Have employees? Then you know part of your employer responsibilities include the annual reporting of employee wages and taxes on Form W-2. And, no Form W-2 reporting is complete without its trusty sidekick, Form W-3. What is a W-3 form?

What is a W-3 form?

Form W-3, Transmittal of Wage and Tax Statements, is a Form W-2 accompanying document that summarizes Form W-2 information. IRS Form W-3 provides a compiled list of employee information included on all of the Forms W-2. The W-3 form is not a standalone form—only file it with copies of all of your Forms W-2.

Form W-3 shows the IRS the total amount you paid to all of your employees, as well as the total federal income, Social Security, and Medicare taxes you withheld from your employees. It also tells the IRS about the number of people you employ and states the total number of Forms W-2 you’re filing it with.

As you know, Form W-2 has numerous copies going to your employee, the Social Security Administration (SSA), and applicable state tax agencies. Here’s a breakdown of which Form W-2 copies go where:

- Copy A: SSA

- Copy B: Employee

- Copy C: Employee

- Copy D: Your records

- Copy 1: State, city, or local tax department, if applicable

- Copy 2: Employee

On the other hand, there’s only one copy of Form W-3, and it goes to one party: the SSA. And, you must make and keep a copy of the form—along with Copy D of Form W-2—for your records.

Send Form W-3 even if you are only filing one Form W-2 with the SSA.

So, what is the purpose of the W-3 tax form? Form W-3 verifies the accuracy of your Forms W-2. Form W-3 also provides a formal reconciliation of your quarterly tax payments for the year.

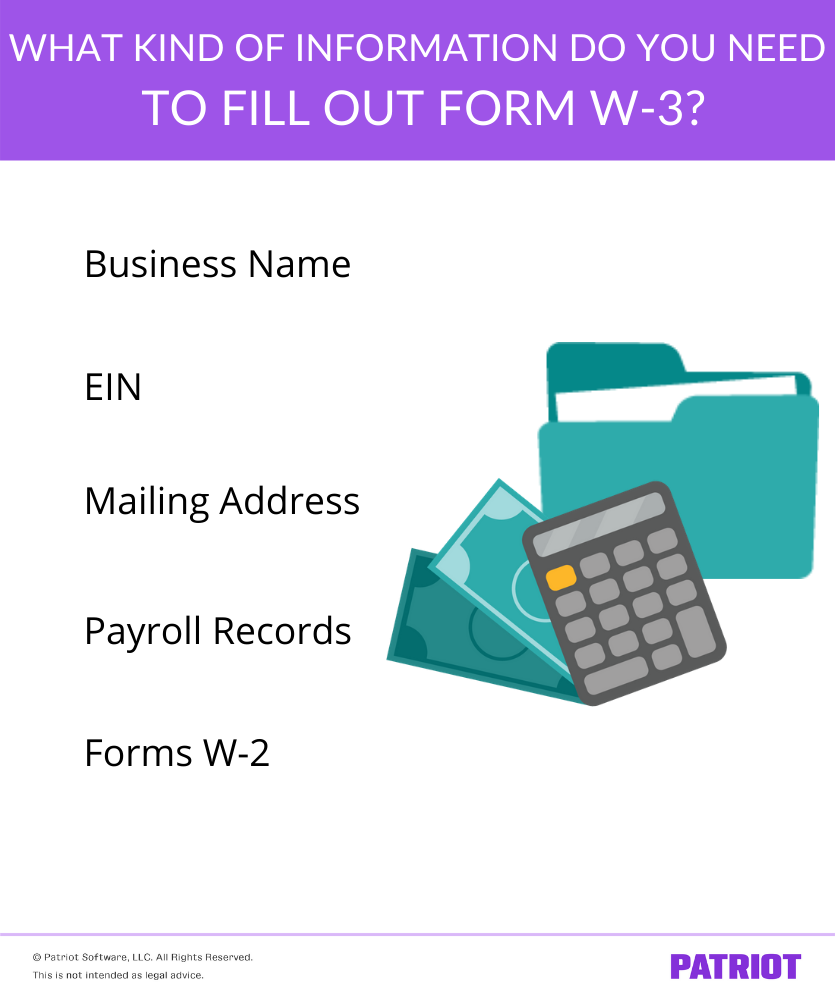

Information you need to complete the W-3 tax form

To complete Form W-3, you need some basic business information, including your company’s legal name, Federal Employer Identification Number (FEIN or EIN), and mailing address.

Additionally, you need your payroll records and Forms W-2. Your payroll records, such as your payroll register and year-to-date payroll information, show employees’ gross wages, taxes and deductions withheld, and net wages.

Rather than inputting information directly from Forms W-2, cross-reference your Form W-2 information with your payroll records for additional verification. That way, you can confirm Form W-2 information is accurate before filling out Form W-3.

Form W-3 instructions

Filling out and filing Form W-3 is a pretty straightforward process. The form has a similar set up to Form W-2.

Boxes a-h ask for employer information. Boxes 1-19 ask about the total wage and tax information for all employees. There are also four unnumbered and unlettered boxes at the bottom that ask for employer contact information.

Here’s an overview of how to fill out a W-3 form, by box:

- a: Control number

- b: Kind of payer / Kind of Employer / Third-party sick pay (if

- applicable)

- c: Total number of Forms W-2

- d: Establishment number

- e: Employer Identification Number

- f: Employer’s name

- g: Employer’s address and ZIP code

- h: Other EIN used this year

- 1: Wages, tips, other compensation

- 2: Federal income tax withheld

- 3: Social Security wages

- 4: Social Security tax withheld

- 5: Medicare wages and tips

- 6: Medicare tax withheld

- 7: Social Security tips

- 8: Allocated tips

- 9: Blank

- 10: Dependent care benefits

- 11: Nonqualified plans

- 12a. Deferred compensation

- 12b. Blank

- 13: Nonqualified plans

- 14: Income tax withheld by payer of third-party sick pay

- 15: State and employer’s state ID number

- 16: State wages, tips, etc.

- 17: State income tax

- 18: Local wages, tips, etc.

- 19: Local income tax

- Employer’s contact person

- Employer’s telephone number

- Employer’s fax number

- Employer’s email address

How to file

You can e-File Form W-3 with Forms W-2 or mail Forms W-3 and W-2 to the SSA. Keep in mind that the SSA encourages you to e-File your forms.

Deadline

Form W-3 is due along with Forms W-2 by January 31. If January 31 falls on a weekend, the deadline is pushed to the next business day.

This deadline is for both paper and electronic filing.

Fixing Form W-3 errors

Errors on Form W-2 can impact the accuracy of Form W-3. If you discover an error on Form W-3, use Form W-3c, Transmittal of Corrected Wage and Tax Statements, to correct the mistake.

If you correct a Form W-2, you must file Form W-3c, too.

Don’t want to deal with the hassle of submitting Form W-3? Patriot’s Full Service payroll services will generate and submit Form W-3 on your behalf. Try it out with a free trial today!

This article has been updated from its original publication date of March 20, 2012.

This is not intended as legal advice; for more information, please click here.