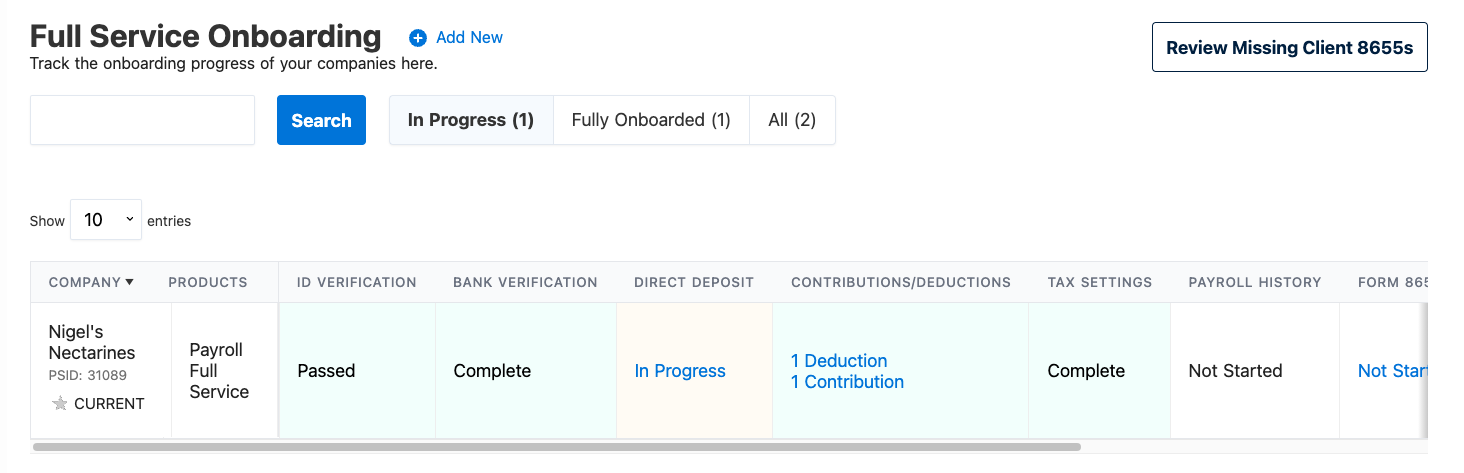

Full Service Onboarding Report

October 18, 2021Permission to onboard? Granted—with our new Full Service Onboarding Report. Available to our advisor partners and their staff, this report streamlines onboarding for multiple accounts by providing an easy way to access and enter in the missing information. Why? Because we want onboarding to be so fast you’ll cruise through in no time flat.

Read More

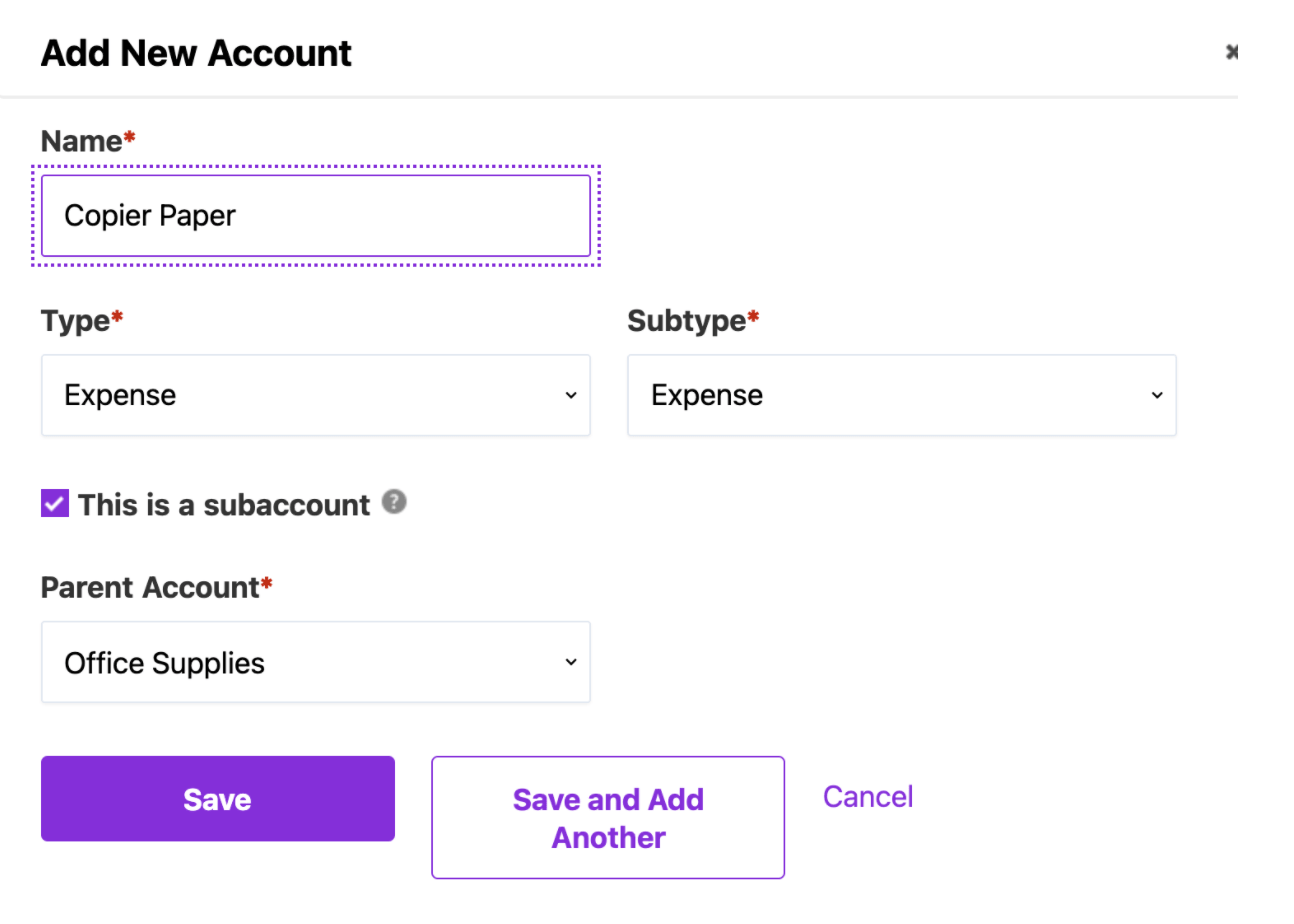

Accounting Subaccounts

October 1, 2021We’re over the moon to announce our new subaccounts feature for Accounting Premium Software customers. This has been highly requested by all detail lovers—and for good reason! Nesting subaccounts under your other accounts will give greater detail when categorizing transactions. So, go ahead all of you “organizers,” “outline fanatics,” and “nitty-gritty-itemizers,” put on your party hats…we won’t judge.

Read More

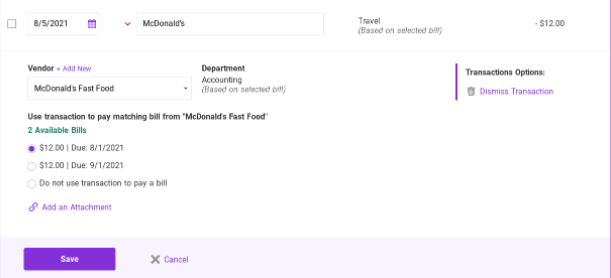

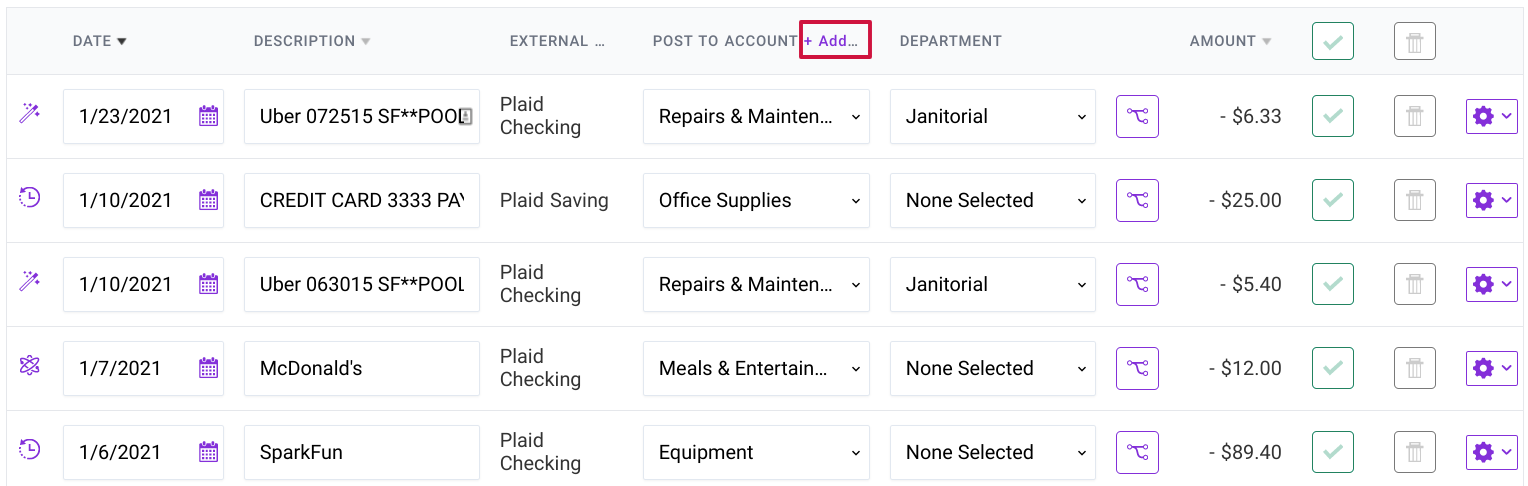

Manage Imported Transaction Improvements

October 1, 2021We’ve streamlined our Manage Imported Transactions page and added more functionality. Now, you can assign vendors or customers to transactions and match unpaid invoices or bills right on the page. We’ve also given it a nice design facelift because the design was “so last year” (yes, it was literally last year). Why? We’re always looking to improve your workflow.

Read More

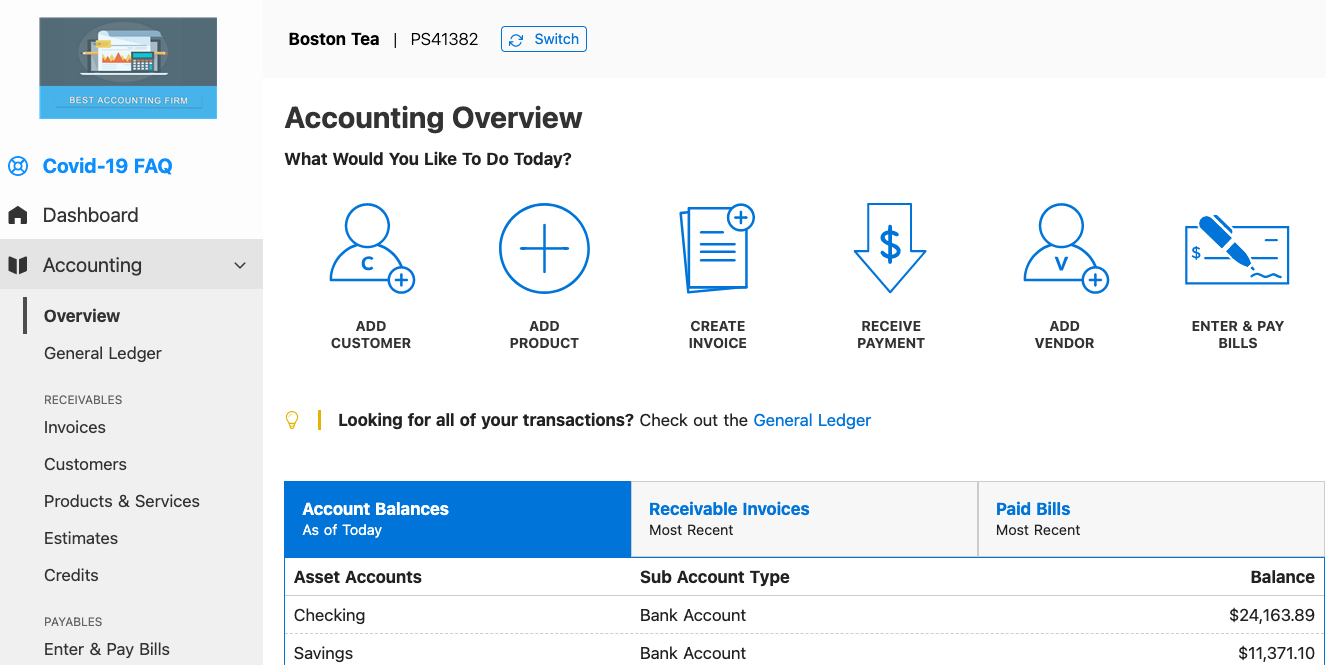

Advisor Client Company Reports

August 13, 2021Hey wholesale advisors, this one’s for you! We’ve added a simple way to view all client information with three new client reports: Payroll Info, Payroll Tax Settings, and Employee Payroll. Who says multitasking has to be hard?

Read More

Improved Tax Filing Issue Resolution

July 19, 2021To err is human … but government tax agencies are not so divine in forgiving. That’s why we’ve created a more efficient way to notify our Full Service Payroll companies when we had issues filing their payroll taxes, resulting in faster resolutions and less stress (for all of us)!

Read More

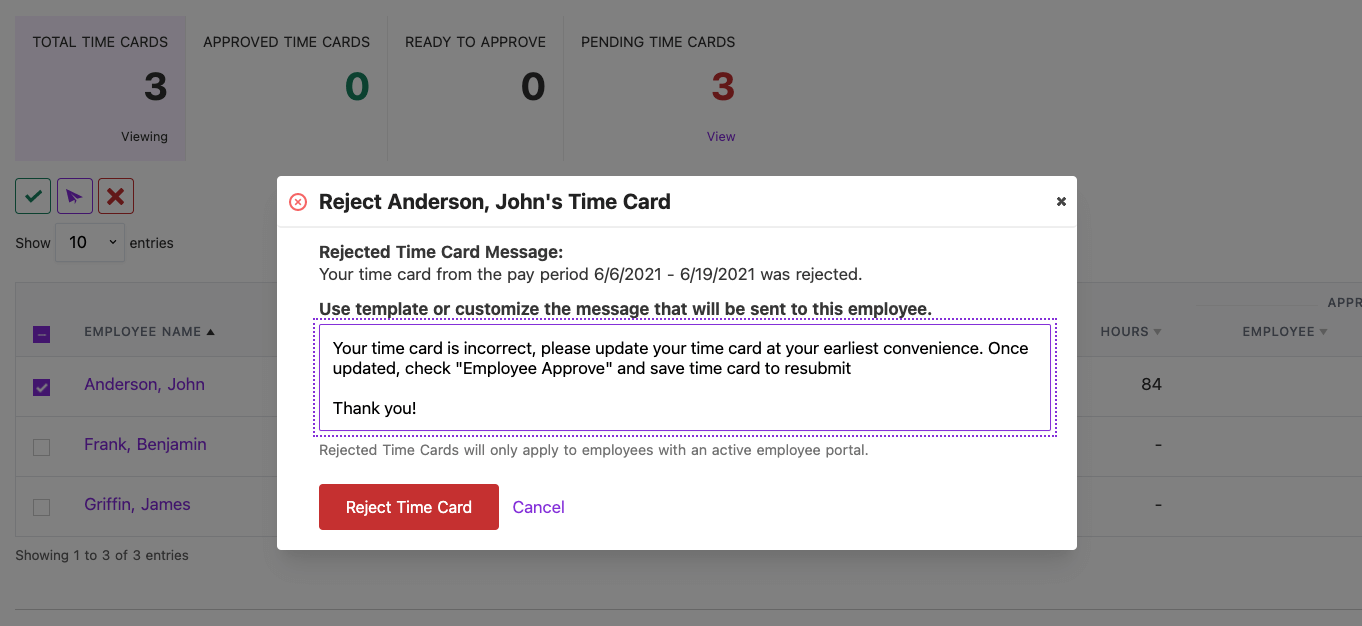

Timecard Rejection

June 22, 2021Rejecting employee timecards is as easy as a click of a button, now with the new timecard rejection feature. The best part? Employees get notified automatically… because we know that chasing people around is only fun when you’re a kid.

Read More

Self-Service Co-branding for Partners

May 14, 2021We’re excited to announce that we’ve released a self-service co-branding tool that lets our partners add their logo and reinforce their brand to their clients. We’re thrilled to have great feedback from our partners about this new tool already. And, when our partners are happy, we’re happy.

Read More

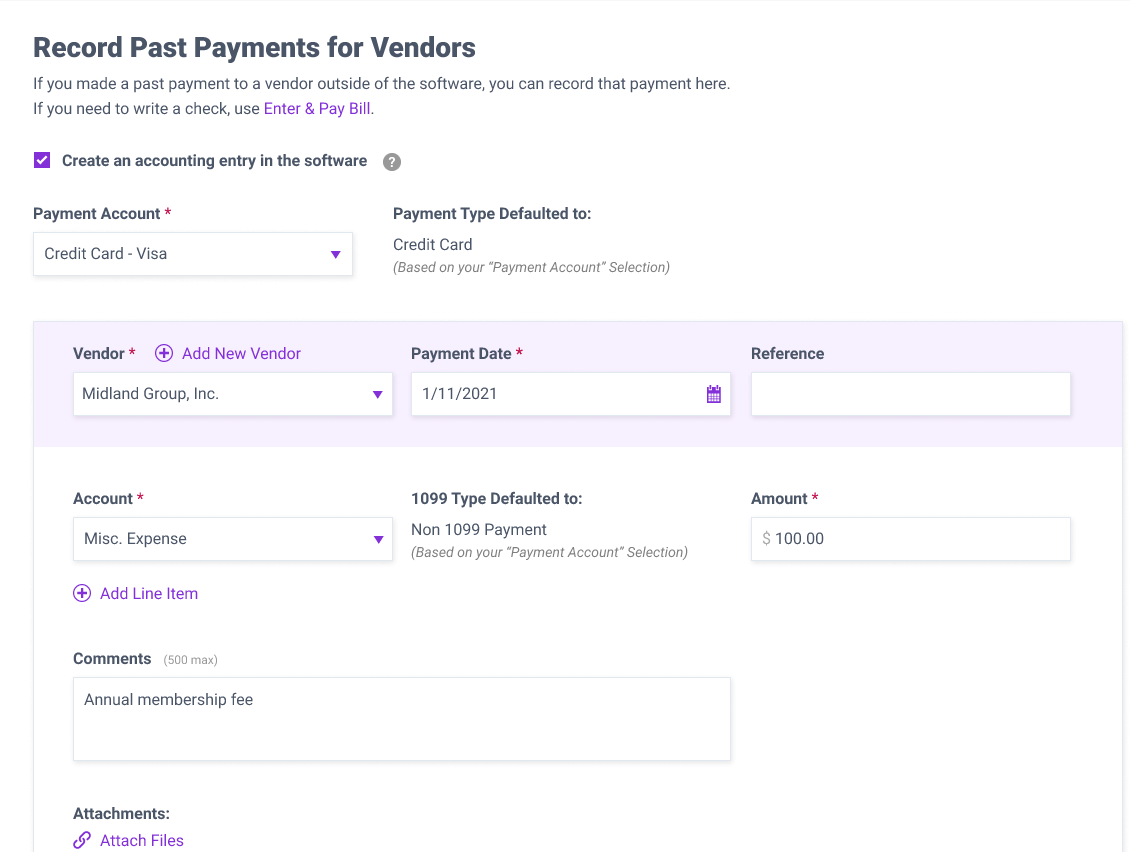

Recording Past Payment Improvements

April 14, 2021We’re saving you time in the present by making improvements to the past—the way you record past payments, that is. Recording past payments made to vendors and viewing the Vendor Payment History Report is easier than ever with our newly laid out pages. Accounting Premium customers can attach receipts on the recorded entry, too. To top it off, we’ve made the drop-down options and workflow fit more of your needs based on feedback.

Read More

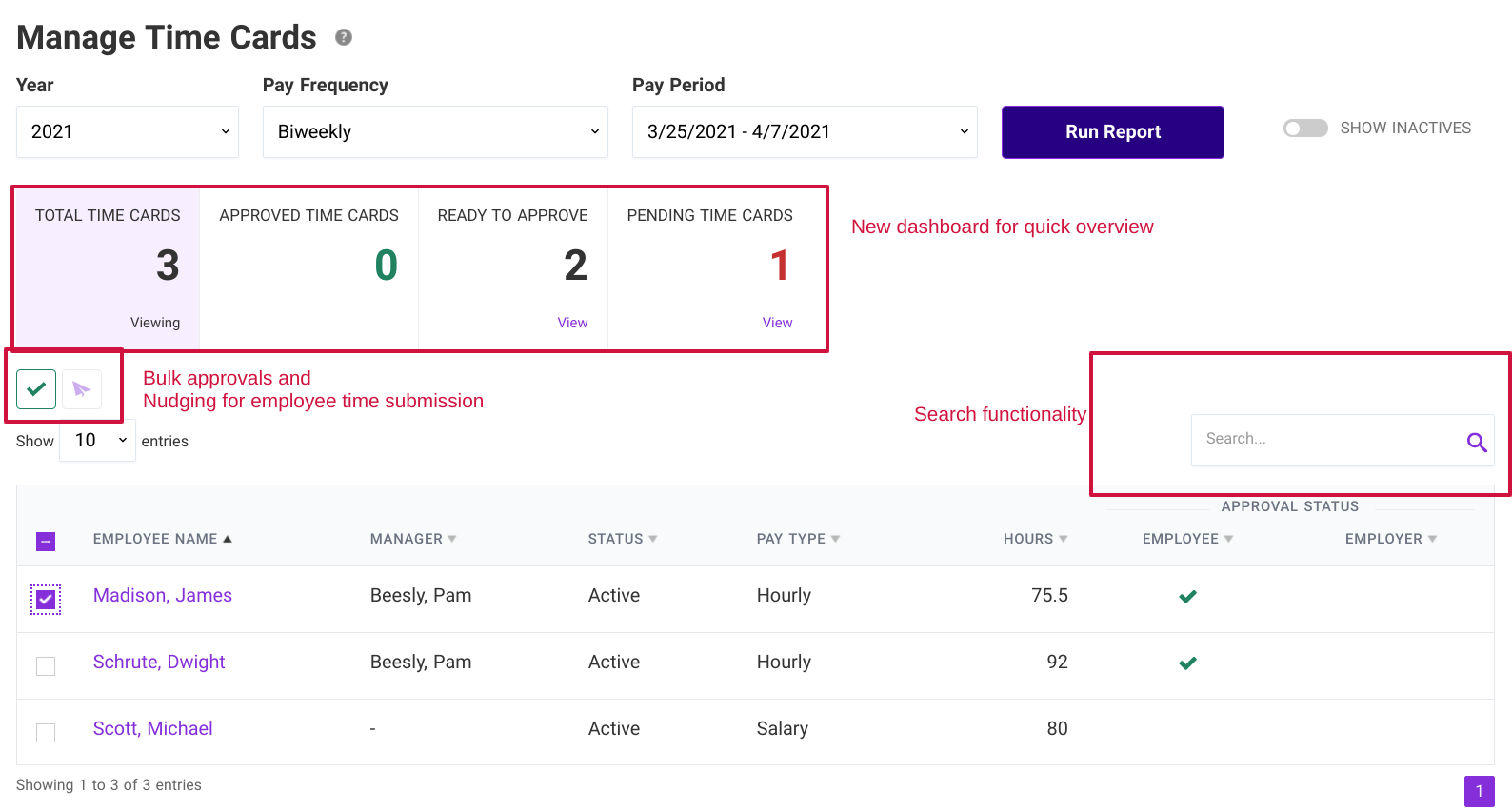

Manage Time Cards Improvements

March 25, 2021Time is money for you and your employees. So, we’ve added some new enhancements to improve your workflow and approve time cards at record speed: an interactive dashboard, search functionality, mass approval functionality, and a nudging tool that will be your new best friend for those pesky late time card submissions.

