With loan forgiveness on the line, you probably didn’t apply for a Paycheck Protection Program (PPP) loan for the low-interest rate of 1%. So, you got the loan. Now, you want to know how to get your PPP loan forgiveness.

If you can get your PPP loan fully forgiven, you will have essentially received free money to help your business navigate through the era of COVID-19. And who doesn’t want that?

But as new guidelines continue to emerge on how to get your PPP loan forgiven, you may have some questions (and frustrations) about the process.

How to get PPP loan forgiveness

Depending on what you do with your PPP loan during the eight or 24 weeks after receiving it, you may qualify for partial or full forgiveness.

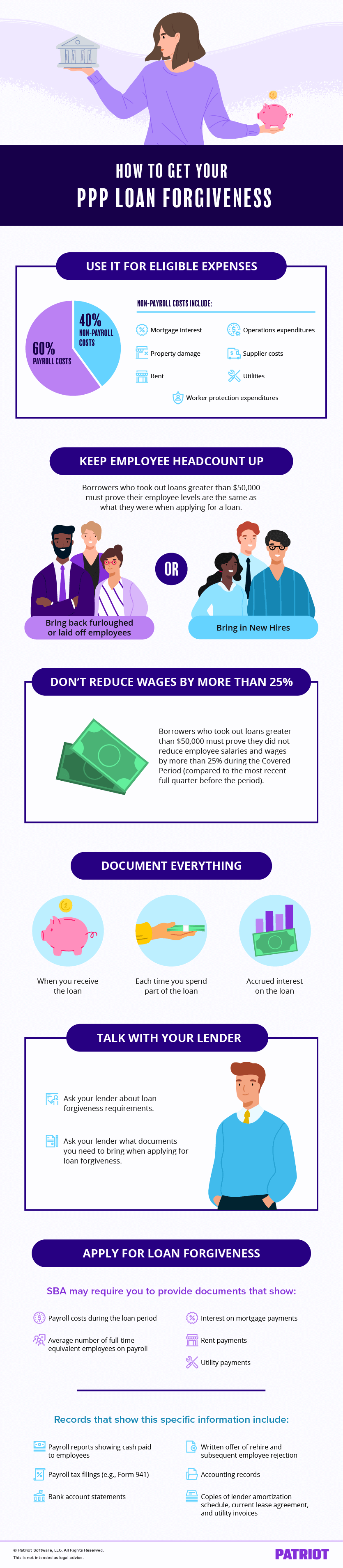

We know you really want to know how to get it fully forgiven. Use the following tips on how to make sure your PPP loan is forgiven to get started:

- Use it for eligible expenses

- Keep your employee headcount up*

- Don’t reduce an employee’s wages by more than 25%*

- Document everything

- Talk with your lender

- Apply for loan forgiveness

*Your responsibilities depend on your loan amount. Borrowers who took out loans of $50,000 or less do not need to worry about loan forgiveness reductions due to employee and wage decreases. If you took out a loan of $50,000 or less, your loan forgiveness depends on 1) whether you used it for eligible expenses. You can learn more about this exemption on Page 3 of the SBA Form 3508S application form.

If you took out a loan of more than $50,000, your PPP forgiveness calculation factors in 1) what you spent your PPP loan on, 2) your employee headcount, and 3) whether you reduced an employee’s wages by more than 25%.

1. Use it for eligible expenses

All borrowers, regardless of PPP loan amount, must use 100% of the loan for eligible expenses for PPP loan forgiveness. Eligible expenses include payroll and qualifying non-payroll costs. And, the SBA requires you to use the majority of your loan for payroll expenses.

Use at least 60% for payroll costs and 40% for qualifying non-payroll costs. Here’s the breakdown:

- 60%: Payroll costs

- Salaries, wages, commissions, tips, bonuses, or hazard pay ($100,000 gross earnings max per employee)

- Employee benefits (e.g., vacation; sick leave*; health care benefits; retirement benefits; and group life, disability, vision, and dental insurance)

- State and local taxes assessed on compensation

- 40%: Non-payroll costs

- Interest on mortgages

- Rent

- Utilities

- Covered operations expenditures (e.g., business software or payroll tracking expenses)

- Covered property damage (e.g., vandalism or looting)

- Supplier costs (i.e., essential items for operation)

- Worker protection expenditures (e.g., personal protective equipment)

*You can use your PPP loan to cover paid sick leave, but you cannot use it to cover paid sick and family leave wages under the Families First Coronavirus Response Act.

