Businesses could apply for a Paycheck Protection Program loan through May 31, 2021. As of June 1, 2021, the SBA is no longer accepting PPP loan applications.

Congratulations on receiving a Paycheck Protection Program forgivable loan! But if you want to receive loan forgiveness, you need to use it for eligible expenses and keep detailed records.

Read on to learn about Paycheck Protection Program (PPP) loan accounting.

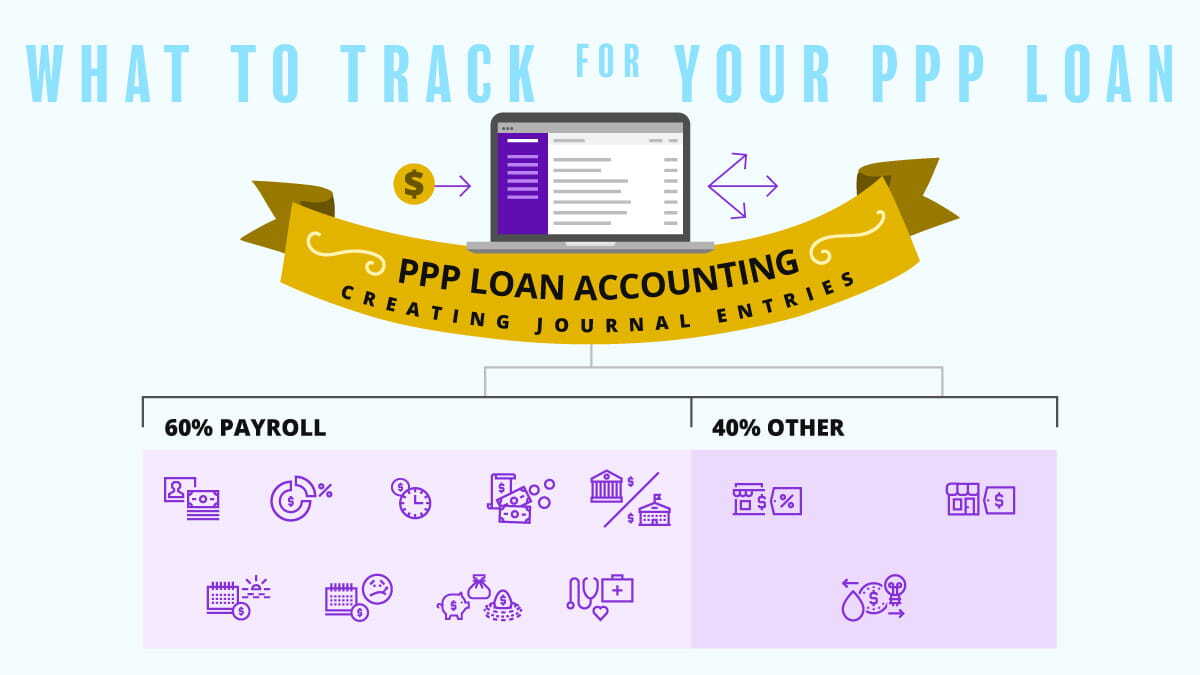

Eligible expenses for PPP loan forgiveness

If you want PPP loan forgiveness, you must use it to cover eligible expenses, which are:

- Payroll costs (60% of loan proceeds)

- Salaries, wages, commissions, or tips ($100,000 max per employee—gross earnings)

- Employee benefits (e.g., vacation; sick leave; health care benefits; retirement benefits; and group life, disability, vision, and dental insurance)

- State and local taxes

- Non-payroll costs (40% of loan proceeds)

- Interest on mortgages

- Rent

- Utilities

- Covered operations expenditures (e.g., business software or payroll tracking expenses)

- Covered property damage (e.g., vandalism or looting)

- Supplier costs (i.e., essential items for operation)

- Worker protection expenditures (e.g., personal protective equipment)

Keep in mind that the primary goal of the PPP loan is to keep employees on payroll. So, you must use at least 60% of your loan for payroll costs and 40% or less for qualifying non-payroll costs.

You can also use your PPP loan funds to cover other expenses. However, the portion of the loan you use for non-eligible expenses cannot be forgiven.

When you use the PPP loan to cover eligible expenses, you need to record it. And if you use your PPP loan to cover non-eligible expenses, you must record it.

Accounting for PPP loans and forgiveness: Tips

To ensure your PPP loan is forgiven, you must keep your accounting records up-to-date. Before you begin accounting for your PPP loan, check out these five tips.

1. Keep separate bank accounts

As a business owner, it’s good practice to keep a separate bank account for business. And, you should be doing the same thing when it comes to a PPP loan.

To keep your PPP funds and transactions organized, consider setting up a separate bank account for the PPP loan money you receive. A separate account lets you easily show that your business used PPP funds for eligible expenses (e.g., payroll costs). Not to mention, a separate PPP loan account will help simplify the PPP loan forgiveness process.

2. Utilize accounting software

Another way to organize your PPP funds and transactions is by taking advantage of accounting software to track and segregate PPP loan transactions.

You can use a separate expense account to record eligible expenses. Before you commit to software, be sure it’s capable of tracking PPP loan information.

Even if you’re not tracking PPP loan expenses or planning on taking out a loan, accounting software can be a helpful tool for your business.

3. Separate PPP loan proceeds from business revenue

Because loan forgiveness is not taxable, you’ll want to make sure you separate your business revenue and PPP loan proceeds.

Again, you can do this by opening a separate bank account. If you don’t want to go through the process of opening an additional account, denote PPP income when you update your books and label transactions accordingly.