Read More

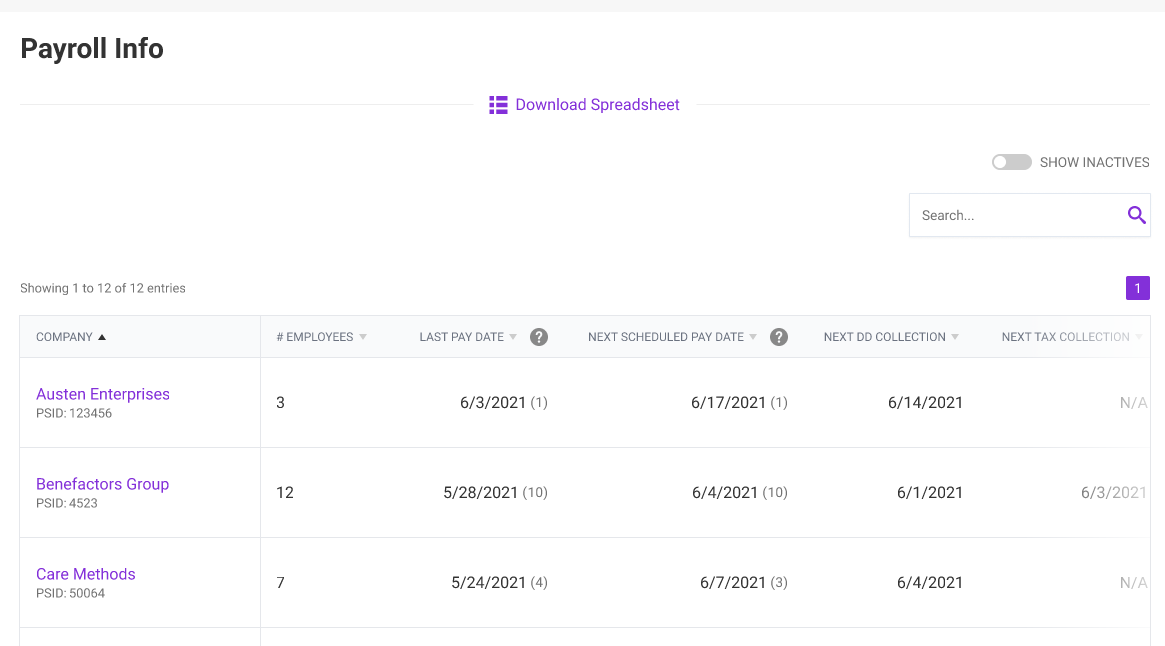

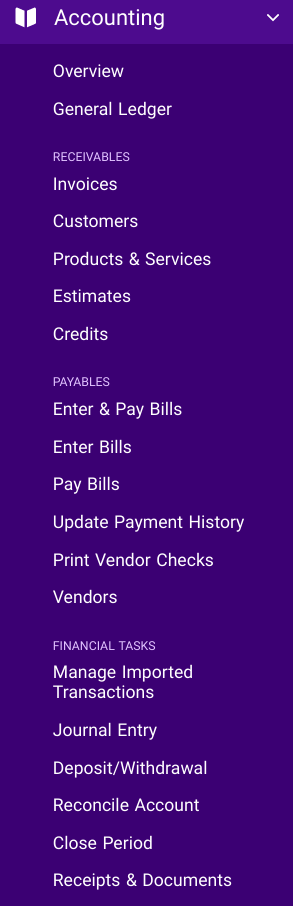

New Accounting Navigation

March 24, 2021Pssst … we’ve been watching you. Well, we’ve been watching all of our accounting software customers. We wanted to see what links our accounting customers are using most to give the best user experience. The result? We’ve slimmed-down accounting navigation to keep the most-used links right at your fingertips.

Read More

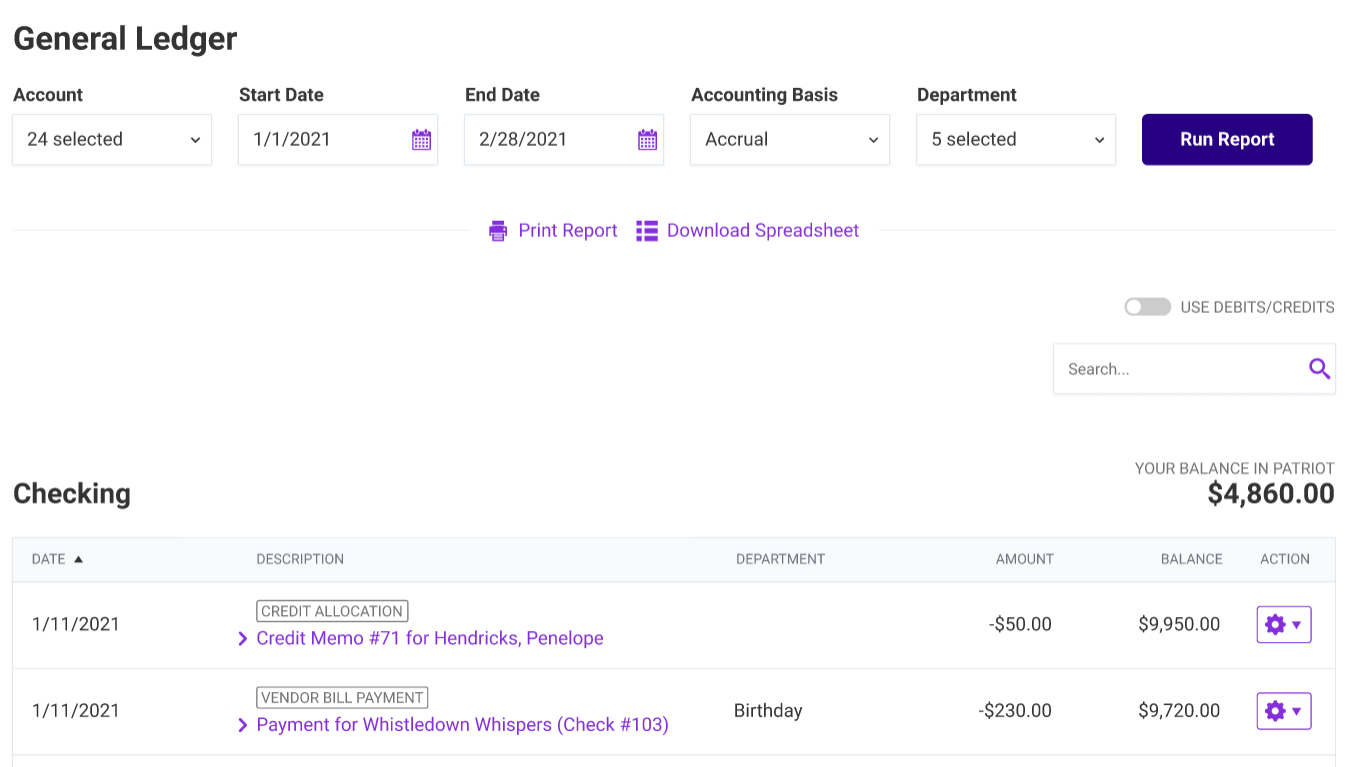

General Ledger

March 23, 2021The Activity by Account now has a new name: the General Ledger Report! But, that’s not all we’ve done. We’ve also added more functionality to edit, void, or delete most entries directly from this report. Accounting premium customers can attach documents and receipts right to an activity on the General Ledger report. You can also search, for quickly finding entries and see running totals as well as your total in your Patriot Accounting Software. Think of it as the command center of all of your accounting activity. Fitting for a “general,” don’t you think?

Read More

Accounting Setup Improvements

February 17, 2021OK—we admit it. We’re obsessed with saving our customers time. Part of the obsession is getting new customers “up and running” in our software as efficiently as possible. That’s why we’re over the moon about our latest accounting onboarding improvements. New Patriot Accounting customers can import a trial balance, optimizing their accounting setup with record-breaking speed.

Read More

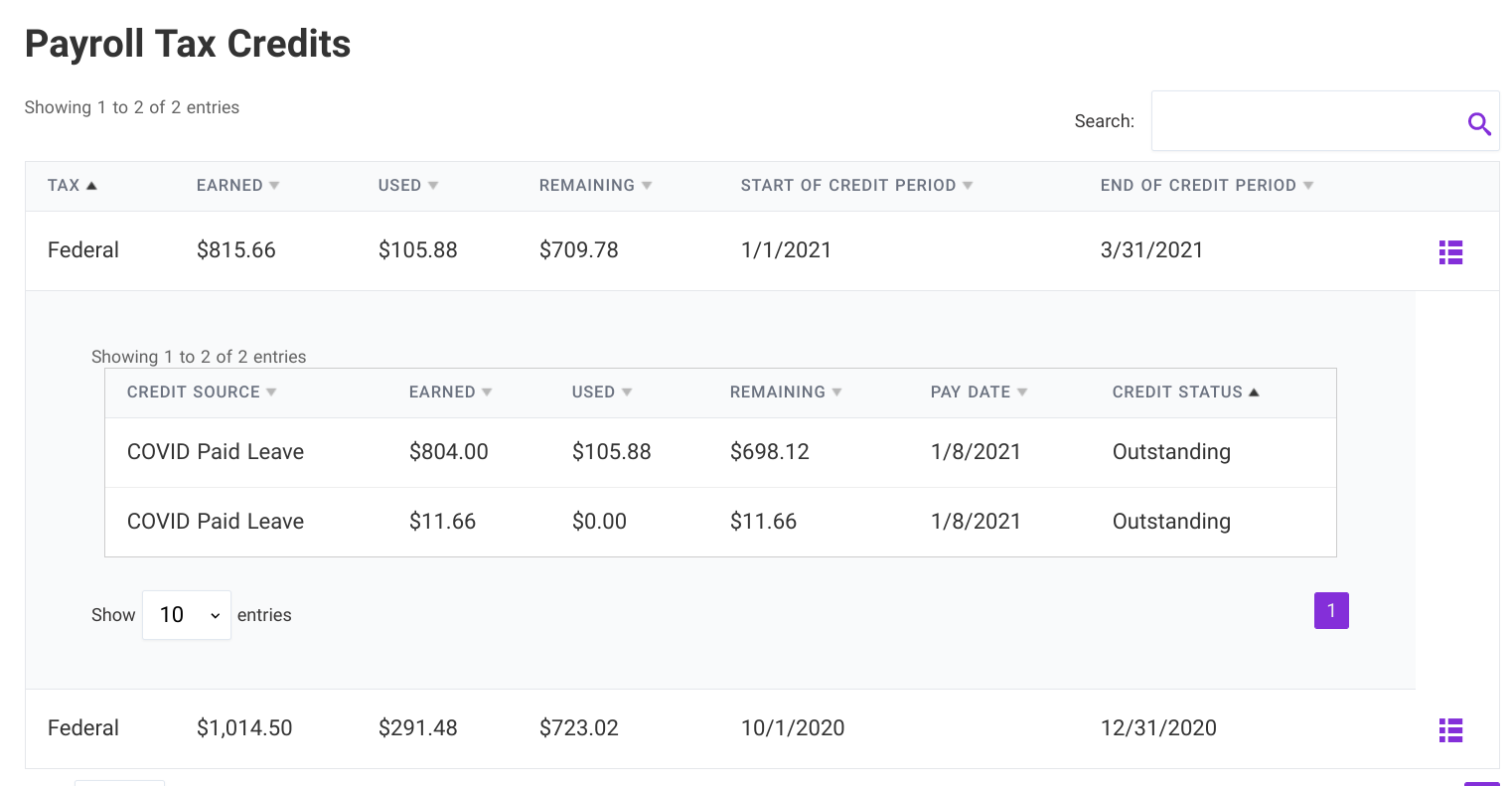

Payroll Tax Credit Report

February 15, 2021We can all agree, the COVID-19 pandemic was not without its challenges. Part of those challenges was remembering all of the payroll tax credits you may have taken as an employer. Cue the Payroll Tax Credit Report.🙌 Insert applause here! 🙌

Read More

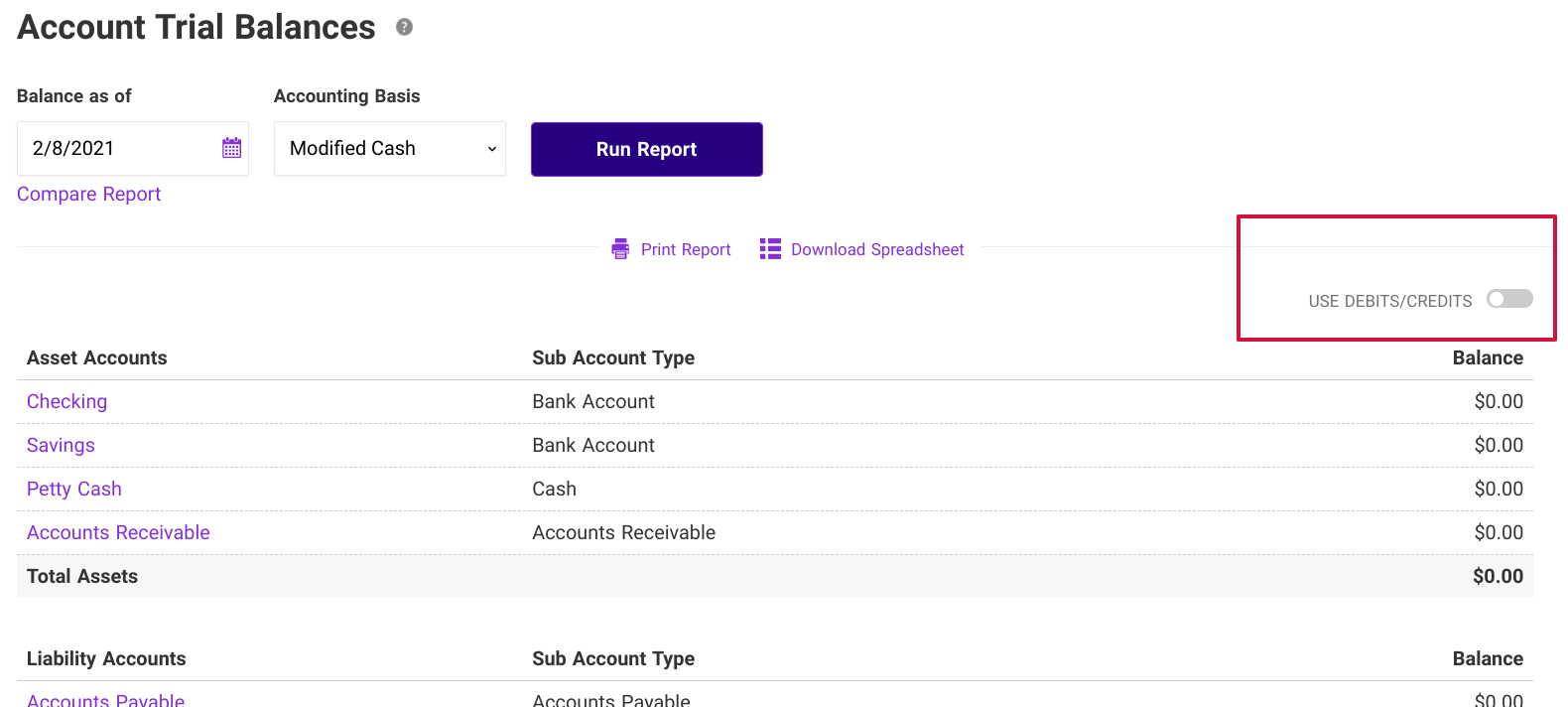

Account Trial Balances Report Improvements

February 8, 2021When the Account Trial Balances Report first came out, we kept it simple to start with just displaying ‘balances’, but we know you accountants out there love your debits and credits. So, we’ve added our credit/debit toggle to give you the choice on how to view the report, either with credit/debits or by balances.

Read More

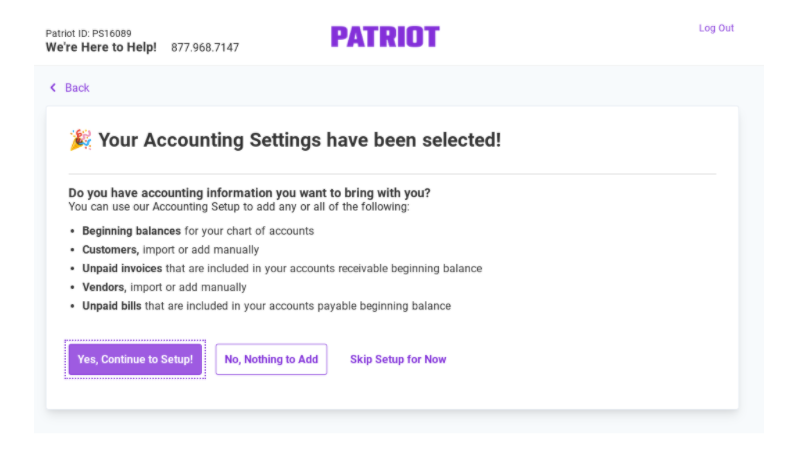

One-Click Accounting Settings

February 1, 2021Getting started sometimes is the hardest thing to do. That’s why we’ve simplified the process for new accounting software customers. Our accounting settings wizard gives new users the option to have the most popular settings and chart of accounts pre-selected for them. “Magic,” you ask? Nah, just really smart software.

Read More

Add Accounts “On-the-fly” When Managing Transactions

January 29, 2021Accounting customers, did you realize you forgot to add a new account in your chart of accounts when importing your bank transactions? If so, you’re going to love our new feature to add a new account to your chart of accounts “on the fly.”

Read More

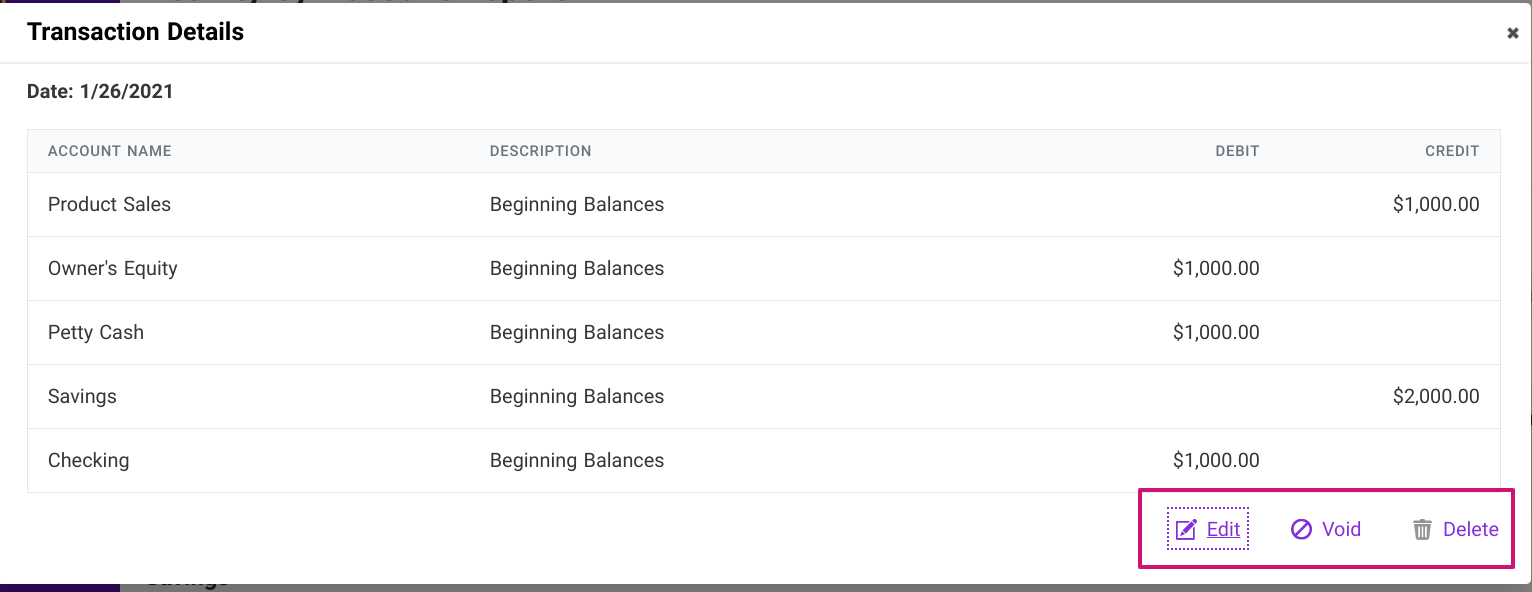

Edit, Void, or Delete Beginning Balances

January 25, 2021Accounting software customers, this one’s for you. We’ve followed your comments and requests and appreciate that you might want a “do-over” with your beginning balances in the accounting software. Whether you made a mistake or just want to go back a little further, you have the ability to edit, void, or delete your beginning balances in the accounting software. It’s not jumping in a time machine, but it’s close.

