One word, two syllables. And completely unavoidable if you’re an employer. Ah yes, we’re talking about payroll. It’s a pretty common term in the workplace (Don’t forget to run payroll!). But, what is payroll exactly?

Payroll definition spoiler alert: Payroll = paying employees. Without payroll, employees don’t get paid. So if your business has employees, you must, must, must run payroll.

What is payroll?

Payroll is the process of paying employees. Employers must handle payroll each pay period so employees receive their wages. But, payroll is more than just a paycheck. There are many moving parts, like gathering employee hours worked, calculating taxes and other deductions, distributing wages, and reporting and remitting taxes and other deductions to the right parties (e.g., IRS).

When it comes to payroll meaning, you may hear phrases like:

- Running payroll: This is the process of actually calculating and distributing wages and taxes.

- Employees on payroll: This is the list of the employees you pay, along with their information. Keep in mind that it does not include independent contractors.

- Payroll expense: This is the amount your business spends on employee wages and taxes. You must record the expense in your accounting books.

It’s time to dive deeper into the parts of payroll.

Key payroll terms

Ready for a lightning-speed round of important payroll terms? Here are some common terms and their definitions:

| Payroll Term | Definition |

|---|---|

| Pay frequency | A recurring length of time that determines how often you pay employees. Common pay frequencies include weekly, biweekly, semimonthly, and monthly. |

| Gross wages | The total amount you pay an employee before withholding taxes and deductions. |

| Overtime pay | Overtime pay is time and a half for every hour an employee works beyond 40 in a week. All nonexempt employees receive overtime pay. |

| Payroll taxes | The amount you withhold from an employee’s wages and contribute as the employer. Taxes may include federal, state, and local income; Social Security; and Medicare taxes. |

| Pre-tax deductions | The amount you withhold from an employee’s wages before calculating and withholding some or all taxes. Examples include health insurance and some retirement plans. |

| Post-tax deductions | The amount you withhold from an employee’s wages after calculating and withholding taxes. Examples include garnishments and some retirement plans. |

| Net pay | An employee’s take-home pay / net wages is the total amount after subtracting taxes and other deductions from the employee’s gross wages. |

| Pay stub | A document that details the employee’s gross wages, taxes, and deductions; employer contributions and taxes; and the employee’s net pay. |

| Payroll forms | Forms employers must file with tax agencies (e.g., the IRS) that summarize employee pay information, such as wages and taxes. Examples include Form 941 and Form W-2. |

| Payroll software | A system that automates the payroll process by calculating wages and taxes. |

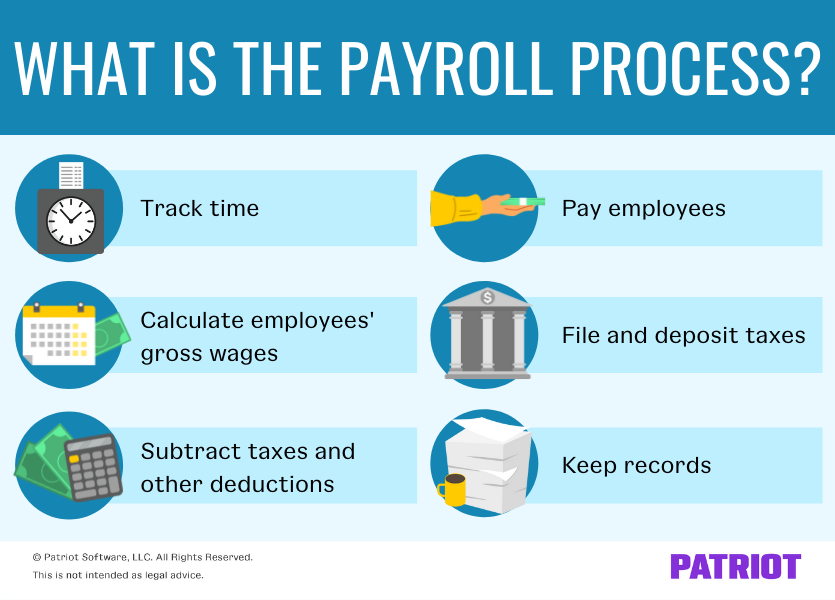

What is the payroll process? An in-depth look

Again, payroll has a lot of moving parts. In this section, we’ll break what is payroll down to a science.

But before you can begin to run payroll, you need to make some decisions. Among other responsibilities, you must:

- Determine your pay frequency (e.g., biweekly)

- Decide how to pay employees (e.g., direct deposit)

- Register for an Employer Identification Number (EIN) and state accounts (e.g., state unemployment insurance)

- Create an Electronic Federal Tax Payment System (EFTPS) account

And each time you hire an employee, you need to decide whether they are exempt or nonexempt from overtime wages. You must also collect Form W-4 (among other new employee forms) to properly run and distribute payroll.

Without further ado, take a look at what is payroll composed of on a micro-level.

1. Track time

To run payroll, you need to track your employees’ time. This includes:

- Regular hours worked

- Time off (e.g., paid time off)

- Overtime hours (i.e., time and a half)

Tracking employee hours ensures you pay your employees the proper amount. Collect timesheets from employees that detail how many hours they worked during the pay period and whether they took time off.

2. Calculate employees’ gross wages

You may have salaried employees, hourly employees, or both. Once you know how many hours they worked, you can calculate their gross wages.

To calculate your salaried employees’ gross wages, divide the number of pay periods in the year by their annual salary. For example, you give an employee a yearly salary of $50,000 and pay them weekly. Because there are 52 weeks in the year, the employee’s weekly gross wages are $961.54 ($50,000 annual salary / 52 weeks). Remember to account for any overtime if the employee is nonexempt and works over 40 hours in the workweek.

