Employers bear the burden of calculating, withholding, and remitting taxes from employee wages. They must also report them to the correct government agencies. But, what must self-employed individuals do? And what about individuals whose income isn’t taxed? What should those individuals do to pay and report their taxes?

If you’re self-employed or receive untaxed income, you may need to pay estimated taxes. So, what is estimated tax? Read on to learn the ins and outs of estimated taxes, including who is responsible for paying, when to pay, and how to pay them.

What is estimated tax?

Estimated taxes on income is a method individuals use to pay income taxes on money not subject to withholding taxes. If you owe estimated tax, you pay projected (aka estimated) tax liabilities quarterly.

The estimated tax pays for things like self-employment and income taxes.

Because the following forms of income aren’t subject to withholding, you may need to pay estimated taxes on them:

- Dividends

- Taxable alimony

- Gains from sales of stock

- Self-employment income

- Cash prizes and awards

- Interest income

- Other income without withholding

Keep in mind that there are also types of income not subject to withholding. Consider speaking with an accounting professional to determine if you must pay estimated taxes on income you receive.

Who pays estimated tax?

The IRS has specific rules regarding who must pay and file estimated taxes. So, you may need to pay estimated tax if you:

- Aren’t an employee

- Do not have taxes withheld by an employer

- Are self-employed

- Have other forms of income not subject to withholding

According to the IRS, you should make estimated tax payments if you:

- Expect to owe at least $1,000 in taxes after subtracting withholding tax and credits,

- Do not expect your withholding tax to equal 90% of the total tax you owe for the tax year, OR

- Do not expect your income tax withholding to cover 100% of your tax liability from the previous tax year.

Do you intend to file as a sole proprietor, partner, S corporation owner, shareholder, or self-employed individual? You will likely need to make estimated quarterly tax payments if you expect to owe $1,000 or more in taxes.

If you file as a corporation, you typically need to make estimated tax payments if you expect to owe $500 or more in taxes for the year.

Pop quiz: Who doesn’t have to pay estimated taxes? You don’t have to pay estimated tax if you meet all three of the following requirements:

- You had no tax liability for the previous tax year

- You were a U.S. citizen or resident for the entire tax year

- Your prior tax year covered a 12-month period

If you’re unsure about whether or not you must pay estimated tax, check with the IRS.

How to calculate estimated taxes

To calculate your estimated taxes, first estimate the following for the entire tax year:

- Adjusted gross income (AGI)

- Taxable income

- Deductions

- Credits

One option you have for calculating the total for the current year is to use last year as a starting point. Use the prior year’s information to estimate the values for the current year. After you estimate that data, calculate the estimated quarterly tax payments.

Follow these steps to calculate your estimated taxes:

- Calculate your AGI

- Determine total estimated taxable income

- Find the estimated income tax for the estimated income

- Divide the estimated income tax by four

To get your AGI, first estimate your total income for the year. Do you plan to earn as much or more than you made last year? Once you have that estimate, subtract any deductions from your estimated income total. This is your adjusted gross income.

Next, find your estimated taxable income by subtracting the standard deduction from your AGI. The 2022 IRS standard deduction is different for each filing status. Use the standard deduction that matches how you file (e.g., head of household).

Calculate your income tax by multiplying your AGI by your income tax rate. Use Publication 15-T and the applicable tax brackets for this step. Tax brackets typically change each year. Use the most recent Publication 15-T to determine the amount of income tax.

The income tax you calculated is for the entire year. To determine how much tax to pay each quarter, divide the amount by four.

If you need help calculating estimated taxes, you can reference the IRS’s Estimated Tax Worksheet on Form 1040-ES, Estimated Tax for Individuals.

You can also access an estimated tax worksheet in IRS Publication 505, Tax Withholding and Estimated Tax.

Paying estimated taxes

Use Form 1040-ES to calculate and pay estimated taxes to the federal government. After you complete the form, you can mail it to the IRS with your payment or e-file it online. Corporations must use the Electronic Federal Tax Payment System (EFTPS) to pay estimated taxes.

But, when are estimated taxes due? Again, estimated taxes are due quarterly. The estimated tax due dates for filing and paying Form 1040-ES each quarter are:

- April 15 for income received January 1 – March 31

- June 15 for income received April 1 – May 31

- September 15 for income received June 1 – August 31

- January 15 for income received September 1 – December 31

If the deadline falls on a holiday or weekend, the due date is the next business day.

Typically, the IRS does not give payment or filing extensions for estimated taxes. However, the COVID-19 pandemic allowed for some extensions. Check with the IRS for more information.

How to pay estimated taxes

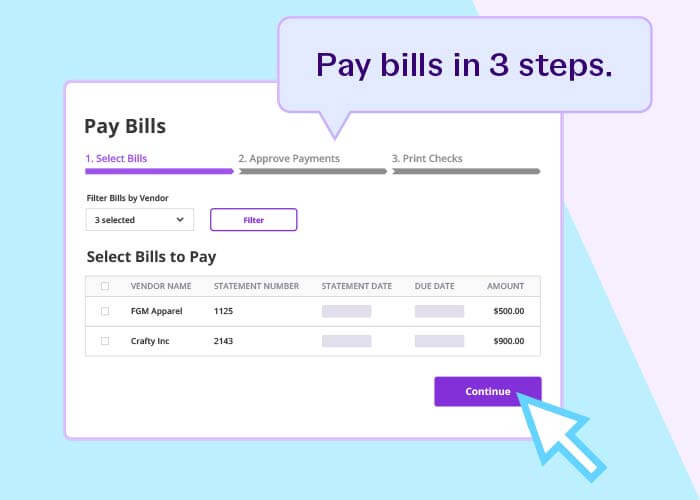

If you need to pay estimated taxes, you have a few options. You can pay online, send a payment (e.g., check) along with Form 1040-ES, pay by phone, or use EFTPS.

Use the IRS Direct Pay option to pay estimated taxes online with the IRS.

If you prefer to mail your payment, you can do so along with your estimated tax forms. Keep in mind it will take longer for the IRS to receive your payment if you mail it.

Another option is to pay via phone by calling the IRS. Enter your debit or credit card information to authorize payment.

EFTPS is another way to pay estimated taxes. The system allows you to track and monitor all electronic payments to the IRS. You must enroll in the system to make any payments.

Refer to Form 1040-ES for additional payment methods if the above options do not work for you.

Estimated tax penalties

The IRS may impose penalties on quarterly tax payments for a few reasons. You might be penalized if you:

- Do not pay on time

- Underpay estimated tax

- Overpay estimated tax

If you underpay your estimated taxes, you will likely need to fill out Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

You have a few options to avoid an estimated tax penalty. To steer clear of penalties, you can do one of the following (whichever is smaller):

- Pay either at least 90% of what you owe in taxes for the year

- Pay the same amount as what you owed the previous year (100%)

Taxpayers with higher earnings might need to pay 110% of their previous year’s tax bill. If your previous year’s adjusted gross income was more than $75,000 (married filing separately) or $150,000 (single or married filing jointly), you are expected to pay 110%.

This article has been updated from its original publication date of October 1, 2015.

This is not intended as legal advice; for more information, please click here.