Read More

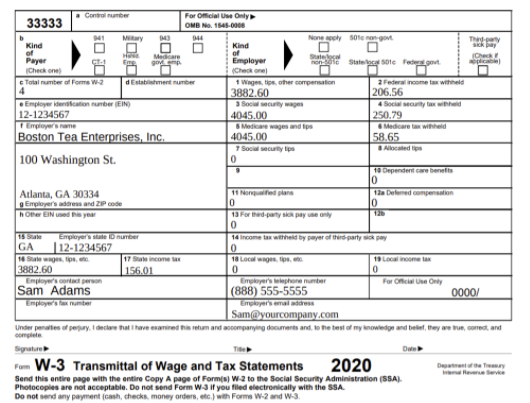

Form W-3 for Employer Records

January 4, 2021Payroll customers, this one’s for you! Although Full Service customers don’t need to file W-3s (Patriot handles it for you), and Basic customers file Form W-3 electronically, we heard you. You want to see what the actual Form W-3 looks like for your records, so we’ve given you the ability to download and print an employer copy of Form W-3 in the software.

Read More

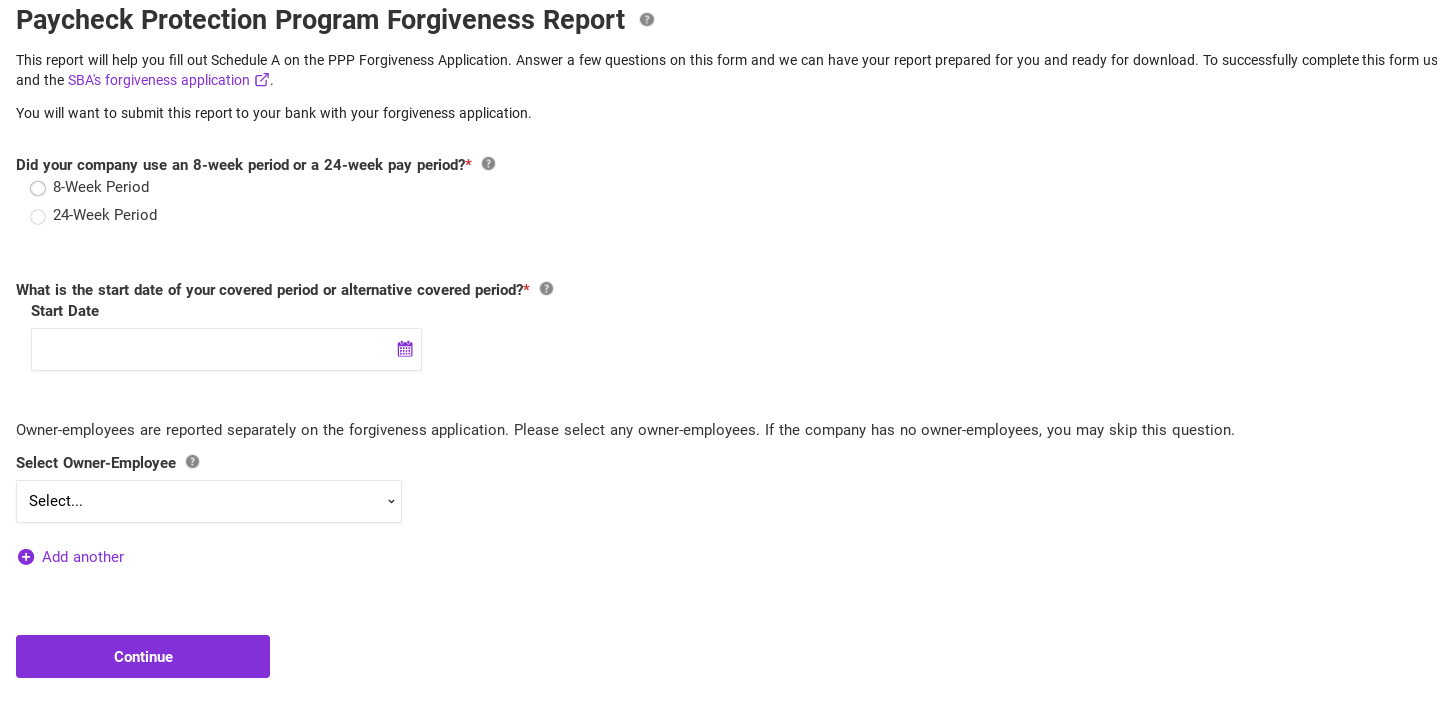

PPP Forgiveness Report

December 8, 2020At Patriot, we pride ourselves on making complex tasks easy. That’s why when the Paycheck Protection Program (PPP) forgiveness applications came out, we knew we could help. Our PPP Forgiveness Report easily calculates complex numbers to help simplify the PPP forgiveness application. Just fill in three simple questions, and Patriot does the heavy lifting.

Read More

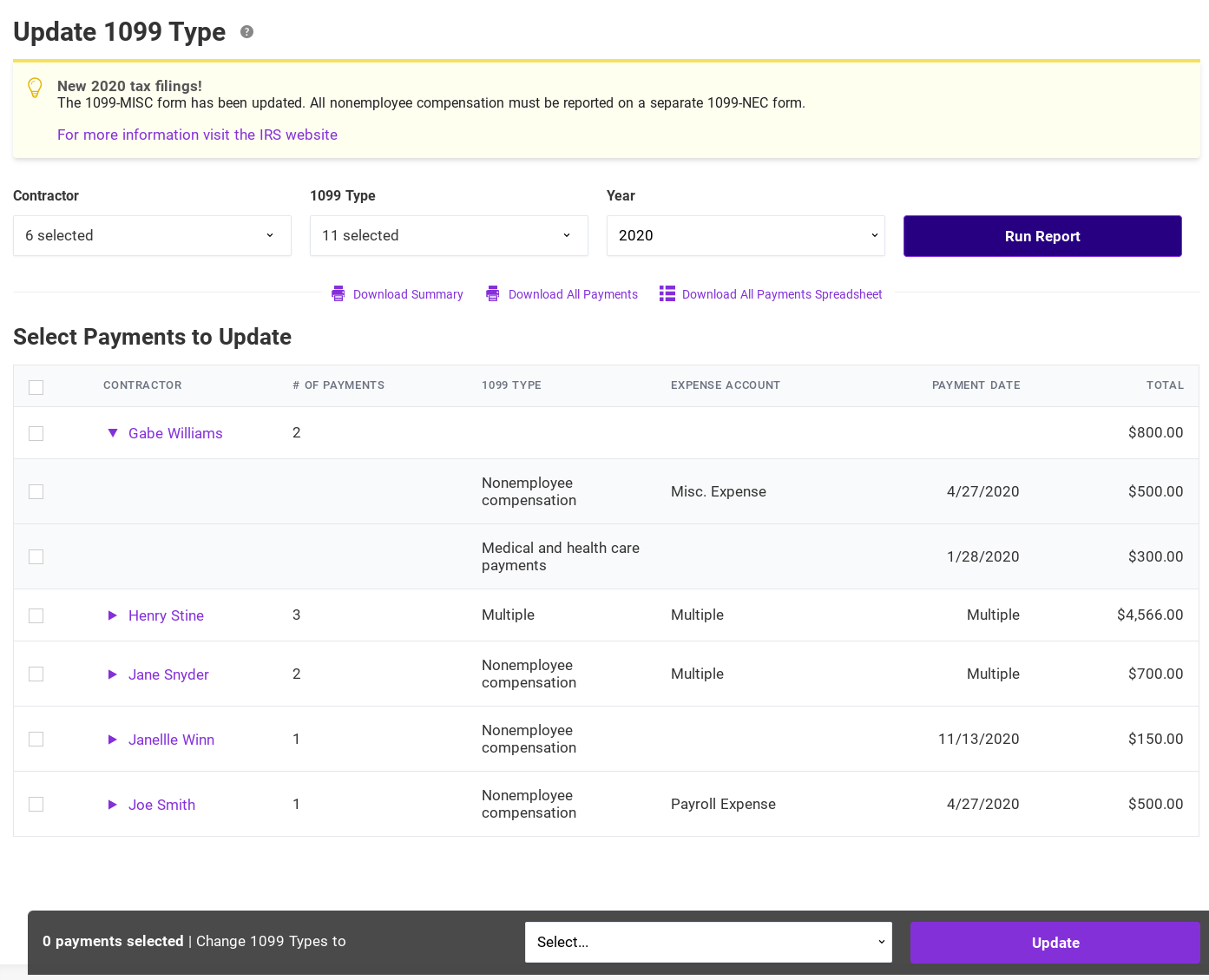

Update 1099 Type Tool

November 23, 2020It’s easy to make mistakes in accounting. Correcting them? Not always easy … until now. When Accounting customers make a vendor/contractor payment with an incorrect “1099 Type” selected, nobody needs to know … because it’s easy to fix!

Patriot’s new “Update 1099 Type” tool gives Accounting customers the flexibility to update 1099 types for contractor payments, all from within their accounts. Just one more way we help customers get in, get out, and get on with their day.

Read More

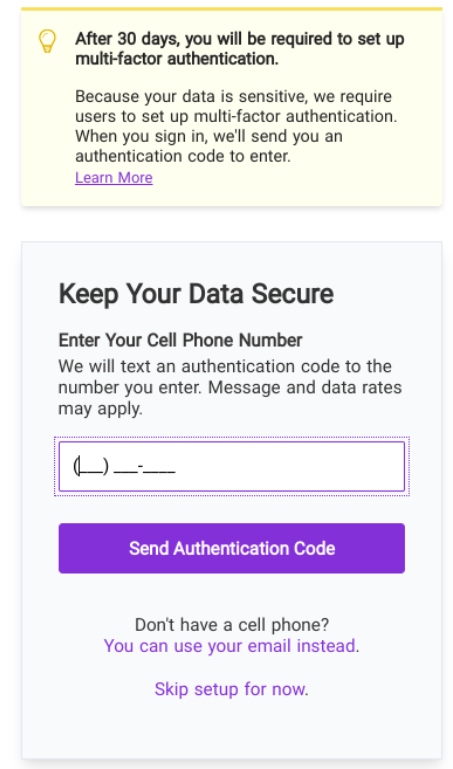

Multi-Factor Authentication

November 16, 2020We care about the security and confidentiality of your data in Patriot Software. In fact, we care so much that we’ve ensured there’s an extra layer of protection for your data by introducing multi-factor authentication.

Read More

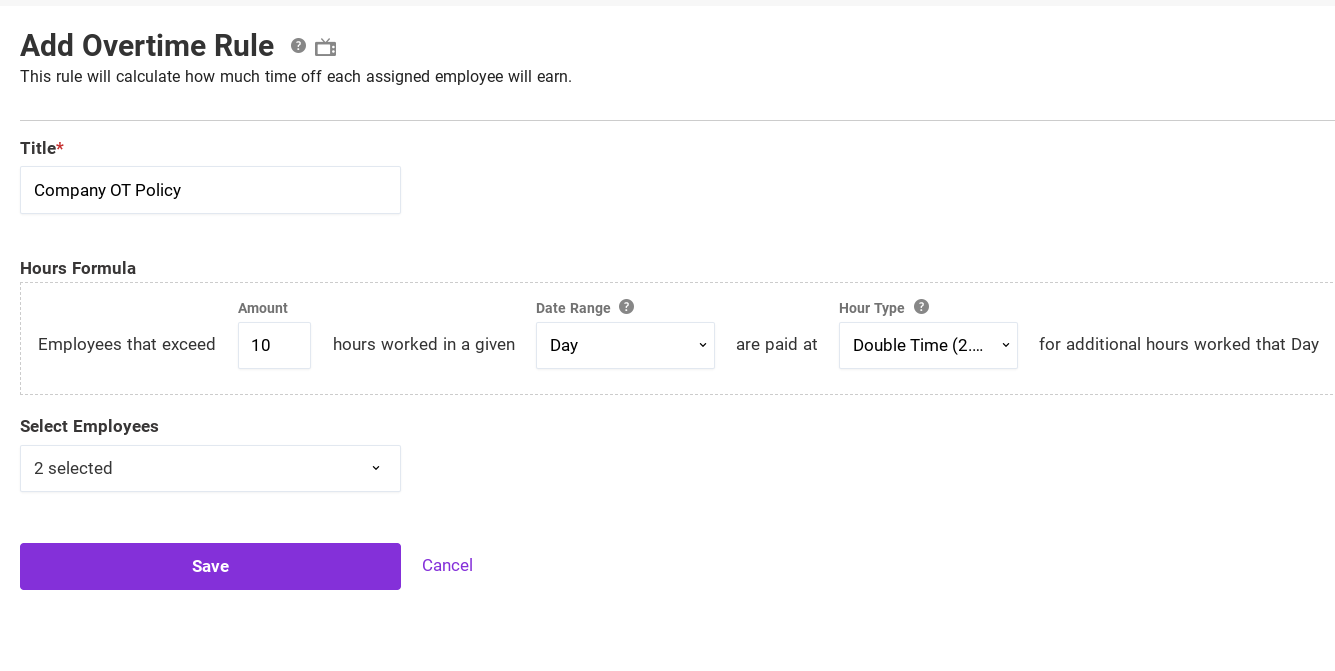

Custom Overtime Rules

November 12, 2020Benjamin Franklin said, “Time is money” … and when it comes to overtime, this couldn’t be more true!

It’s important to get overtime right! That’s why we’re pleased to announce a new feature to customize overtime rules in Patriot’s Time & Attendance software to meet your state or company-specific overtime requirements.

Read More

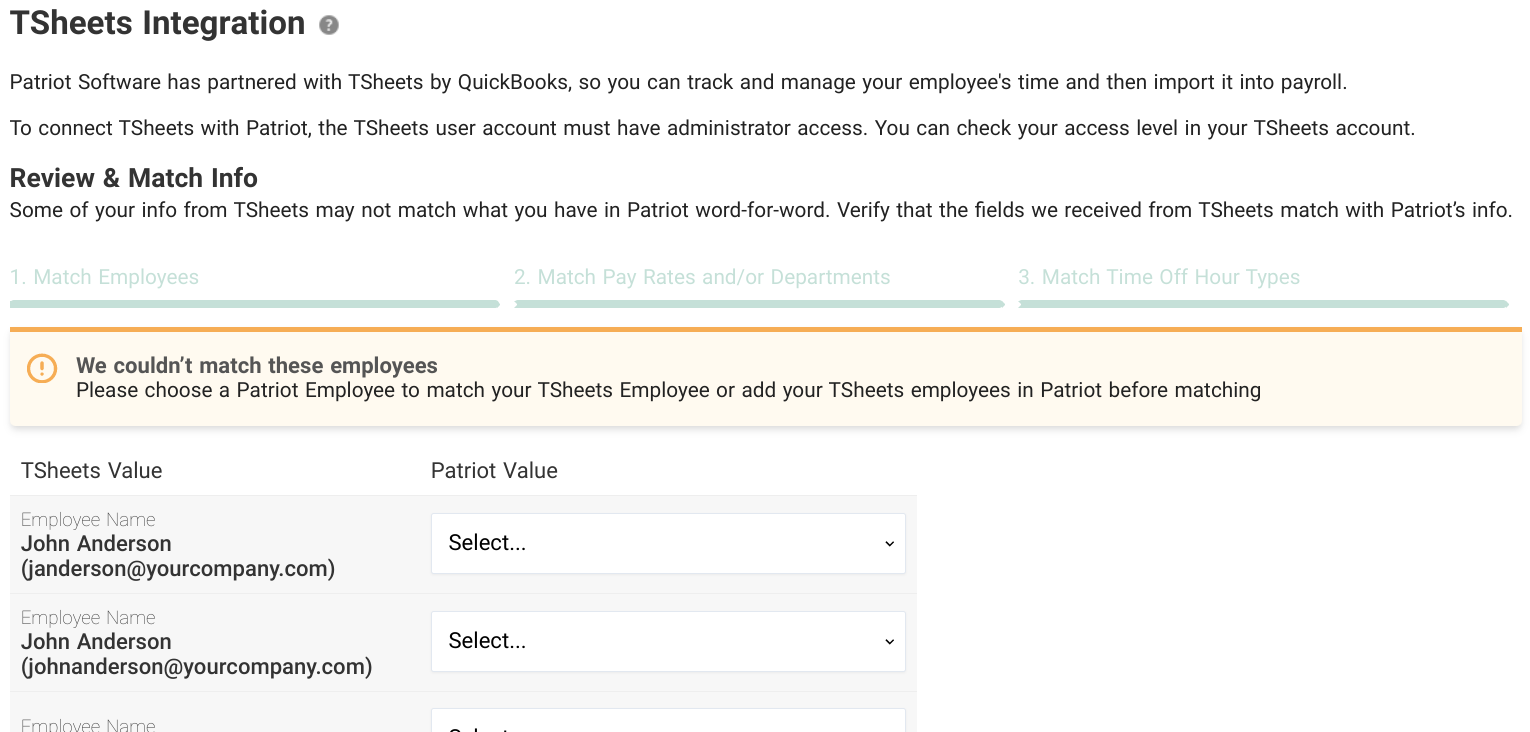

TSheets Integration

November 6, 2020Attention Patriot payroll customers: the moment you’ve all been waiting for is here (drum roll, please). Patriot’s Basic and Full Service Payroll software now integrates with Quickbooks time (formally known as TSheets).

Payroll customers can now integrate their Quickbooks Time account directly in Patriot Software in a few easy steps, making tracking and managing employees’ time a breeze. With Patriot’s Quickbooks Time integration, you can kick manual time entries to the curb and get back to your business.

Read More

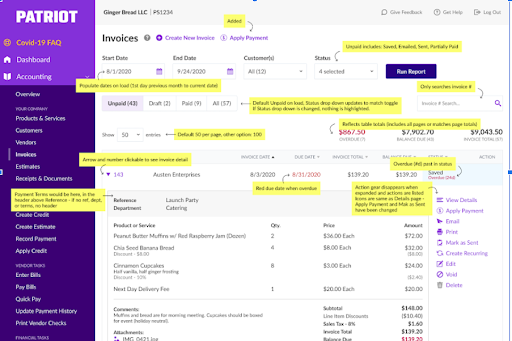

Invoice List Improvements

October 29, 2020We’re all about making our software more convenient and user-friendly to help our customers save their oh-so-precious time. Our newest invoice list improvements focus on just that. Accounting customers will see a big overhaul that consists of many handy changes to make information that is needed upfront and more visible.

Read More

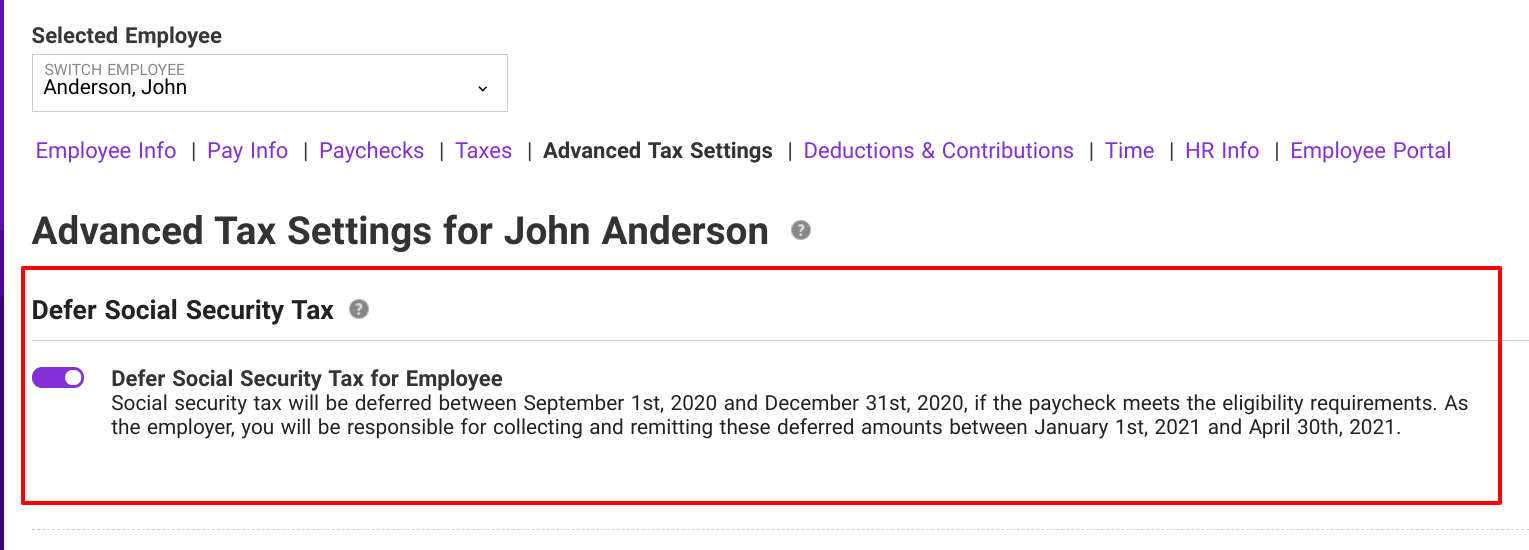

Employee Social Security Tax Deferrals

October 20, 2020Eligible employees can defer their portion of Social Security tax through the end of 2020. But here’s the catch: employers are the ones who have to opt-in (because they’re the ones on the hook for any unpaid taxes).

That’s why Patriot has given employers full control over whether they want to opt into the employee Social Security tax deferral and—if they do—which employees will have the deferrals.

Read More

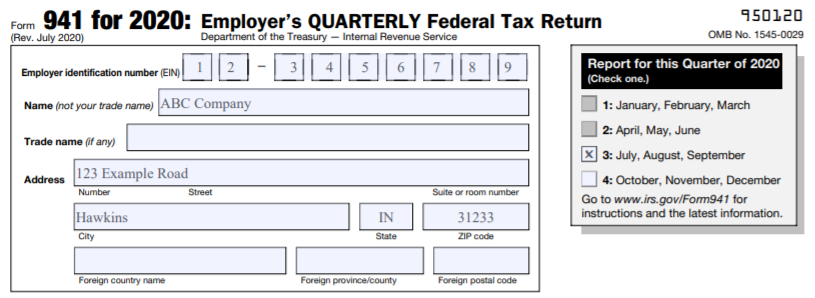

New 941 for 2020 Q3 Released

October 19, 2020Form 941 once again got a makeover—this time to accommodate employee Social Security tax deferrals.

Sound scary? Don’t worry—Patriot has handled the hard part for you. We’ve updated our software to include the IRS’s newly released 2020 Quarter 3 941.

