As a small business owner, you may find yourself struggling to keep up with your business’s books. As soon as you know it, another month has passed and you’ve fallen behind recording transactions.

Sure, closing your books can be stressful and time-consuming. But if you have a monthly closing process and checklist in place, you’ll be finishing accounting tasks and reconciling accounts in no time.

So, how can you simplify your responsibility of closing your books monthly? Say goodbye to disorganized books and hello to a month-end closing procedure.

Read on to learn tips for creating your month-end close checklist and closing monthly accounts.

What’s a month-end close?

Before we get down to the nitty-gritty of month-end closing procedures, you need to learn what it is. So, what is a month-end close? In accounting, a monthly close is a series of steps a business follows to review, record, and reconcile account information.

Businesses perform a month-end close to keep accounting data organized and ensure all transactions for the monthly period were accounted for.

Before you can begin closing your books, you need to round up some information. Some information you need to gather before you close your books may include:

- Revenue totals

- Bank account information

- Inventory levels

- Petty cash fund amount

- Financial statement information

- Balance sheets

- Total fixed assets

- Income and expense account information

- General ledger data

Keep in mind, each business’s month-end accounting procedures can vary depending on the type of business, accounts, and accounting method.

Month-end closing process

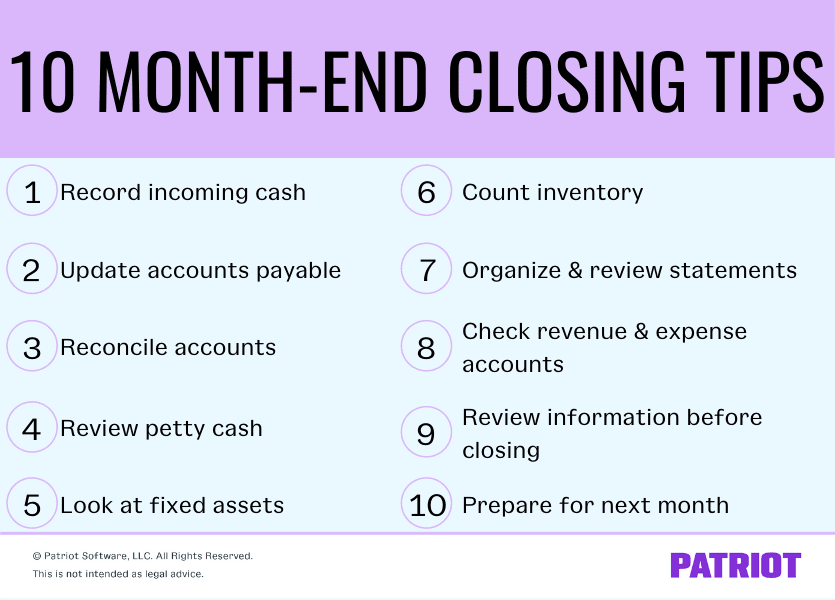

To keep your accounting books as accurate as possible, you need to stay organized. Use the tips below to ensure your month-end close process runs smoothly.

1. Record incoming cash

When closing your books monthly, you need to record the funds you received during the month. Some incoming cash you might need to record includes:

- Revenue

- Loans

- Invoice payments

Compare your invoices with your records to make sure you aren’t missing any customer payments. Make sure you sent an invoice to every customer you completed work for during the month. If you find any discrepancies, fix them right away.

For example, say you did not receive payment from your customer, John. Contact John to inform him of the missing payment. And, let John know about any late fees associated with an unpunctual payment.

2. Update accounts payable

Chances are, you probably don’t have time to record transactions every day. If this is the case, make sure you write down your purchases and organize receipts. That way, you can keep your accounts payable in tip-top shape for your monthly close.

After tracking your transactions, record them in your books at the end of each week or month. During your monthly close, cross-check your records to make sure you paid all bills and invoices.

3. Reconcile accounts

During your month-end close process, you need to reconcile all of your accounts. To do this, match your records to your account statements from outside entries, such as the bank. Make sure your records for the month are accurate by performing a bank statement reconciliation.

