As a small business owner, you need to record your financial transactions. But, accounting is not easy, and all signs point to accounting software. Why use accounting software? Cloud-based accounting software could be a low-cost, time-saving option for tracking your business’s finances.

The cloud

Do you think understanding the “cloud” is over your head? [pun intended] The cloud is a service provided on the Internet. Instead of working from your hard drive, you store information on the Internet.

Cloud accounting allows you to store your accounting data online. You need an Internet connection to access your records. You can access your records from anywhere with an Internet connection. You may even be able to do your accounting from a mobile device.

Cloud accounting software allows you to generate your financial reports without an accountant. If you use an accountant, you can still record information with cloud-based software. Cloud software may also help you share data with your accountant.

Choosing cloud accounting software

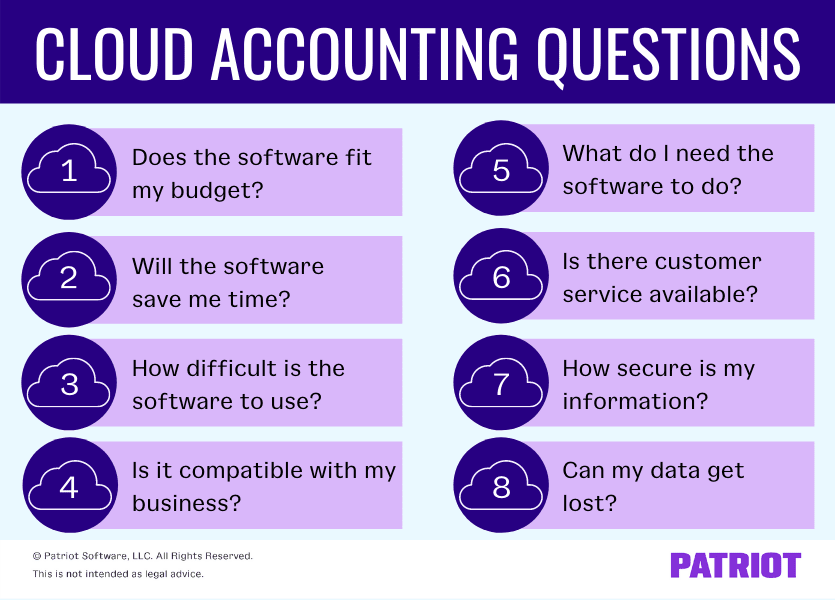

There are many factors to think about when you consider cloud-based accounting software. Here are eight questions you want to ask.

1. Does the software fit my budget?

Cloud accounting software ranges in cost. Depending on your needs, you can find quality software for under $25 per month. After you subscribe to the software, you don’t pay to maintain it.

Look for a software company that updates the software for free. For example, some cloud-based software companies don’t charge you to update the software when the software changes.

2. Will the software save me time?

Balancing your accounts takes time. The more time you spend on your accounting, the less time you spend growing your business.

The software computes figures for you. Your accounting information is automatically organized. You don’t waste time physically filing or searching for statements.

3. How difficult is the software to use?

Shop around for user-friendly cloud accounting software. Some software allows you to try a demo or sign up for a free trial.

Software designed specifically for small businesses may be easier to use. Small business software might exclude big business features that you do not need.

4. Is the software compatible with my business?

Every small business has unique accounting needs. Some businesses need industry-specific features.

For example, a construction company owner may want software that tracks the expenses for individual projects. Decide if your business needs industry-specific accounting software.

5. What do I need the software to do?

Know which accounting features you need for your business. Find software that meets those needs. You do not want to pay for extra features that you will never use.

Also, decide if you need more features as your business grows. Find out if the software provider has add-on features that meet your needs.

You may want your cloud-based accounting software to:

- Create invoices

- Store customer information

- Track expenses

- Pay bills

- Prepare financial statements

6. Is there a customer service team available?

Some cloud accounting software companies offer you help from customer service representatives.

You might be able to reach a customer service representative by phone, email, or online chat. Will the software company’s service representatives answer your specific questions? Also, find out if your time with a customer representative is limited.

7. How secure is my information?

Cloud accounting software should protect your accounting information (e.g., customer contacts and account numbers).

Service representatives should not be able to access your personal information or passwords. The software company should be bonded and insured.

8. Can my data get lost?

Cloud-based accounting could prevent your accounting data from being lost or destroyed. You do not store your information on your computer’s hard drive.

Instead, you store your information on the Internet and can access it from any computer. You will not lose your accounting data if your computer crashes.

Are you interested in using cloud-based accounting software? Try our easy-to-use accounting software for free today!

This article has been updated from its original publication date of November 18, 2015.

This is not intended as legal advice; for more information, please click here.