Juggling different expenses comes with the job of being a small business owner. One cost you’re responsible for is your company’s taxes. There are several aspects of your business that the government enforces taxes on. To stay legally compliant, you must stay on top of your small business tax liability.

What is tax liability?

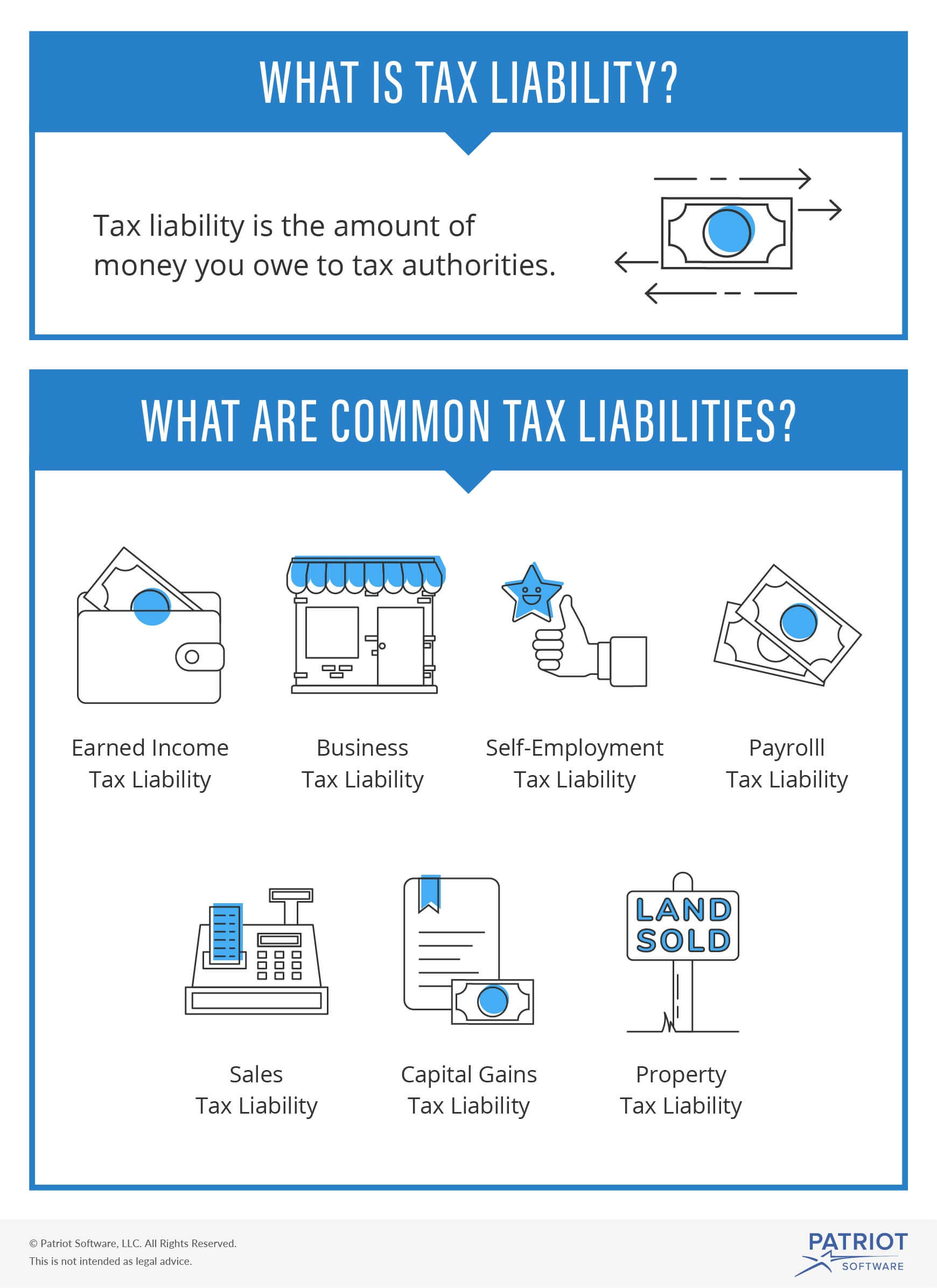

Tax liability is the amount of money you owe to tax authorities, such as your local, state, and federal governments (e.g., the IRS). When you have a tax liability, you have a legally binding debt to your creditor. Both individuals and businesses can have tax liabilities.

The government uses tax payments to fund social programs and administrative roles. For example, Social Security tax funds retirement and disability benefits.

Tax liabilities are current liabilities. Current liabilities are short-term debts you must pay within a year. Generally, you incur short-term liabilities from normal business operations. Report tax liabilities with other current debts on your small business balance sheet.

Failing to pay a tax liability can result in back taxes, a tax lien, penalties, interest, and even jail time. If you can’t pay taxes due to money constraints, you might be able to work out a payment arrangement.