Mixing business revenue and PPP loan proceeds together can not only make your books sloppy, but it also makes it difficult to track transactions for loan forgiveness.

4. Track as much information as possible

When it comes to the PPP loan, the more records you track, the better off your business will be when it comes to loan forgiveness.

To ensure loan forgiveness, make sure you keep track of the following in your books:

- Payroll costs (e.g., wages, salaries, tips, etc.)

- Eligible mortgage, lease, and utility payments

5. Determine how to handle leftover money

Your business may wind up receiving more PPP loan money than you need. If this happens, you can either:

- Return leftover funds

- Use the rest of the money as a low-interest loan

If your business needs to do one of the above because you have unspent PPP funds, record the transaction in your books, and keep any documentation in your records for safekeeping.

PPP loan accounting process

Accounting for a PPP loan can be an overwhelming process. You may be asking yourself a number of questions, such as How do I record the PPP loan in my books? or How do I record certain PPP expenses? If you’re curious about these PPP accounting questions and more, you’ve come to the right place.

To learn more about the PPP loan accounting process, take a look at how to record PPP transactions in your books below, plus examples.

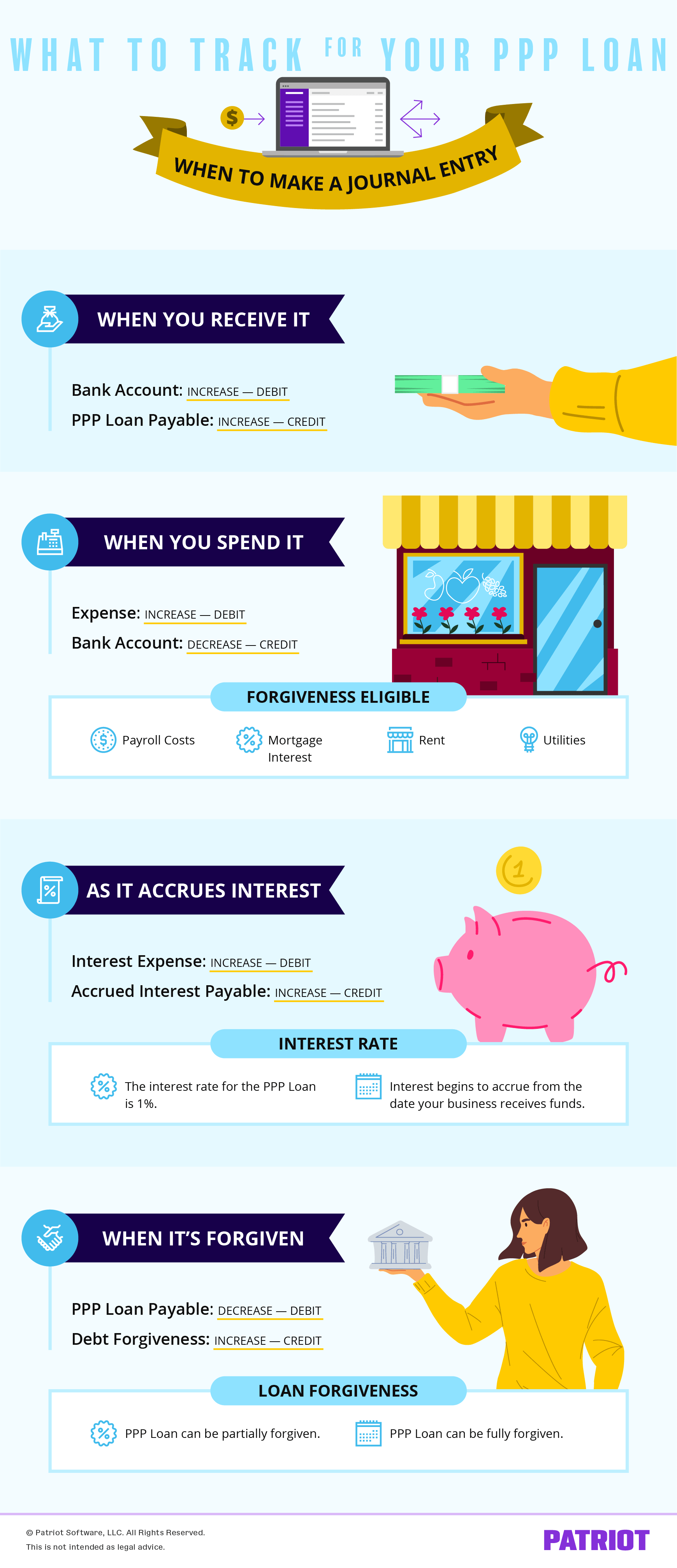

1. Recording the loan in your books when you receive it

When you receive a loan, you increase your business’s funds and liabilities. To reflect this increase, debit an asset account (your bank account) and credit a liability account.

Until your lender tells you that part or all of the loan is forgiven, it’s a liability.

Again, strongly consider separating your PPP funds for clearer recordkeeping. For example, your liability account could be called a PPP Loan Payable account.

- Asset Account: Bank Account, Debit

- Liability Account: PPP Loan Payable, Credit

Whatever accounts you decide to use, debit your bank account for the amount of the loan and credit your liability account for the amount of the loan.

If you separate funds, your bank account will be a special PPP loan bank account. If you do not separate funds, your bank account will be your regular bank account (e.g., Checking).