Keep in mind that you can use your loan to cover other expenses. However, that portion won’t be forgiven.

The bottom line on how to get your PPP loan fully forgiven: Use at least 60% of your PPP loan to cover payroll costs. You can use the remaining 40% to cover qualifying non-payroll costs.

What’s the time period for using the loan on eligible expenses?

Your PPP loan is meant to cover eight or 24 weeks’ worth of expenses. So, your loan forgiveness depends on your costs during the covered period.

The clock starts when your lender makes your first PPP loan disbursement. From that date, you’ll have eight or 24 weeks to make eligible payments. This is known as the “covered period.”

SBA guidance released on May 15 gives borrowers with a biweekly or more frequent payroll schedule the option to use the “Alternative Payroll Covered Period.” This begins the covered period on the first day of the first pay period after receiving the first disbursement.

If you have extra money left over at the end of the covered period, you have two options:

- Return it to your lender

- Use it, but remember that you’ll have to pay that portion back, plus 1% interest

2. Keep your employee headcount up

Did you take out a PPP loan of more than $50,000? Then this one’s for you.

The purpose of the Paycheck Protection Program is to keep employees on payroll (and off of unemployment). This is why keeping your employee headcount at the same level as when you applied is essential to getting your loan forgiven.

Of course, keeping your employee headcount up is only part of the equation. You already know that using 60% of your loan for payroll costs (and 40% for the other qualifying expenses) is a must for forgiveness. But even if you spend 60% on payroll costs and 40% on non-payroll costs, you could lose part of your loan forgiveness if your workforce drops.

When you applied for your PPP loan, you included all employees you employed—full-time and part-time workers—in the calculation.

But for loan forgiveness, the CARES Act looks at your average full-time equivalent (FTE) employees during the covered period.

You can use one of the following methods to calculate your FTE during the covered period:

- Enter the average number of hours each employee was paid for per week, divide by 40, and round to the nearest tenth (maximum, 1.0).

- Assign a 1.0 for employees who work 40 hours or more per week and 0.5 for employees who work fewer hours

The SBA will reduce PPP loan forgiveness based on your average FTE employee reduction. Here’s the calculation to determine your PPP loan forgiveness reduction amount for FTEs:

Loan Forgiveness Reduction Percentage = Average number of FTEs during the covered period / Average number of FTEs per month employed during an eligible time period of your choice**

**You can use one of two time periods:

- February 15, 2019 – June 30, 2019

- January 1, 2020 – February 29, 2020

(If you’re a seasonal employer, you can use one of the above time periods or any consecutive 12-week period between February 15, 2019 – February 15, 2020.)

Then, multiply your loan forgiveness reduction percentage by your loan forgiveness amount (based on eligible expenses) to determine your loan forgiveness reduction.

You can calculate the average number of FTE employees by calculating the average number of employees for each pay period per month.

I reduced employee levels … what can I do?

Thankfully, the SBA provides two “safe harbors” that help eligible borrowers avoid the FTE reduction.

If you decreased your FTE employee levels as a result of complying with eligible health and safety requirements or guidance, you may qualify for an FTE Reduction Safe Harbor 1 (i.e., no FTE loan reduction).

Or, you might qualify for FTE Reduction Safe Harbor 2 if you reduced FTE employee levels between February 15, 2020 – April 26, 2020 and restored levels no later than December 31, 2020 (for loans made before December 27, 2020) or before the last day of the Covered Period (for loans made after December 27, 2020).

The SBA also has exemptions in place in case a laid-off employee refuses your rehire offer. You may be exempt from the FTE loan forgiveness reduction if you made a good faith, written offer of rehire. And, you must document the employee’s rejection. Keep in mind that the laid-off employees may no longer be eligible for unemployment compensation if they refuse your rehire offer.

To learn more about these safe harbors, check out the loan forgiveness application form.

3. Don’t reduce an employee’s wages by more than 25%

Did you take out a PPP loan of more than $50,000? Then this one’s for you.

If you want full loan forgiveness, don’t reduce an employee’s wages by more than 25% of what they received in the most recent full quarter.

