Businesses could apply for a Paycheck Protection Program loan through May 31, 2021. As of June 1, 2021, the SBA is no longer accepting PPP loan applications.

Does your small business need financial assistance as a result of the coronavirus pandemic? If so, one of the biggest federal initiatives for small businesses is the Paycheck Protection Program.

Want to know more about eligibility, important dates, and the application process? We’ve got you covered.

What is the Paycheck Protection Program?

The Paycheck Protection Program (PPP) provides forgivable loans to small businesses to help cover up to 24 weeks of payroll costs and qualifying non-payroll costs. PPP is a small business relief measure that incentivizes businesses to retain employees on payroll.

Here are some fast facts about all the Paycheck Protection Program-related legislation signed into law:

- Coronavirus Aid, Relief, and Economic Security (CARES) Act: Established the PPP on March 27, 2020 ($349 billion)

- PPP and Health Care Enhancement Act: Gave the program a surge of additional funds ($310 billion) on April 24, 2020

- PPP Flexibility Act: Made important changes to the program, making PPP loan forgiveness easier on June 5, 2020

- Consolidated Appropriations Act (the Act): Established PPP 2.0 ($284 billion) and expanded the PPP on December 27, 2020; the portion relating to the PPP and other small business support is also called the “Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act”

- American Rescue Plan: Provided $7.25 billion in additional funding to PPP 2.0 on March 11, 2021. This plan did not extend the program deadline set under the Consolidated Appropriations Act (i.e., March 31, 2021).

- Paycheck Protection Program Extension Act of 2021: Extended the PPP deadline until May 31, 2021.

Although the Paycheck Protection Program closed on August 8, 2020, the Consolidated Appropriations Act reopened the program through March 31, 2021. The PPP Extension Act extended the program through May 31, 2021.

This means you have until May 31, 2021 to apply for your first or second PPP loan.

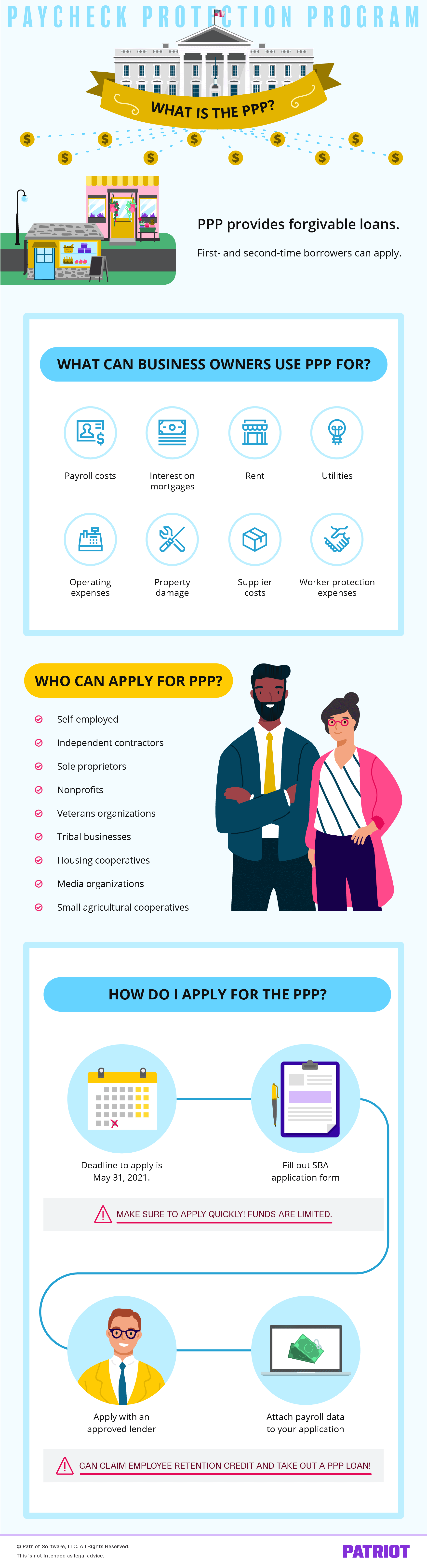

What can employers use PPP funds for?

If you take out a PPP loan, you need to spend the money on qualifying expenses if you want it to be forgiven. Although you can use the money for non-qualifying expenses, that portion of spending will not be forgiven.