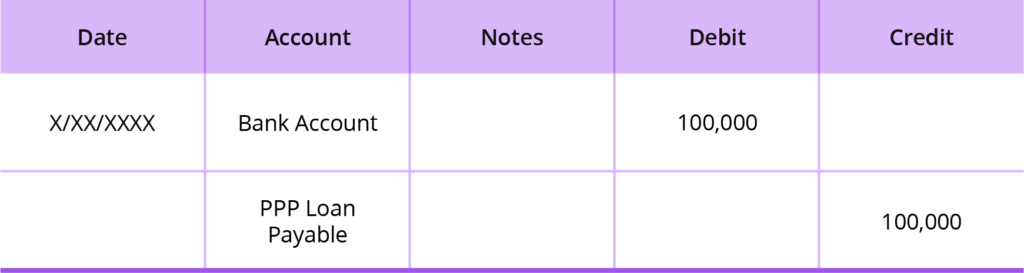

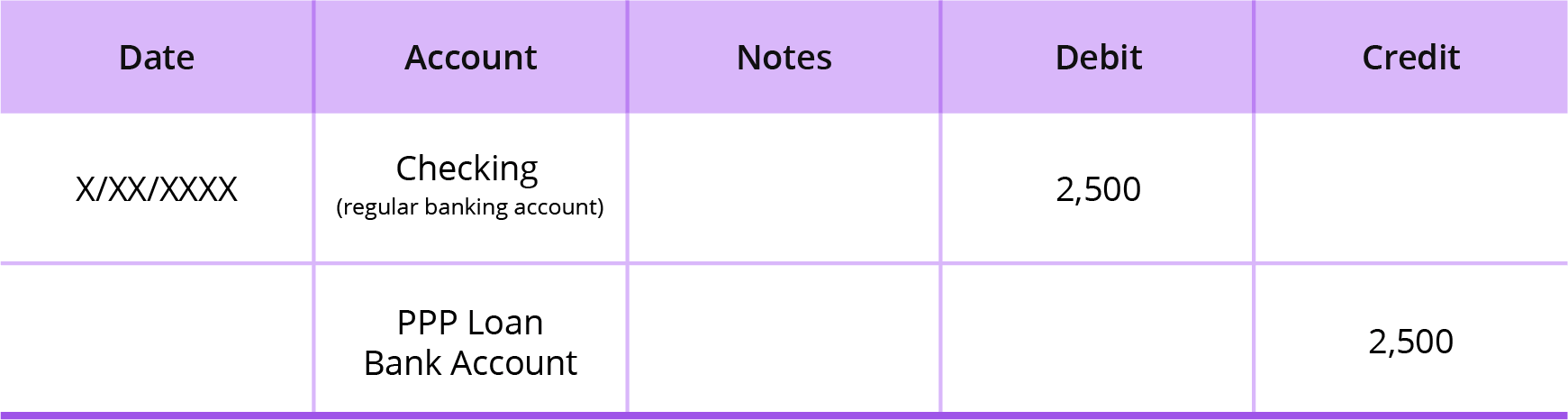

Let’s say you receive a PPP loan totaling $100,000. Your journal entry would look like this:

Do not touch your PPP Loan Payable (liability account) unless your lender tells you that your loan is forgiven or at the point repayment is required. If your loan is partially or fully forgiven, you will create a journal entry writing off the forgivable portion (shown below).

2. Recording expenses you use the PPP loan for

When you use PPP loan funds to cover expenses—eligible for forgiveness or not—you must record it in a journal entry.

Again, these expenses are eligible for loan forgiveness:

- Payroll costs

- Mortgage interest

- Rent

- Utilities

How you record the entry depends on whether you create a separate PPP loan account or add the PPP loan funds directly into your regular bank account.

If your loan is in a separate bank account

Again, creating a separate bank account for your PPP loan is a good idea for simple tracking. If you are able to create a separate bank account for your PPP loan, you’ll create two journal entries.

Use your regular bank account to pay for expenses. Then, transfer the appropriate PPP loan funds from your PPP account to your regular bank account to cover them.

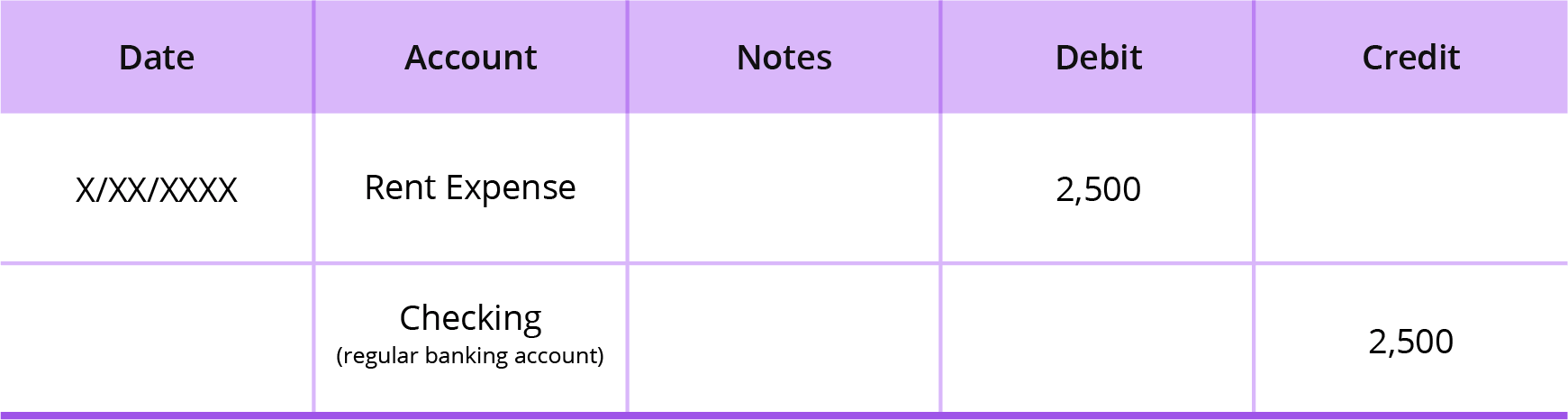

Your first journal entry will debit the appropriate expense account (e.g., Payroll, Mortgage Interest, Rent, or Utility). And, you’ll credit your regular banking account (e.g., Checking), which is an asset account.

