After deciding to streamline your business processes with accounting software, you might be wondering, What now? You need to know how to use accounting software to get all the great benefits out of it.

The first step in using accounting software is to choose which one you want. Though not all accounting software is the same, there are basic features you need to understand. Read on to learn how to use accounting software.

Accounting software features

First things first—you need to choose a software that matches your business needs. Determine the features, accessibility, and usability you want your software to have.

Here are some of the basic functions of accounting software:

- Invoice processing

- Track expenses and income

- Pay vendors

- Organize financial statements

- Access and print IRS tax forms

Tracking expenses and income, processing invoices, and accessing IRS tax forms are all necessary functions in accounting software. Why are these important, what do they do, and how do you use them?

How to use accounting software

One of the main reasons businesses use accounting software is to stay organized and access financial records. Take a look at how to use the different functions in accounting software.

Invoice processing

Accounting software is a great tool to use for storing invoice information. You can create and distribute invoices to customers who owe you money. And, you can enter vendor invoices when you owe money.

To create an invoice, you will enter information like the name of the customer, invoice number and date, due date, product or service provided, quantity, price, and account. You can print and mail the invoice or email it to your customer. The invoices act as records for the money that is owed to you.

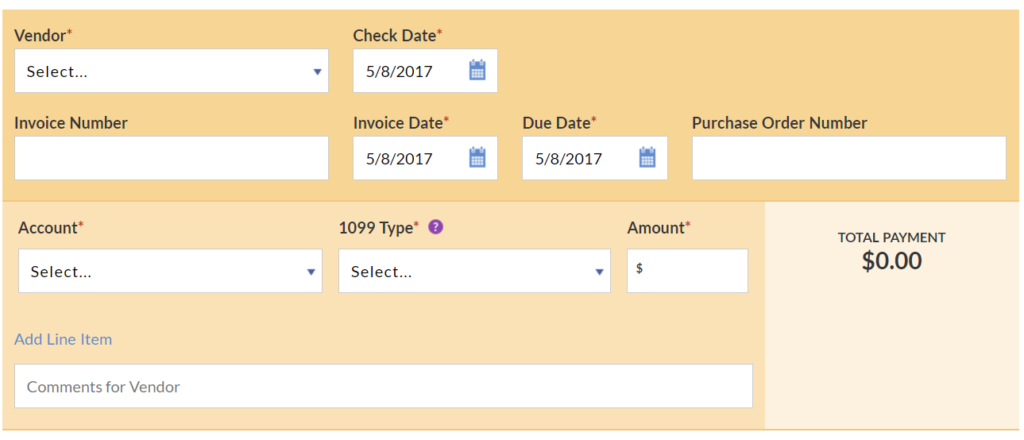

When you receive an invoice, you must enter it into the software. This gives you a record of who you owe money to and makes it easier to pay the invoice.

Typically, you will input information like the vendor’s name, invoice number and date, due date, account, amount, and description.

Track expenses and income

Your accounting software lets you track expenses and income. When you make or receive payments, your accounting software will show you the new balance of how much you owe and how much is owed to you.

To have accurate financial records, you need to know the expenses you owe and the income owed to you. If you use accrual accounting, your software should have easy-to-use accounts receivable and accounts payable tracking.

Using your vendor invoices lets you track how much you have in expenses. Once you have a list of different vendors you owe money to, you can view unpaid invoice reports to gauge your business expenses.

You can track how much you have in income by the number of unpaid customer invoices. After creating and sending invoices to customers, you will be able to get a better idea of how much your business has earned.

Pay vendors

Accounting software gives you the ability to easily make payments. Because your invoices are saved in your software, you know how much you owe to each vendor. This simplifies the payment process.

Select the vendor you want to pay, the date, the amount of the payment, and the account. Then, print a check. This automates the process for you so you don’t need to handwrite checks. And, you know exactly how much you owe without needing to reference paper invoices or notes.

Organize financial statements

Using accounting software gives you instant access to your financial reports. You can view your income statement (profit & loss) and balance sheet within your software. Simply select the date of the period you want to view.

As long as your software is tracking your company’s income and expenses, it will generate the report for you. You won’t need to make a statement yourself.

Storing financial statements within your software prevents lost records. Paper files can easily get damaged or lost, leaving you scrambling. With online accounting software, your information is secure. If your business is audited, you have quick access to your records.

Access and print IRS tax forms

Another helpful accounting software task is the ability to create and print Forms 1099 and 1096.

As a small business owner, you might hire independent contractors from time-to-time. When you do, you need to file Form 1099-MISC, Miscellaneous Income and Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Let’s say you hired an independent contractor whom you paid $1,250. To create Form 1099, enter your name, address, and federal identification number in the software. Then, enter the recipient’s name, address, and identification number. You will mark the amount you paid ($1,250).

After you fill in the information and create Form 1099 and Form 1096, you will print and send them to the appropriate parties.

If you do not have access to IRS tax forms in your accounting software, you need to order them from the IRS and wait for it to ship the forms to your business.

Using accounting software: Recap

To record invoices, enter vendor invoice information and create customer invoices within your software.

For tracking expenses and income, use your invoice lists. And, record when you receive a payment as well as when you make a payment.

You can make payments and print checks from the software.

To view financial statements, enter the period you want to see and run the report within the system.

Create and print Forms 1099 and 1096 in your software by entering your business and the recipient’s information.

Finding accounting software

Look for a software system with a small learning curve. In general, using accounting software shouldn’t be difficult. It should simplify the process for your business, not cost you more time.

If you want to be able to access your system anywhere, anytime, you need cloud accounting software rather than desktop software. With the cloud, you can access your account as long as you have an internet connection.

When choosing accounting software, make sure it has the features that fit your business needs. Do some research, take advantage of free trials, and land on a software that is easy-to-use, inexpensive, and time-saving.

Ready to give accounting software a go? Patriot’s online accounting is simple enough for non-accountants and powerful enough for accountants. Easily handle your accounting responsibilities within the software. Get your free trial today!

This is not intended as legal advice; for more information, please click here.