So, you’ve started your dream venture (cue the applause and the confetti cannons!). But now, it’s time to get your registrations out of the way. You might be wondering: Do I need to open a business bank account?

Well, wonder no more. We’ve got the scoop below.

Do I need to open a business bank account?

The short answer is: More than likely, yes. You might be wondering, Why do I need to open a business bank account? The IRS recommends keeping separate business and personal accounts for easier recordkeeping.

Some businesses are legally required to open a separate business bank account. And even if you don’t legally need to separate funds, you may want to.

Who legally needs to open a separate business bank account?

Whether your business legally needs a separate bank account for personal and business funds boils down to two factors: your business structure and name.

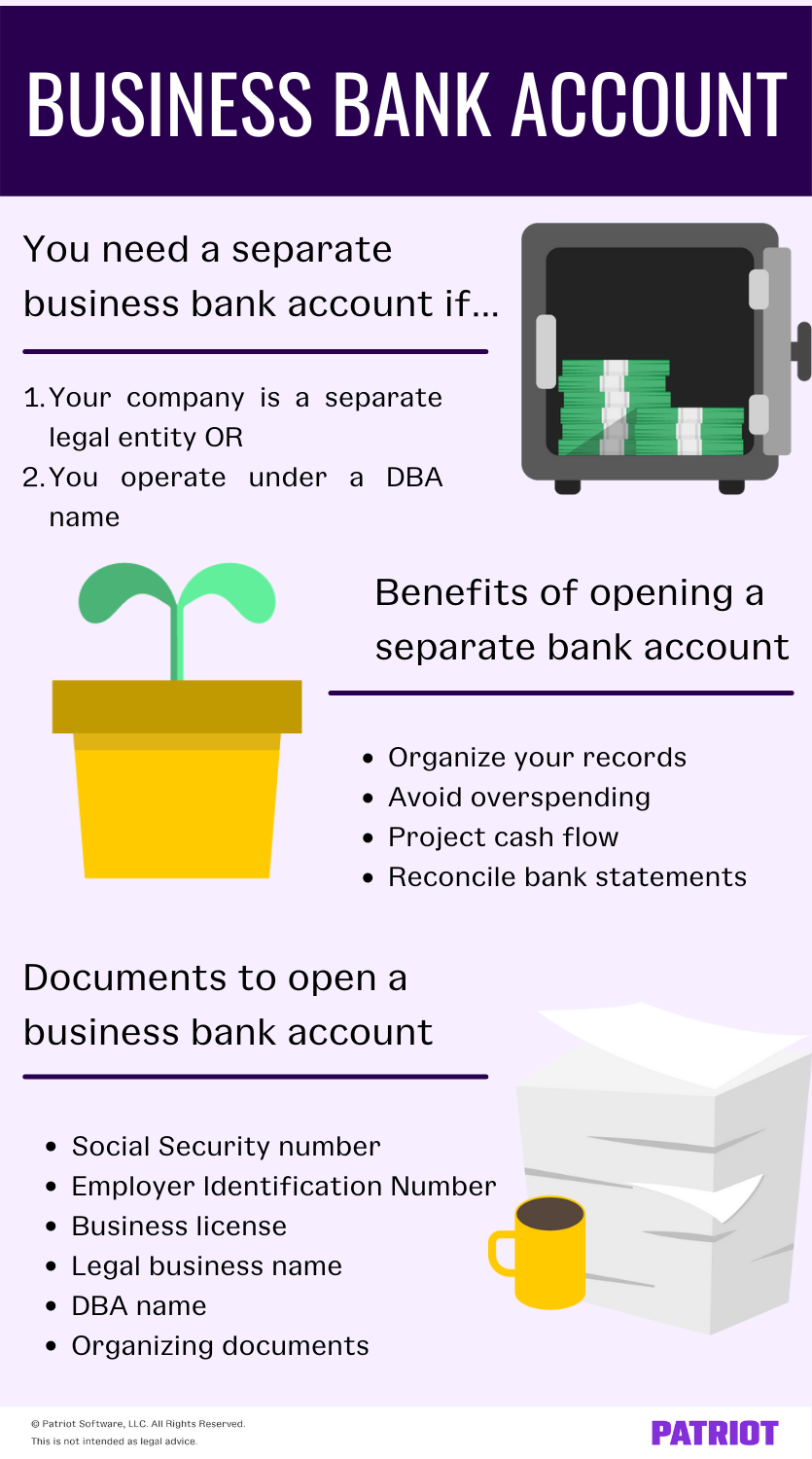

Legally, you must open a business bank account if one of the following is true:

- Your company is a separate legal entity

- You operate under a doing business as (DBA) name

1. Separate legal entity

A separate legal entity is a business that operates separately from its owner. If your business is incorporated, your business is a separate legal entity.