For PPP forgiveness, use the loan on the following eligible expenses:

- Payroll costs (60% of loan proceeds)

- Salaries, wages, commissions, or tips ($100,000 max per employee—gross earnings)

- Employee benefits (e.g., vacation; sick leave; health care benefits; retirement benefits; and group life, disability, vision, and dental insurance)

- State and local taxes

- Non-payroll costs (40% of loan proceeds)

- Interest on mortgages

- Rent

- Utilities

- Covered operations expenditures (e.g., business software or payroll tracking expenses)

- Covered property damage (e.g., vandalism or looting)

- Supplier costs (i.e., essential items for operation)

- Worker protection expenditures (e.g., personal protective equipment)

The Consolidated Appropriations Act expanded eligible expenses to include covered property damage; supplier costs; worker protection expenditures; and group life, disability, vision, and dental insurance.

Keep in mind that independent contractors are not on payroll. Because they do not count as employees, do not include their payments when calculating your payroll costs.

Second-time borrowers

The great thing about PPP 2.0 is that employers who already took out a loan in 2020 may be eligible. This is known as “Second Draw” PPP loans.

To be eligible for a second PPP loan, you must:

- Employ 300 or fewer employees

- Have used up your first PPP loan proceeds

- Demonstrate that your gross receipts in any 2020 quarter are at least 25% less than the same 2019 quarter

- Not engage in political or lobbying activities, describe yourself as a think tank, or be affiliated with businesses in China

- Not receive a Shuttered Venue Operator Grant

How much can you receive?

First-time applicants can receive PPP loans of up to $10 million. Second-time applicants can receive PPP loans of up to $2 million.

To calculate your loan amount, multiply your average total monthly payment for payroll costs (either during the one-year period before the loan is made OR calendar year 2019) by 2.5.

If your business is in Accommodation and Food Services industries, multiply your average total monthly payment for payroll costs by 3.5.

Seasonal businesses can choose any 12-week period between February 15, 2019 – February 15, 2020 and multiply monthly payroll costs by 2.5.

Who can apply?

Small businesses with 500 or fewer employees that are eligible for other SBA 7(a) loans can apply for a PPP loan. Again, small businesses with 300 or fewer employees can apply for a second PPP loan. This includes:

- Businesses

- Self-employed individuals

- Independent contractors

- Sole proprietorships

- Nonprofits (including 501(c)(6) organizations)

- Veterans organizations

- Tribal businesses

- Housing cooperatives

- Media organizations

- Small agricultural cooperatives

If you’re a second-time borrower, you must demonstrate that your gross receipts in any 2020 quarter are at least 25% less than your gross receipts in the same 2019 quarter.

You cannot apply for a PPP loan if you were not in operation by February 15, 2020.

You also cannot apply for a PPP loan if you own a publicly-traded company. Businesses that are controlled directly or indirectly by federal government figures (e.g., president) are also ineligible.

PPP 2.0 alert! Set-aside funds: There are set-aside PPP loans for borrowers in low- and moderate-income communities, as well as for community and smaller lenders. This is part of the SBA’s steps to increase PPP loan funding to minority, underserved, veteran, and women-owned businesses.

When can you apply?

Again, the program is available through May 31, 2020.

First-time borrowers: PPP 2.0 resumed January 11, 2021 for first-time borrowers applying through participating Community Financial Institutions.

Second-time borrowers: Business owners who received a PPP loan in 2020 could begin submitting applications on January 13, 2021 to participating Community Financial Institutions.

On January 15, 2021, the program opened to small participating lenders with $1 billion or less in assets. Both first- and second-time borrowers can apply.

PPP 2.0 is fully open to all first- and second-time borrowers as of January 19, 2021.

Funds are limited. PPP loans are first come, first served. And, it will take lenders time to process applications, meaning you won’t receive funds instantaneously. As a result, consider applying for a PPP loan when the application period opens.

Loan details

A payroll-protection loan has a repayment plan of five years and a fixed interest rate of 1%. You do not need collateral to apply.

If you receive a PPP loan, your loan payments are deferred until you receive loan forgiveness from the SBA (or 10 months after the covered period if you don’t apply for forgiveness), although interest will accrue during this time. However…

…if you retain your employees and maintain salary levels, the Small Business Administration (SBA) will forgive part or all of the principal amount of the loan (plus accrued interest)—depending on what you use it for.

Again, the SBA will only forgive the portion of the loan spent on eligible expenses during the covered period. That means 60% of the loan must go towards qualifying payroll costs and 40% to qualifying non-payroll costs.

You can choose between an eight-week or 24-week covered period. The covered period begins on the date you receive your loan and ends either eight or 24 weeks later.

Requesting PPP loan forgiveness

The SBA released three different versions of the PPP loan application: Form 3508, 3508EZ, and 3508S. The form you use depends on how much you borrowed and whether you reduced employee salaries and headcount.

