Knowing how your business’s finances are going is one part of owning a small business. You should have the three main financial statements at your business: balance sheet, income statement, and cash flow statement. What is a cash flow statement?

What is a cash flow statement?

A cash flow statement, or statement of cash flows, refers to the amount of cash entering and leaving a business during a particular time period. Cash flow statements only include the amount of actual cash your business has. Credit is not recorded. Cash flow statements are divided into three parts, which are operations, investing, and financing.

You can have positive cash flow, which indicates your business has more money coming in than your expenses. Or, you can have negative cash flow, which shows that you spend more money than what you’re bringing in.

If a customer makes a purchase without paying, do not include it on your cash flow statement. And, if you buy something from a supplier on credit, you will not include it on your cash flow statement until you pay it. Cash flow statements only record when you actually have the money at your business or when the money actually leaves your business.

Cash flow statement shows the inflow and outflow of your money, but it does not give an accurate picture of profitability. Since the cash flow statement does not include credit, you might have negative cash flow. For example, if you use accrual accounting, you include credit in your books. You might have sold a lawnmower to a customer, but they haven’t paid you yet. Instead, you invoice them. If you make your cash flow statement before they pay you, your statement of cash flows will not include the sale.

Take a look at the three parts of a cash flow statement: operations, investing, and financing. The final line on your cash flow statement is the net increase or decrease in cash.

Operations

Operations measure the cash going in and out of your business that is related to your products or services.

Include the money you receive from customers. And, include what you pay to operate your business. Some common operating costs include marketing costs, bank charges, office supplies, rent, employee salaries, and the cost of goods sold (COGS). COGS is what you spend on the raw materials and direct labor for your products or services.

The operations section of your business’s cash flow statement shows that your business is generating enough money from sales to keep up with expenses.

Investing

The second part of your cash flow statement is investing activities. Investing reflects when your business buys or sells long-term assets. An asset is property you own that adds value to your business.

Assets include equipment, stocks, property, or other similar investments for your small business. Some other forms of investing include notes and mortgages. You can also bring in money from selling investments.

Money moves slower in the investing section than the operations section because you do not continually invest or sell investments. The investing section can show that your business is growing because you are investing more in your company’s future.

Financing

To start a business, you need to know how to finance it. One way to finance your small business is to get a loan from the bank. The financing section of the cash flow statement looks at how your company pays back lenders and investors.

The third section of your statement of cash flows shows inflowing and outflowing cash as a result of debts, loans, or dividends. A negative cash flow in the financing section indicates that you are paying off debt. When you make loan payments, you decrease money in the financing section.

Net increase or decrease in cash

Your cash flow statement’s last line tells you whether you had an increase or decrease in cash during a particular period. If you have a decrease, the number is written in brackets or parentheses.

Who benefits from seeing a cash flow statement?

A few people analyze the cash flow statement to check your business’s overall financial health. Here are some people who might want to look over the cash flow statement:

- Small business owner

- Investors

- Lenders

- Vendors

- Accountant

As the small business owner, you want to look at your cash flow statement to determine whether your business has positive or negative cash flow for a specific time period. Negative cash flow shows you that your business’s income and expenses are not synchronized. That means that you don’t have enough cash on hand to pay expenses. Increasing your sales will improve your cash flow.

Investors and lenders want to make sure they won’t lose money from your business. The cash flow statement shows them that your business is generating enough money to pay off your expenses, including loans and investments.

Vendors might also want to look at your cash flow statement. They want to make sure you will have the money to pay them back, especially if you purchase large quantities from them.

How to prepare a cash flow statement

Before you can see the cash going in and out of your business, you need to know how to prepare a cash flow statement.

There are two methods for calculating the statement of cash flows: direct and indirect. The difference between direct and indirect methods is in the operations section.

How you organize the information differs between the direct and indirect method, but both produce the same final numbers on your cash flow statement.

Cash Flow Direct Method

The direct method is not used as often as the indirect method. The direct method includes a detailed list of where cash is coming and going.

With the direct method, show the amount of cash your customers give you. Do not include depreciation with the direct method.

With the direct method, you need to know the exact amount of physical cash you have on hand at all times. Since it requires more information to create the cash flow statement with the direct method, most businesses use the indirect.