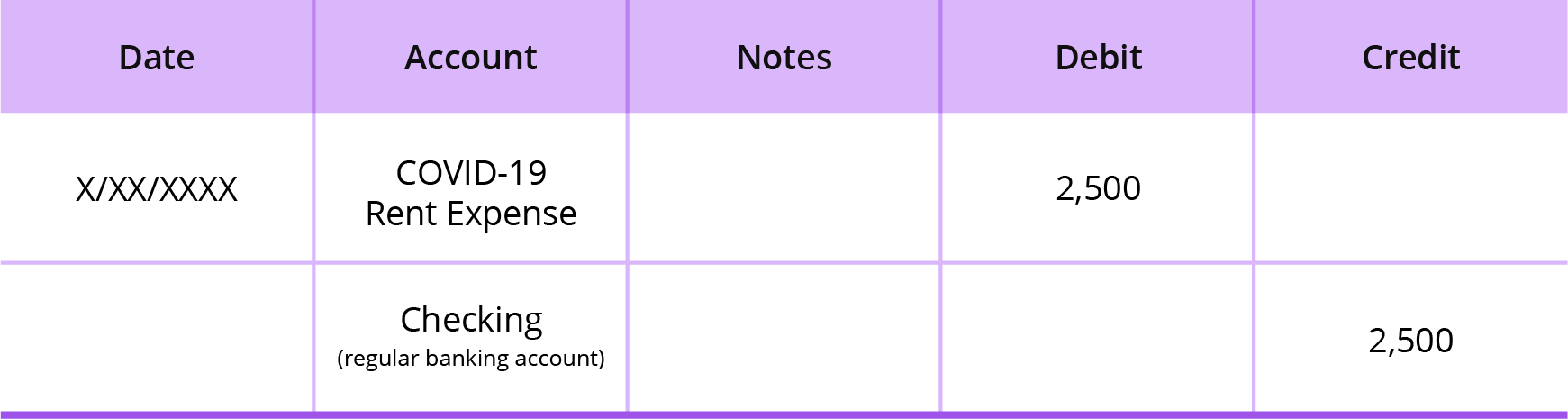

Let’s say you have a $2,500 rent expense. Your first journal entry debits your Rent Expense account $2,500 and credits your regular banking account, Checking, $2,500.

Your second journal entry records the transfer you made to replenish the money in your regular bank account by transferring money out of your PPP loan account.

Now, you’ll be increasing the cash in your regular banking account and decreasing the cash in your PPP loan account. Debit your regular banking account (e.g., Checking) and credit your PPP loan account to reflect this. Both are asset accounts.

Using the example of a $2,500 rent expense, your second journal entry debits your regular bank account $2,500 and credits your PPP loan account $2,500.

If your loan is not in a separate bank account

If you can’t open a new bank account to house your PPP loan, your journal entries will look a little different.

Create one journal entry to record expenses you use the PPP loan to cover. Your expense account should be specific to the COVID-19 expense. Create a separate expense account name for accurate tracking.

Because your PPP loan funds are commingled with your other funds in one bank account, pay extra attention to your loan proceeds spending. Consider keeping a running total of how much loan proceeds you’ve used to date in a separate spreadsheet.

Debit your COVID-19 Expense account and credit your regular banking account. Again, let’s say you have a $2,500 rent expense. Your journal entry would look like this:

Payroll expenses are a bit more involved than mortgage interest, rent, and utility expenses. But because payroll expenses must make up 60% of your PPP loan expenses for forgiveness, we’re going to take a look at a payroll example.