To calculate your hourly employees’ gross wages, multiply their rate of pay by the number of hours worked in the pay period. Let’s say you pay an employee $18 per hour. Because the employee worked 40 hours this week, you would pay them $720 ($18 per hour X 40 hours).

Keep in mind that employees could have additional sources of pay you must include in payrolls, such as tips, commissions, or bonuses.

3. Subtract taxes and other deductions

One of the most important (and confusing) parts of payroll is subtracting taxes and other deductions from employees’ gross wages.

Pre-tax deductions: First, determine if an employee has pre-tax deductions. If they do, subtract them from the employee’s gross pay before calculating applicable taxes.

Taxes: Next, it’s time to calculate the employee’s tax withholding. You must deduct the following taxes from an employee’s pay:

- Federal income tax

- Social Security tax

- Medicare tax

- State and local income taxes (if applicable)

- State-specific taxes

Keep in mind that you must also pay employer taxes on your employees’ pay. Employer taxes include Social Security, Medicare, federal unemployment, and state unemployment taxes.

Post-tax deductions: If the employee has any post-tax deductions, withhold them after calculating employee taxes.

4. Pay employees

After subtracting taxes and other deductions from the employee’s gross wages, voila. You arrive at the employee’s net, or take-home, pay.

Before you pay employees, verify that your information and calculations are correct. Once you’ve approved payroll, it’s time to pay employees.

You might pay employees via:

- Direct deposit

- Paychecks

- Mobile wallet

- Pay cards

- Cash

When you pay employees, you might also provide paper or digital pay stubs. That way, employees can see their payroll information.

5. File and deposit taxes

Think paying employees is the end of the payroll process? Not so fast. You also need to file and deposit taxes with the IRS and, if applicable, your state and local governments.

Deposit federal income, Social Security, and Medicare taxes with the IRS. You must deposit them monthly or semiweekly, depending on your deposit schedule. To report the taxes, file Form 941, Employer’s Quarterly Federal Tax Return, or Form 944, Employer’s Annual Federal Tax Return.

Deposit state and local taxes depending on the tax agencies’ rules. The forms you must file to report the taxes vary, too.

Last but not least, remember to deposit and file employer-only taxes, like federal unemployment tax and state unemployment tax.

6. Keep records

The Fair Labor Standards Act (FLSA) and IRS require you to keep detailed records for, well, a while. So, how long do you need to keep payroll and tax records? Check out the chart to find out:

| Type of Record | How Long to Keep |

|---|---|

| Timecards and other records on which wage computations are based | At least 2 years |

| Payroll records | At least 3 years |

| Employment taxes | At least 4 years |

Not only are detailed records required by the FLSA and IRS, but you also need them to complete Form W-2, Wage and Tax Statement, each year.

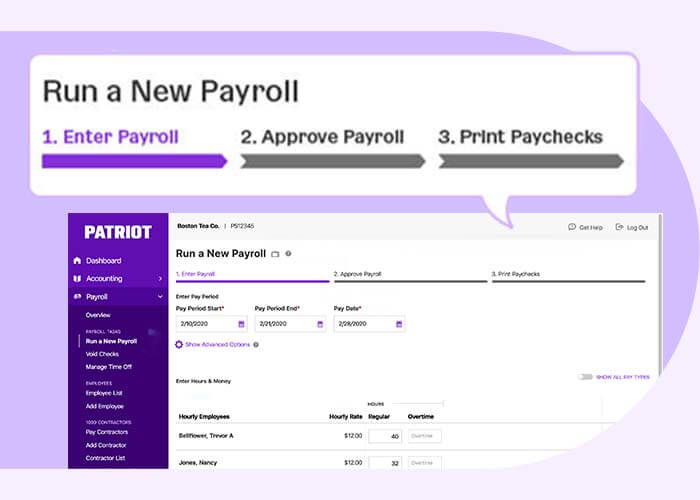

How to run payroll

And now, it’s time to go from learning What does payroll mean? to learning how to handle payroll. You have three payroll solutions when it comes to running payroll.

You can:

- Do payroll by hand

- Outsource payroll

- Use payroll software

1. Do payroll by hand

This option is the most time-consuming (but least expensive) payroll option. It requires you to learn the ins and outs of payroll.

You must calculate taxes and other deductions manually. The IRS provides income tax withholding tables you can use to calculate federal income tax withholding. Consult your state for information on state income tax withholding.

Also, keep organized and detailed records someplace secure and safe. For example, you might use a spreadsheet to show gross pay, taxes and deductions, and net pay.

Last but not least, you’re responsible for filing and depositing taxes with the IRS and any state and local agencies, if applicable. Set calendar reminders to avoid late fees and other penalties.

2. Outsource payroll

Outsourcing payroll is the most expensive (but least time-consuming) payroll option. Although you free up precious time from doing payroll by hand, you should consider whether doing so is in your budget.

You might outsource payroll to a payroll accountant or professional employer organization (PEO). The person or company you outsource payroll to typically handles the entire process for you, from calculations to wage distribution.

3. Use payroll software

Looking for an option in the middle between doing payroll by hand and outsourcing payroll? If so, payroll software might be just right for you.

Payroll software can be inexpensive and easy to use. So, what is payroll software? Again, payroll software calculates wages and taxes so you don’t have to. So no, you don’t have to worry about using the IRS tax withholding tables.

And if you opt for full-service payroll software, you don’t need to file or deposit taxes either (the system does it on your behalf!).

This article has been updated from its original publication date of January 10, 2011.

This is not intended as legal advice; for more information, please click here.