Whether your employees work at an office, laboratory, warehouse, or worksite, the workplace can be dangerous. And as an employer, you’re responsible for protecting your employees from hazards in the workplace.

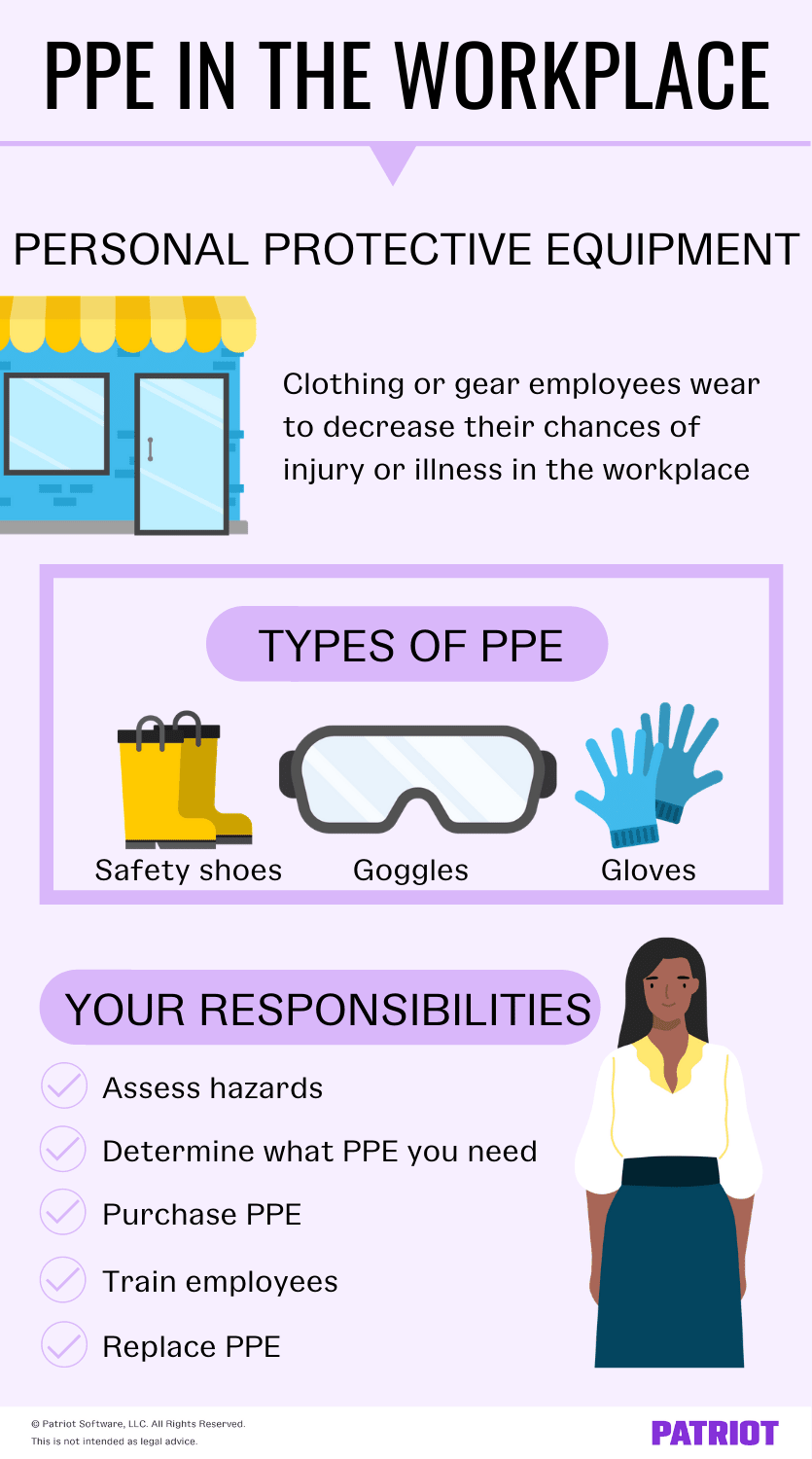

One way to minimize employee exposure to workplace hazards is through personal protective equipment (PPE). So, how much do you know about PPE in the workplace?

Get the scoop on what PPE is, who pays for it (spoiler, it’s you), and your employer responsibilities when PPE safety is involved.

What is personal protective equipment?

Personal protective equipment is clothing or gear (e.g., goggles) that employees wear to decrease their chances of injury or illness in the workplace. Thanks to the OSH Act, the Occupational Safety and Health Administration (OSHA) regulates the use of safety gear in the workplace.

In an ideal world, a workplace would be safe enough that employees wouldn’t need to wear additional protective equipment. But, we all know that’s not the case, and that’s where PPE comes into play.

PPE is required when engineering, work practice, and administrative controls don’t cut it. The personal protective equipment provides an additional safeguard against hazardous working conditions.

There are a number of hazards employees could come across, such as:

- Chemical

- Electrical

- Mechanical

- Physical

- Radiological

- Viral (e.g., coronavirus)

If you fail to give employees the appropriate PPE to do their job safely, they can file a complaint directly with OSHA. An OSHA complaint could prompt a workplace inspection. You cannot fire, demote, transfer, or retaliate against workers who make PPE complaints to OSHA.

