Even if you don’t like accounting, understanding your business balance sheet is essential for you to be a successful entrepreneur. You can learn a lot about your business by reviewing your balance sheet. In fact, it can help you make smart decisions for your business. What is a balance sheet?

Financial statements for your small business

The balance sheet is one of three important financial statements. These statements all track performance. As you operate your small business, you should periodically review these financial statements:

- Balance sheet

- Income statement

- Cash flow statement

Financial statements help you answer crucial questions about your business, including:

- How much are you making?

- Can you pay the bills on time?

- How much is your business worth?

- Can you pay your employees?

- Can you pay yourself?

You need to be able to answer the above questions at any time. Not knowing where you stand financially is dangerous for your business.

If you don’t look at your financial statements, it’s time to start looking at your books. To get started, check out your small business balance sheet.

What is on a balance sheet?

A balance sheet is a financial statement that tracks your business’s progress. There are three parts to a balance sheet: assets, liabilities, and equity.

In the simplest terms, you can think of the parts like this:

- Assets = What you own

- Liabilities = What you owe

- Equity = What is left over after you pay expenses

On a balance sheet, the total assets should equal your total liabilities plus your equity.

Assets = Liabilities + Equity

Assets

Assets are items of value at your business. For example, the money in your checking account and your company vehicles are assets. Assets are items that you can turn into cash.

When you create a balance sheet, divide assets into two parts: current and noncurrent. Current assets can be turned into cash quickly while noncurrent assets cannot.

Current assets

- You can quickly turn them into cash

- Cash and cash equivalents (e.g., checking and savings accounts)

- Accounts receivable (unpaid invoices)

- Investments

- Inventory

Noncurrent assets (or fixed assets)

- You do not quickly turn them into cash while managing fixed assets

- The most common types are plants, property, and equipment

- Property you use to operate your business (your building, land, and equipment)

- Intangible assets (patents, trademarks, and logos)

Liabilities

Liabilities are the debts you owe to other people, businesses, organizations, and government agencies. For example, your unpaid invoices are liabilities.

Like assets, liabilities are also divided as either current or noncurrent liabilities. You pay current liabilities in a short amount of time, usually in less than one year. Noncurrent liabilities take longer to pay.

Current liabilities

- Accounts payable (invoices you have not paid)

- Accrued expenses (liabilities you owe but haven’t been invoiced for)

- Short-term debt (your credit card balance)

- Current tax liabilities (sales taxes you collected and payroll taxes you must remit)

Noncurrent liabilities

- Long-term loan debt

- Other noncurrent liabilities (long-term lease obligations)

Equity

Equity reflects ownership in a business. To find your equity, take the worth of everything you own in the company (investments and earnings) minus your liabilities. As a sole proprietor, your owner’s equity is the business’s assets minus the liabilities.