Read More

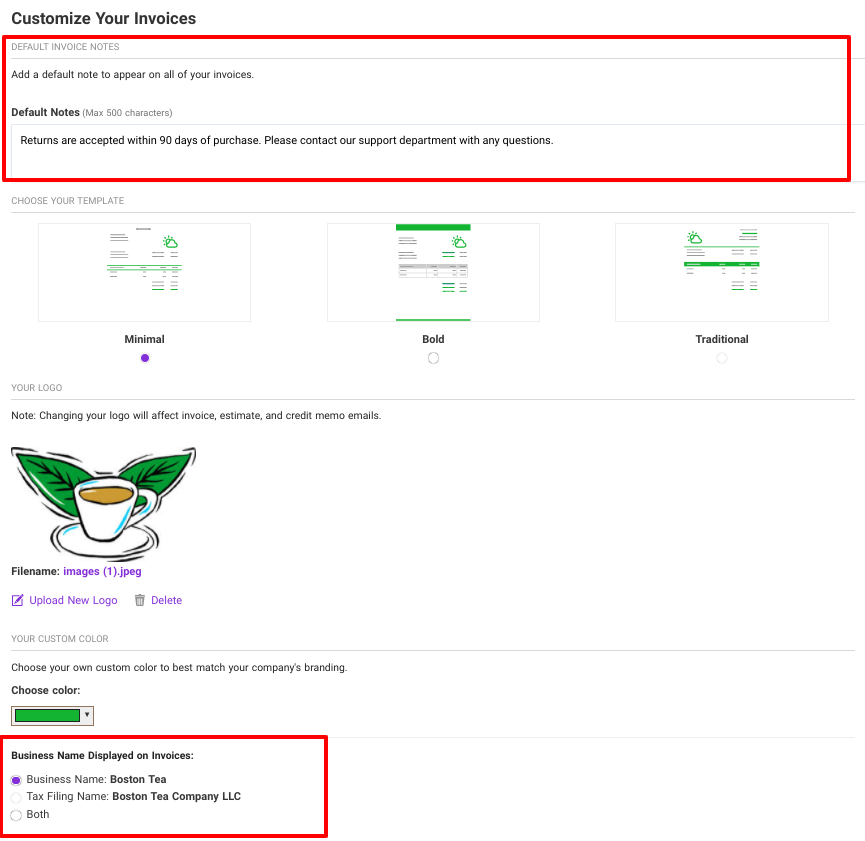

Streamlined Invoice Improvements

October 9, 2020You’ve asked for it, and we delivered! We are always listening to improve our accounting product to make it more user-friendly and meet our accounting customers’ needs.

Accounting Premium customers can now add default notes to all customer invoices allowing for terms and conditions or other important information to display on each invoice. And, all accounting customers can now select how they want their business name displayed on invoices, and print or email invoices again after customer payments have been applied.

Read More

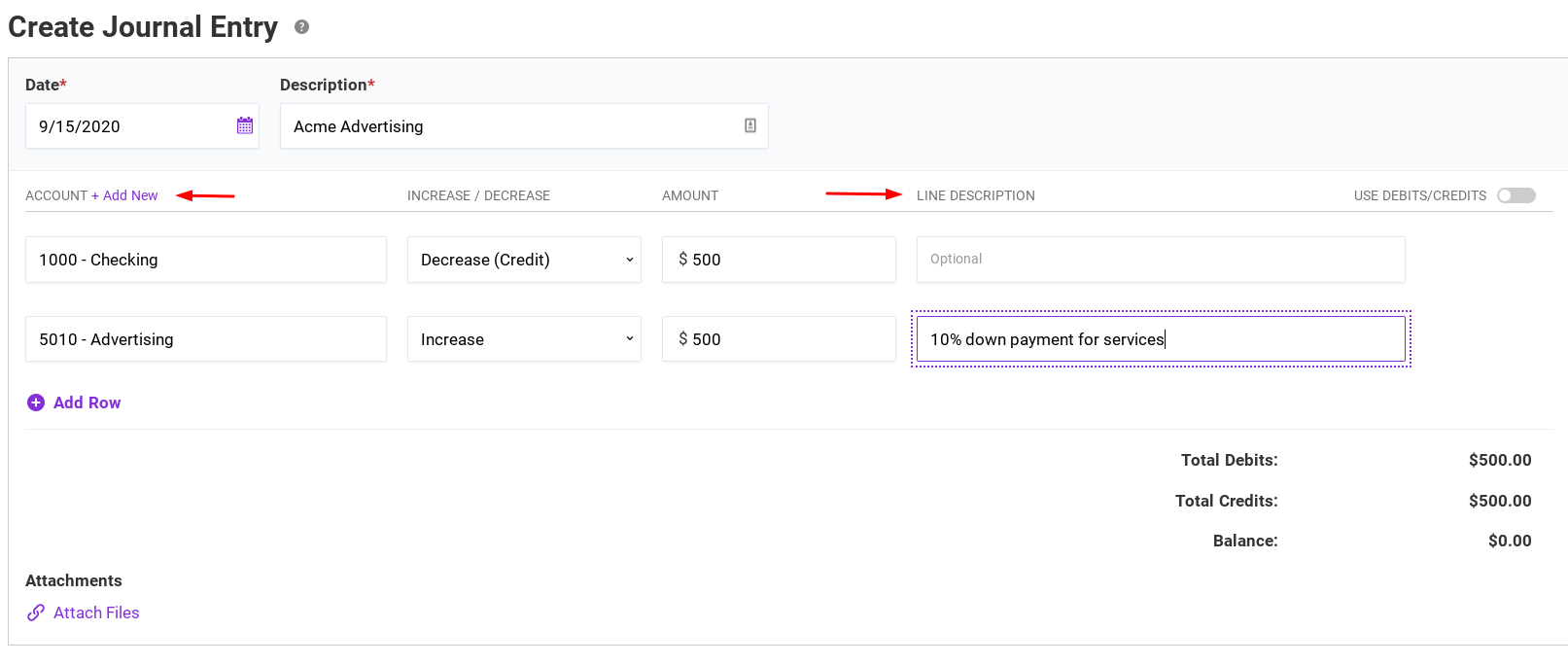

Time-saving Journal Entry Improvements

September 16, 2020We’ve made some improvements to the Journal Entry screen! These make recording your accounting transactions even faster because we value your time as much as you do.

Read More

“Smart Suggestion” Feature

September 9, 2020Accounting software customers, buckle up because the future is here. Machine learning has come to Patriot through our new Smart Suggestion feature! Now when you import bank transactions, you’ll get automatic expense account suggestions … and more time to go about your day.

Read More

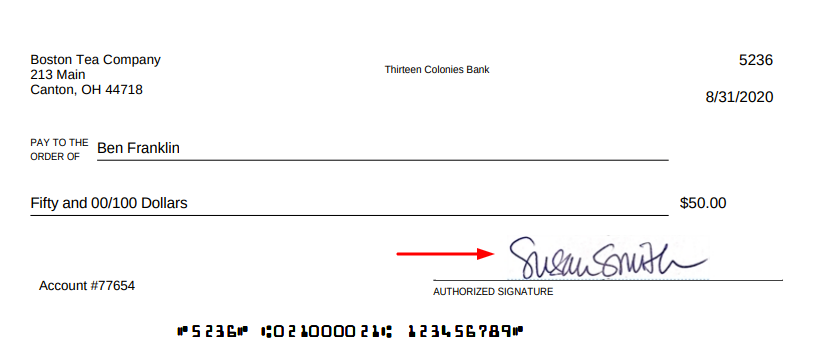

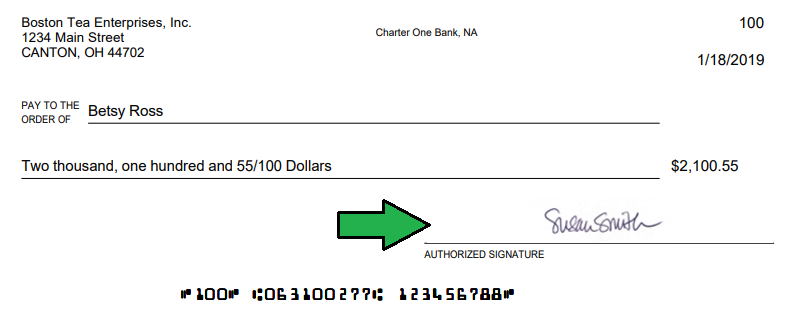

E-sign Vendor and 1099 Contractor Checks

September 4, 2020Put down that pen! It’s time to save yourself another step when paying your 1099 contractors and vendors. You can now digitally sign checks, so you’ll never need to write out your name on checks one-by-one again.

Read More

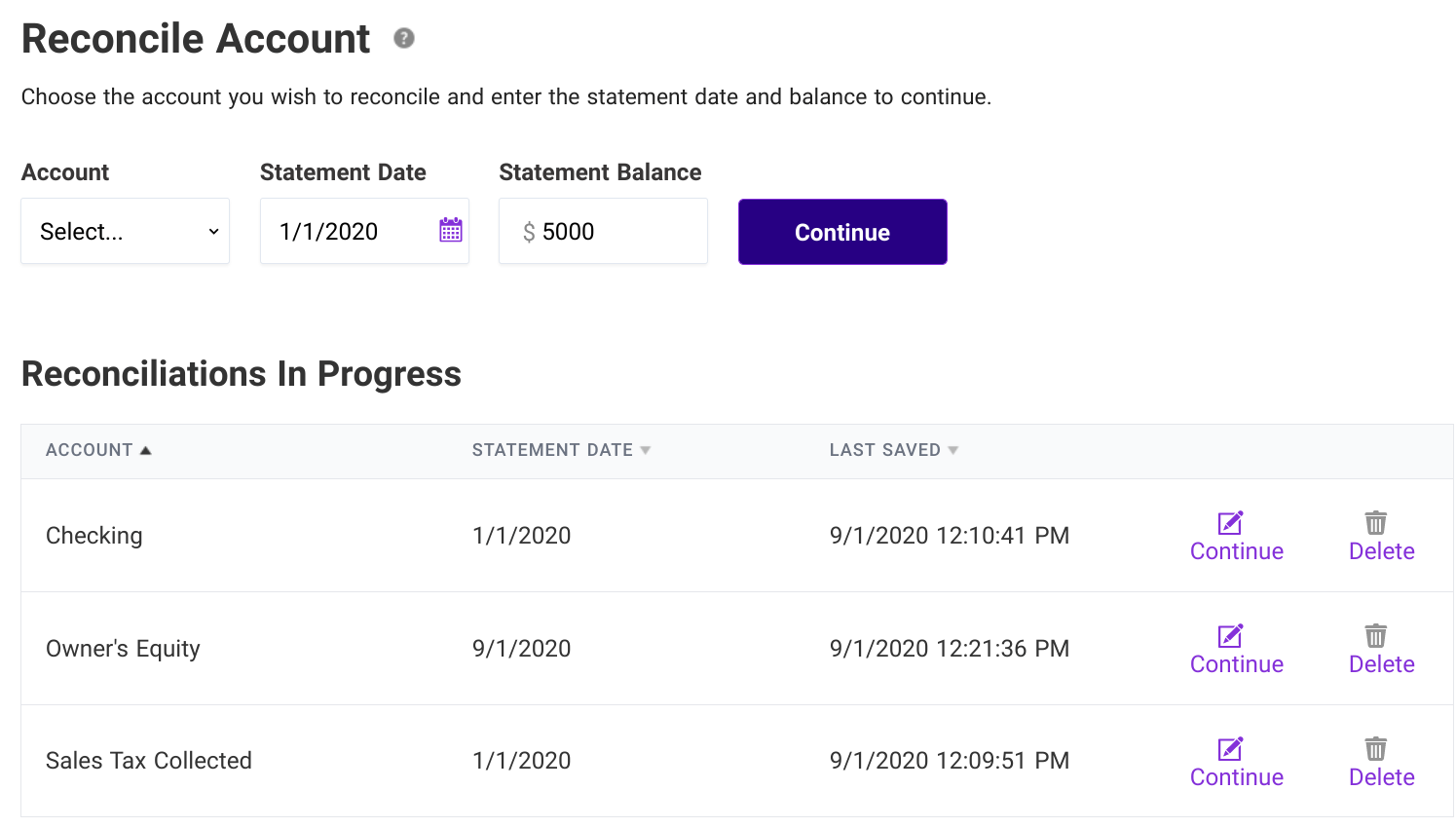

Reconcile Liability and Equity Accounts

August 20, 2020If crunching numbers is your cardio, you’re going to love our new reconciliation feature for liability and equity accounts. This feature helps accounting customers spot errors, or missing transactions.

Read More

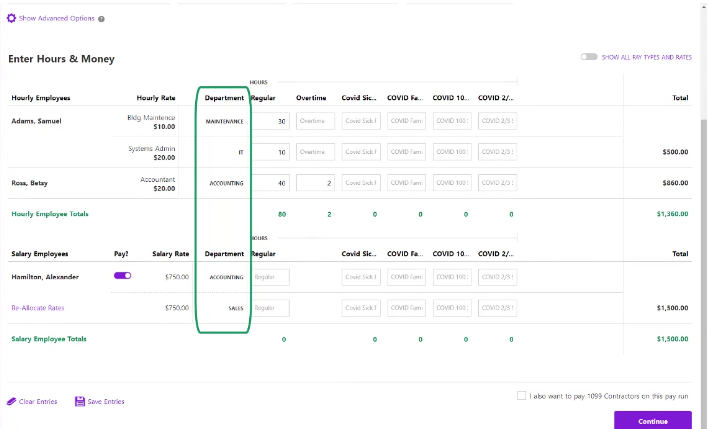

Departments in Payroll

August 19, 2020Get ready to take your payroll’s organization to the next level. We’re excited to announce “departments in payroll,” a feature that has been highly requested by our payroll customers, is now available!

Read More

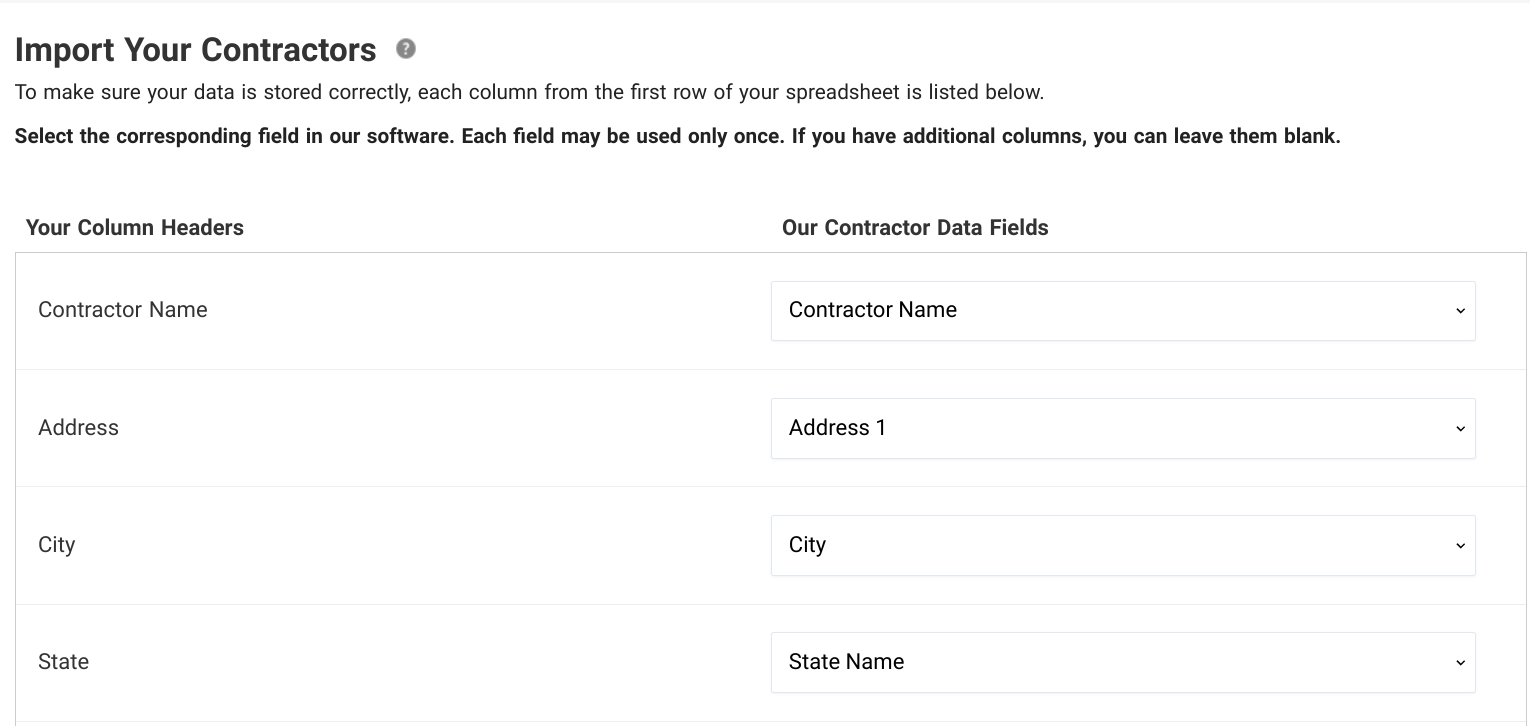

Bulk Import 1099 Contractors in Payroll

August 13, 2020We’re happy to announce another new feature that can give you back precious time in your day. You can now upload a file to bulk import 1099 contractors in the payroll software!

Read More

Manager Settings

August 12, 2020You asked, we listened! Patriot’s HR software customers can now designate managers, assign managers’ direct reports, and view manager and employee information all on one easy-to-digest page (and who doesn’t like it when things are that easy?)!

Read More

Sign up or Sign in Using Google SSO

August 11, 2020We’re thrilled to announce you can now conveniently use your Google account to sign up and sign in to Patriot Software. It’s a nifty little feature. In fact, we think it ranks right up there with other big time-savers, like the wheel, sliced bread, and, well…Patriot (of course).

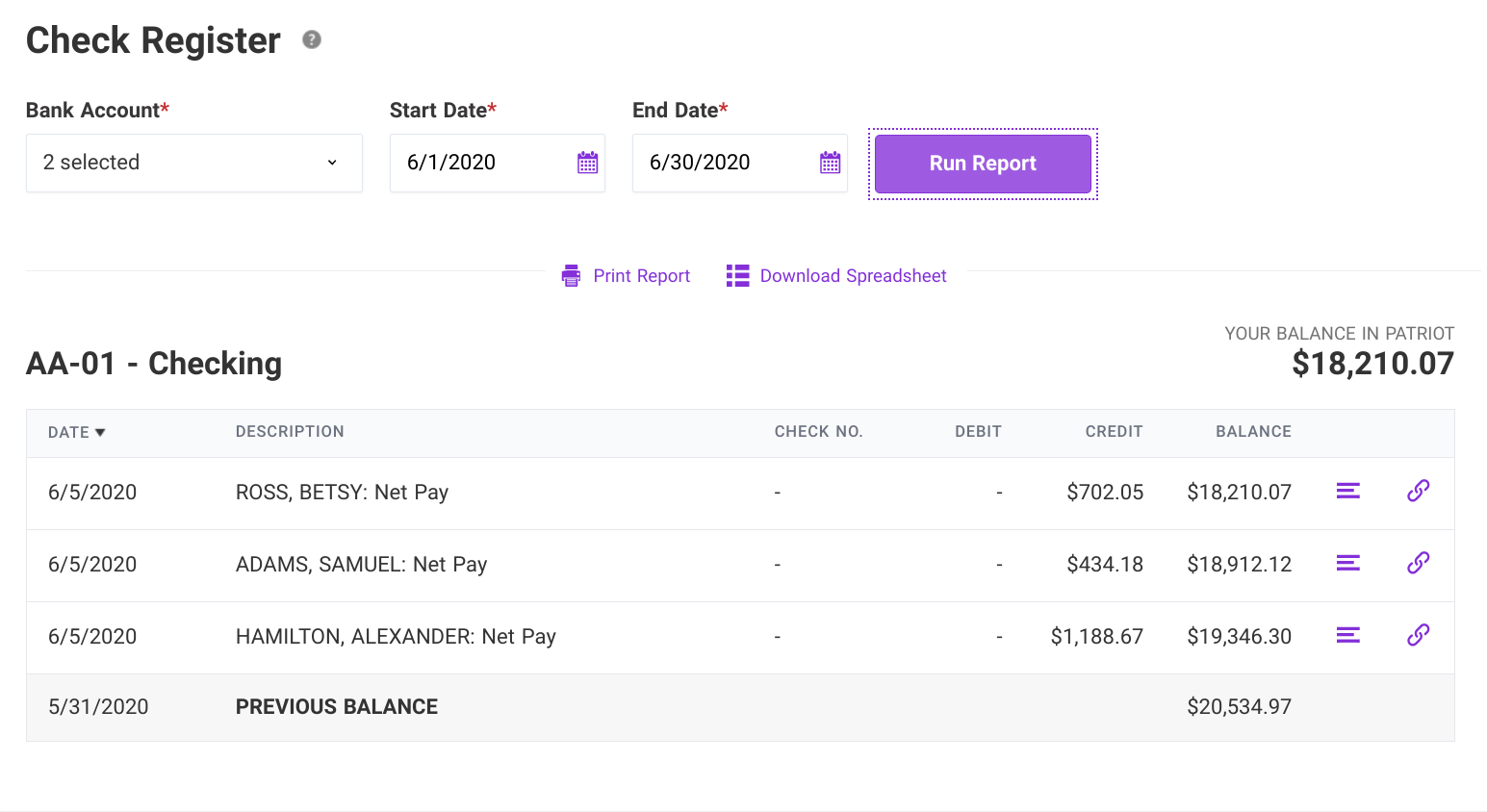

Read MoreCheck Register Report

July 31, 2020Patriot’s Accounting Customers now have an easy way to view bank activity details and balances with our new Check Register Report. Just one more way Patriot simplifies your accounting for you.