Types of personal protective equipment

From chemical protective clothing to eye and face protection, there’s a pretty extensive PPE list. Personal protective equipment includes:

- Gloves

- Goggles and safety glasses

- Face shields and masks

- Earplugs and muffs

- Hard hats and helmets

- Safety shoes

- Chemical or fall protective equipment

- Coveralls

- Gowns

- Respirators

- Full bodysuits

An employee may need multiple types of personal protective equipment. For example, a chemist might need a lab coat, goggles, and rubber boots with steel toes to safely perform their job.

Regardless of the type of PPE, you need to make sure that it is safe, clean, and comfortable. It’s important that the personal protective equipment fits each employee.

PPE in the workplace: Who pays?

Unless you skipped to this part, the cat’s out of the bag: employers must pay for personal protective equipment. Employers must pay for PPE that employees use to comply with OSHA standards.

You can use a reimbursement system for PPE. That way, employees can purchase PPE on their own. Keep in mind that you have one pay period or one billing cycle to reimburse the employee for their PPE expense.

Employees can also use their own PPE if they voluntarily offer. You cannot force them to use it in lieu of employer-sponsored gear. And if the employee wants to use their own personal protective equipment, you’re responsible for making sure it’s an appropriate substitute.

There are exceptions to footing the bill for PPE. You do not have to pay for:

- PPE replacements when the employee loses or intentionally damages company-sponsored equipment

- Everyday clothing (e.g., long-sleeve shirts, long pants, etc.)

- Non-specialty safety-toe protective footwear and prescription safety eyewear, as long as employees can wear these away from the job site, too

- Items that solely offer protection from weather (e.g., sunscreen, winter coats, etc.)

- Items employees wear for consumer safety (e.g., hair nets and gloves)

- Lifting belts

If an employee you provided PPE for leaves your business, you can also take steps to get the gear back if you still have ownership. If the employee doesn’t return it, you may be able to charge the employee for the unreturned PPE.

Do I have to pay employees for the time it takes them to put on PPE?

In addition to paying for the equipment itself, you may be responsible for paying employees for the time it takes them to put on and take off PPE. This is known as donning and doffing.

You have to pay employees for donning and doffing if you treat the time as hours worked or if it’s integral to the employee’s job.

Do I have to pay for PPE related to COVID-19?

There was a sharp uptick in PPE safety concerns at the onset of the coronavirus pandemic, especially with mask shortages. To comply with increased safety precautions, businesses have had to ramp up the use of personal protective equipment.

Add PPE costs to the other effects of the pandemic, and you have some pretty cash-strapped small business owners.

In response to these concerns, the House of Representatives introduced the Small Business PPE Tax Credit Act proposal in June 2020. Under the proposal, qualifying small businesses would be able to take a tax credit of up to $25,000. The purpose of the proposed tax credit is to offset the costs of providing COVID-related PPE (e.g., gear, cleaning supplies, etc.). However, it has not passed.

Employer PPE responsibilities

Now that you know you’re responsible for funding your employees’ OSHA personal protective equipment, you might be wondering what else you need to do.

The short answer: you have to do everything involving the PPE lifecycle. That means researching and figuring out what PPE your employees need. It also requires you to maintain the equipment and update it if necessary.

Take a look at your full employer PPE responsibilities.

1. Perform a hazard assessment

Your first step in determining what are some types of PPE that employers must pay for is to assess what employees need.

Do a thorough evaluation of your business using OSHA standards. Write down potential workplace safety issues and the types of equipment to protect employees.

2. Determine what PPE you need and purchase

Once you’ve identified potential hazards in your business, you know what types of PPE in the workplace you need to keep employees safe.

When purchasing the PPE, gather information from your employees, such as clothing size. Again, personal protective equipment needs to be comfortable and fit each employee appropriately.

If you set up a reimbursement system, decide whether employees need to purchase PPE from certain companies. Give employees a list of the PPE they need to buy. If applicable, give them a list of the places they can purchase the equipment from.

3. Train employees

Your next step is training employees on how to use and care for the equipment. If the employee needs to leave their PPE at work, give them a rundown on what they need to do after removing it.

Of course, the use of personal protective equipment doesn’t always need to come with a manual. Employees should know how to put on goggles, for example. But, you still need to be thorough in telling them when they need to wear the gear.

4. Replace PPE

If personal protective equipment becomes worn or damaged, you need to replace it. Unless an employee loses or purposely damages their gear, you are responsible for paying for replacements.

Don’t wait too long before getting fresh equipment. Worn PPE may not effectively protect employees from workplace hazards, exposing you and your business to OSHA violations.

You should also monitor the effectiveness of the personal protective equipment in your business. Does it help employees? Is there better, safer gear employees could use? If so, make adjustments to what PPE you require employees to wear.

If you decide to reimburse employees for PPE, remember to dole out the reimbursement. With Patriot’s payroll, you can easily add reimbursements to your regular payroll process. And with a free trial, what do you have to lose (besides headaches)? Sign up today!

This is not intended as legal advice; for more information, please click here.