What is your small business tax liability?

Your business can incur tax liabilities from many taxable events. A taxable event is a transaction that results in tax liability, such as earning taxable income, making sales, and issuing payroll.

The government decides which events are taxable. When a taxable event occurs at your business, you must pay the appropriate tax authority. The amount of your tax liability depends on the event. Generally, you can calculate tax liability as a percentage of the total taxable event.

You may have additional tax liabilities other than the ones listed here, such as franchise or excise tax. But, here are some of the most common tax liabilities many small business owners come across.

Earned income tax liability

Working individuals are generally required to pay federal income tax, and possibly state and local income taxes, on their earnings.

Employers withhold income tax liabilities from employee wages. But when you are a small business owner, you won’t receive wages (unless you’re incorporated). And when you don’t receive wages, you do not have income taxes withheld from your earnings.

Your earned income tax liability also may include tax from your business’s income, unless you are a C corporation. You can also pay your earned income tax liability by making estimated tax payments throughout the year.

Business tax liability

Your business is required to pay taxes on its profits. However, if you structure your business as a sole proprietorship, partnership, S corporation, or LLC (not taxed as a corporation), you enjoy pass-through taxation. Pass-through taxation means the business taxes pass through your business and onto you, which is why you include the business income tax liability as income on your personal income tax return.

If you structure your business like a C corporation, your company becomes a separate legal entity. As a separate legal entity, your corporation owes taxes on business profits. Corporate tax is in addition to the tax you pay on your earnings as an individual.

Your C Corp must pay a federal corporate income tax rate of 21%. And, your corporation might also pay a state corporate tax.

Self-employment tax liability

Working individuals must pay Social Security and Medicare taxes on their earnings. For employees, these taxes are withheld from their wages in the form of FICA tax, which is an employer and employee tax. Self-employed individuals pay these taxes in the form of self-employment tax.

As a small business owner, you have a self-employment tax liability unless your business is incorporated. Self-employment tax essentially covers both the employer and employee portions of Social Security and Medicare taxes.

Your self-employment tax liability is 15.3% of your net earnings. Like earned income tax, you can pay self-employment taxes through estimated tax payments.

Payroll tax liability

If you have employees, you are responsible for withholding, filing, and remitting payroll taxes. And, you must pay employer taxes. The money you withhold from employees, as well as the money you spend as the employer, make up your payroll tax liability.

You must withhold federal income tax, state and local income taxes (if applicable), and FICA tax from employee wages.

As the employer, you are required to contribute a matching amount for FICA tax for each employee. You are also required to pay federal and state unemployment taxes.

Together, income, unemployment, and FICA taxes make up your payroll tax liability. You must deposit these taxes with the IRS according to your depositing schedule.

Sales tax liability

When you sell goods to customers, you must tack on a sales tax. After collecting the sales tax from your customers, you have a sales tax liability. You must remit the sales tax to your state or local government.

Sales tax is a percentage of a customer’s total bill. The sales tax rate differs based on where your business has a physical presence.

Capital gains tax liability

You may have a capital gains tax liability if you sell an investment or another type of asset for a profit. Capital gain taxes are taxes you pay on the gain. Your gain is the difference between what you purchased the asset for minus what you sold it for.

Property tax liability

Does your business own real estate (e.g., buildings, land, etc.)? If so, you have a property tax liability. Property tax is a tax that property owners pay to their local governments.

Property tax rates vary drastically. Your tax liability is based on the value of the property. Generally, your local government will reassess your tax rate per year. Multiply your tax rate by the market value of your property to calculate your property tax liability.

Tax liabilities and tax deductions

Your tax liabilities can add up. To counter the high cost of taxes, the IRS lets you claim tax deductions for certain things. Tax deductions reduce your tax liability, often resulting in you owing less in taxes.

You can claim a self-employment tax deduction that lets you deduct the employer-equivalent portion of your self-employment tax when figuring out your adjusted gross income.

Other common tax deductions for small businesses include interest on a business loan, retirement plan, car, home office, and health insurance premium tax deductions.

Tax liability and recordkeeping

Not paying attention to your tax liability can turn into a big deal. You need to know what your tax liability is. And, you must have the records to back it up. Records are necessary to determine your tax liability as well as act as proof if the IRS audits you.

Collect and set aside the correct amount of taxes. For example, withhold payroll taxes from employees each pay period, and place the withheld taxes in a separate bank account.

Keep track of your tax liability by tracking expenses and income in your accounting books for small business. Stay up to date on tax laws so you know how much your tax liability is. Maintain documents in your records, too.

Stay on top of your tax liability due dates. Familiarize yourself with your business’s tax depositing schedule, and mark down due dates in a calendar.

You need organized accounting records to track your tax liabilities. Patriot’s online accounting software makes it easy to manage your books and organize your records. Interested in a free trial? Get yours today!

This article has been updated from its original publication date of July 28, 2016.