Read More

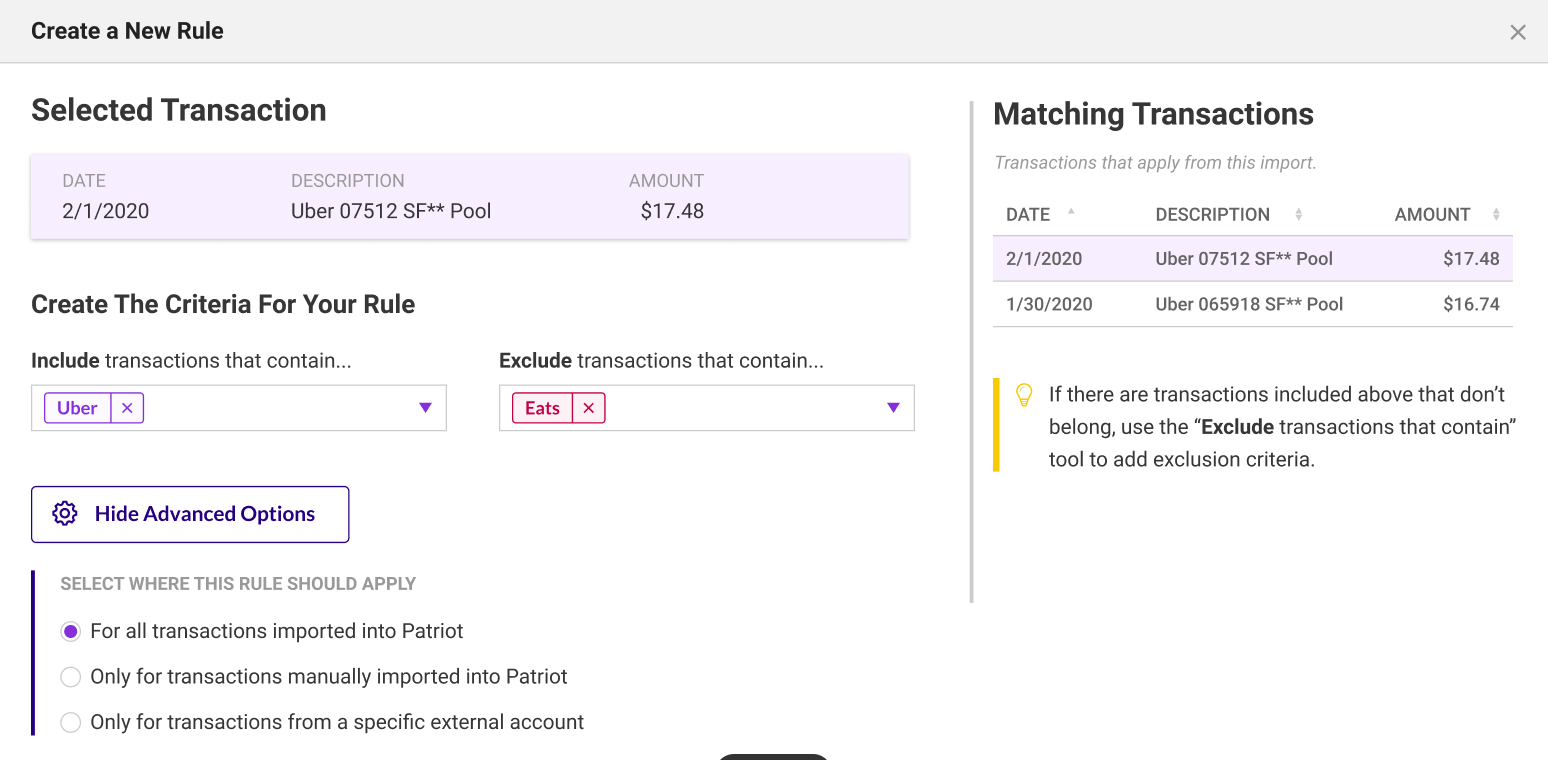

Rules for Imported Transactions

July 29, 2020We are excited to announce a huge time-saver for Patriot Accounting Customers who import banking transactions. We’ve added a new feature that allows accounting software customers to add customized rules to streamline their imported banking transactions by automatically assigning them to the correct account and department.

Read More

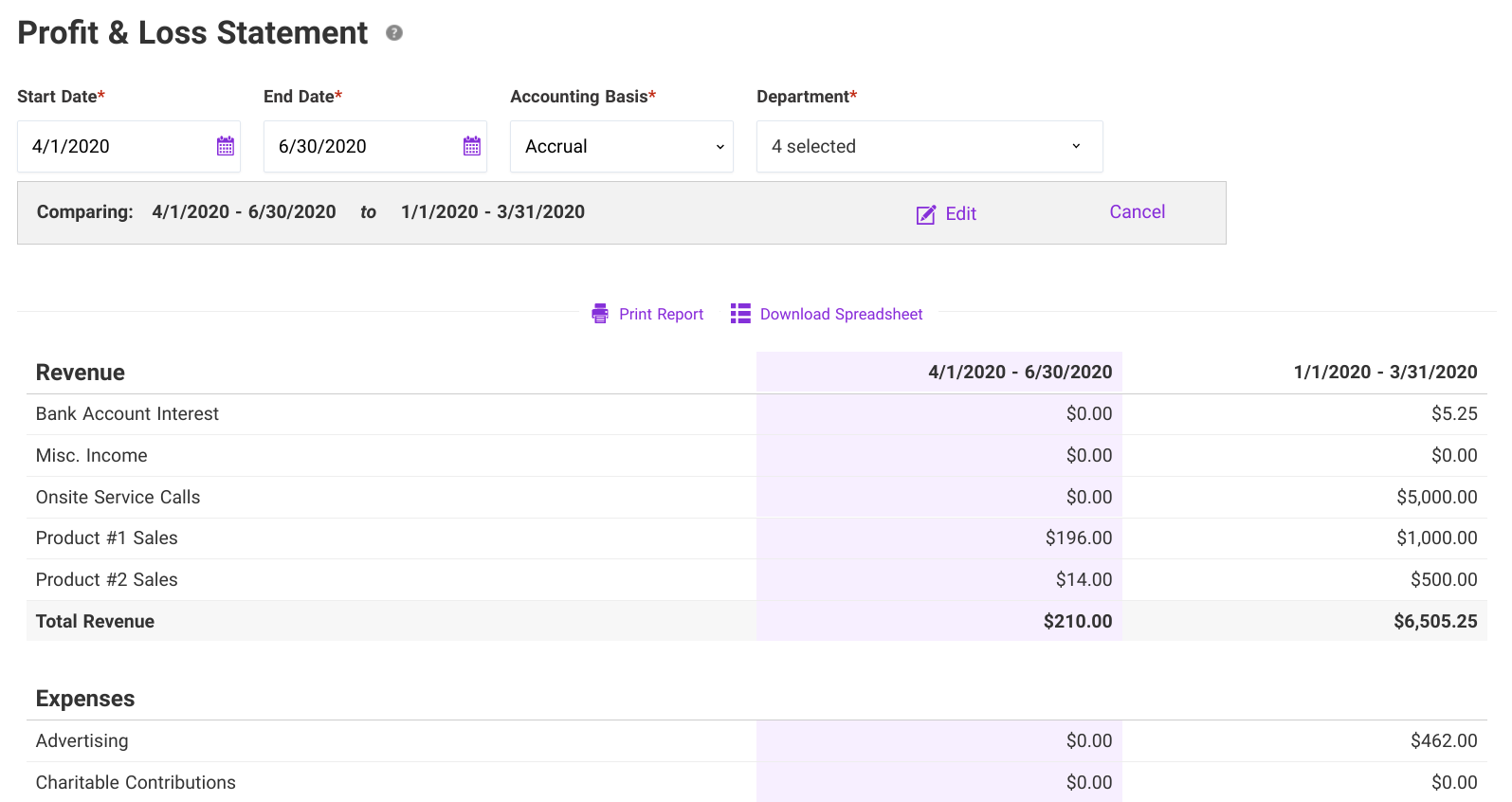

Comparison Reporting for Accounting Financial Reports

July 28, 2020We’re thrilled to announce comparison reporting for Accounting Basic and Accounting Premium customers for Account Balances, Balance Sheet, and Profit and Loss Statements. Comparison reporting allows views of data broken down by date range for easy analyzing!

Read More

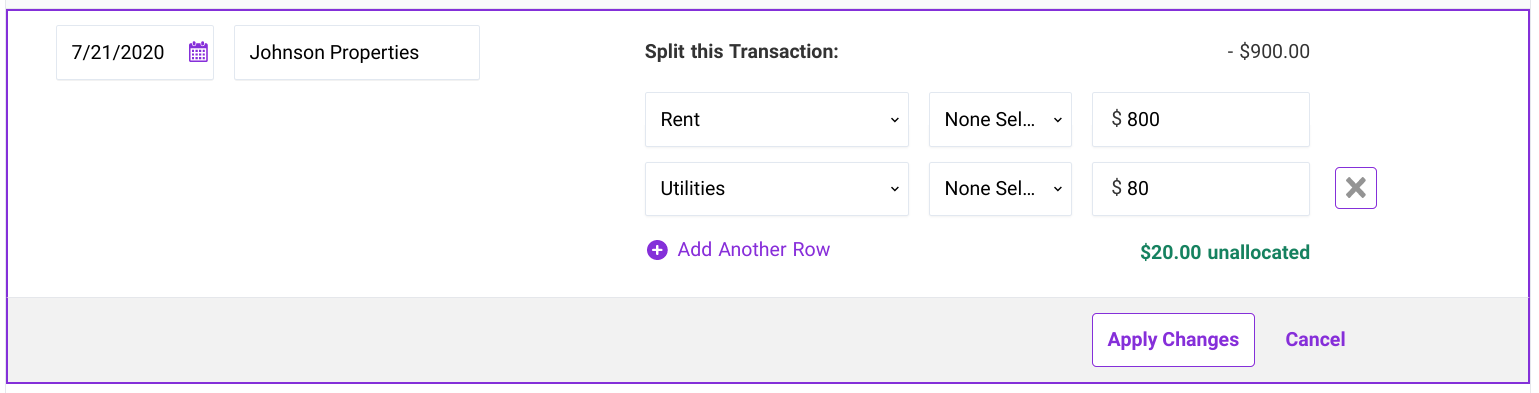

Split Imported Bank Transactions

July 22, 2020Accounting software customers can split single bank transactions imported into the software. That way, transactions can be allocated to different accounts and departments (if applicable).

Read More

New 941 for 2020 Q2 Released

July 14, 2020Our software has been updated with the new 2020 941 released by the IRS on June 26, 2020. The IRS requires the new 941 be used for Quarter 2 tax filing due July 31, 2020. The IRS revamped Form 941 to accommodate the new IRS tax laws.

Read More

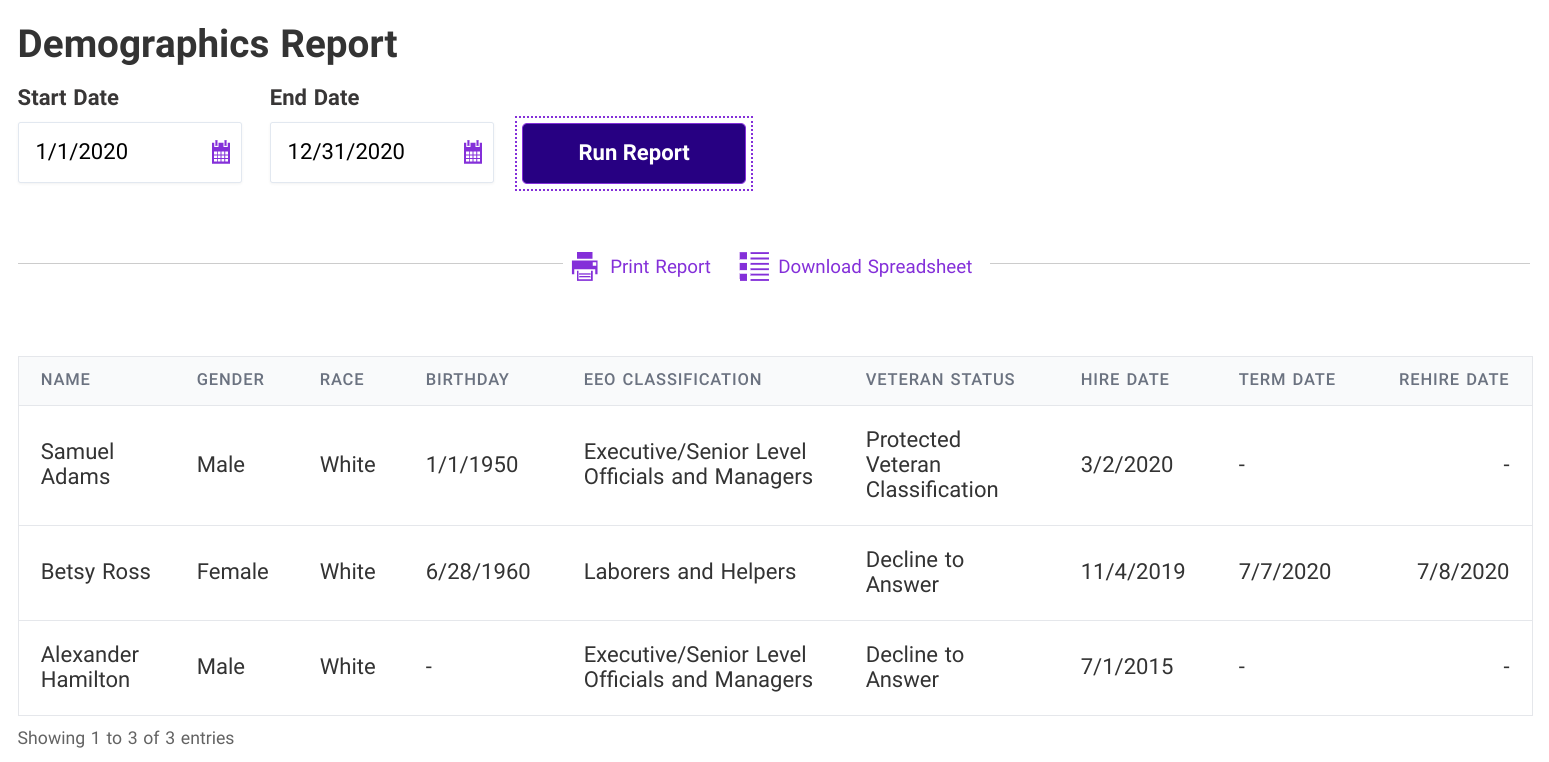

New HR Fields and Demographic Report

July 9, 2020HR customers can get important information from our new Demographic Report for a quick snapshot of employee information for EEO-1 and VETS-4212 reporting.

Read More

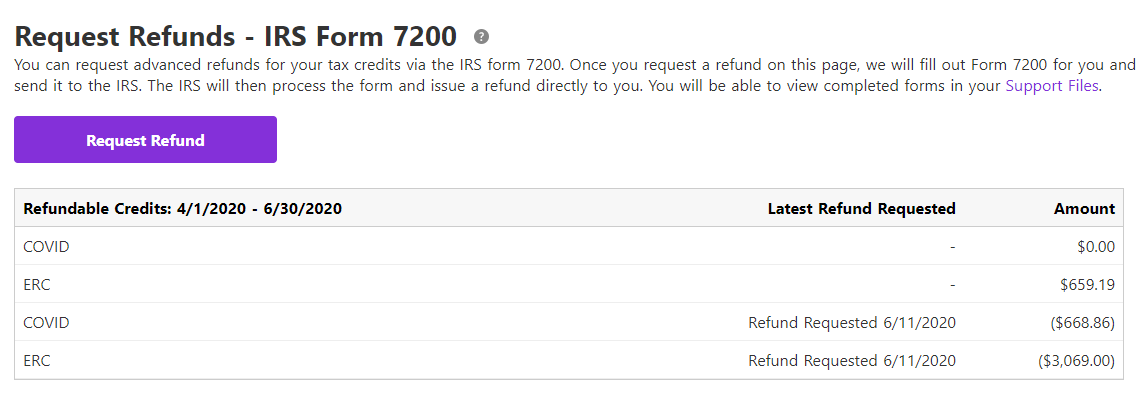

COVID Payroll Enhancements

June 12, 2020We are very pleased to announce some COVID-related payroll software enhancements!

Read More

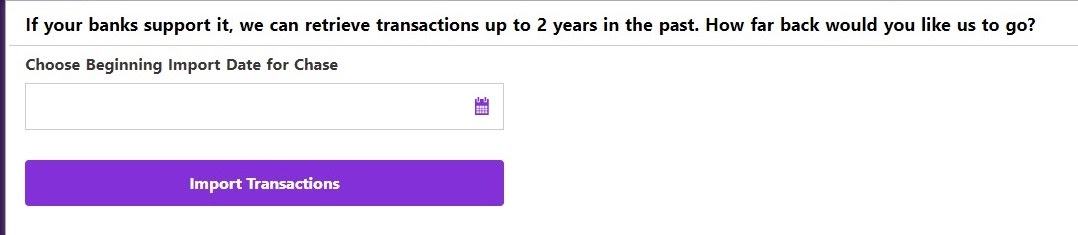

Bank Transactions Can Now Be Imported From Up to Two Years Ago

June 8, 2020Accounting customers who connect their bank accounts to Patriot’s Accounting Software can now choose to begin importing transactions as far back as two years. We know that importing these transactions will help with new users who are just starting with the Accounting Software, or for our current users who may be behind on their accounting transactions. (No judgement here, friends, we got you.)

Read More

Patriot Software Updated Terms of Use

May 29, 2020We at Patriot have redesigned our Customer Service Agreement to make it easy to access and comprehensive for our Accounting and Payroll software customers.

Read More

Patriot Announces New Referral Program

May 27, 2020Patriot Software is pleased to introduce a new customer referral program.

Read More

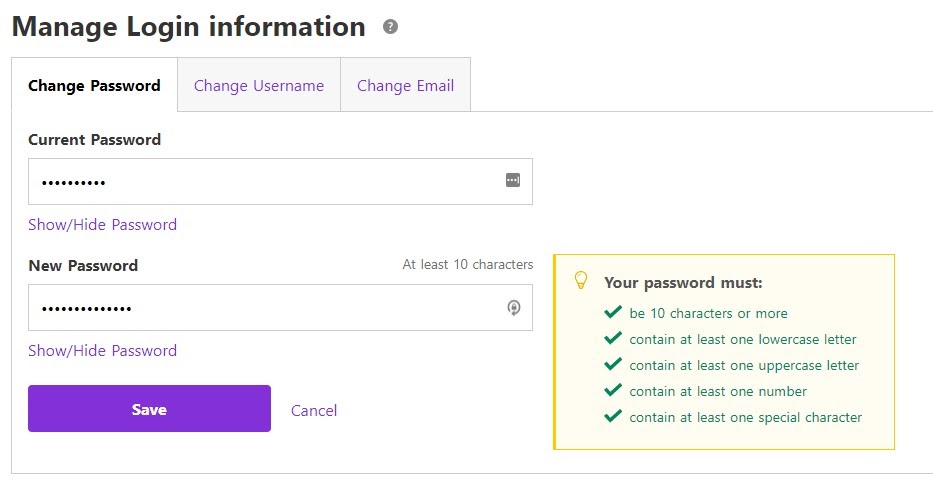

Enhanced Password Strength

May 21, 2020Patriot Software has added new password standards to increase the security of our customer login credentials.

Read More

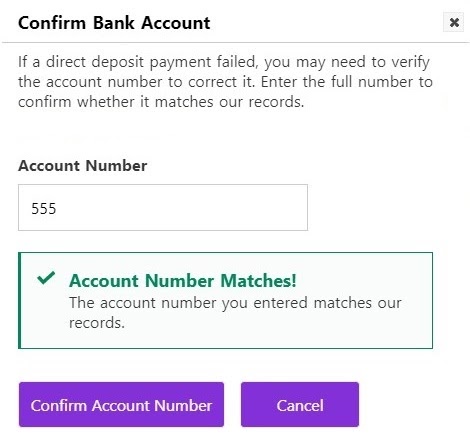

Verify your Employee or Contractor Bank Account

April 23, 2020As a Payroll Customer, there are times when you may want to confirm an employee or contractor’s full bank account number that was entered for direct deposit.

Read More

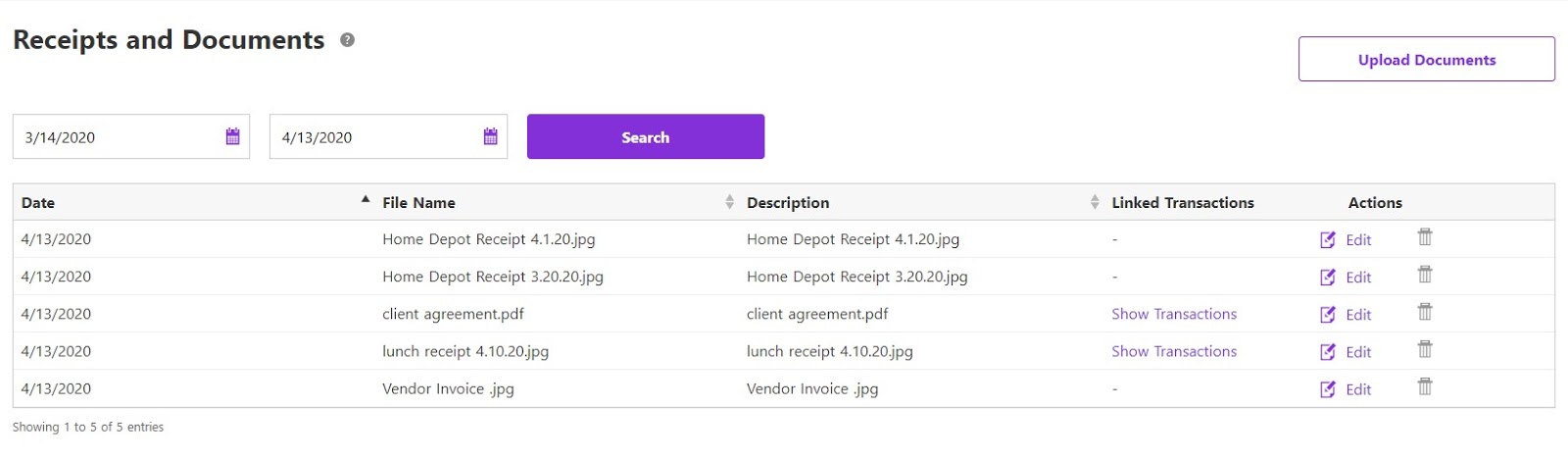

Accounting Receipts and Documents

April 22, 2020Accounting Premium customers can now upload and manage all of their receipts and other documentation, and attach these electronic files to accounting transactions.

