Here’s a number that might surprise you: 29%. That’s how many startups fail because they run out of cash. To make sure you have enough capital to see your dream through, consider small business financing.

From taking out a loan to securing a venture capitalist investment, we’ll go over your small business financing options. That way, you can make an informed decision when pursuing a little extra cash cushion for your company.

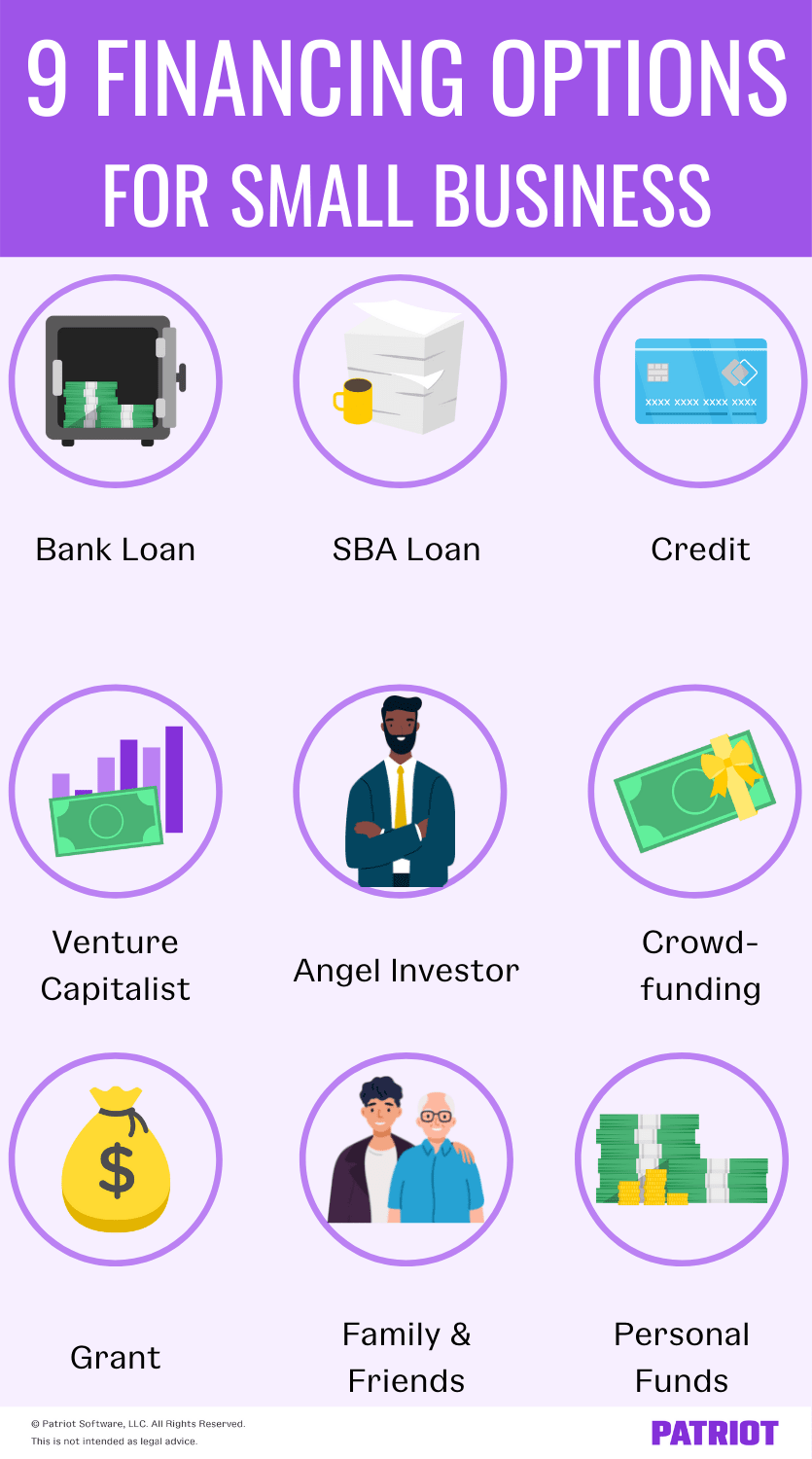

9 Small business financing options

Being strapped for cash when starting or growing your business is the last thing you want. Thankfully, there are a number of small business funding options.

Compare the following nine business financing options to help you choose the best one for your enterprise.

1. Bank loan

If your first thought is getting a bank loan for small business financing, you’re not alone. Financing a new business by obtaining a bank loan is a popular option. Unfortunately, securing a bank loan for startups (and existing businesses) from can be difficult.