This rule applies to employees who earned:

- $100,000 or less at an annualized rate in 2019 (for all pay periods)

Do not count employees who you did not employ at any point in 2019. These employees do not decrease your PPP loan under the salary reduction.

Reducing an employee’s wages by more than 25% will result in a decreased PPP loan forgiveness amount equivalent to the amount you reduce their wages by.

I cut wages … what do I do?

Like with FTE levels, there is a Salary/Hourly Wage Reduction Safe Harbor that may prevent loan forgiveness reduction if you qualify.

To qualify for this safe harbor, you must restore the employee’s average salary or wages to what they were as of February 15, 2020 by December 31, 2020 (for loans made before December 27, 2020) or the last day of the Covered Period (for loans made after December 27, 2020).

4. Document everything

In addition to keeping documents supporting your PPP loan application, you need to record everything from the moment you receive your PPP loan disbursement.

Document:

- When you receive the loan

- Each time you spend part of the loan

- Accrued interest on the loan

Keep copies of every expense you use your PPP loan to cover, no matter how small. This includes payroll records; copies of mortgage interest, rent, and utility payments; receipts for any other expenses you use the PPP loan for; bank account statements; and journal entries.

No document is too insignificant when it comes to PPP loan forgiveness. When in doubt, it’s better to be safe than sorry and have something in your records.

And, documenting everything will be much cleaner if you separate your PPP loans from your other funds.

| Need help keeping detailed records for your loan forgiveness? Read our article, “PPP Loan Accounting: Creating Journal Entries,” to learn how to record every PPP-related transaction. |

5. Talk with your lender

Keep the communication lines strong with your lender throughout the process. From the day you apply to the day you request forgiveness, talk with your lender about your loan forgiveness responsibilities.

When applying for a PPP loan, ask your lender about loan forgiveness requirements. And, ask them what documents you need to bring when applying for loan forgiveness.

6. Apply for loan forgiveness

To apply for PPP loan forgiveness, use the SBA’s Loan Forgiveness Application form, Form 3508, or your lender’s equivalent form. You might be able to use Form 3508EZ or Form 3508S if you meet the eligibility guidelines.

After completing the form and attaching any necessary documents, submit it to your lender.

Here’s a brief overview of who can use the different forgiveness application forms:

- Form 3508: Any borrower

- Form 3508EZ: Borrowers who did not reduce employee salaries by more than 25% and either did not reduce staff / were unable to rehire or find similarly qualified employees OR were unable to operate due to following health guidelines

- Form 3508S: Borrowers who received a PPP loan of $150,000 or less

In addition to the loan forgiveness application form, you may also need to attach supporting documents.

Your lender may have additional requirements when it comes to documentation, but you may need documents showing the:

- Payroll costs during the loan period (don’t include employer share of taxes)

- Average number of full-time equivalent employees on payroll

- Non-payroll cost payments

The records you bring showing this information include:

- Payroll reports showing cash paid to employees

- Payroll tax filings (e.g., Form 941)

- Receipts

- Bank account statements

- Accounting records

For more information on documents that the SBA requires, consult the Loan Forgiveness Application forms. And for more information on documents that your lender requires, consult your lender.

If your loan is fully or partially forgiven, update your accounting books to reflect the debt forgiveness.

If you have further questions, check out the SBA’s FAQs on PPP loan forgiveness.

What if some of my loan isn’t forgiven?

If part or all of your loan isn’t forgiven, you may be able to file a PPP loan appeal.

You have to pay back the loan if your appeal is denied. Here’s what you need to know about paying back unforgiven PPP loan funds:

- 2-year maturity (loans issued prior to June 5, 2020) OR 5-year maturity (loans issued after June 5, 2020)

- 1% interest rate (accruing immediately)

- Loan payment deferral until SBA remits borrower’s loan forgiveness amount to lender OR 10 months after the end of the Covered Period for the borrower’s loan forgiveness (if you doesn’t apply for forgiveness)

There’s no prepayment penalty if you want to pay off your loan balance before the five years are up.

Talk with your lender about how you can make payments on any unforgiven PPP loan amount and when payments are due.

| Although the Paycheck Protection Program is over, other forms of government aid are available for declared disasters and emergencies. Download our FREE guide to navigating through disasters and emergencies here! |