Business structure affects many aspects of your company, including your tax obligations. Choosing the right structure for your business could mean the difference between expensive, time-consuming taxes or affordable, simplified tax liabilities. As a small business owner, you need to know how business structure affects taxes.

How business structure affects taxes

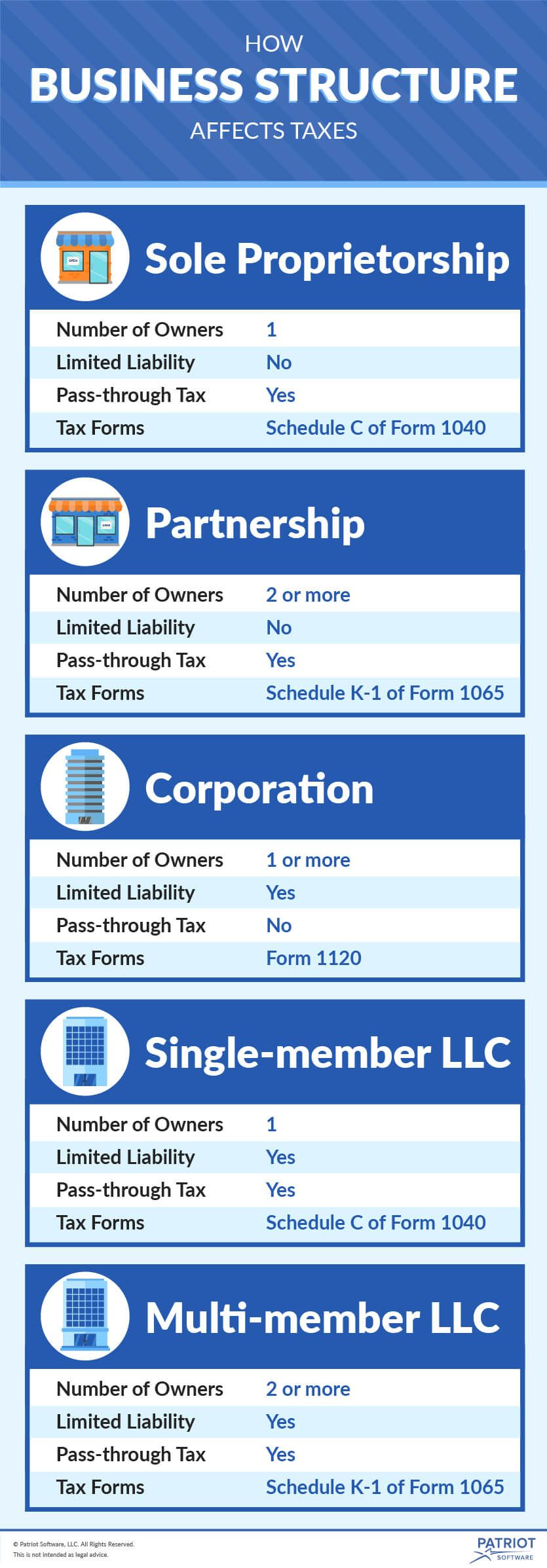

A business structure is the way you legally organize your company. Many factors go into choosing between the different types of business structures. Consider how the tax entity types will affect your company. The following business entity comparison chart breaks down the usual tax obligations for each type of business.

Share this business entity comparison chart with your audience

Sole proprietorship

A sole proprietorship has one owner. The owner is called the sole proprietor. As the sole proprietor, you are entitled to all the business’s income.

Depending on your state, you may need to register your business. Check with your state to find out which licenses and registrations you need.

Business entity tax obligations

Forming a sole proprietorship is the simplest way to structure a business. Caron Beesley, a small business owner, writer, and marketing communications consultant, explained:

The advantages are that it’s one of the easiest business structures to form. There are no legal hoops to jump through or incorporation forms to worry about. Just be sure to register your business name (‘doing business name’ or ‘DBA’), if you’re using anything other than your personal name, with your local authorities. The downside is that, as a sole proprietor, there is no separation between you and your business, so you are personally liable for any legal complaints brought against your business. In addition, your business taxes are also reported through your personal tax return. You can also find yourself paying more in tax than if you were to incorporate, since an LLC has some tax advantages over a sole proprietorship. It’s worth consulting a tax professional, since every business is different.”

Sole proprietorships have fewer government regulations and tax obligations than other tax entity types. This business structure is only taxed at the personal level.

The simplified taxes of a sole proprietorship come with a price. You and your business are considered the same legal entity in the eyes of the government. You must pay taxes on business income with personal funds.

Generally, as a sole proprietor, you are liable for all the business’s losses and liabilities. If your business incurs heavy debt, you are personally responsible for paying creditors. Your assets could be at risk, such as your mortgage, vehicle, or personal savings.

Forms to use

Sole proprietorships use Schedule C to file business taxes. Schedule C breaks down the business’s profits and losses throughout the year. The business owner attaches Schedule C to the personal income tax return, Form 1040.

Taxes sole proprietors pay

Taxes are not automatically withheld from a sole proprietor’s income like they would be from an employee’s wages. Because taxes are not withheld, sole proprietors must pay self-employment tax and estimated taxes.

