When you start a small business, you need an easy and reliable way to track income and expenses. One way you can manage your books is by using accounting software. But, what’s the cost of accounting software? Find out the factors that can impact pricing and what additional costs to look out for while shopping for software.

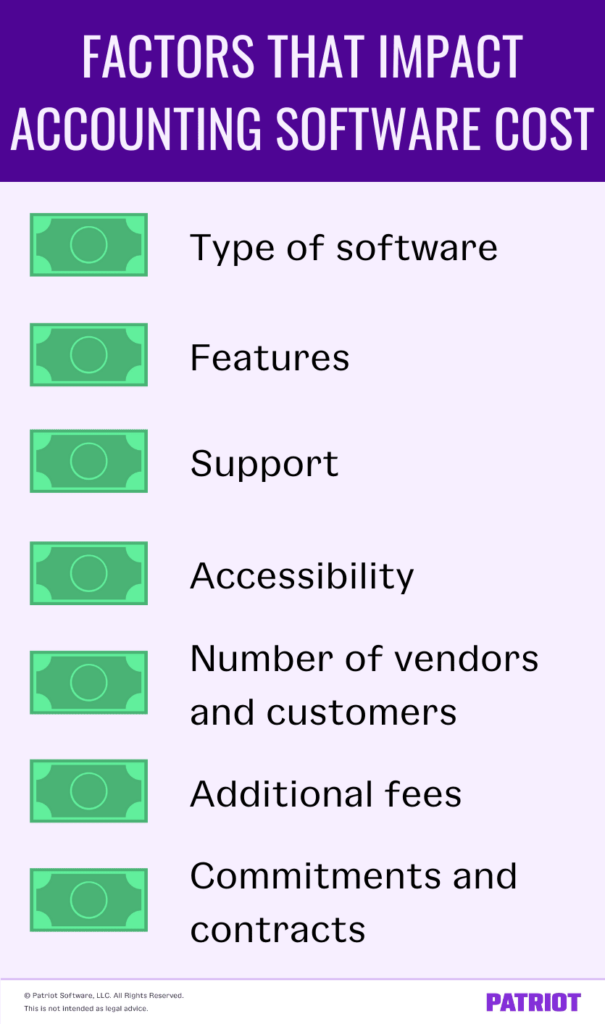

Cost of accounting software: 7 Factors that impact price

So, how much is accounting software? Accounting software can range anywhere from a few dollars per month to thousands of dollars per year, depending on what you’re looking for. There are a number of factors that go into accounting software cost. When you’re shopping around and comparing accounting software pricing, consider these seven factors.

1. Type of software

When you’re looking at accounting software, cost can fluctuate depending on if you’re looking for:

With basic software, you typically receive fewer features than with premium accounting options. Basic software may have simple accounting features, like payments to vendors, bank transaction imports, and an easy way to track transactions. On the other hand, premium accounting may have more advanced features, such as subaccounts, account reconciliation, and custom invoices.

Type of software can also boil down to desktop vs. cloud accounting. With desktop accounting software, you may be tied to one computer or device to manage your books. With online software, you can access the software from multiple devices and securely store information in the cloud.

Before committing to costly software, do your research to find out what kind of software your business needs (i.e., basic vs. premium and online vs. desktop).

2. Features

Another factor that can drive up accounting software price is features. Generally, the more features a software has, the more expensive it can be. An accounting platform that’s feature-rich will probably cost you a pretty penny.

You need basic accounting features, like recording payments and invoicing. But, you may also need some additional features, such as payroll integration, invoice payment reminders, account reconciliation, and the ability to create and send business estimates.

Depending on the software, they may charge you one standard rate to access all features. Or, your price may vary depending on usage.

The last thing you want to do is get stuck with a bunch of features you don’t need or use. So before you take the plunge, make a list of your must-have features to narrow down your needs. And, do your homework to find out if there are any hidden fees or costs associated with features (e.g., you have to pay an additional fee for the XYZ feature).

3. Support

When it comes to accounting software, having helpful and reliable support is a must. After all, you need someone to call if you have questions, concerns, etc. But sometimes, that extra helping hand comes with an additional cost.

When looking into the price of accounting software, check to see if the company charges additional fees for support. Some software companies offer free support, while others charge for different levels of support.

If you can, try to find a company that has free expert support. That way, you don’t have to worry about coughing up more money when you need help or have questions.

4. Accessibility

As a busy business owner, you need your books to be easily accessible. That way, you can record transactions, make payments, check reports, and so on as soon as possible. But, one factor that can drive up accounting software cost is accessibility.

Accessibility comes in many shapes and forms. Maybe you want an app so you can easily access your books on the go. Or, maybe you want to be able to download your desktop software onto any computer or device. Either way, accessibility can mean additional expenses for your company.

While perusing your accounting options, check to see how accessible the software is. If your provider offers a mobile app, is it free? If the software is desktop-based, do you have to spend additional money to add it to another device? Ask yourself these questions and more before making any commitments.

5. Number of vendors and customers

Depending on how the accounting software’s pricing works, you may need to shell out some extra money based on the:

- Amount of customers you invoice

- Number of vendors you pay

When checking out pricing, check to see if there’s an additional cost for adding a certain amount of vendors or customers or if you can add an unlimited amount of each. Some software providers may let you add as many as you want, while others may have you pay an additional cost for additional customers and vendors.

6. Commitments and contracts

Another factor that can hike up the cost of accounting software is commitment and contracts.

While some companies don’t have any contracts or commitments necessary to use the software, many providers require you to commit to their product or service for a certain amount of time (e.g., at least one year).

If you’re window shopping for accounting software and comparing prices, check to see what level of commitment you have to make to use the software. Check to see if there are any contracts or cancellation fees. Also, do your research to see if month-to-month pricing is an option.

Try to find software that offers no obligations or commitments. That way, you can leave at any time and are not tied down to a contract.

7. Additional fees

Let’s face it—some software providers love to secretly tack on additional costs. So before you commit to an accounting software, make sure you know all of the potential fees your business may incur.

Here are some examples of hidden costs and fees you may need to pay:

- Startup fees

- Cancellation fees

- Support fees

- Annual upgrade fees

- Fees for additional users

- Integration fees

Accounting software cost: Other considerations

Accounting software doesn’t have to cost you an arm and a leg. In fact, there are plenty of ways you can cut back on costs and find the accounting software of your dreams.

Here are a few things to look out for to save money on accounting software:

- Free trial offers

- Low month-to-month pricing

- No contracts or obligations

- No additional fees for usage

- No cancellation fees

If you’re thinking about getting software or switching providers, keep an eye out for special deals and pricing. Also, look at customer reviews to see what customers have to say. This can give you special insight on if the provider is charging any hidden fees and what the user experience is like.

This article has been updated from its original publication date of October 6, 2017.

This is not intended as legal advice; for more information, please click here.