As a reminder, the types of business structures are:

- Sole proprietorships

- Partnerships

- Limited liability companies (LLCs)

- Corporations (C and S Corps)

Limited liability companies and corporations are separate legal entities. If you operate as one of these business structures, you must open a separate business bank account.

You might be wondering, Do I need a business bank account for a sole proprietorship? What about partnership? Sole proprietorships and partnerships are not legally required to open a business bank account unless you have a…

2. DBA name

A DBA name is a fictitious name that’s different from your business’s legal name (e.g., legal name Mark Smith / DBA Mark’s Mechanics). Many businesses tend to operate under a DBA name rather than their legal name.

So, do you run a sole proprietorship or partnership? Do you operate under a DBA name (also called a trade name)? If so, you need a separate business bank account.

Why would you want to open a separate account if you don’t have to?

If your business isn’t structured as an LLC or corporation, and if you don’t operate under a DBA name, you may be wondering, Can I use a personal checking account for business?

Well, you might want to heavily consider opening a separate account regardless. There are a number of benefits you can reap from opening a business bank account.

Consider separating your personal and business funds to:

- Keep your finances in tip-top shape

- Legitimize your business

- Have organized accounting records

- Make it easier to file your business tax return

- Help you avoid overspending

- Avoid missing growth opportunities

- Create a clear audit trail

- Project cash flow

- Reconcile bank statements

- Create accurate financial statements

Imagine mixing all of your personal and business transactions together. You would waste time sorting through invoices and receipts when the time comes to update your books or file your taxes. Sounds like a recipe for disaster, right?

Not to mention, opening a separate account for business can help prevent any confusion with the IRS. To avoid an IRS nightmare and unnecessary stress, learn how to organize business receipts and your accounting books. If you do combine your business and personal transactions, make sure you keep a paper trail to prevent any issues.

Ready to open a business bank account? Here’s what you need

All banks require businesses to provide some sort of documentation when opening up a business account. So, you need to gather some information (aka, paperwork to prove you’re a legitimate business).

Take a look at the information you might need to provide the bank with:

- Social Security number (SSN)

- Employer Identification Number (EIN)

- Business license

- Legal business name

- DBA name

- Organizing documents (e.g., articles of organization)

Depending on your bank’s requirement, you might need to provide various pieces of information to establish a business bank account. When researching your banking options, make sure you know what each’s requirements are for opening a business bank account.

Documents by structure

The documents you need can vary depending on your type of business structure. Check out what type of documents you need to provide, broken down by business entity.

Sole proprietorships

- SSN or EIN

- Business license or business name filing document (e.g., DBA name)

Partnerships

- EIN

- Partnership agreement

- Business name filing document (e.g., DBA form)

LLCs

- SSN or EIN

- Articles of organization

Corporations

- EIN

- Articles of incorporation

Checklist for opening an account

Opening a business bank account is a big step for your company. And, opening an account requires you to do research and follow a few steps.

Before you run off and open an account, review the following checklist:

- Select a banking institution

- Prepare your documents

- Open the account in person or online*

- Double-check that your information is accurate

*Generally, you can choose between opening the account in person or online. But, you must open your small business bank account in person if you are in one of the following industries:

- Telemarketing

- Precious metals

- Gambling

- Government

Consider tracking your funds to ensure they are coming in and going out of the correct accounts. Catching issues early on can prevent financial disasters in the future.

Looking for an easy way to track your business bank account’s transactions? Patriot’s accounting software lets you connect your bank or credit card to automatically import transactions. Or, you can manually record information using journal entries. The choice is yours! Get started with your free trial today!

This article has been updated from its original publication date of June 28, 2016.

This is not intended as legal advice; for more information, please click here.