When it comes to running payroll, there are a lot of terms you need to be familiar with. One that you need to know like the back of your hand is gross wages. But, what are gross wages? And, how do you calculate them for your employees’ checks? We’ve got the answers to these questions and more (just keep reading!).

Gross wages definition

Gross wages, or gross pay, are the total amount you pay an employee before you withhold taxes and other deductions.

An employee’s total gross wages can vary depending on a few factors:

- Wage rate

- Overtime pay, if applicable

- Other types of pay (e.g., double time)

- Pay frequency

You need to know each employee’s gross pay amount so you can accurately withhold taxes and calculate deductions.

Gross wages vs. net wages

Again, gross wages are what an employee earns before tax withholdings and deductions.

On the other hand, net wages, or net pay, are what an employee earns after taxes and deductions. This is also called take-home pay.

To find net pay, you must deduct taxes (e.g., Social Security, Medicare, and federal income taxes), pre- and post-tax deductions, and other contributions. Here are some examples of what you may need to deduct from an employee’s gross wages to get their net wages:

- 401(k) or other retirement contributions

- Medical, dental, or health insurance premiums

- HSA account contributions

- FSA account contributions

- Wage garnishments

Deductions can be either mandatory (e.g., Social Security tax) or voluntary (e.g., retirement plan contributions).

To calculate net pay, use the following formula:

Net Pay = Gross Pay – Deductions

How to calculate gross pay

How you calculate gross rate of pay varies depending on if your employee is hourly or salaried. Learn how to calculate gross pay for your employees below.

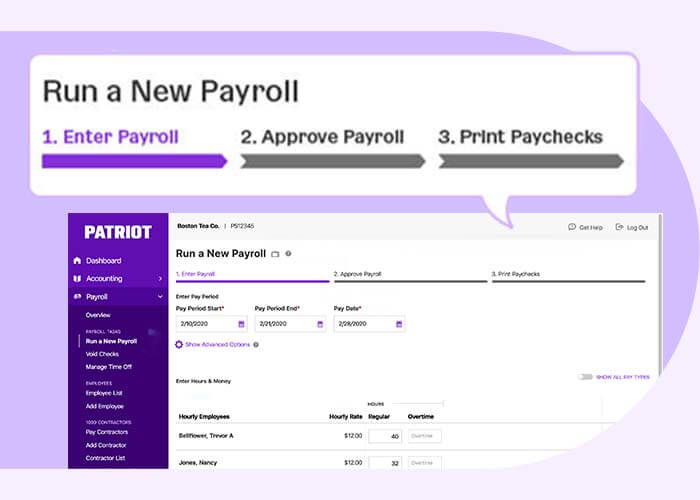

Keep in mind that if you use payroll software, the software does the gross pay calculations for you for both hourly and salaried employees.

Gross salary employees

For salaried employees, start with an employee’s annual salary to calculate gross wages. Then, divide the annual gross wages by the number of pay periods in a year to find their gross pay for each period.

Here’s a breakdown of the number of pay periods per year for each common frequency:

- Weekly: 52

- Biweekly: 26

- Semimonthly: 24

- Monthly: 12

To find a salaried employee’s gross pay, use the following formula:

Gross Pay for Salaried Employees = Annual Gross Pay / # of Pay Periods Per Year

Hourly employees

For hourly employees, calculate gross wages by multiplying the hourly wage by the number of hours worked in the period. If an hourly employee works overtime, include the overtime pay in their gross pay.

Gross Pay for Hourly Employees = (Hourly Wages X # of Hours Worked in the Period) + (Hourly Wages X 1.5 X # Overtime Hours in the Period)

If an employee can earn other types of pay, like double time, be sure to include that in your gross wage calculation, too.

Gross pay examples

Ready to see calculating gross pay in action? Check out a few examples of calculating gross wages.

Salaried: Example 1

Say your salaried employee’s yearly gross wages are $40,000, and you pay them monthly. Divide your employee’s annual gross pay by their monthly pay frequency (12) to find their gross wages per pay period.

Gross Pay = $40,000 / 12

The employee’s gross pay each month is $3,333.33.

Salaried: Example 2

Your employee’s annual gross pay is $78,000, and they receive biweekly wages. Divide their annual gross wages by the number of biweekly pay periods per year (26) to find their gross pay.

Gross Pay = $78,000 / 26

The salaried employee’s gross wages per pay period are $3,000.

Hourly: Example 1

Say your hourly employee makes $15 an hour and worked 70 hours the past two weeks. For this biweekly pay period, they did not earn any overtime. Multiply their hourly wages by the number of hours they worked during the period to find their gross pay.

Gross Pay = $15 X 70 hours

The employee’s gross wages for the period are $1,050.

Hourly: Example 2

Your employee earns $25 an hour and worked 45 hours during the week. Of the 45 hours, 5 hours were overtime.

Calculate the employee’s gross pay by multiplying their regular hourly wages ($25) by the number of regular hours worked (40). Then, calculate overtime pay by multiplying overtime hours (5) by the employee’s overtime rate (1.5 X $25). Add together the total regular wages and overtime wages to get the employee’s total gross pay.

Gross Pay = ($25 X 40 hours) + (5 X 1.5 X $25)

$1,000 + $187.50 = $1,187.50

The employee’s gross wages (including overtime pay) for the pay period is $1,187.50.

This article is updated from its original publication date of January 26, 2015.

This is not intended as legal advice; for more information, please click here.