That means that the less you borrow, the less work you have to do to request PPP loan forgiveness.

And here’s another bit of good news: forgiven debt is not considered federal taxable income thanks to the Act. And, you can deduct business expenses paid with forgiven PPP loans from your taxes.

However, some states may treat forgiven PPP loans as taxable income for the purposes of state taxes.

Thanks to the Consolidated Appropriations Act, you do not need to submit “…any application or documentation in addition to the certification and information required to substantiate forgiveness” if you took out a loan of $150,000 or less, according to the legislation.

Regardless of what form you need to use, keep detailed records to prepare for requesting loan forgiveness. To simplify your records, consider:

- Creating a separate expense account to accumulate all eligible costs

- Keeping the loan funds in a separate bank account and only withdraw to cover eligible expenditures

You can request loan forgiveness by submitting a request to your lender after the covered loan period. If applicable, include documents showing:

- The number of full-time equivalent employees and pay rates

- Eligible mortgage, lease, utility, operations expenditures, property damage, supplier costs, and worker protection expenditure payments

Your lender has 60 days to make a decision on your loan forgiveness under existing SBA Paycheck Protection Program rules.

PPP vs. ERC: No longer either or

Under the Consolidated Appropriations Act, you can now take out a Paycheck Protection Program loan and claim the Employee Retention Credit.

The ERC is another CARES Act relief measure for businesses that was extended by the Consolidated Appropriations Act. It is a fully refundable tax credit with a maximum limit of $7,000 per quarter. The credit is 70% of wages paid up to $10,000 for any quarter.

Overview of the PPP application process

Applying for a new loan can be overwhelming, especially one that has just been implemented. Take a look at the following sections to learn more about the application process.

Where do you go to apply?

You can apply for a PPP loan through any:

- Existing SBA 7(a) lender

- Federally insured depository institution (e.g., bank)

- Federally insured credit union

- Participating Farm Credit System institution

- Regulated lender that has been approved and is enrolled in the program

If you’re unsure whether a lender is participating in this payroll protection program, consult the Small Business Administration.

Employers should try to obtain PPP loans through their bank. However, if their bank isn’t accepting applications, other small business lenders, such as BlueVine, may be an option.

Form

The application form will ask you for basic business information such as:

- What type of business you operate (e.g., nonprofit, self-employed, etc.)

- Your business’s legal name and DBA (if applicable)

- Business taxpayer identification number

- Business address, phone number, and email address

The form then dives into payroll and loan details such as:

- Average monthly payroll

- Loan amount (average monthly payroll X 2.5 or 3.5)

- Number of jobs

- Loan purpose (e.g., payroll, rent, etc.)

There are a number of Yes/No questions on the form. Use these questions to determine whether you are eligible for a loan.

If you applied for an SBA Economic Injury Disaster Loan (EIDL), you may need to attach a separate sheet with details to your application.

In addition to the application, also provide a good amount of documentation, explained in the next section.

What information do you need?

Again, you need documents to back up your application information. You must have payroll data.

| If you’re a Patriot payroll customer and need help pulling your payroll data for the SBA PPP loan, read our help article: “I Need Payroll Data for the SBA PPP.” |

Some of the documents you may need to pull for your payroll protection loan application include:

- Copies of your business’s IRS Form 941

- An employee’s compensation whose principal place of residence is outside the U.S.

- Payroll ledgers that show payroll costs by employee

Do not include the following in your payroll costs:

- FICA tax (Social Security and Medicare taxes)

- An employee’s compensation amount over $100,000 per year

- An employee’s compensation if their principal place of residence is outside the U.S.

PPP 2.0 at a glance

Here are the highlights of the 2021 Paycheck Protection Program:

- Who can apply? Qualifying first- and second-time borrowers

- When is the application deadline? May 31, 2021

- Can employers also claim the ERC? Yes, employers can now claim the Employee Retention Credit and take out a PPP loan

- What are the additional qualifying expenses? Group life, disability, vision, and dental insurance (payroll); Operating expenditures, property damage, supplier costs, and worker protection expenditures (non-payroll)

- How does taking out a PPP impact taxes? Employers can deduct business expenses paid with the PPP loan from their taxes

PPP infographic

Take a look at our Paycheck Protection Program infographic for a visual showing what is the PPP, what you can use funds for, who can apply, and how to apply.

Paycheck Protection Program resources

Use the following resources to help you navigate the ins and outs of the application process:

| Although the Paycheck Protection Program is over, other forms of government aid are available for declared disasters and emergencies. Download our FREE guide to navigating through disasters and emergencies here! |