To receive a loan from the bank, you need:

- Personal and business credit history

- Financial statements

- Small business plan

- Cash flow projections

- Personal guarantee

- Business experience

Interested in this financing option? If so, next up is learning how to apply for a business loan. Review your loan options carefully (e.g., short-term vs. long-term) to make sure you’re applying for the right loan for your business.

Snapshot of bank loans:

- Popular business financing option

- Can be difficult to secure a loan, especially for startups

Questions to ask:

- Can I afford to take on more debt?

- What is the interest rate and loan term?

- Do I meet traditional lending criteria?

- What’s my credit score?

- Am I willing to offer collateral?

2. SBA loan

Getting a traditional bank loan is difficult for many businesses, particularly startups. A Small Business Administration (SBA) loan is an alternative to going directly through the bank.

The bank still provides the loan, but the SBA guarantees part of the loan and backs it, increasing your chances of securing a small business loan.

There are limits to how much you can take out when it comes to an SBA loan. Generally, you can apply for up to $5.5 million.

Keep in mind that there are eligibility requirements you must meet to qualify for an SBA loan. You must have good personal credit, be a USA-based business that is for-profit, and meet the SBA’s small business size requirements.

You can apply for one of the many SBA loan programs, including SBA 7(a) loans, 504 loans, and microloans.

Ready to learn more? Head on over to the Small Business Administration’s website.

Snapshot of SBA loans:

- Bank loan partially guaranteed by the SBA

- Can apply for loans of up to $5.5 million

- Must meet eligibility requirements to apply

Questions to ask:

- Am I an eligible small business?

- Do I run a for-profit business?

- Do I have time to work through this application?

- Do I know how to apply for an SBA loan?

3. Credit

Looking to finance your small business with credit? A line of credit can be useful if you need revolving funds. But, be sure to make immediate payments on what you borrow. Otherwise, high interest rates can cripple your business growth over time.

Before applying for a line of credit or business credit card, establish credit. That way, you can increase your chances of getting lower interest rates.

When you apply for credit, identify and explain the purpose of getting the funds. You also need to provide information such as your business’s annual gross sales and establishment date.

Snapshot of credit:

- Revolving credit gives you spending flexibility

- Can be helpful to grow your business if you make immediate payments

- Establish credit ahead of time to get lower interest rates

Questions to ask:

- What’s my personal and business credit scores?

- What is the interest rate?

- Do I have to offer a personal guarantee?

- What’s the purpose of this line of credit?

- Do I need a DUNS number to apply?

4. Venture capitalist

If you’ve ever seen Shark Tank, you know what a venture capitalist is—and how difficult it can be to strike a deal with one. A venture capitalist (VC) is someone who provides capital investments in exchange for an ownership share and role in your company.

Typically, a VC focuses on high-growth businesses. As a result, they tend to invest high amounts for a high percentage of your business.

The process for getting a VC investment can be nerve-wracking. The investor(s) do their due diligence so they know the ins and outs of your business (e.g., management, market, offerings, etc.).

If a VC offers you a deal, you can try to negotiate the terms and conditions, such as funding amount, ownership percentage, and funding use.

Snapshot of venture capitalists:

- Invests in companies in exchange for ownership

- Tend to want a role in the business

- Can invest high amounts of money for a high percentage of your business

Questions to ask:

- Do I want to give up ownership in my business?

- What kind of experience can the VC bring?

5. Angel investor

An angel investor is someone who invests in small business startups in exchange for partial ownership. Often, angel investors are colleagues of friends or family. You can also ask fellow entrepreneurs, lawyers, or accountants for referrals.

Angel investors tend to invest their own money into businesses they believe in, with the goal of helping build someone’s business. Generally, angel investors’ return expectations are lower than that of venture capitalists. As you begin making a profit, you’ll need to give part of your earnings to the investor.

When you pitch to an angel investor for money, give them a clear exit strategy so they know their money is protected if your business fails.

Snapshot of angel investor:

- Give business funds in exchange for partial ownership in company

- Priority is typically to help build someone’s business rather than profiting right away

Questions to ask:

- Do I want to give up ownership in my business?

- Where can I find angel investors?

6. Crowdfunding

Crowdfunding is a funding option where you raise capital through investors on crowdfunding sites or platforms (e.g., Kickstarter, GoFundMe, etc.).

By crowdfunding, you can share your pitches on the platform to get your idea in front of a large pool of investors. Keep in mind that having a catchy idea can help you attract investors.

