As a small business owner, it’s easy to get caught up in day-to-day operations. Periodically, ask yourself questions about the tasks you complete. One question you should answer is whether or not you should switch to accounting software. Why use accounting software?

Why use accounting software?

Accounting software offers many benefits to small business owners. Are you wondering, “Do I need accounting software?”

A software program can streamline your books and get you back to running your business. Take a look at these five ways a simple software program can improve your company.

1. It improves efficiency

You want to be able to operate your business as efficiently as possible. This is especially true for completing administrative duties that keep you from growing your business. Learning how to use accounting software will get you in and out of your books quickly so you can focus on profit-generating tasks.

Many accounting software programs allow you to complete your bookkeeping in a few easy steps. You simply enter your business’s transactions and the software computes totals. If you use cloud accounting software, you can do your accounting from anywhere with an internet connection.

Accounting software also keeps your information in one place, making it simple to reference past transactions. You won’t waste time digging through paperwork or spreadsheets.

2. It automates your accounting

Automation makes accounting duties simple. Depending on the accounting software you choose, the program can add totals, compile statements, and generate invoices. Automated figures save you the hassle of calculating totals by hand.

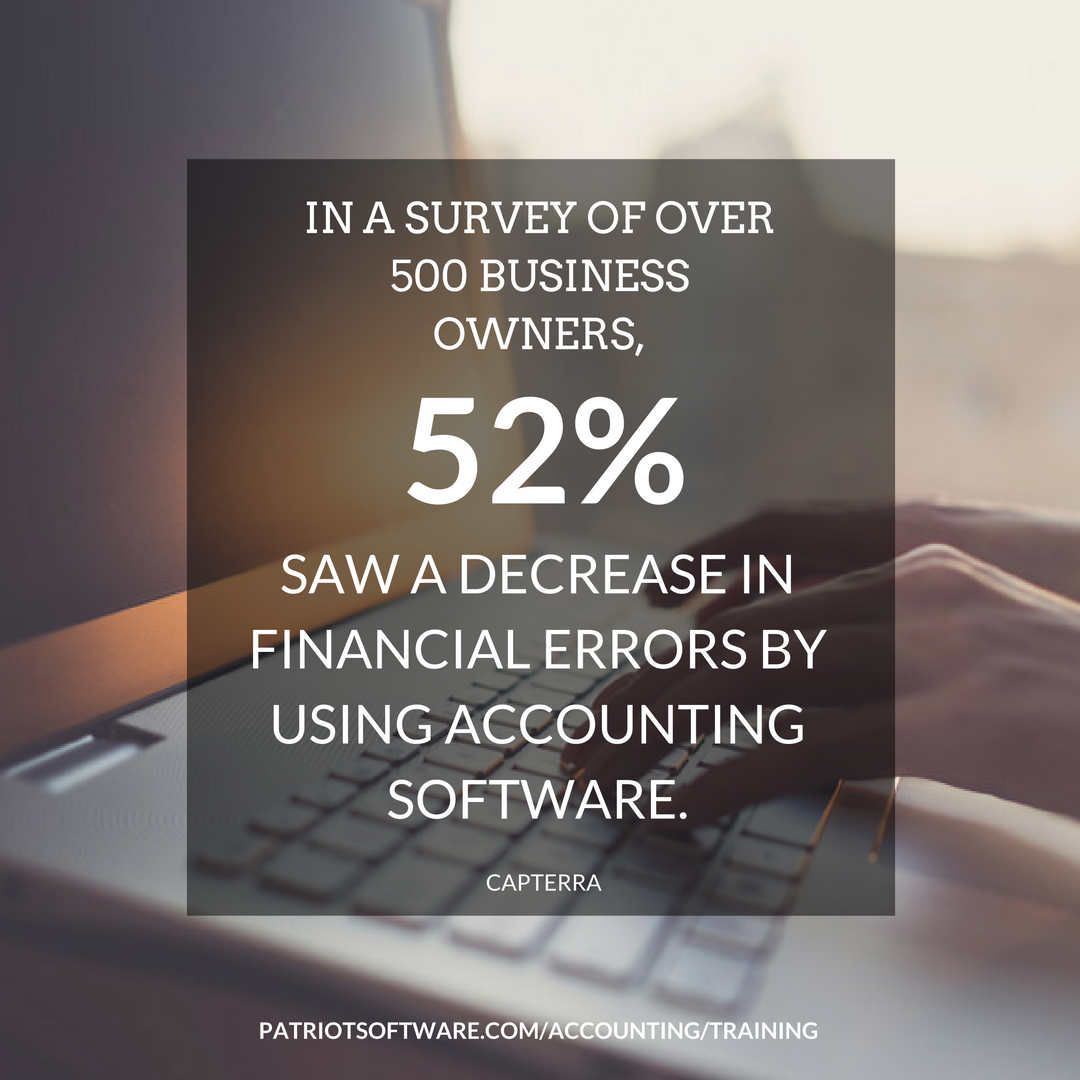

Automatic totals are also more accurate than hand-calculated figures. You have less room for error when the software computes income and expense totals for you. That means you will have a clearer picture of your business’s bottom line.

3. It simplifies tax filing

Disorganized records can cost you when you file taxes. If you hand a box of receipts over to your accountant, it might be time to buy some basic accounting software.

Misrepresented information on your return could land you fines, penalties, and possible legal issues. Unless you’re confident you will never lose a receipt or misrecord a sale, software might be your best accounting option.

Even if your return makes it through the IRS with no discrepancies, disorganized books can still cost you. If your tax preparer charges an hourly rate, you will pay for the extra hours spent making sense of your records. And, it’s easier to miss out on deductions that your business is eligible for.

Accounting software keeps your business’s transactions organized. Your tax preparer can easily access your books to fill out the return. They will spend less time sorting through paperwork and more time getting you a higher refund.

4. It protects you during an audit

In the case of an audit, you need to have accurate and complete accounting records. Auditors will check your books for correct information. If an auditor finds inconsistencies, you could get a penalty or fine.

Doing your books by hand often leads to more errors than using accounting software. Errors increase your chances of getting audited. Accounting software can prevent IRS audit red flags so that you can avoid audits altogether.

Not sure if your business is at risk for an audit? Download our free whitepaper to find out: 8 Things That Trigger an IRS Audit and How to Avoid Them.

If you are audited, accounting software helps you look professional and organized. Audits are usually shorter for businesses with formal records than those with hand-recorded books. Instead of reviewing your transactions line-by-line, an auditor can navigate figures and reports within the software.

5. It gives you a running history of your business

Accounting software makes it easy to form realistic, achievable goals. You can use your financial history to track progress and plan ahead. With a clear picture of your past income and expense patterns, you can set business milestones. Milestones help you reach goals.

For example, you might have a goal to increase sales. You set a milestone to sell 15% more products than last year. Looking at last year’s sales in your accounting software, you can see exactly how much you need to sell to meet your goal.

Looking at past records also helps you plan cash flow. By comparing your business’s income and expenses from one year or month to the next, you can project cash flow. Use your projections to create a business budget and make smart purchasing decisions.

Considering accounting software for your small business? Get a free trial of Patriot’s online accounting software. You can complete your books in a few simple steps. And if you need help, we offer free, U.S.-based support.