As a business owner, you likely deal with invoices on a regular basis. Maybe you send them to your customers. Or, maybe you’ve received them in the past for making purchases. Regardless, if you’re planning on invoicing your customers, you need to come up with solid invoice payment terms.

What are invoice payment terms?

An invoice is a document that records a transaction between a buyer and seller. And when you create an invoice for a customer, you set payment terms so that the person who receives the invoice knows:

- When the invoice payment is due

- Forms of payment (e.g., credit card, check, etc.)

- How to pay

- If there are any penalties or fees for late payments

- Other invoice terms and conditions

Invoice payment terms break down invoice information to the customer to let them know when and how to pay you and if there are consequences for paying late. Essentially, payment terms are the guidelines customers use to pay you for your goods or services.

What are standard invoice payment terms? Many businesses have 30-day terms where the payment is due 30 days after the invoice date. However, your business can choose whichever terms you’d like.

Importance of invoice terms in business

Every business’s ultimate goal is to get paid. But, you can’t expect to get paid if your invoice terms are lax.

Your terms spell out the specifics of the payment for your customers. How strong your terms are can impact:

- Payment timing

- Cash flow

- Working capital

If you don’t lay your invoice payment terms out on the table for your customers, you could wind up finding your company struggling to stay afloat. Not to mention, you’ll probably need to chase down customers for payment, which no business wants to do.

Not being strict with your payment terms and coming up with a solid plan can cause a lot of issues for your company. So, it’s best to fine-tune your terms to ensure your business gets paid.

8 Tips for invoice payment terms and conditions

Want to perfect your small business invoice payment terms? Take a look at a few tips to improve your terms and conditions.

1. Discuss payment terms early on

The last thing you want to do is leave your customers in the dark about payment terms and conditions for invoice. So instead of avoiding payment terms questions like the plague, be transparent about your terms and conditions.

When you kick off a new customer relationship, be open and honest about your terms, especially if the customer asks. Be clear during the process about your payment terms, and don’t wait until you send the invoice to discuss them.

