Selling products or services to customers is your main objective. Sometimes, instead of collecting money right away in exchange for your offering, you send the customer an invoice. What is an invoice?

What is an invoice?

An invoice is a bill sent to a customer after they have already received a product or service. If a customer purchases something without paying immediately, you will send an invoice. An invoice sent to a customer is known as a sales invoice.

You might also receive invoices from your vendors. These are known as purchase invoices because you made the purchase and owe the vendor.

Invoices can be distributed electronically or through mail. Most businesses send invoices via email.

There are different times you can invoice a customer. You can give an invoice with a delivered product or a certain number of days after making a sale.

Before invoicing a customer, you may send them an estimate that details the job you’re going to perform or the products you’ll provide (which is why you also need to know what to say when sending an estimate).

What is the purpose of an invoice?

Invoices act as records for your business. The purpose of an invoice is to stay organized and knowledgeable about which customers owe you. And, you know when payments are overdue.

An invoice is also a record for the person receiving them (however, there is a marked difference between invoice and receipt). Create an invoice to act as a receipt, letting a customer know the amount they owe your business and when it is due.

If you use accrual accounting, record the amount of the invoice as accounts receivable in your books. The customer owes you the money for the good or service. Invoices help you make sure your accounting books are accurate.

What are invoices used for? When it comes down to it, an invoice is what leads to a payment from a customer. Without an invoice, and without an invoice done correctly, you will have slow cash flow. To get cash from customers, you need to remind them that they owe you money with an invoice.

If you get audited by the IRS, you need to have financial records, including invoices. Keep copies of your invoices (either electronic or paper) in a safe place for accurate invoice tracking.

How to create an invoice

An invoice is an important record, so you need to know how to invoice customers. Before sending an invoice, make sure that it is accurate. If there are inaccuracies, it could slow down the process of collecting money.

You can use accounting software to create and send invoices. Or, you can create invoice templates from scratch. Whether you automate the invoice process or not, understand the different parts of an invoice.

Parts of an invoice

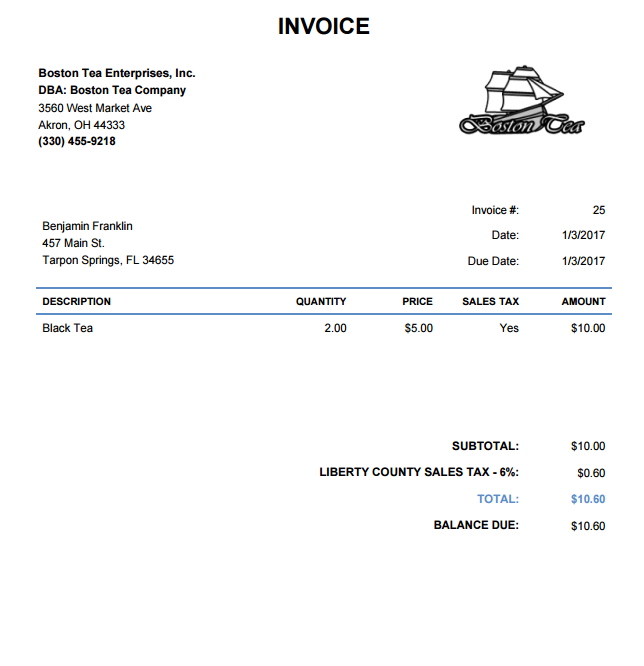

What does an invoice contain? Clearly label an invoice so a customer knows what it is. All invoices should include the same basic information:

- Invoice date: This shows the customer the date the invoice was created.

- Customer information: Clearly state the customer’s name, business (if applicable), address, and phone number on the invoice.

- Seller information: Include your business’s name, address, email address, and telephone number. That way, a customer can contact you if they have any questions.

- Goods and/or services purchased: List out the exact products or services, quantities, and prices the invoice is for. A good description will alleviate potential confusion.

- Total amount due: After adding up the total and sales tax (if applicable), include the total amount the customer owes you. If they paid part of the total at the time of purchase, make sure to account for that.

- Payment terms: You must include invoice payment terms detailing when the payment is due. Also, list payment methods you accept. Write where the customer can make checks payable to. If you offer discounts for early payments, write it on the invoice.

- Invoice number: When you create an invoice, be sure to number it. And, make a note of the invoice number in your business records. An invoice number will let you easily look up the invoice in the future. Let’s say a customer calls with questions about their invoice. They can give you the invoice number so you can find them in your system.

You might need to send subsequent reminders if the customer won’t pay you. Continue to contact the customer (politely) if they have not paid past the due date. If a customer loses their invoice, send them another one.

Sample invoice

Here is an example of an invoice:

Need help creating invoices? Patriot’s online accounting for small businesses lets you create invoices with your business logo and email them to your customers. The software keeps records and generates reports so you can easily manage your invoices. Try it for free today!