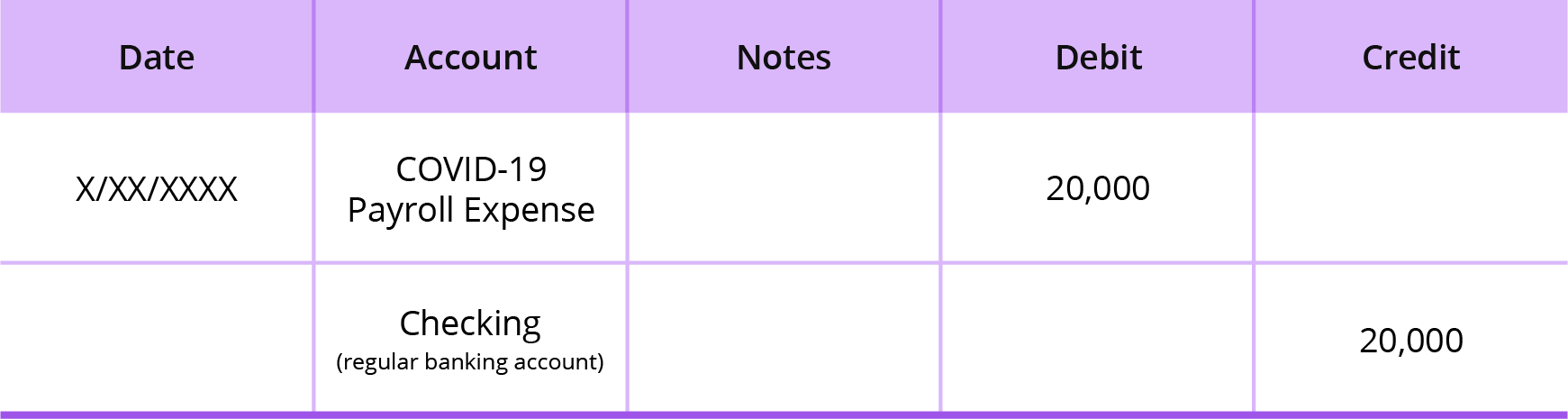

Let’s say you have a total of $20,000 in payroll expenses over a biweekly payroll period. How you record your payroll expenses may depend on whether you lump all expenses under a COVID-19 Payroll Expense account or if you separate them by type.

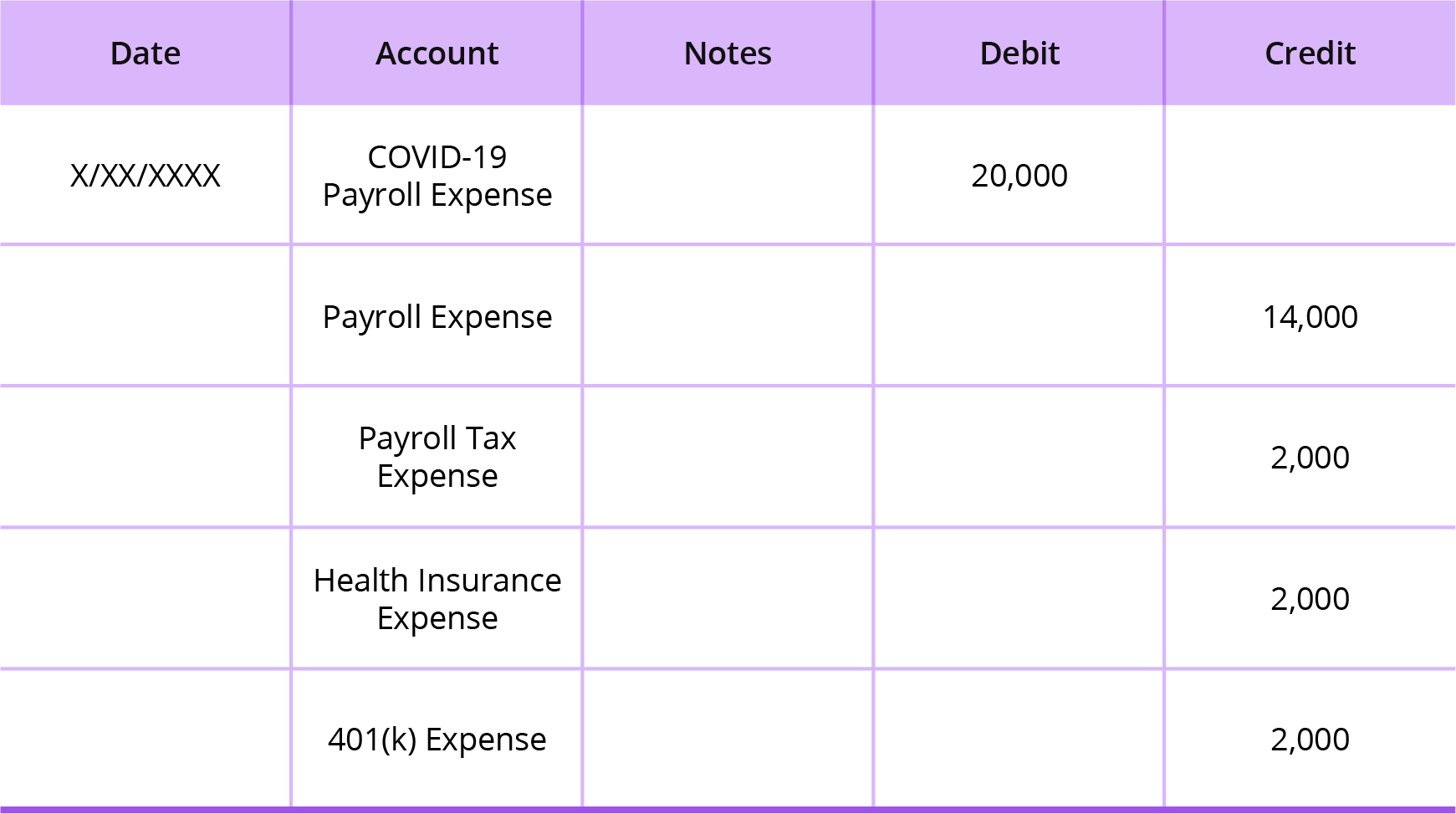

If you lump all your payroll expenses under a COVID-19 Payroll Expense account, your journal entry would look like this:

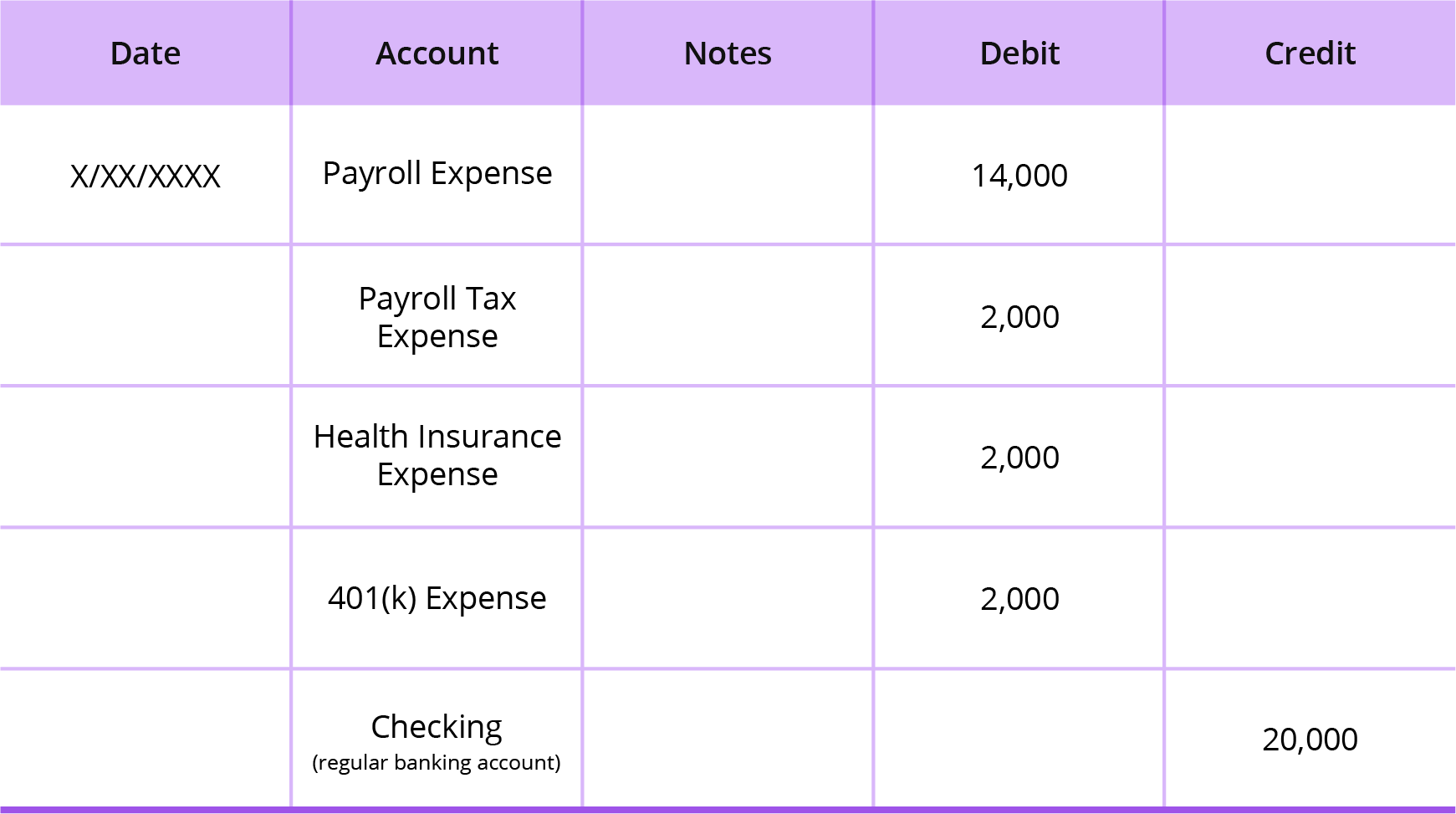

But if you separate your payroll-related expenses, you’ll need two journal entries. You might separate your payroll expenses using the following types of accounts:

- Payroll Expense account (salaries, wages, commissions, paid leave, etc.)

- Payroll Tax Expense account (your employer tax expenses eligible for forgiveness)

- Health Insurance Expense and 401(k) Expense accounts (costs associated with the payroll)

This would be a good idea to do for more detailed recordkeeping. First, you’ll debit your general Payroll Expense accounts and credit your bank account.

Next, you would create a reclassification entry for easy reporting when the 24-week loan period is over. To do this, debit a COVID-19 Payroll Expense account credit all the payroll-related expense accounts that would be impacted.

For example, your entry could look like this:

3. Recording accrued interest expenses

For the PPP loan, interest begins to accrue from the date your business receives funds. As a reminder, the interest rate is 1%. If you receive a PPP loan, loan payments are deferred for six months with interest accruing during the six-month period.

If you retain employees and maintain salary levels, the Small Business Administration (SBA) will forgive part or all of the principal amount of your loan, plus accrued interest.

To calculate accrued interest for the PPP loan, you can use the following formula:

PPP Accrued Interest = Loan Amount X 1% X (# of days from the date of the loan to the end of the month / 365)

Keep in mind that terms can vary depending on your bank.

To record accrued interest in your books for the PPP loan, debit your Interest Expense account and credit your Accrued Interest Payable account (which is a liability account).

Many businesses record interest accruals during the month-end closing procedures and include interest incurred to that month-end date. Record interest accrued for your PPP loan during your month-end closing process.