Equity = Assets – Liabilities

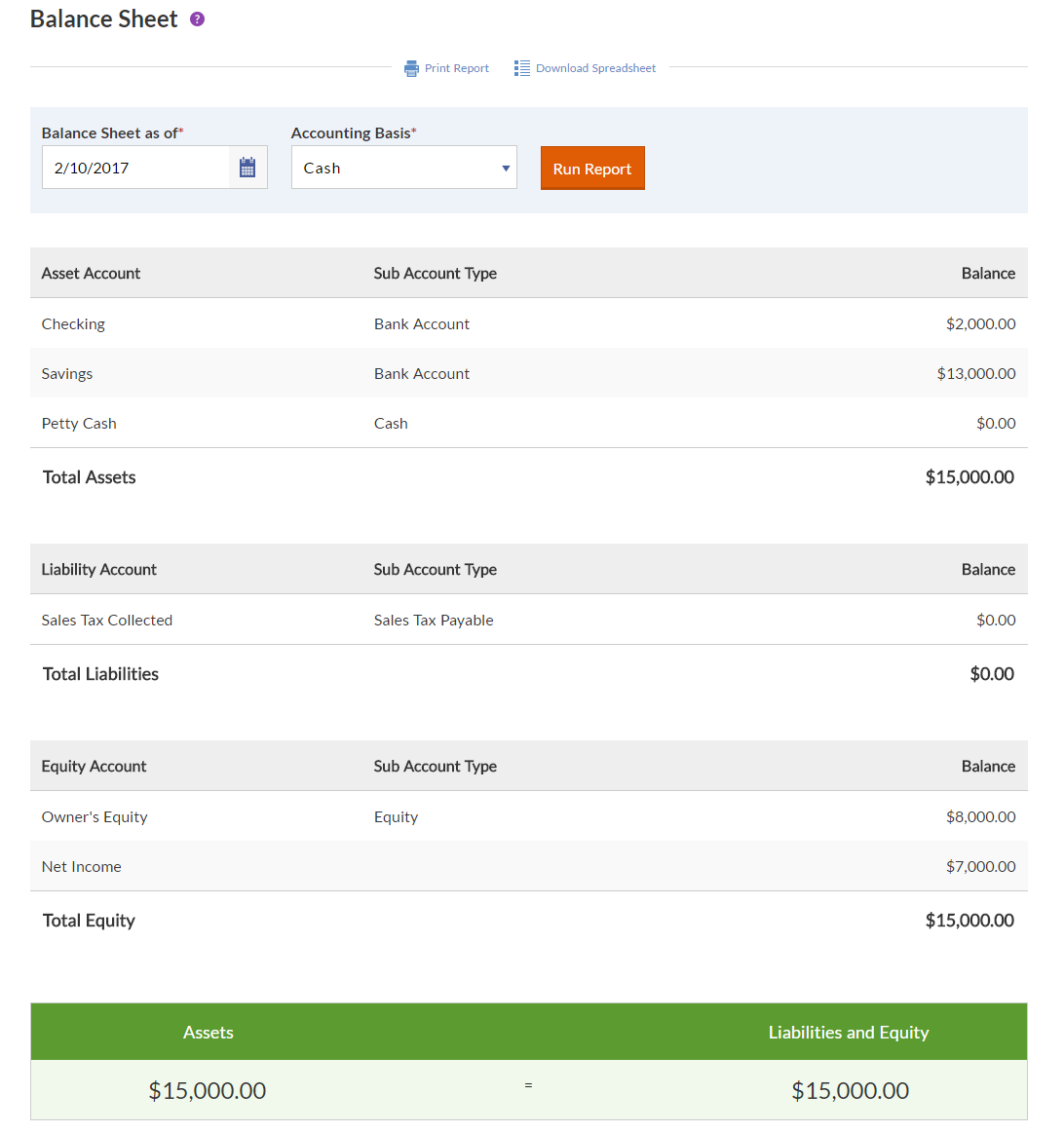

Small business balance sheet example

Take a look at the small business balance sheet example below. Notice that the total assets at the bottom of the statement are equal to the total liabilities and equity.

Using your balance sheet

The balance sheet is the best indicator of your business’s current and future health. You can use your balance sheet for both internal purposes and to talk about your business to people outside your company.

As you run your business, you constantly have money coming in and going out of your accounts. Grasping an understanding of your company’s health can get overwhelming.

Your balance sheet is like a photograph of your business’s finances. It shows a snapshot of your health during a single moment in time. By evaluating your balance sheet, you can take a breath and dig deep into where you stand financially. This picture gives you insight into your company’s overall stability so you can make smart and guided decisions.

Small business owner, writer, and marketing communications consultant Caron Beesley explained in a Bplans article:

At its simplest level, the balance sheet summarizes key financial information on a given date (as opposed to the income statement, which shows profitability over a period of time) and is a good indicator of company stability and liquidity (both important factors in determining your business’s ability to fund its own growth without requiring outside financing).

Because a balance sheet shows revenue, expenses, and equity, it is more complete than a profit and loss statement or cash flow statement. The combination of the information included on the balance sheet can help you see if your pricing strategy is effective, your marketing efforts are working, and your spending is under control, among other things.

The balance sheet also helps you with issues outside of internal operations. A lender or investor might want to see your balance sheet when you apply for a small business loan. And, a supplier might be interested in your small business balance sheet because it indicates your business’s overall stability.

Need an easy way to track your business’s transactions? Patriot’s online accounting software for small business uses a simple cash-in, cash-out system. Complete your books in a few simple clicks. Try it for free today!

This article was updated from its original publication date (10/3/2014).