Typically, you can break your accounts down into three categories:

- Cash, checking, and savings accounts

- Bank loans and notes

- Prepaid or accrued accounts

Start with one of the above categories and work your way to the others. Divvying up the records when reconciling your bank statement can help you stay organized and catch errors at month-end.

4. Review petty cash

If you use petty cash or have a petty cash fund, you need to account for those at month-end, too.

Record all of the receipts for items you purchased using petty cash. Make sure your receipts and records match the balance of your petty cash fund. If it does not, chances are you are missing a transaction.

To compare your petty cash fund to your records, physically count the leftover cash in your fund. If it does not match up, you might be missing a receipt. Or, you might have forgotten to record the used petty cash in your books.

5. Look at fixed assets

Your fixed assets are long-term items that add value to your business. Things like buildings, equipment, furniture, vehicles, and land are considered fixed assets.

Your fixed assets usually do not convert directly into cash. And because fixed assets are generally larger purchases, they can depreciate in value over time.

When closing your books at the end of the month, record any payments related to your fixed assets.

6. Count inventory

If you want to make sure your inventory is correct, you need to perform monthly inventory counts. Counting your inventory monthly allows you to accurately record inventory levels in your books at month-end. Plus, doing a monthly inventory count can help you decide what items you need to replenish and how frequently.

You might need to monitor some types of inventory more than others. If you don’t accurately track your inventory, you could experience problems like inventory shrinkage. Say you own an ice cream shop and you have milk in your inventory. Because milk can spoil, you would need to check your perishable food inventory more frequently.

Use your inventory count to make adjustments and reconcile your books when you complete your end-of-the-month procedures.

7. Organize and review financial statements

At month-end close, you have the responsibility of organizing and reviewing all of your financial statements. These mainly include your:

- General ledger

- Business balance sheet

- Profit and loss statement

Consistently organize your statements each month. That way, you’re not scrambling at month-end looking for documents. One way to stay organized is by using basic accounting software to track your transactions and store your reports.

You can also use your financial statements as an opportunity to improve your small business. For example, when you review your statements, you might notice that you’ve been spending a lot of money for a product that’s not selling. You might decide to use cheaper materials to produce the product. Or, you might decide to switch up the product altogether.

Reviewing statements can help you catch issues early on, like overspending, and prevent problems later on with your books.

8. Check revenue and expense accounts

At month-end close, review your revenue and expense accounts to confirm they are accurate. Check to see if you recorded your expenses in the correct accounts for the period. Be sure that accruals and prepaid expenses are recorded accurately in your books.

9. Review information before closing

Before you completely close the accounts at month-end, consider having a second set of eyes review your work. The person reviewing your accounting information could be a manager or supervisor who has experience handling your books.

If you do not have another person you can ask to review your information, double and triple check your own work to ensure the information is accurate.

10. Prepare for next month

To keep on top of your monthly accounting responsibilities and cut down on time spent closing your books, create a monthly financial calendar. Your calendar can help you prepare for closing your books for the next month. And, your calendar can help you avoid falling behind on your books.

On your calendar, plan out when you’re going to collect reports, record transactions, and close your books. Establish a closing date by which all expenses and income must be posted. Be sure to communicate the closing date with anyone who has access to adjusting the ledger.

As time goes on, you can tweak your calendar if you find a process and order that works better for you and your business.

Importance of closing your books monthly

Closing your books monthly is essential for your business. It can show you your business’s financial information and what areas you need to improve in. Closing your books monthly can also help you make decisions about your business’s finances, prevent costly mistakes, and prepare you for tax time.

If you’re not completely sold on the idea, here are the pros of closing your books monthly (in a nutshell):

- Keeps your financial statements and books accurate

- Makes tax filing simpler

- Backs you up during an audit

- Gives you a clear snapshot of your business’s financial condition

- Prepares you for the future

- Prevents future accounting mistakes

Need a way to record your business’s monthly transactions? You’ve come to the right place. Patriot’s accounting software lets you streamline the way you record your transactions so you can get back to your business. Get started with your self-guided demo today!

We’re always ready to keep the conversation going. Give us a like on Facebook and share your thoughts on our latest articles.

This article has been updated from its original publication date of November 5, 2015.

This is not intended as legal advice; for more information, please click here.