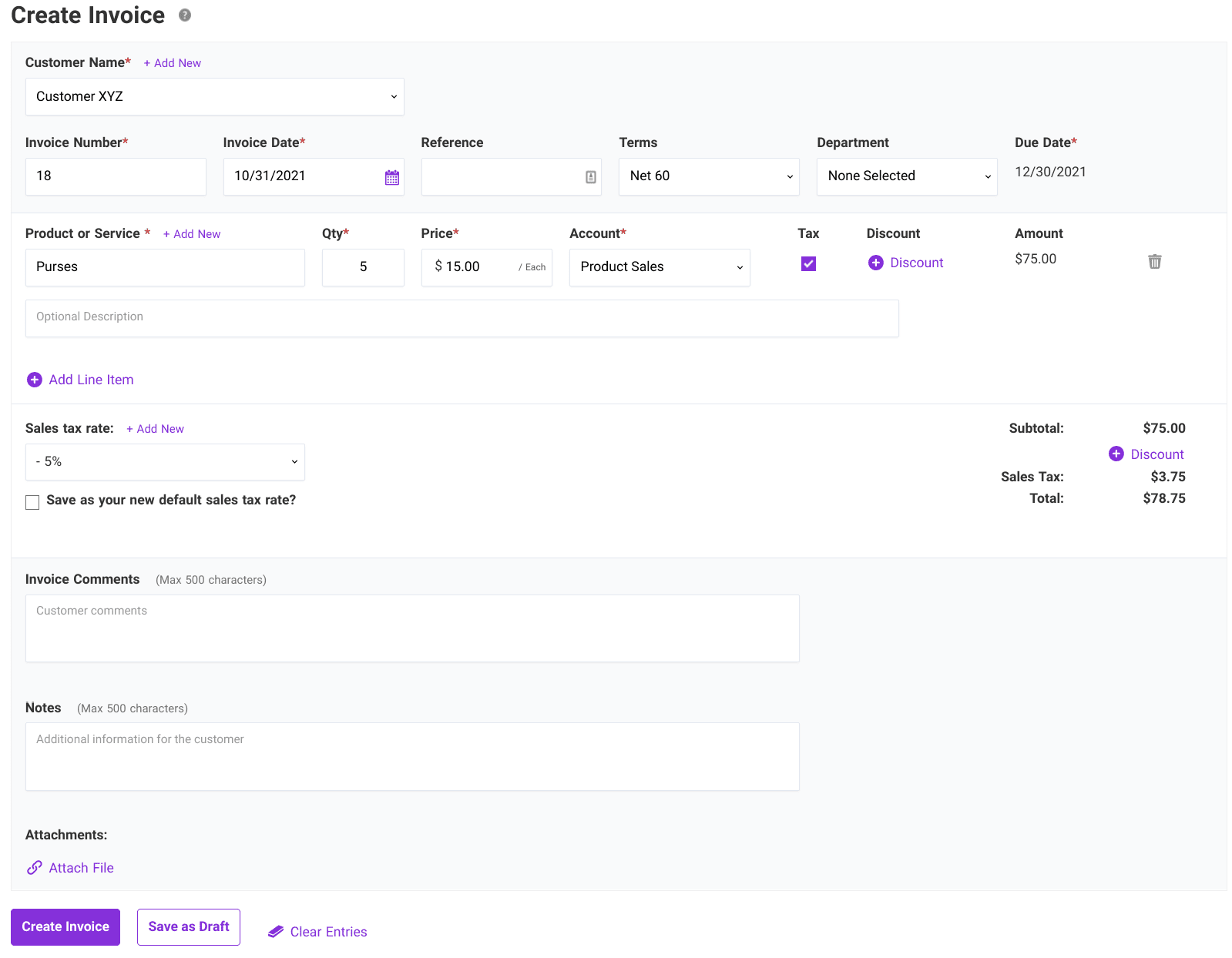

2. Make sure your invoice lists the essentials

Your invoice should be clear as day for your customers. If a customer has a hard time understanding your invoice, it might take a longer time for you to receive payment. Be sure to list all the essential details before you send off any invoices:

- Invoice date

- Invoice number, if applicable

- Due date

- Product or service information (e.g., quantity and price of each)

- Sales tax, if applicable

- Discounts, if applicable

- Any additional comments and notes

- Your contact information

- Payment information (e.g., how to pay, payment types you accept, etc.)

- Late fees if the invoice is not paid on time, if applicable

- Early payment discount information, if applicable

Before you send each invoice, check them for accuracy to ensure you didn’t make any mistakes.

3. Invoice as soon as possible

To make sure you get paid promptly, invoice your customers as soon as possible. The sooner your customer receives an invoice, the sooner you can receive payment.

Send an invoice as soon as you complete a job or deliver a product. To speed up the process, use online accounting software to create and track invoices.

4. Offer a variety of payment options

The harder it is for a customer to pay you, the more difficult it’s going to be to get paid. To make things simple for you and your customers, offer a variety of invoice payment options to customers, if possible.

You could give customers the option to pay with a credit or debit card online or by mailing a check. And if you use software (e.g., accounting software), you may be able to send customers a direct link to pay you with the click of a button (e.g., email).

If you want to streamline your payment options, look into getting software to make invoice payments easy for your customers. And, see if you can set up a way for customers to make automatic payments.

| Looking for a reliable and affordable accounting solution that makes it a breeze to create invoices and send invoice payment reminders? Try Patriot’s online accounting software free for 30 days! |

5. Offer early payment discounts

To encourage customers to pay more quickly, consider offering early payment discounts. For example, you may offer a 2% discount if the customer pays the invoice within 10 days (i.e., 2/10 net 30 days).

Offering customers invoice discounts for early payments can also:

- Strengthen customer relationships

- Help build loyalty with the customer

If you plan on offering a discount, take some time to research common discount amounts to determine which early payment discount is ideal for your customers and business.

6. Track late payments

Whatever you do, make sure you’re keeping track of late payments. Otherwise, late payers could slip through the cracks and you could miss out on payments.

You can track late payments manually (e.g., spreadsheet) or by using accounting software. If you use accounting software, you can generally pull a report, like an accounts receivable aging report, to see which invoices are past due.

Analyze your report and determine which invoices are past due and contact the customer for payment.

7. Have a plan when customers won’t pay

So, what are you going to do if a customer won’t pay for services or products? Come up with a solid game plan in case this happens.

To get customers to pay overdue invoices, you can:

- Send invoice payment reminders (or get software that does the nudging for you)

- Contact late payers directly via phone, email, etc.

- Offer late payers a payment plan to break up invoice payments

- Hire a collection agency

Whatever you do, make sure your plan is professional and understanding. You never know why a customer isn’t paying (hint: they may have just forgotten). Work with your late paying customers to find a solution that works for both you and them so that you don’t soil the relationship.

8. Keep detailed records

Like with anything in accounting, keep detailed records of estimates, invoices, invoice payments, and late payment information. That way, if something happens or you need to review an invoice, you can easily access details through your records.

Invoice payment terms example

Let’s take a look at an example of an invoice with payment terms, shall we?

Check out an example invoice below. On it, you will see the payment term “Net 60.” This means that the customer has 60 days to pay the invoice from the invoice date. The higher the terms, the longer the customer has to pay the invoice.

This article has been updated from its original publication date of September 27, 2016.

This is not intended as legal advice; for more information, please click here.