Read More

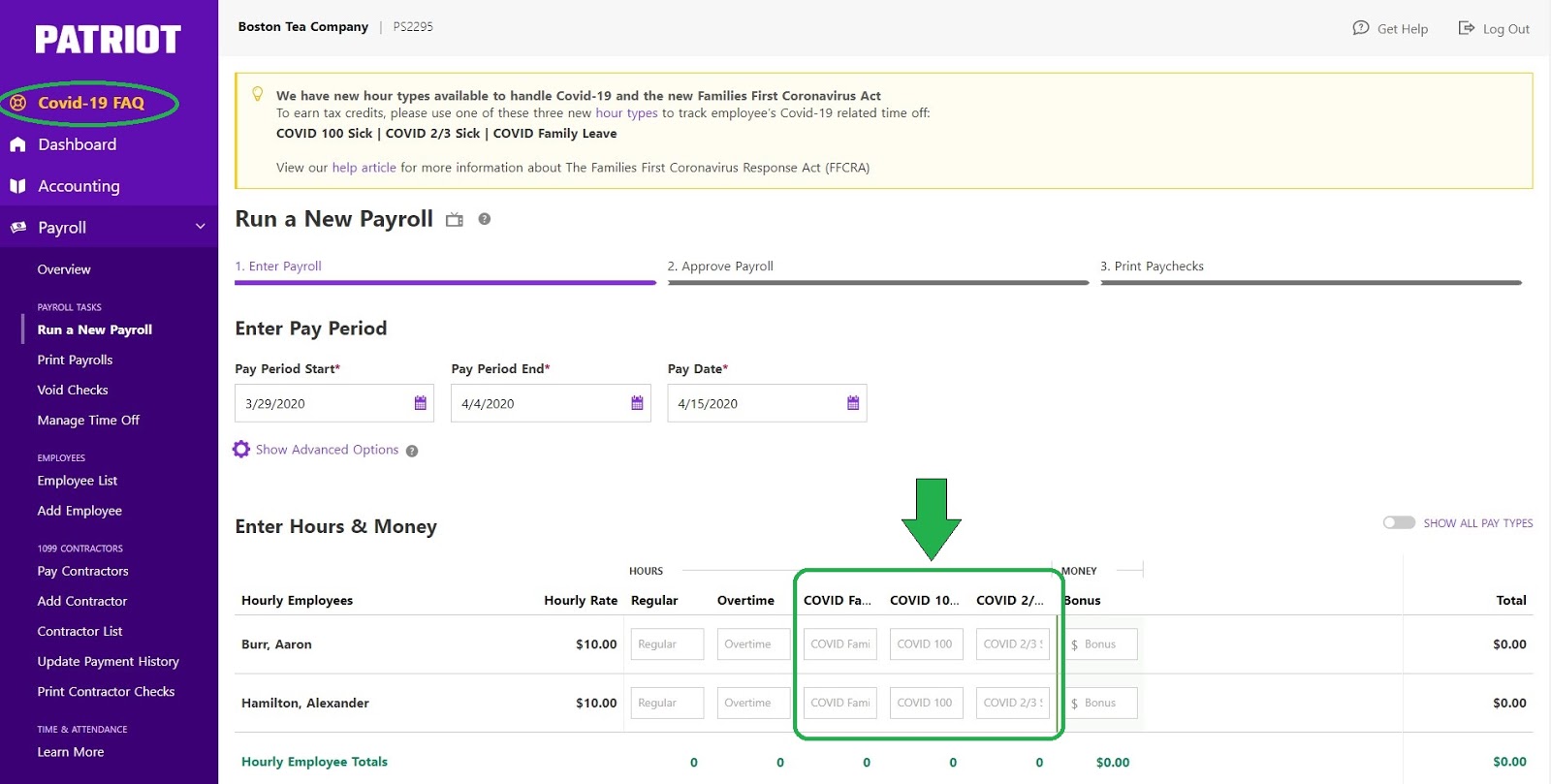

COVID-19 Paid Leave Software Updates

April 6, 2020Patriot payroll customers who are required to comply with paid leave requirements of the Families First Coronavirus Response Act (FFCRA) can now pay employees for time off with special hour types.

Read More

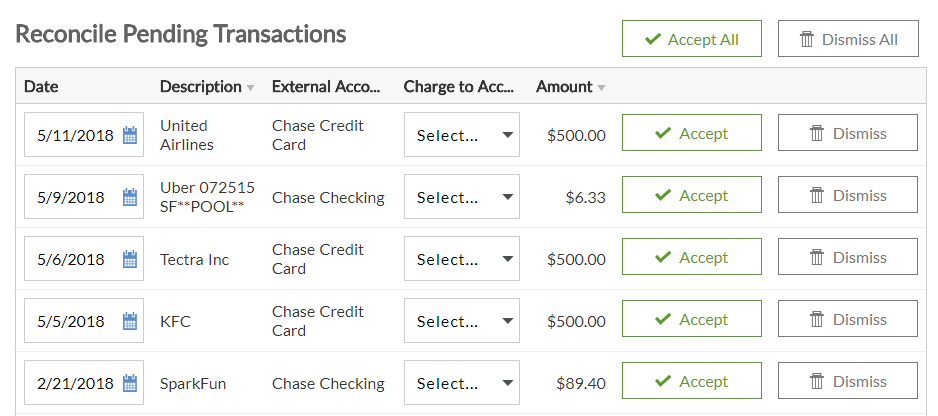

Automatic Bank Import Improvements

March 20, 2020Accounting customers who automatically connect their bank accounts or credit card accounts and import transactions into Patriot will see some enhancements to this process:

Read More

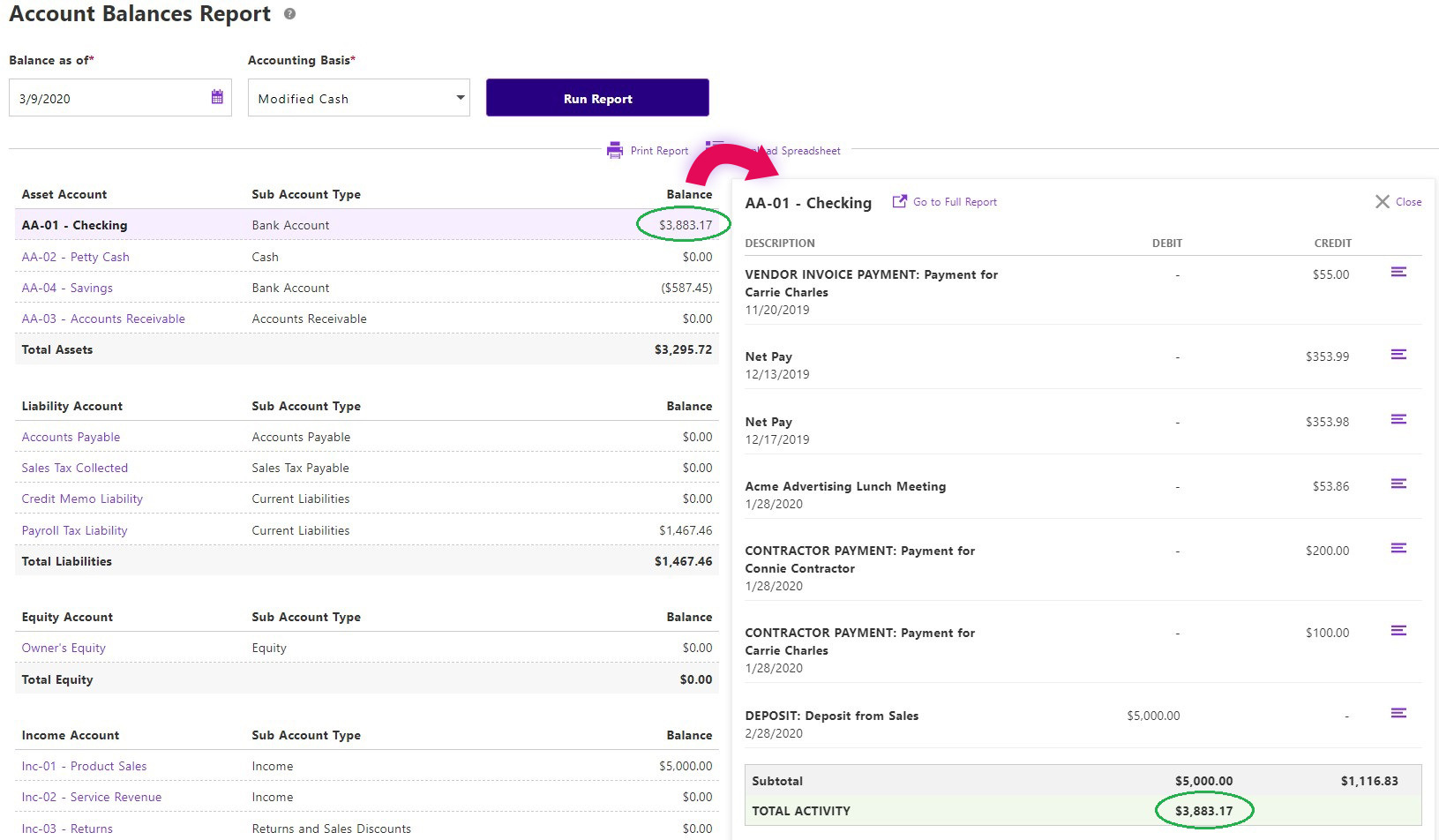

Accounting Drill Down Reporting

March 12, 2020We are pleased to announce that Accounting customers will be able to see more detail in three of their financial reports:

Read More

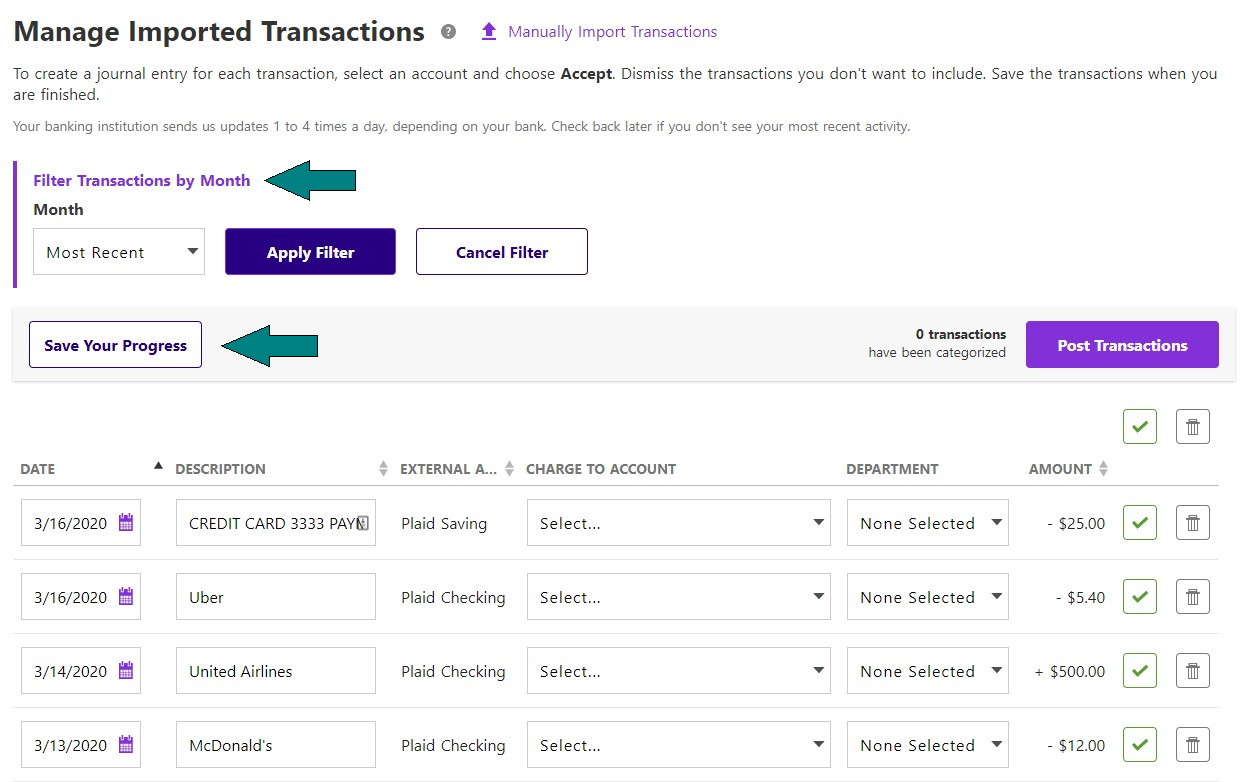

Saving Manually Imported Bank Transactions

March 4, 2020Accounting customers who manually import bank transactions into Patriot’s Accounting software now have the option to save their work and come back later.

Read More

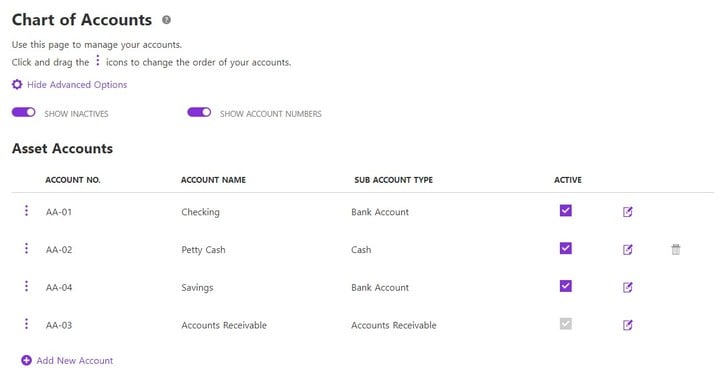

Chart of Accounts Enhancements

February 12, 2020Accounting customers now have the option to add account numbers to their Chart of Accounts.

Read More

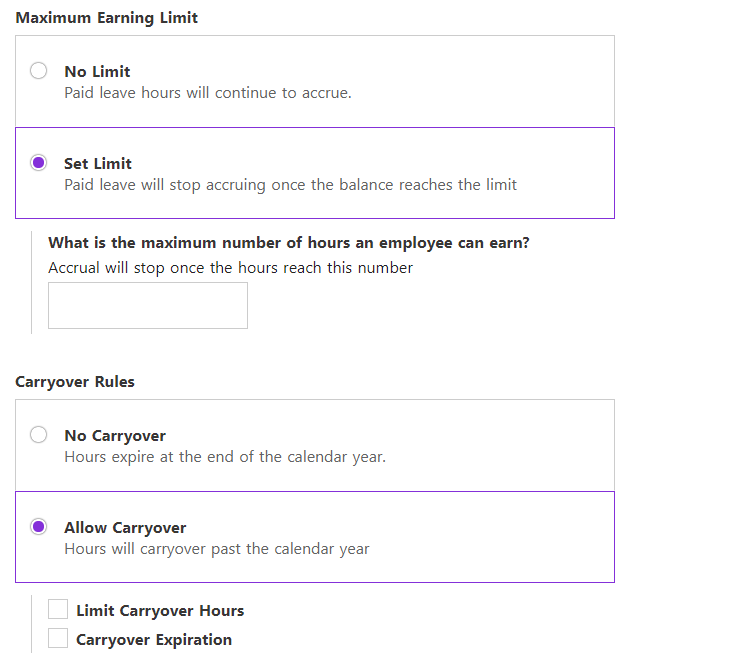

Time Off Accrual Limits and Carryovers

February 5, 2020When setting up time off accrual rules, payroll customers can now add a maximum accrual earnings limit for the year.

Read More

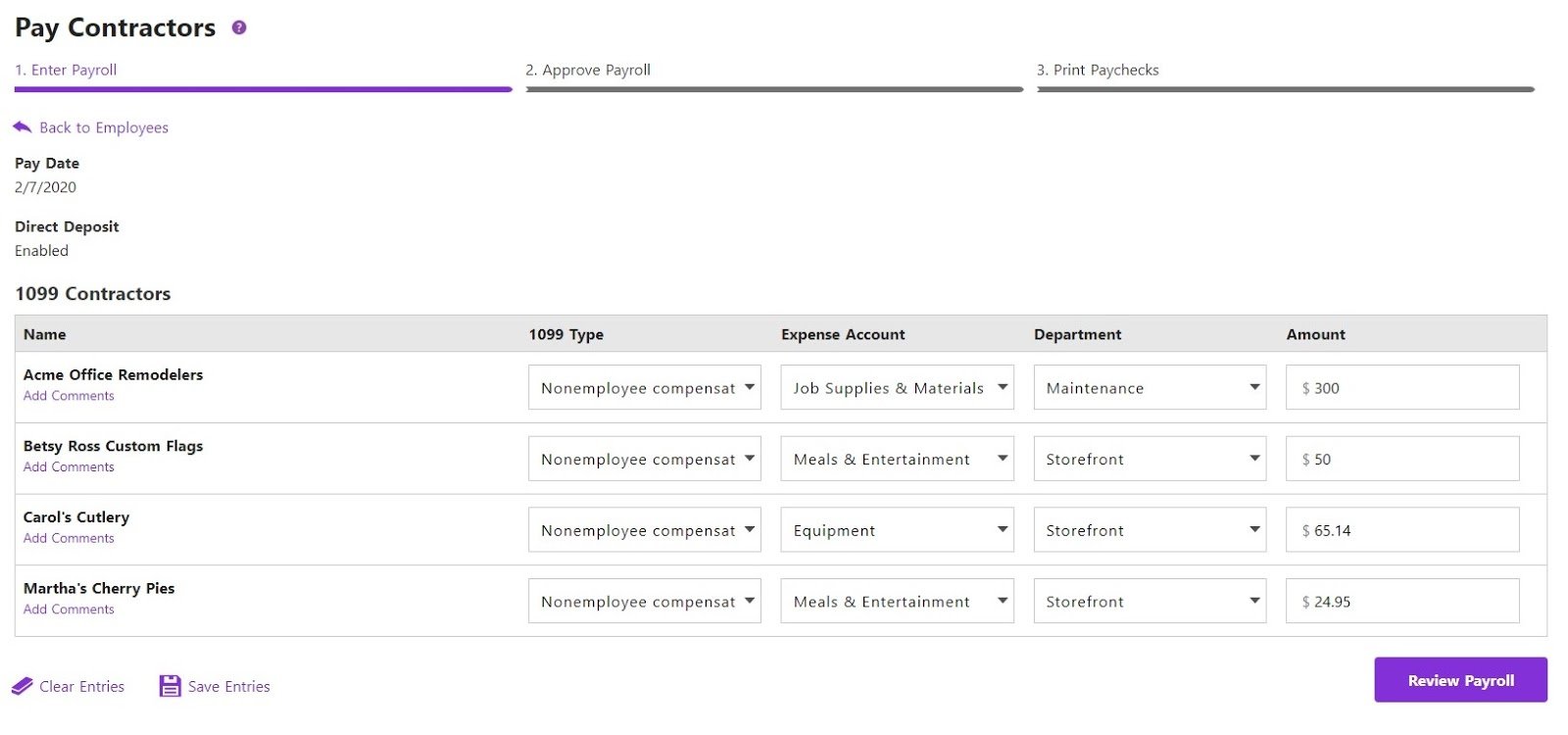

Patriot Software Announces 1099 Contractors in Payroll

January 31, 2020We are excited to announce a new payroll feature! Both Basic and Full-Service Payroll customers can now manage 1099 contractors in payroll, and pay them with either paper checks or direct deposit, along with your employees.

Read More

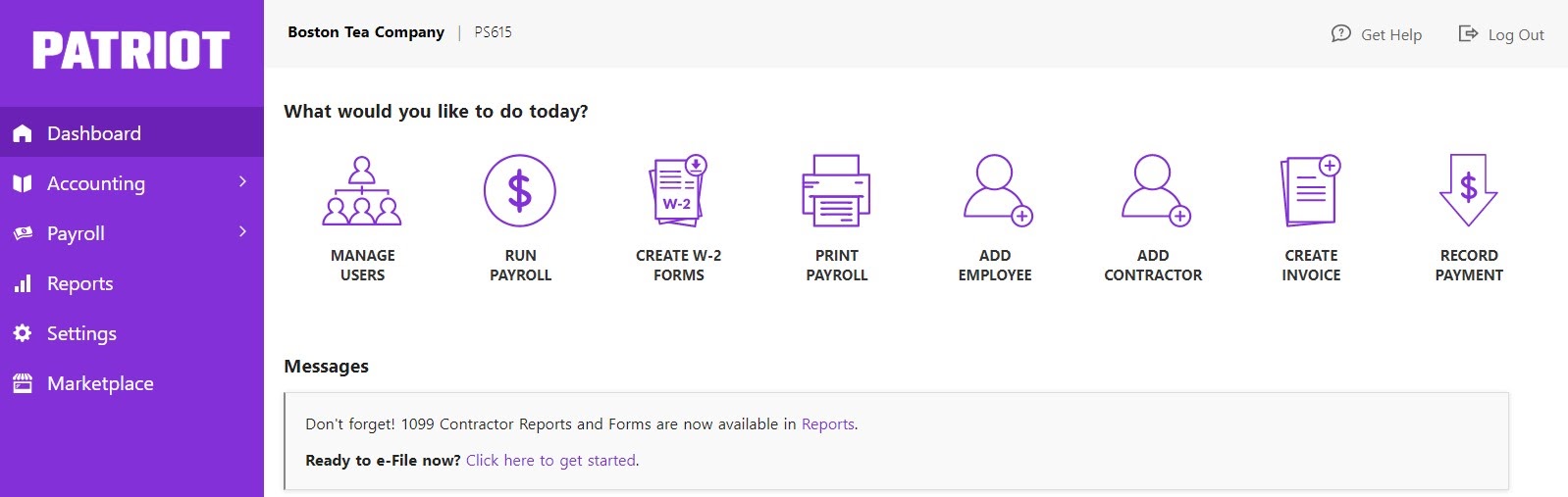

New Brand, New Look!

January 31, 2020Patriot Software has a new logo and new brand! The software colors have been updated to match the branding on our public website.

Read More

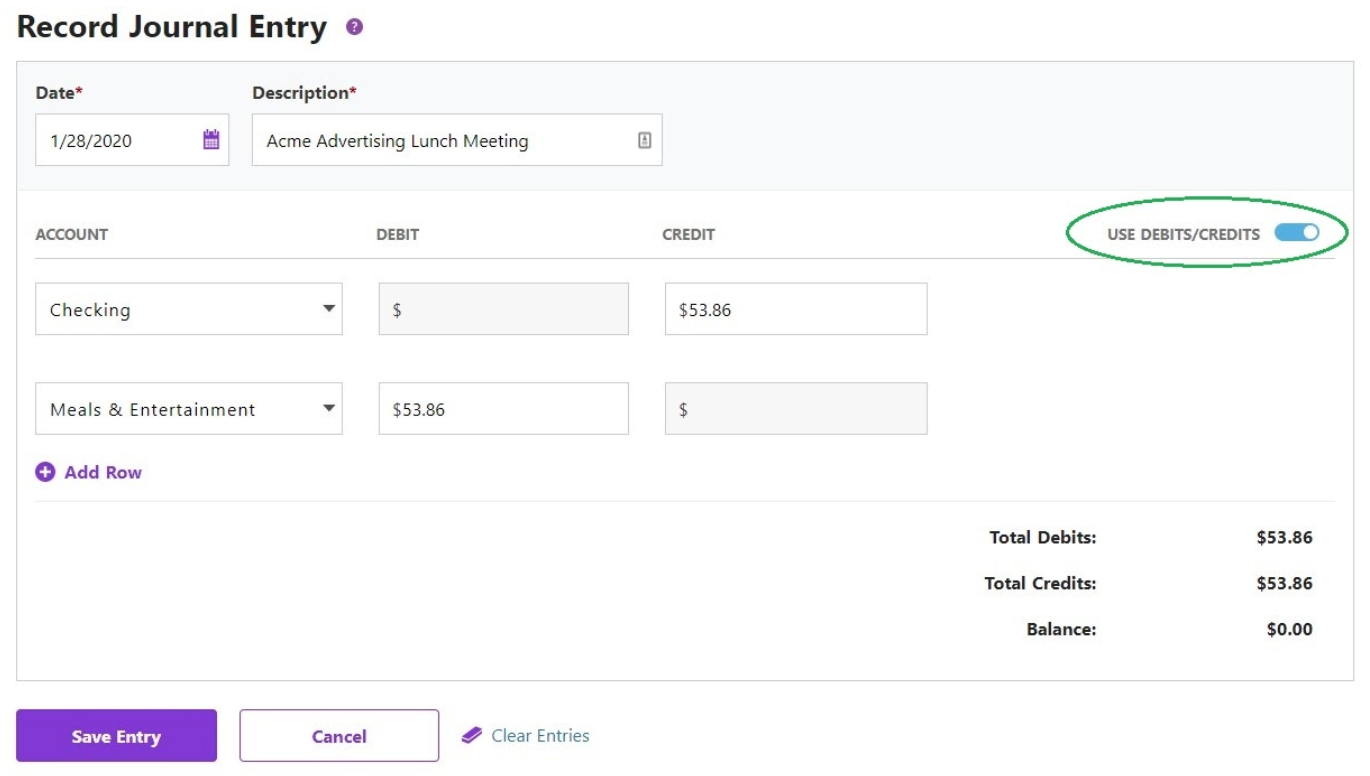

Journal Entry Improvements

January 29, 2020Accounting customers are now able to choose how they want to make a journal entry.