Self-employment tax includes both the employer and employee portions of Social Security and Medicare taxes. Together, these two tax obligations are known as the Self-Employment Contributions Act (SECA) tax. Often, you will need to pay self-employment taxes quarterly with an estimated tax payment.

Estimated taxes are like income taxes taken out of an employee’s paycheck. Sole proprietors must estimate the amount of income tax owed to the government and pay them quarterly.

Partnership

A partnership is owned by two or more people. The owners of a partnership are called partners. Each partner is entitled to a share of the business’s profits and losses.

There are three main types of partnerships:

- General partnerships: All partners are liable for liabilities of the partnership.

- Limited partnerships: There is at least one general partner (who is liable for all liabilities) and the rest are limited partners (who are only liable to the extent of their investment).

- Joint ventures are like general partnerships, but are limited by time like a contract. Though they are partnerships, a joint venture can take on any legal structure.

Business entity tax obligations

Like sole proprietors, partners are considered the same tax entity as the business. Partnerships are taxed once at the personal level.

Being a partner in a partnership results in a different type of tax implication. Partnerships are pass-through tax entities. The business itself does not pay income taxes. The tax liability skips, or “passes through,” the business and falls onto the partners.

Generally, partners pay taxes on business income based on how much of the business they own. Each partner is responsible for the paying his/her share of the business’s pass-through income. Together, the partners must include the business’s taxes and debts on their personal income tax returns.

Let’s say a business has three partners with equal ownership (Tony, Jaime, and Tom). The partnership has a profit of $9,000, so each partner is responsible for $3,000.

Forms to use

Partnerships use Form 1065 to file taxes. Form 1065 is an information form sent by the business to the government to report profits and losses.

The business gives Schedule K-1 of Form 1065 to each partner. Schedule K-1 details the partners’ shares of profits and losses. Each partner includes the activity from their Schedule K-1 on their personal tax return, Form 1040.

Taxes partners pay

Taxes are not withheld from the partners’ incomes. Partners are considered self-employed. Like sole proprietors, partners generally must pay self-employment taxes and estimated taxes.

Again, self-employment taxes include the employer and employee portions of Social Security and Medicare taxes. Self-employment and estimated taxes are paid quarterly to the government.

Corporation

A corporation, or C Corp, is a separate legal entity from the owners. The amount of money each owner invests in the business is represented by shares.

To incorporate a business, you must file articles of incorporation. The articles of incorporation describe how operations will run, the roles of the owners, and a business plan. Owners must appoint directors, get licenses and permits, and choose a company name.

Business entity tax obligations

The corporation and the owners are considered different legal entities. The business’s tax obligations are separate from the owners’. Owners of a corporation are not personally liable for business debts and their personal assets are protected.

The tax implications of incorporating your business is more complicated for corporations than other tax entity types. And, corporations have the highest administrative fees.

Corporations are double-taxed entities. First, the business itself is taxed. Then, the business’s profits are taxed again by the owners when dividends are paid. Corporations use Form 1120 to report income and expenses.

Taxes corporations pay

The corporation pays a corporate income tax rate on its profits. Generally, the estimated amount is paid each quarter.

If the owner of a corporation is actively working for the business, the owner generally receives a salary. The employee portions of Social Security and Medicare taxes are withheld from the salary. The corporation pays the employer portions of Social Security and Medicare taxes. Income taxes are withheld from the owner’s salary.

Corporate shareholders receive dividends. Each owner must pay income taxes on their dividend.

Limited liability company (LLC)

An LLC combines aspects of corporations and partnerships. Business and personal liabilities are separate, like a corporation. Owners have shared tax responsibilities, like a partnership. Depending on whether you have a single-member, or multi-member LLC, you will have to file different LLC tax forms.

Each state has different rules for LLCs. Check with your state to find out which laws apply to your business.

Single- and multi-member LLCs

The owners of an LLC are called members. LLCs can be either single-member or multi-member businesses.

By default, the IRS taxes single-member LLCs as sole proprietorships. Single-member LLCs report profits and losses on Schedule C. They attach the schedule to their personal income tax return.

By default, the IRS taxes multi-member LLCs as partnerships. Owners pay taxes on their share of the business and report income on their personal tax returns.

Pass-through tax

LLCs limit tax obligations for members by using a pass-through tax. The business itself does not pay taxes. Instead, members are taxed at the personal level.

Unlike sole proprietorships and general partnerships, members are not personally liable for business debts. The members’ personal assets are not at risk, even if the business cannot pay creditors.

Taxes members pay

LLC members are self-employed business owners. Income taxes are not automatically withheld from the owners’ incomes. You must estimate your income tax liability and make quarterly tax payments.

Members of an LLC also pay self-employment taxes. Self-employment taxes include the employer and employee portions of Social Security and Medicare taxes.

LLC taxed as a corporation

In some states, you might be able to have your LLC taxed as a corporation. Sometimes, being taxed as a corporation means lower business tax rates. If you want to elect your LLC to be taxed as a corporation, use Form 8832, Entity Classification Election. If you are taxed as a corporation, you will use Form 1120 to file taxes.

No matter how you structure your business, you need an easy way to keep track of your company’s transactions. Patriot’s online accounting software uses a simple cash-in, cash-out system. We offer free, U.S.-based support. Try it for free today.