Structuring your business as a limited liability company (LLC) can have great benefits, but filing small business tax returns can get confusing. Because LLCs take aspects of both corporations and partnerships, there is not a standard LLC form you will use. Learn about the different tax forms for an LLC.

What is an LLC?

A limited liability company is a combination of the limited liability characteristic of a corporation and the pass-through taxation benefits of a sole proprietorship or partnership.

If you establish an LLC, you are separate from your business, like a corporation. You are not held personally responsible for your LLC’s business decisions. And, you are only taxed once at the personal level, like a sole proprietorship or partnership.

Under this business structure, owners are known as members. LLCs can be either single-member (one owner) or multi-member (two or more owners). There is no limit to how many people can own an LLC.

You can only form an LLC if you file the articles of organization with your state and pay a filing fee. And, some states require that you announce your LLC’s formation in a local newspaper. Contact your state if you have questions about forming an LLC.

Operating an LLC can be attractive because it is a hybrid business structure. But, you need to understand which LLC tax return form to use.

Tax forms for an LLC

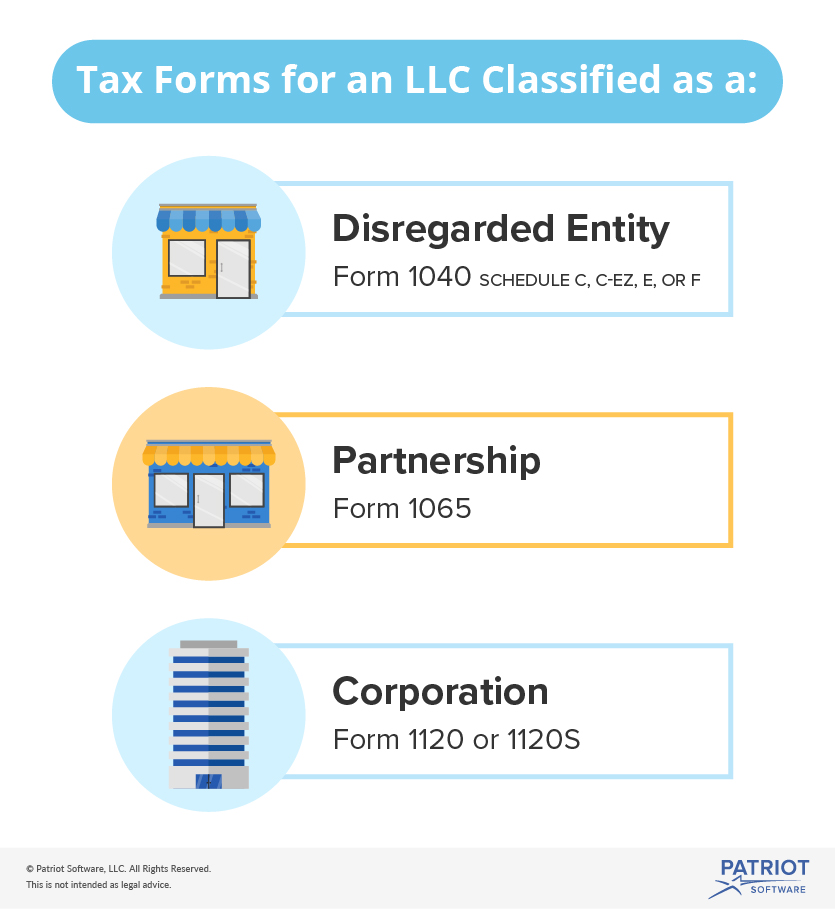

What tax form does an LLC file? Here are the main tax forms for an LLC:

- Form 1040

- Form 1065

- Form 1120

The LLC tax form you use depends on whether you are a single-member or multi-member LLC and your classification. An LLC can be classified as either a disregarded entity, partnership, or corporation.

LLC tax form for a disregarded entity

A disregarded entity is a single-member LLC, combining both aspects of a corporation and a sole proprietorship. If you are a single-member LLC, the IRS automatically classifies you as a disregarded entity.

Under a disregarded entity classification, the business is with the business owner for income taxes. Report your LLC’s income, gains, and losses on your federal income tax return if you are the owner of a disregarded entity.

To report your business taxes as a disregarded entity, attach a single-member LLC tax form to your Form 1040:

- Schedule C, Profit or Loss From Business (Sole Proprietorship)

- Schedule C-EZ, Net Profit From Business (Sole Proprietorship)

- Schedule E, Supplemental Income and Loss

- Schedule F, Profit or Loss From Farming

Unless you have employees or must file excise tax forms, you are not required to have an Employer Identification Number (EIN). You can use your Social Security number to file small business taxes.

If you do have an EIN, you can use either your SSN or EIN on your LLC tax form.

If you add owners to your LLC, your classification will default from a disregarded entity to partnership.

LLC tax filing form for partnership

A multi-member LLC is automatically classified as a partnership. LLCs classified as partnerships must report business taxes on and file Form 1065, U.S. Return of Partnership Income

Multi-member LLCs must elect a member manager to sign the partnership tax return. The member manager is an owner of the LLC who represents the LLC and can make management decisions.

Multi-member LLCs must file taxes using an EIN.

If you lose owners, your classification will default from a partnership to a disregarded entity.

LLC tax filing for corporations

If you own an LLC and are classified as either a partnership or disregarded entity, you can elect to be classified as a C corporation or S corporation.

To be classified as a C Corp, you must file Form 8832, Entity Classification Election. You will need to attach a copy of Form 8832 to your next federal income tax return.

Generally, you can only elect to become an S Corp if you are already a C Corp. This is not the case with LLCs. If you want to be classified as an S Corp, you just need to file Form 2553, Election by a Small Business Corporation.

LLCs classified as corporations file one of the following:

- Form 1120, U.S. Corporation Income Tax Return

- Form 1120S, U.S. Income Tax Return for an S Corporation

You need an EIN to file taxes if you are an LLC classified as a corporation.

To file tax forms for an LLC, you need to keep track of your business’s income and expenses. Patriot’s online accounting software makes it easy to track your money. And, we offer free, U.S.-based support. Get your free trial today!

This article has been updated from its original publish date of 09/15/2015.

This is not intended as legal advice; for more information, please click here.