If you opt for financing through crowdfunding, you likely need to pay fees to promote your campaigns (e.g., 8% of earnings).

So, what do investors get for investing in your business? What you give your investors depends on the type of crowdfunding you go with:

- Donation crowdfunding: Campaign where contributors do not receive a return

- Reward crowdfunding: Campaign where you provide contributors a reward or incentive

- Equity crowdfunding: Campaign where you offer contributors equity shares

- Debt crowdfunding: Campaign where you borrow money from contributors

Before crowdfunding, be sure to weigh the pros and cons to decide if it’s right for your business. Although this financing option can connect you with potential investors, it can be time-consuming and expensive. Not to mention, you need to be on the lookout for scammers.

Snapshot of crowdfunding:

- Lets you get your business in front of a large pool of investors

- Different types of crowdfunding include donation, reward, equity, and debt

- Must pay a portion of your earnings in fundraiser fees

Questions to ask:

- Is my product catchy enough to attract the public’s interest?

- Do I want to give up some of my earnings?

- What type of crowdfunding do I want to use?

7. Grant

A small business grant is “free money” available to eligible businesses that meet specific criteria. So unlike loans and credit, you don’t have to repay grant money.

Business grants are typically available to specific types of business owners, such as minorities, women, and veterans.

You can apply for grants through government agencies, organizations, and private corporations. Keep in mind that grants are competitive and time-consuming.

Finding and applying for grants could take up a significant amount of time without guarantee that the organization will choose your business. And, keep in mind that you must accurately and timely report your funds usage.

Snapshot of getting a grant:

- Free money

- Time-consuming to apply

- Must meet specific criteria

Questions to ask:

- Do I qualify for a business grant?

- How much time do I have to devote to grant writing?

- What kind of work do I need to do after receiving the funds?

8. Family and friends

You might consider turning to your family and friends for a loan to finance your new business. If a friend or family member offers you a loan, make sure you have a plan for how to pay them back.

Borrowing from family and friends can be difficult because they want to see you succeed, but they also don’t want to throw their hard-earned money away.

Treat their loan as any other kind of loan. Show them your business plan, consult a lawyer, and put agreement terms in writing. Also, remember to set up a payment plan.

Snapshot of borrowing from family and friends:

- Borrow money without a time-consuming application

- No need to give up ownership in your business

- Can create problems if there’s no agreement

Questions to ask:

- Do I have a plan in place to pay them back?

- Could this jeopardize our relationship?

9. Personal funds

Another financing option is using personal funds, also known as bootstrapping your business. When you bootstrap your business, you don’t need to worry about researching or applying for financing, taking out a loan, or giving someone a piece of your business.

However, exclusively using personal funds can be difficult. Starting a business can be expensive, and you may need to make necessary cuts (personal or business) to make it work.

Depending on your personal financial situation, you could quickly run out of cash and miss out on growth opportunities.

Snapshot of bootstrapping your business:

- No need for a loan

- Can be difficult to do on your own

Questions to ask:

- Do I have enough funds to cover my startup expenses?

- Can I afford to spend my personal savings?

6 Steps on how to finance a small business

How to get financing for a business depends on the option you’re pursuing. Naturally, there’s a difference between applying for a loan and pitching to an investor.

But, each financing option follows a similar process. When it comes to how to obtain financing for a small business, follow these basic steps:

- Research: Step one of getting financing is to review available options to you. Weigh the pros and cons of each and learn what’s involved in the process.

- Gather: After choosing the financing option you want to pursue, gather the necessary documents to apply. Examples include your business plan, a request detailing the amount of funds you need, financial statements, and receipts.

- Question: Find out as much information as you can about the strings that come with receiving the funds. Ask about interest rates, how much ownership in the company you need to give up, etc.

- Apply: Feel good about the option you’re going with? It’s time to “apply” by starting your crowdfunding campaign, filling out your credit application, putting together an agreement, etc.

- Receive: Ah, sweet success—you’ve received the funds!

- Record: Remember to record the incoming money in your accounting books. And, keep track of your obligations (e.g., making monthly payments, meeting with investors, etc.)

To help you through the process (and weigh your business funding options), consider consulting an accountant or small business lawyer.

After you secure financing, make sure you pay back your loan(s) on time. Patriot’s online accounting software tracks your income and expenses so you know exactly where your money is going. Try it for free today!

This article has been updated from its original publication date of December 30, 2016.

This is not intended as legal advice; for more information, please click here.