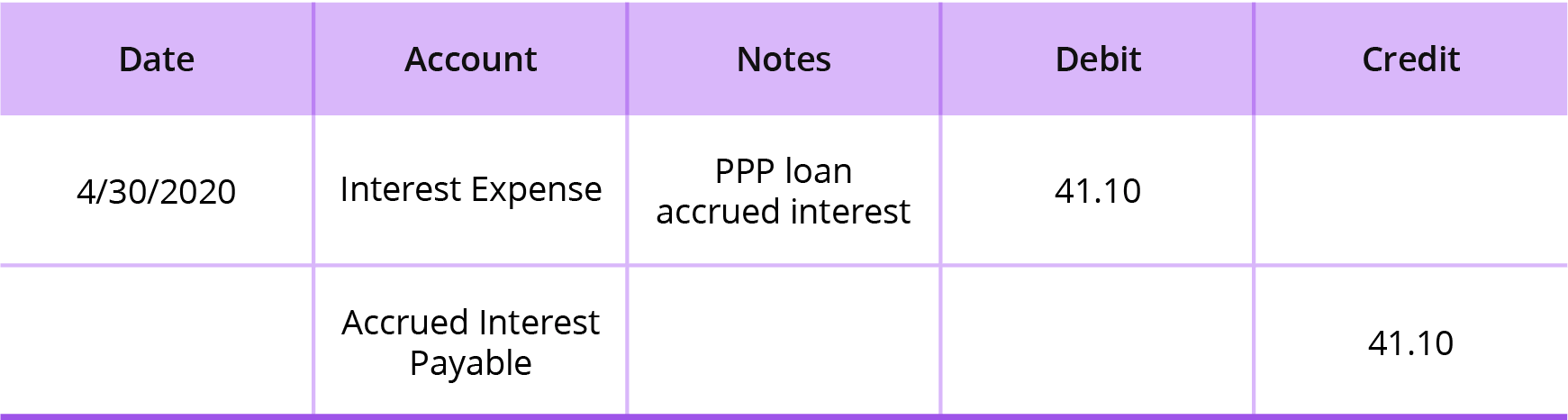

Say you received a $100,000 loan. You received the loan proceeds on April 15. When you’re recording the loan in your books on April 30 (15 days later), the accrued interest would equal $41.10 for the month of April.

Loan Amount X 1% X (# of days from the date of the loan to the end of the month / 365)

$100,000 X 1% X (15 / 365) = $41.10

You need to debit your Interest Expense account $41.10 and credit your Accrued Interest Payable account $41.10. Here’s what your accrued interest journal entry would look like:

For the month of May, your accrued interest would equal $84.93 ($100,000 X 1% X (31 / 365) = $84.93). For June, your accrued interest would be $82.19 ($100,000 X 1% X (30 / 365). Record May and June’s accrued interest the same way you recorded the accrued interest for the month of April (see example above). Your total accrued interest for April, May, and June combined would be $208.22.

4. Writing off the forgivable portion of the PPP loan

Depending on how much of the loan is forgiven, there are a couple of ways to record the forgivable portion of the PPP loan in your books. You may need to record a:

- Partially forgiven loan

- Fully forgiven loan

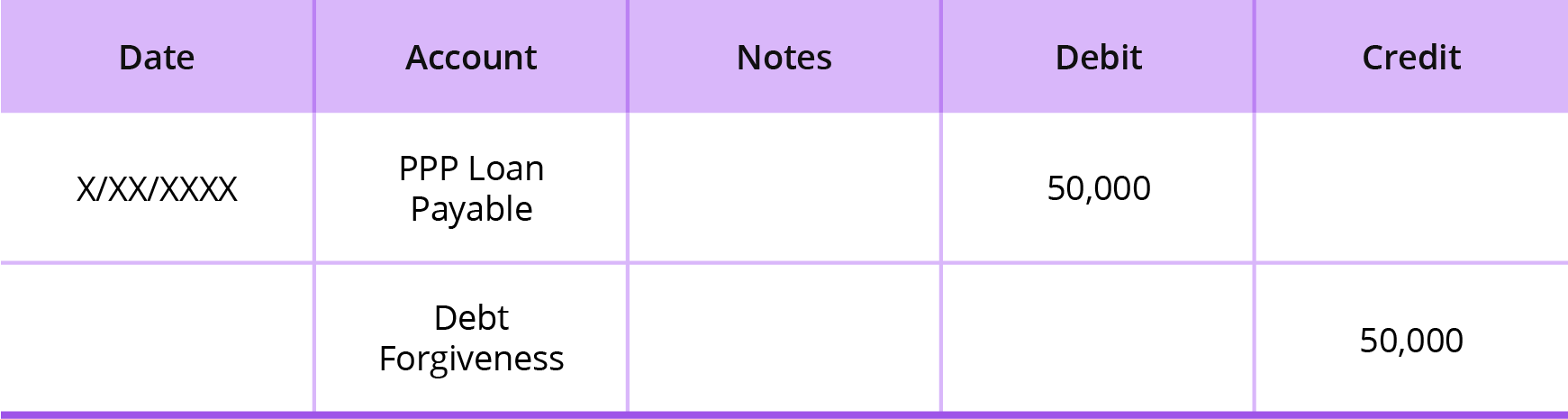

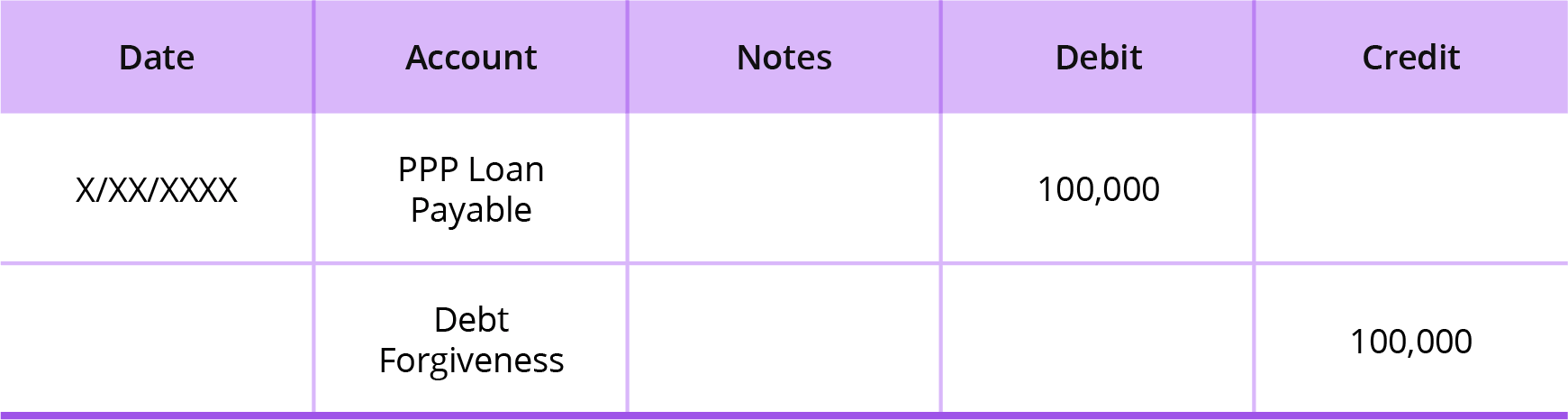

Regardless of if the loan is partially or fully forgiven, debit your PPP Loan Payable account and credit your Debt Forgiveness account for any amount that is forgiven. A Debt Forgiveness account is similar to a bad debt. Set a Debt Forgiveness account up as an other income account.

Say you have a partially forgiven loan. Only $50,000 out of your $100,000 loan was forgiven. Debit your PPP Loan Payable account $50,000 and credit Debt Forgiveness account $50,000.

Your PPP Loan Payable account would still have a balance of $50,000. Each time you make a loan payment, you would need to create repayment journal entries to reduce the remaining balance over the repayment period.

Now, let’s say your $100,000 PPP loan was 100% forgiven. Debit your PPP Loan Payable account $100,000 and credit your Debt Forgiveness account $100,000 because the loan was completely forgiven.

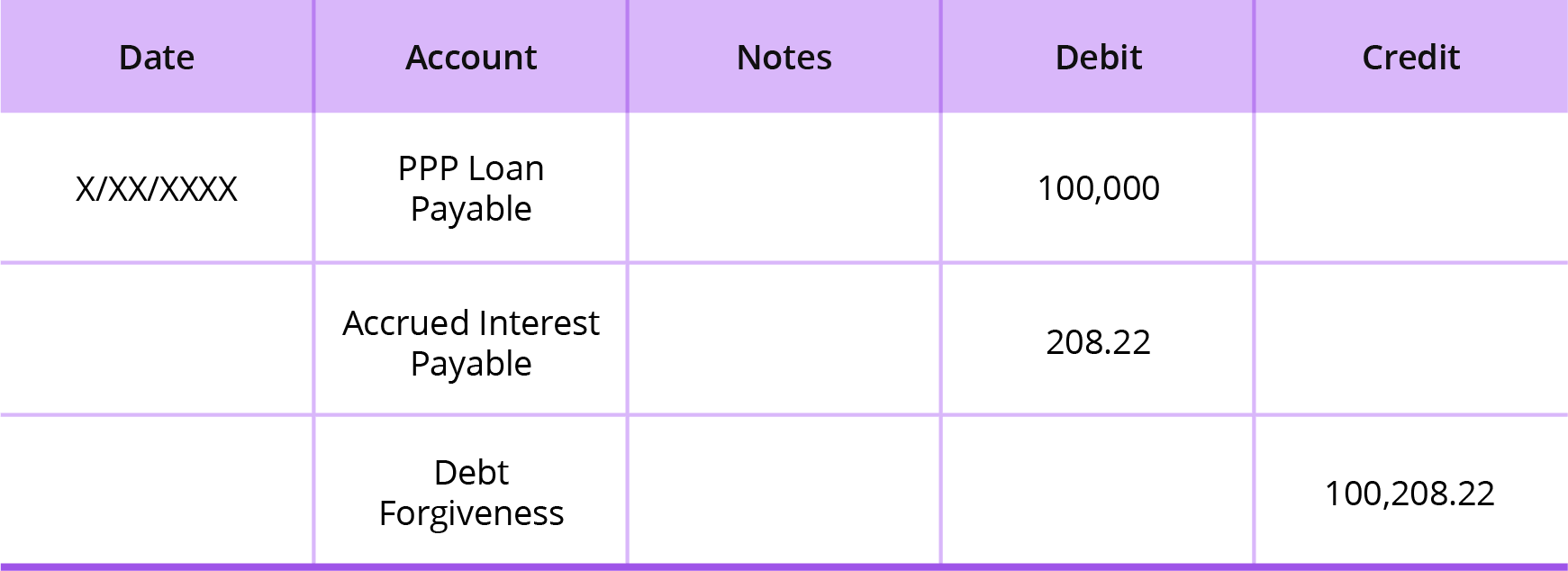

In addition to recording a forgiven loan, you may also need to write off accrued interest that is forgiven. To do this, debit your PPP Loan Payable account and your Accrued Interest Payable account. Then, credit your Debt Forgiveness account.

Say 100% of both your PPP loan and accrued interest is forgiven. Your loan is $100,000 and your accrued interest is $208.22 (accrued interest from example above). Debit your PPP Loan Payable account $100,000, debit your Accrued Interest Payable $208.22, and credit your Debt Forgiveness $100,208.22.

This is not intended as legal advice; for more information, please click here.