Read More

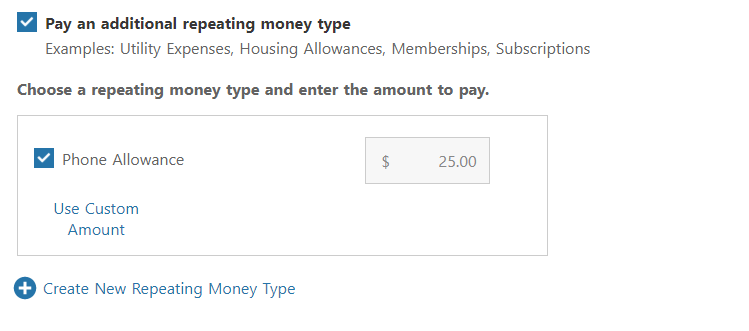

Repeating Dollar Payments in Payroll

December 26, 2019Payroll customers can now set up repeating dollar amounts for employees who are paid the same additional dollar amount each payroll.

Read More

Software Menu Updates

December 18, 2019We are pleased to announce we have simplified our Accounting and Payroll software menus.

Read More

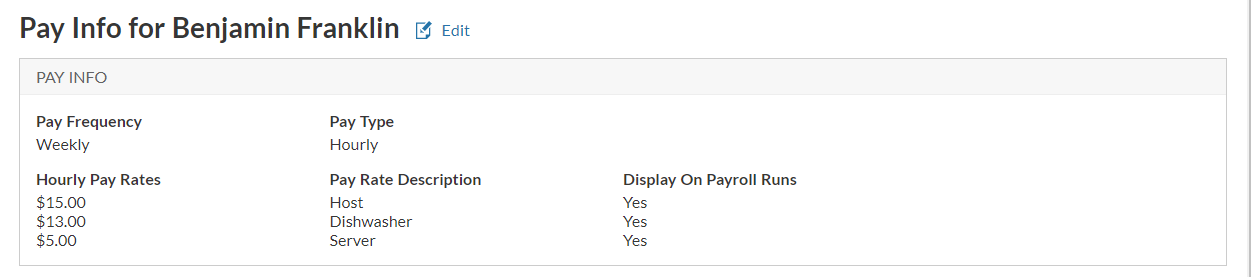

Multiple Pay Rates for Employees

November 14, 2019Payroll customers can now add multiple pay rates for each hourly employee.

Read More

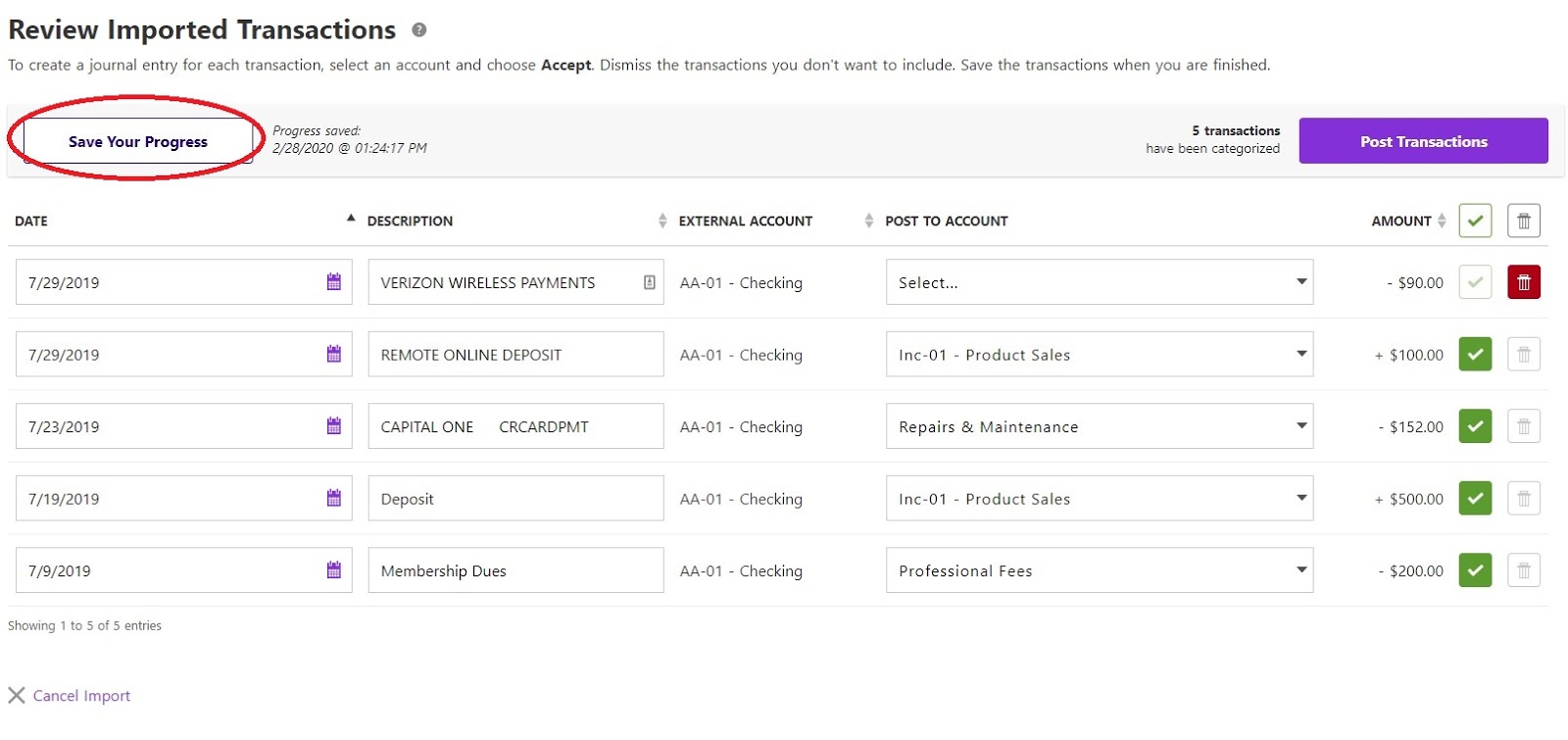

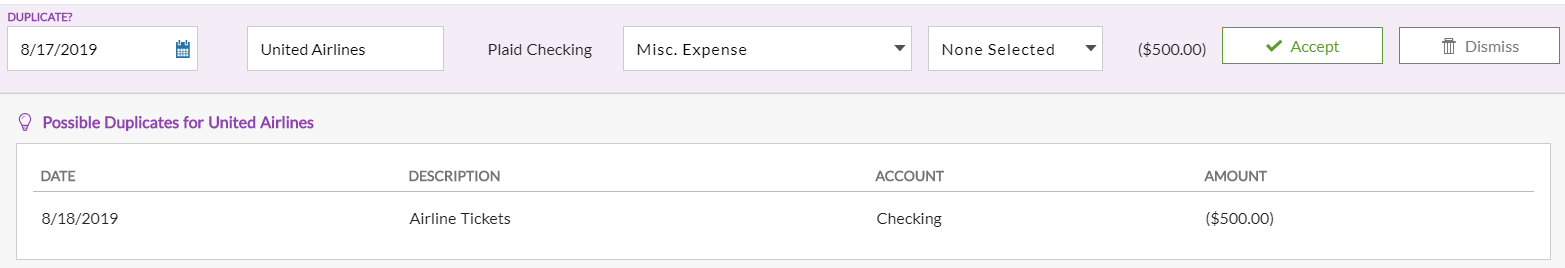

Duplicate Transaction Warning When Importing Bank Transactions

September 3, 2019We have added an enhancement to our bank transaction import feature in our Accounting Software.

Read More

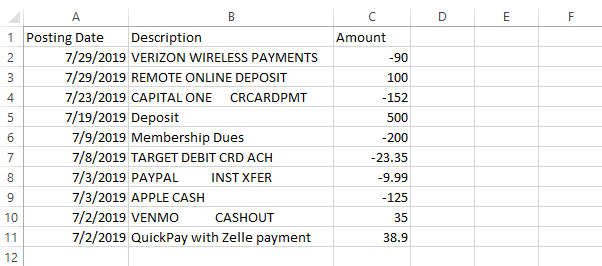

Manually Import Bank Transactions in Patriot Software

September 3, 2019Accounting customers can now manually import bank or credit card transactions by exporting a file from their bank and importing the file into Patriot Software.

Read More

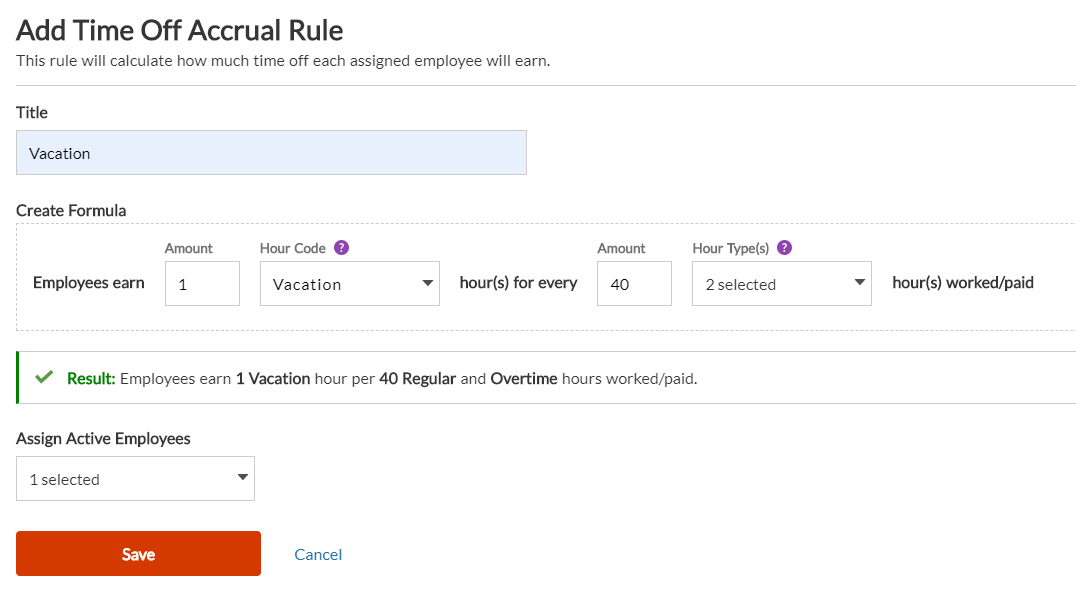

Patriot Software Announces Time-Off Accruals

August 9, 2019Patriot Software Payroll customers can now set up time-off accrual rules, for example earning 1 vacation hour for every 40 hours worked.

Read More

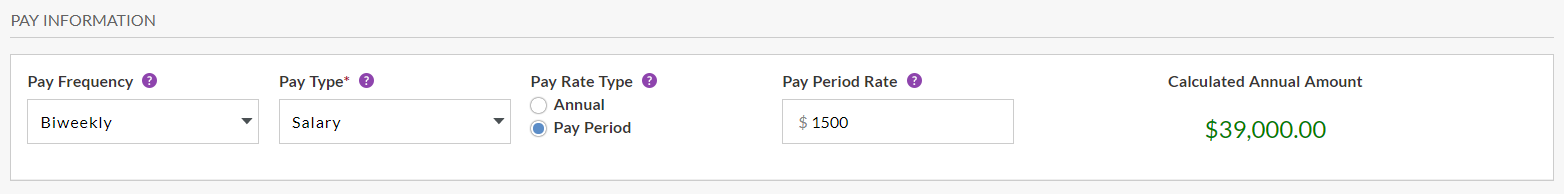

Entering Salary or Salary Non-exempt Employee Pay Rate

May 29, 2019When adding a new salary or salary non-exempt employee, payroll customers can now choose between an annual pay rate or rate per pay period.

Read More

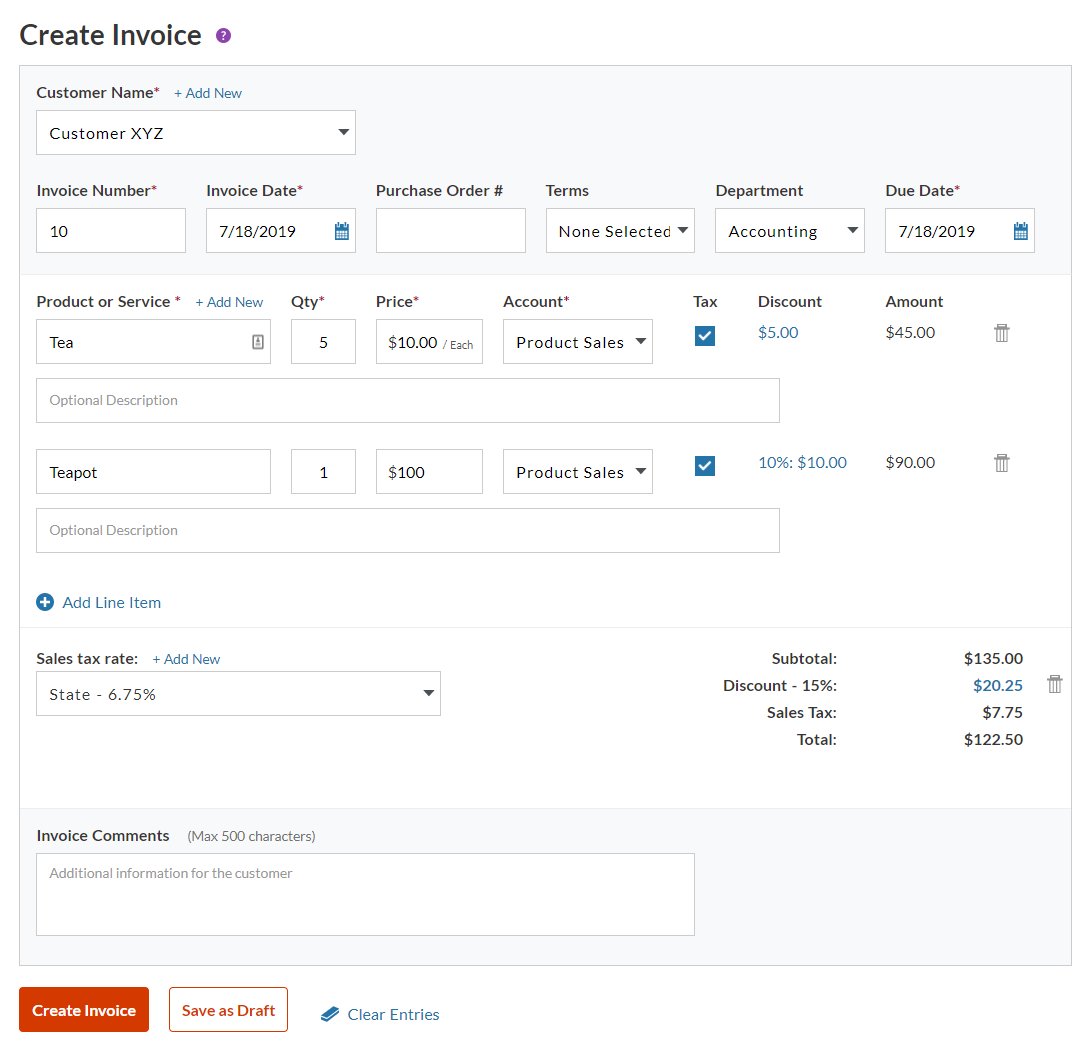

Discounts to Invoices

May 6, 2019Accounting software customers can now add discounts to specific products or services, invoice totals, or both.

Read More

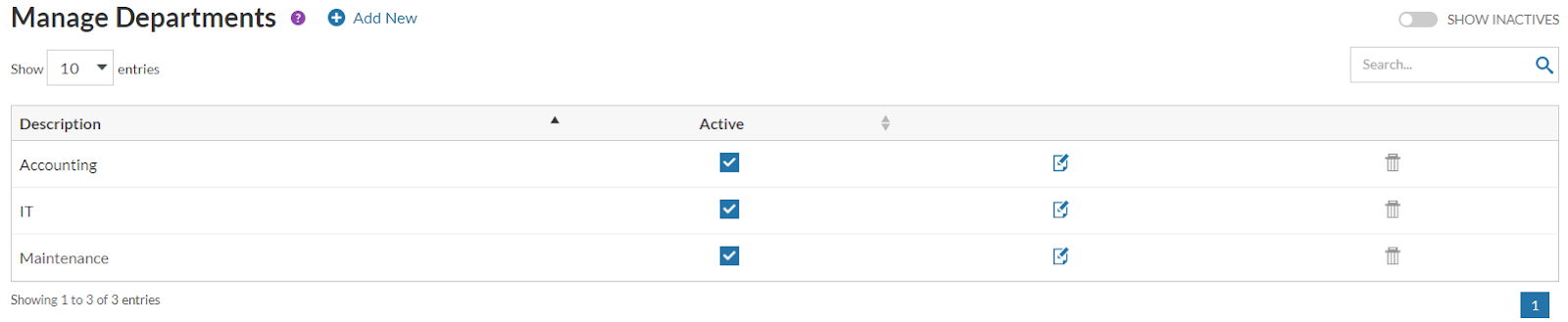

Accounting Departments

February 20, 2019Beginning February 20, 2019, accounting customers can now set up and manage departments in the software.

Read More

Patriot Software Announces Accounting Premium

February 7, 2019Patriot Software is excited to announce a new Accounting product option for customers who need enhanced features for their business.

Read More

Adding E-Signature to Paychecks

January 30, 2019Payroll customers can now upload an e-signature image file to their check print settings to save the time of manually signing each paycheck.

Read More

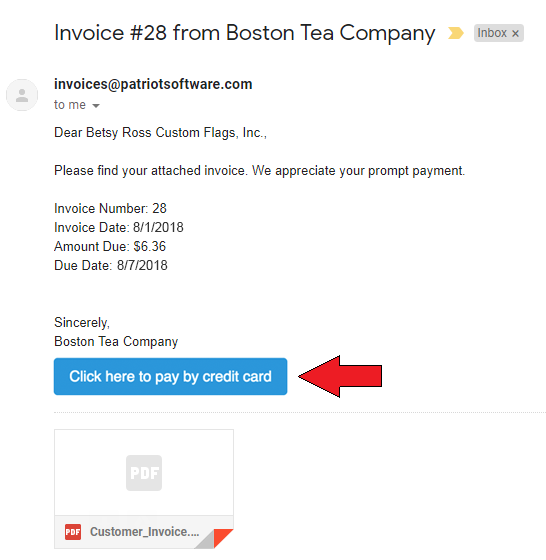

Accepting Customer Credit Card Payments

November 16, 2018Accounting customers can now accept customer credit card payments for invoices.

Read More

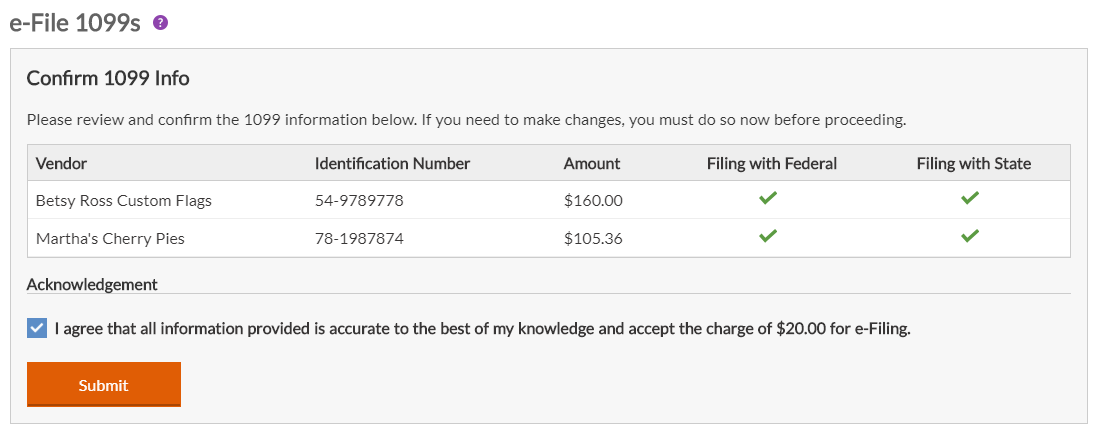

Electronic Filing for Form 1099-MISC

November 1, 2018Beginning January 1, 2019, Patriot Software offers an optional e-File service for 1099-MISC forms for our 1099 Only and Accounting customers. The cost to have Patriot e-File your 1099s will depend on the number of 1099s issued to your vendors.

Read More

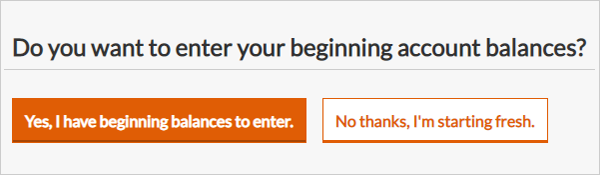

Enter Your Accounting Beginning Balances

August 29, 2018New Accounting customers can now enter their beginning balances and outstanding invoices from their former accounting software into Patriot Software, so they can begin using Patriot right where they left off.