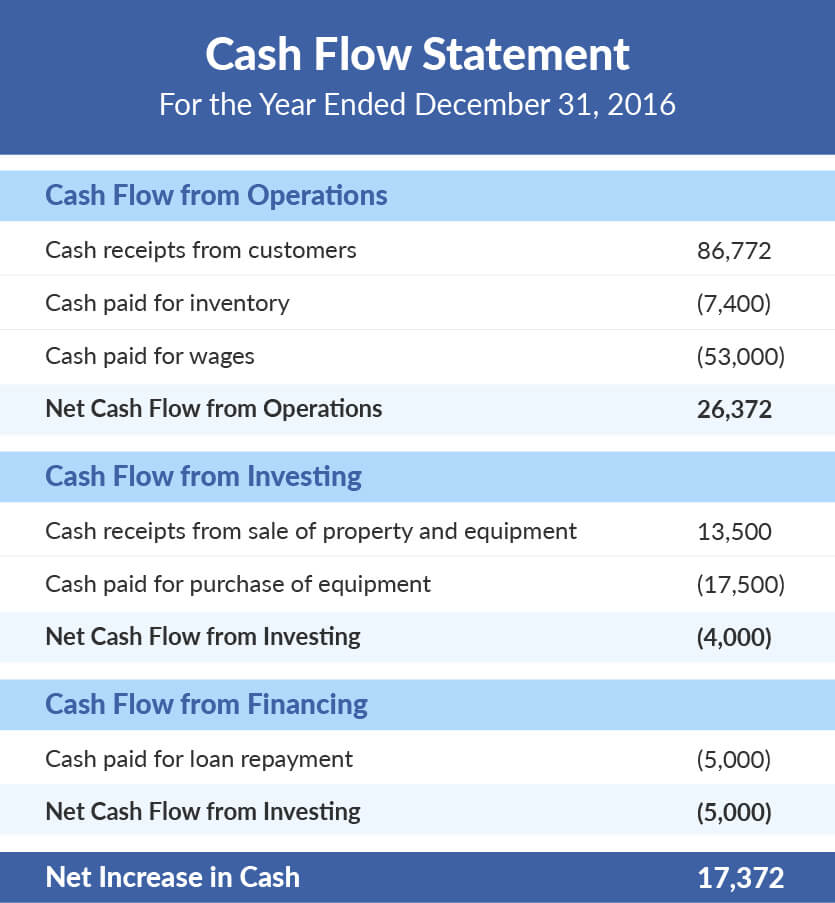

Direct cash flow statement example

Here is a basic cash flow statement using the direct method. As you can see, the operations section shows where money is coming from and exactly where it’s going.

All numbers under each section are dollar amounts. The amounts in parentheses are negative values.

At the end of the year, the business has an increase of $17,372. This is a positive cash flow statement for 2016. Although positive, this number is still relatively low. If your cash flow statement is negative or a low positive amount, consider new ways to manage your cash flow.

Cash Flow Indirect Method

The majority of businesses prefer using the indirect method for creating their cash flow statement because it doesn’t require as much information as the direct method. The indirect method is not as clear on where exactly money is coming and going in the operations section.

With the indirect method, the cash flow statement begins with net income or loss from the profit and loss statement. The net income might include money you don’t actually have yet if you’re using the accrual method. With accrual, you include accounts payable and receivable even if you don’t have the cash.

Your cash flow, on the other hand, only shows how much actual cash you have. You need to adjust your earnings so you only have actual cash in your operations section.

Adjust for gains and losses on assets. If you lose money on an asset, add the loss. Add depreciation and amortization since depreciation, which is not actual cash, reduces net income. If you gain money on an asset, subtract the gain. Subtract the value of assets like copyrights since you do not have cash from it.

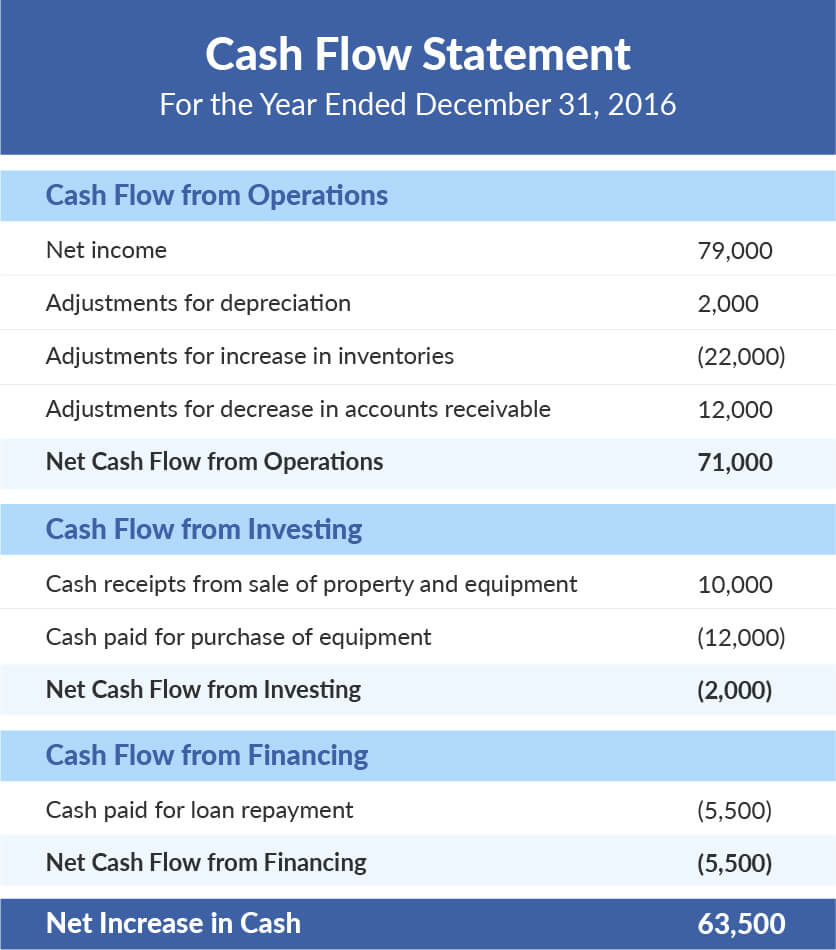

Indirect cash flow example

Below is a basic cash flow statement using the indirect method. Though the operations section differs from the direct method, both methods have a line for net cash flow from operations. Again, the numbers in parentheses are negative.

This table shows a significant net increase in cash compared to the other example. A business generating this increase might want to continue what it’s doing. The net cash flow from operations is enough to generate a positive cash flow statement on its own, which is what investors look for.

For a healthy cash flow statement, you need to receive customer payments. Patriot’s online accounting software lets you track your expenses and income. And, you can record payments as they come in. Try it for free today!

This is not intended as legal advice; for more information, please click here.