As a small business owner, you pay close attention to the money coming in and going out of your company. You want to increase profits while keeping costs down. To get your finances on track, you need to know how to reduce business expenses.

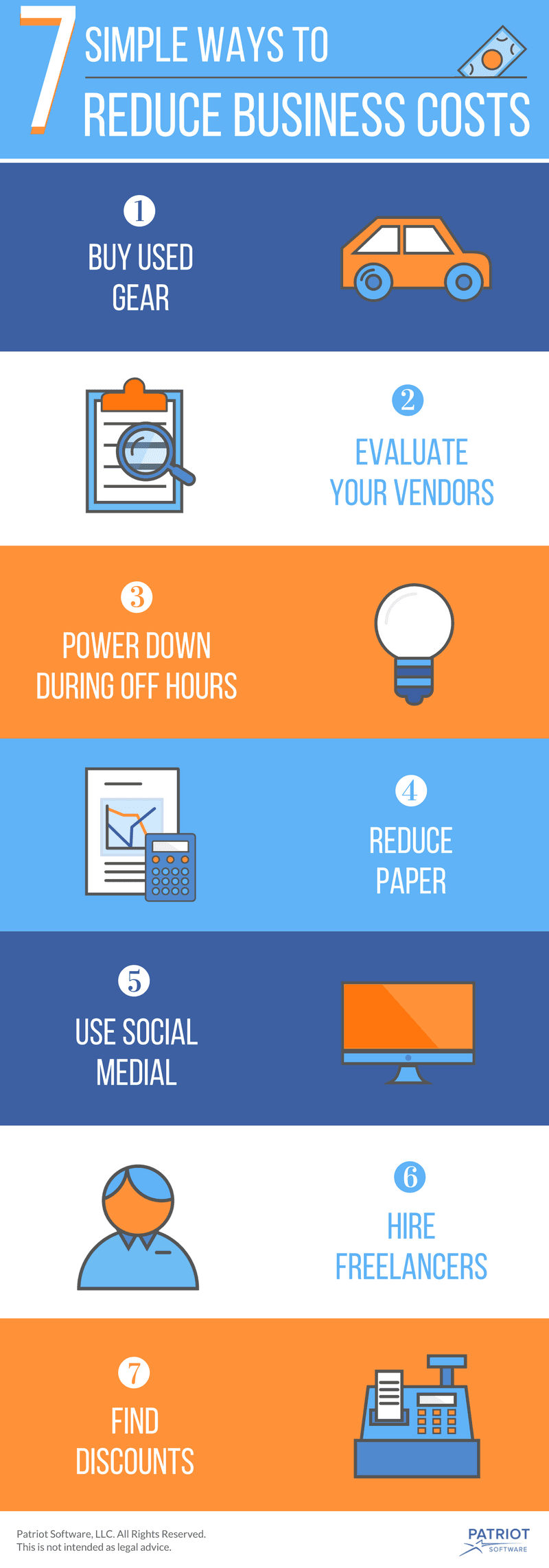

How to reduce business expenses

Keeping expenses low is a crucial part of running a business. To reduce business costs, try these seven cost cutting strategies for companies.

1. Buy used gear

There’s nothing better than buying shiny, straight-from-the-factory equipment. Buying used is one of the less popular workplace cost cutting ideas. But, the truth is, used equipment often gets the job done at a fraction of the cost. Used equipment might not be as pretty, but brand new gear can run up a high bill that might not be worth the cost.

For example, many small businesses need vehicles. If you’re willing to trade that new car smell for a more robust bottom line in business, buying used could be the way to go. Just make sure you don’t purchase something that will require a ton of maintenance later on.

2. Evaluate your vendors

Supplies take up a large part of a small business budget. But, you probably need goods to keep up with day-to-day operations. Take a look at your current needs and payment agreements. You might be able to save money by negotiating terms and shopping around.

In business, prices are often negotiable. If you’re not happy with the first number a vendor says, don’t sweat it. Most suppliers are prepared to negotiate payments. Of course, if the price you name is unreasonable, you probably won’t end up with those terms. But, many vendors will try to meet you in the middle.

The stronger the relationship you have with your supplier, the more favorable payment terms you’ll get. Take time to build a mutually beneficial connection with vendors. Trust and respect go a long way for small business owners looking to reduce business costs.

If a vendor doesn’t want to work with your budget, it might be time to shop around for a new supplier. Evaluate all your options to see which is the most cost effective for your business.

3. Power down during off hours

Some ways to cut business expenses are as simple as flipping a switch. Energy costs can get expensive, especially if you leave appliances running when they’re not in use. Turn off machines and devices when your business is not operating. If you use old, energy-wasting equipment, replace it with something newer and more efficient.

Powering down unused equipment is easy, and it’s a classic example of how to cuts costs. But, your business might need to adjust, especially if you have employees. Make it a team effort to get all your employees (and yourself) in the habit of turning off computers, lights, and machines at the end of the day.

4. Reduce paper

Paper can be a big money waster for small businesses, but it’s a great example of how to reduce expenses in a company. While old school methods might work for you, they could also be draining your bank account. Files and stacks of paper cost you money in printer maintenance, paper, and ink — not to mention the time employees spend managing documents.

Reducing paper at your business, or even moving to a fully paperless office, will simplify processes and reduce business expenses. To cut down on paper forms and reports, scan digital copies to your computer. Manage your banking, startup business credit cards, and taxes online. To record transactions, consider choosing accounting software that operates in the cloud. Accounting software costs could be negligible compared to the maintenance that a “paper empire” requires within your business.

5. Utilize social media

You know social media is out there and that people use it. But, do you know you can leverage social media marketing for small business? Social media offers cheap (often free) ways to advertise, connect with customers, and recruit employees. Because of its widespread adoption, social media is a popular example of how to reduce expenses in a company.

When using social media for business, make your account is professional and brand-focused. As a small business, you are able to engage with social media users individually. Send personal messages to followers, answer questions, and promote events. You can also place ads on social media that might be cheaper than other forms of marketing, such as print advertising.

6. Use freelancers

As your business grows, it gets tougher to keep up with tasks. You’ll need an extra set of hands, but you might not be ready to hire an employee. For short-term jobs that require specialized skills, consider working with freelancers or using contract staffing services.

Freelancers fill holes in your workforce when you don’t want to commit to a long-term employee. Unlike employees, freelancers do not work for you after the job is complete. You don’t need to worry about finding consistent tasks for them to do or handling payroll taxes.

7. Look for small business discounts

Sometimes, you can get a discount on your business-related purchases. For example, a supplier might offer a discount on bulk orders. If you use certain goods regularly, and you need a large order, consider buying wholesale. If the quantity is too large, you might not want to take advantage of bulk discounts.

Some vendors offer early payment discounts for those who pay before the deadline. Look at your bills for early payment options to see if you can reduce the amount due. Check your cash flow statement to make sure you have enough cash on hand to run your business before making the early payment.

Now that you’ve harnessed these cost cutting ideas for companies, you’ll need a simple way to keep track of your business’s expenses. Patriot’s online accounting software is easy-to-use and made for small business owners, like you. We offer free, U.S.-based support. Try it for free today.