Read More

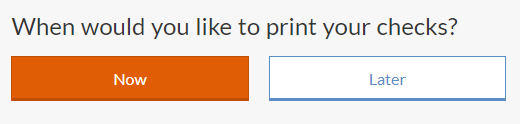

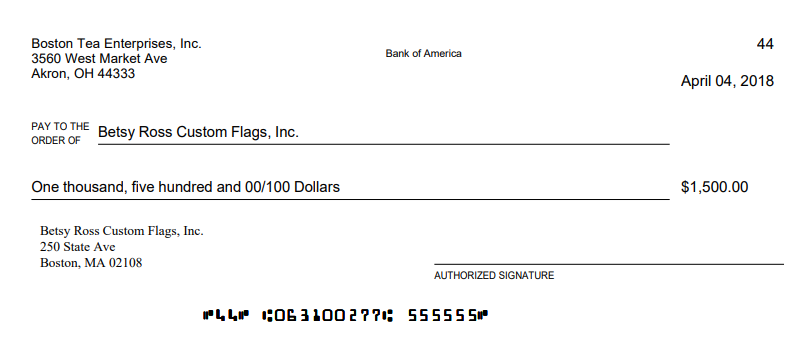

Printing Vendor Checks After Payment

June 21, 2018When Accounting customers pay vendors either by Quick Pay or paying a vendor invoice, they now have the option to print checks at a later time.

Read More

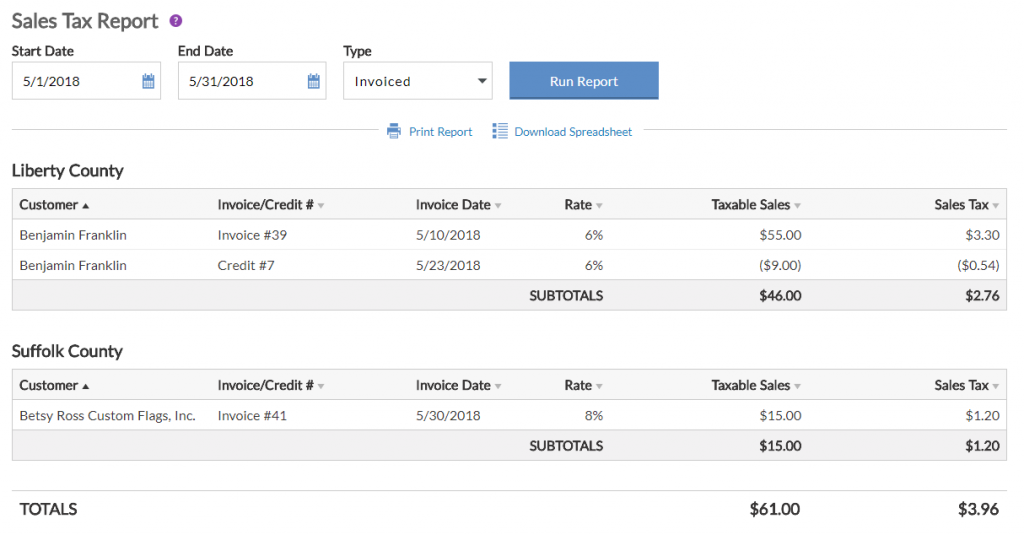

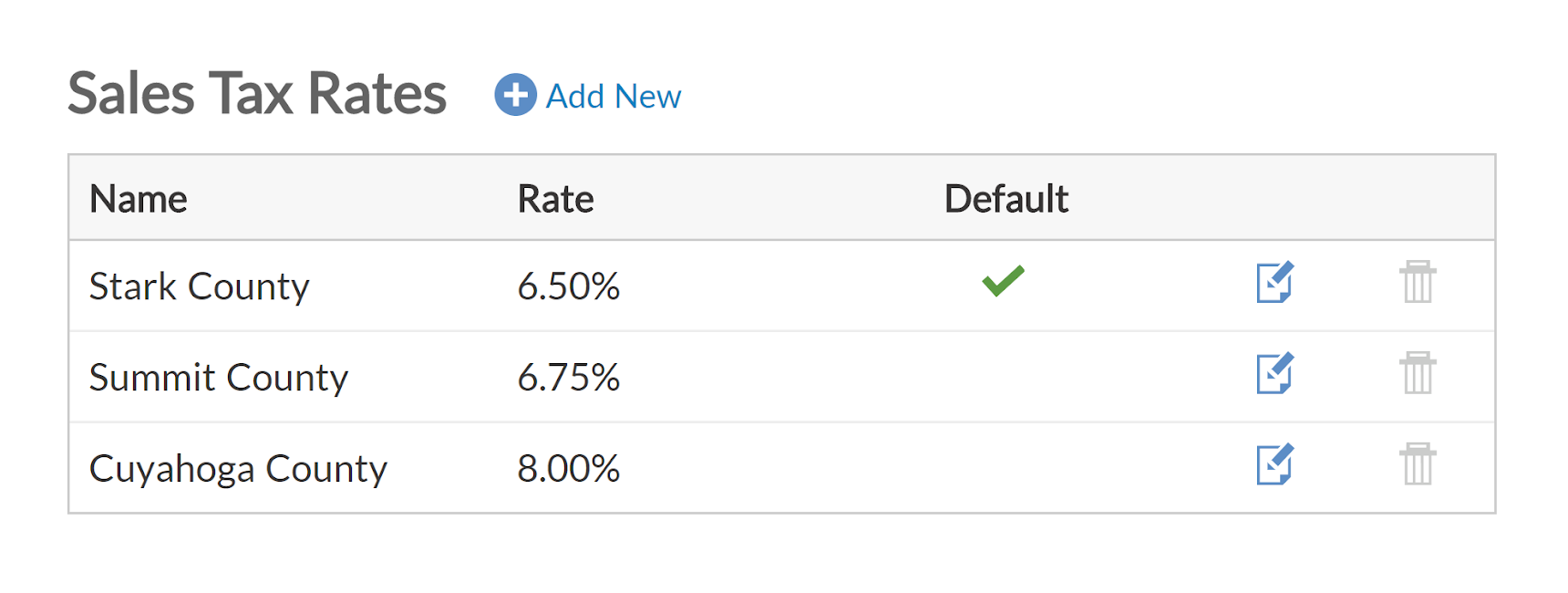

Sales Tax Report

June 8, 2018Accounting customers can now view the sales tax they have invoiced and collected from their own customers, in order to assist with paying and filing state and/or local sales tax.

Read More

Importing Bank Account Transactions

June 7, 2018Accounting customers can now connect their bank accounts or credit card accounts and import transactions into Patriot’s Accounting general ledger.

Read More

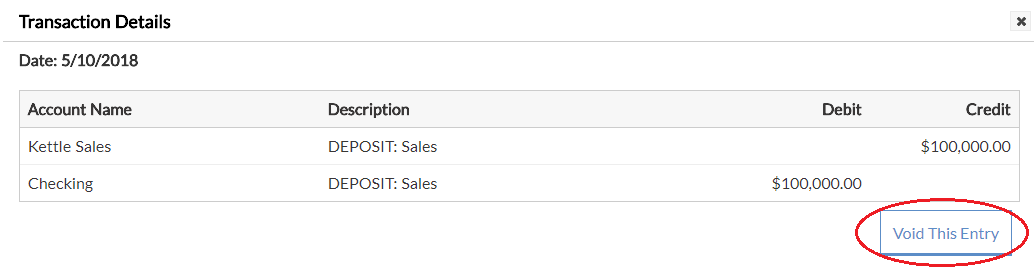

Voiding a Journal Entry

May 16, 2018Accounting customers can now void miscellaneous journal entries they enter in Patriot Software. You can do this on the Activity By Account Report.

Read More

Importing Accounting Vendors and Customers

May 10, 2018New Accounting customers coming to Patriot Software from another accounting software package can now import their existing vendors (the suppliers you pay) and customers (who pay you) into Patriot Software.

Read More

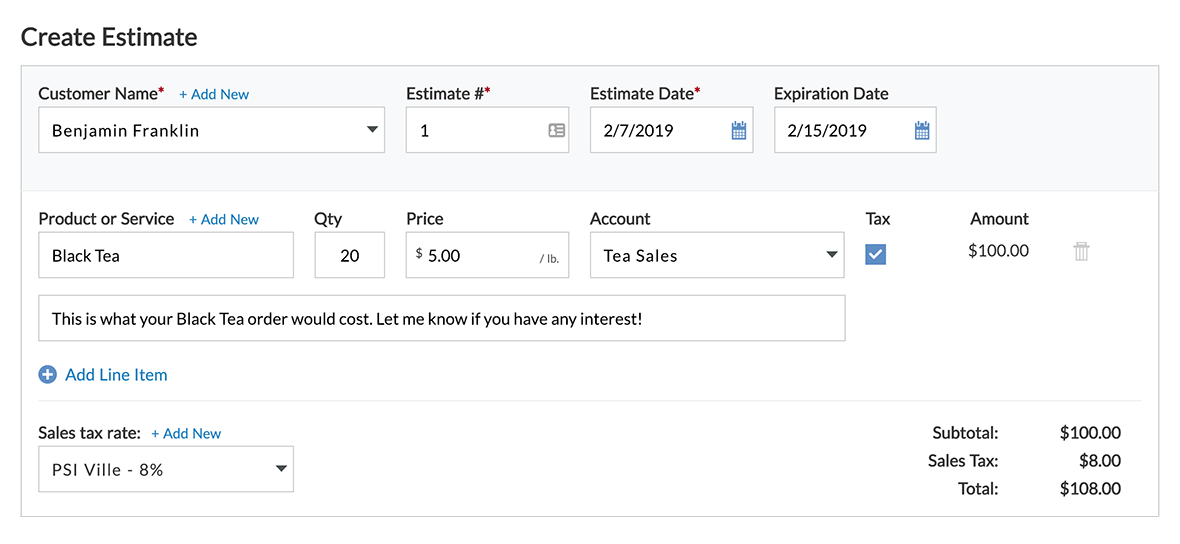

Customer Invoice Improvements

May 8, 2018We have made improvements to our customer invoices for Accounting customers.

Read More

Managing Your Sales Tax Rates

April 24, 2018Accounting customers can now create and track multiple sales tax rates for customer invoices. This is useful if you are required to charge different sales tax rates based on your or your customer locations.

Read More

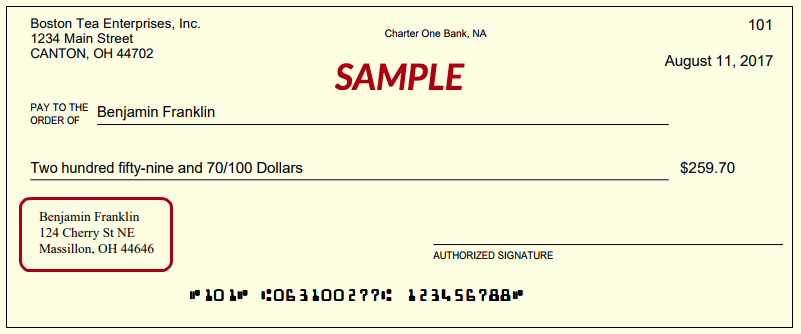

Print Vendor Checks with Blank Check Stock

March 29, 2018Accounting customers now have a choice for printing checks to pay their vendors: use pre-printed check stock or blank check stock.

Read More

W-2 Box and Label Guidance for Deductions

April 10, 2018Payroll customers will now see more guidance when adding company-level employee deductions and company-paid contributions.

Read More

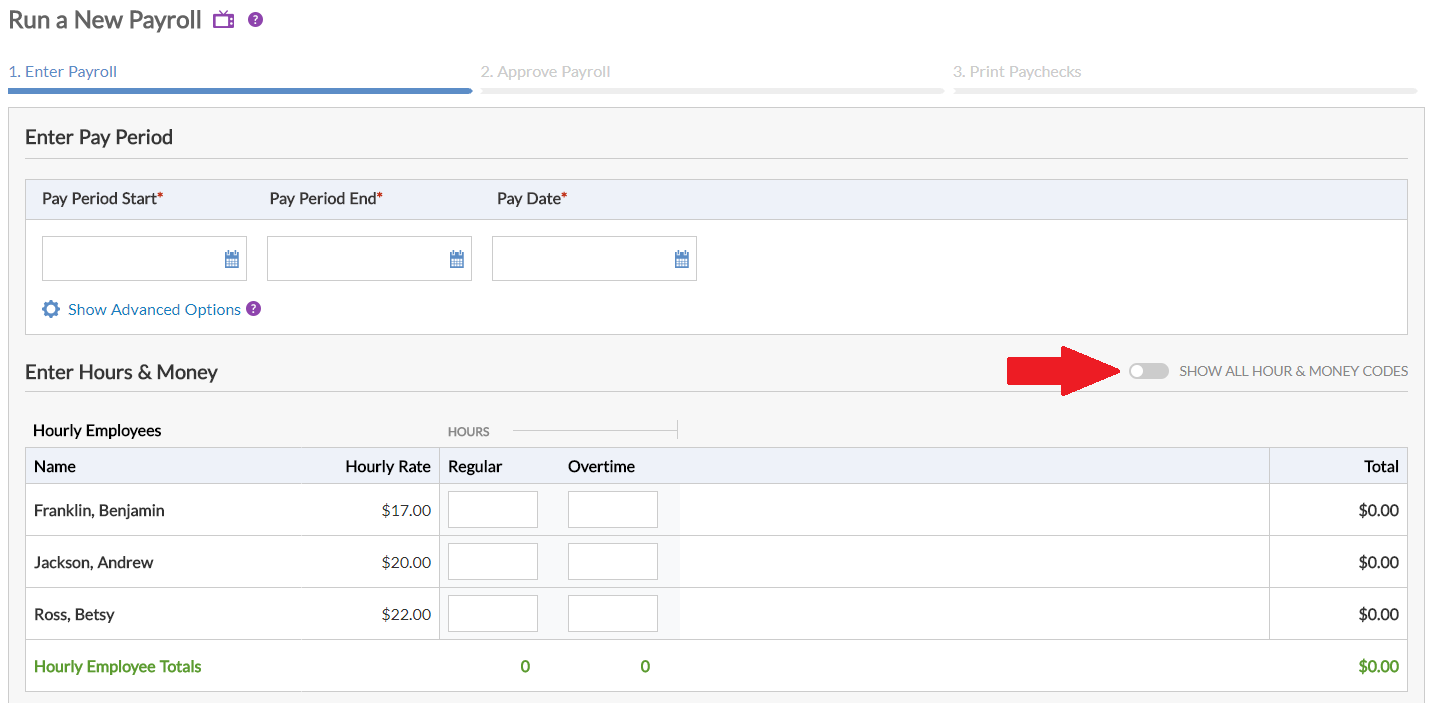

Frequently Used Hours and Money in Payroll

February 23, 2018Payroll customers can now filter their frequently used hours and money codes on their payroll entry page. If you need to use more hour or money codes, you can flip a switch to view all of your codes.

Read More

Pay As You Go Workers’ Compensation Insurance

January 23, 2018Patriot Software, LLC has partnered with AP Intego to offer pay as you go workers’ compensation insurance to our payroll customers, among other types of property and casualty insurance.

Read More

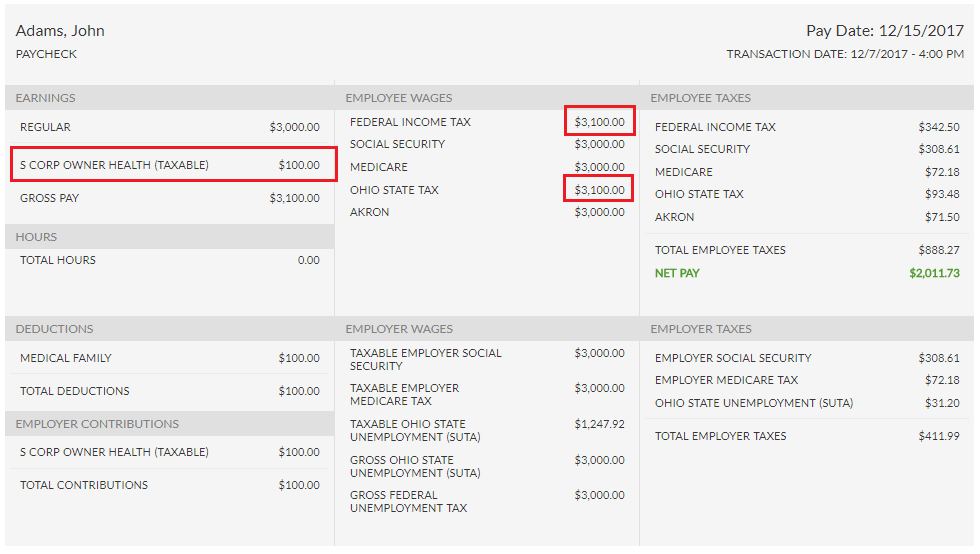

S Corp Shareholder Employee Health Premium Tracking

January 19, 2018Employees who are greater than 2% shareholders of S Corporations must report company-paid health insurance premiums as taxable wages for federal and state income tax purposes. Patriot now offers two ways to update shareholder taxable wages.

Read More

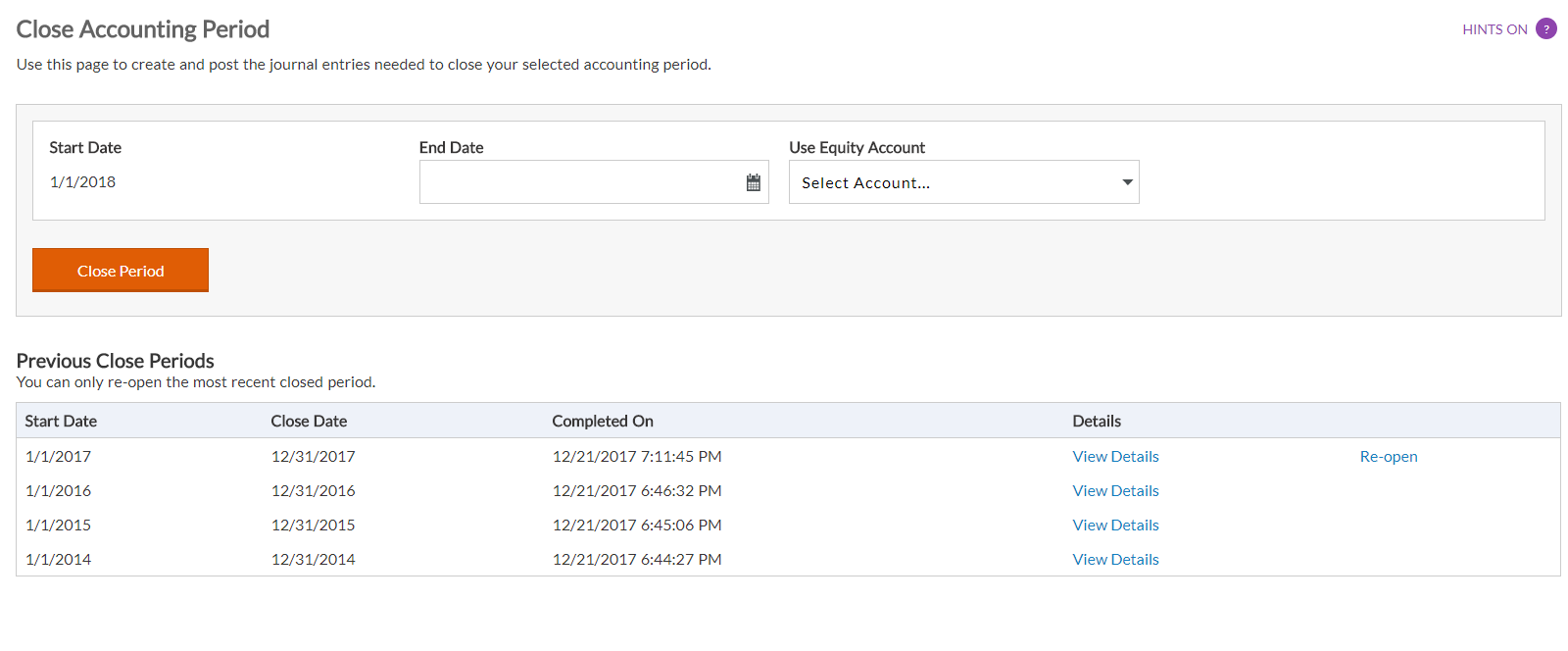

Close Your Accounting Periods

January 18, 2018Customers of Patriot’s Accounting Software can now close out a period frequency of their choosing (monthly, quarterly, annually) in order to keep their books clean.

Read More

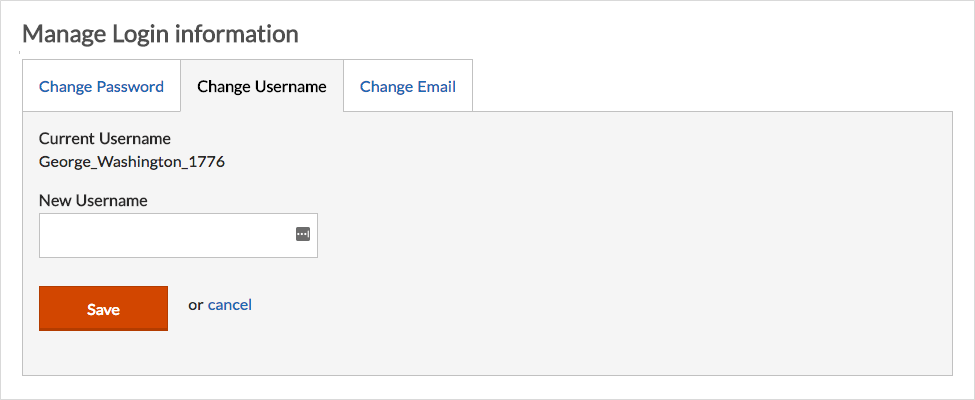

Change Your Own Username in Patriot Software

December 12, 2017If you want to change your username you use to log in to Patriot Software, you can now do this yourself. Previously, you would have needed to contact our Support Department to request a username change.

Read More

Adding Multiple Company Locations in Patriot Software

October 19, 2017If your business has more than one physical location, even in different states, you can now add multiple company work locations, for the same company under the same federal tax ID number.

Read More

Print Employee Addresses on Paychecks for Mailing

August 30, 2017As a Patriot Software Payroll customer, you now have the option to print the employee name and address directly on the paychecks, so the address displays through a window envelope for mailing.

Read More

Patriot Software Has a New Look!

August 21, 2017We at Patriot Software are constantly looking for ways to improve your software experience, and make you payroll and accounting tasks faster and better. We will be making some improvements to our page layouts very soon. Here’s a summary of the changes you will see.

Read More