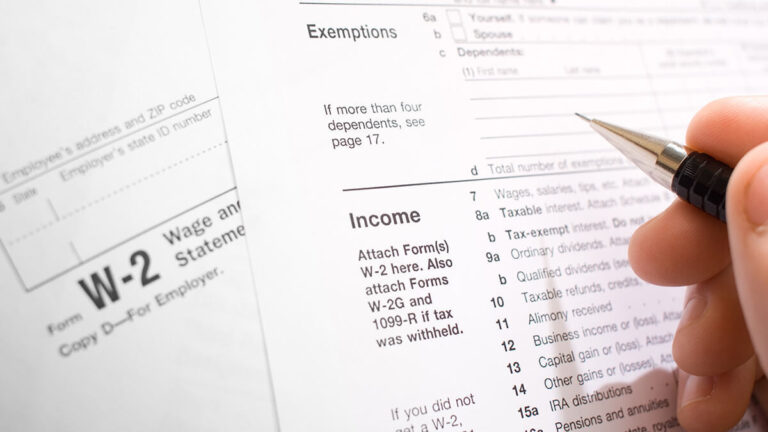

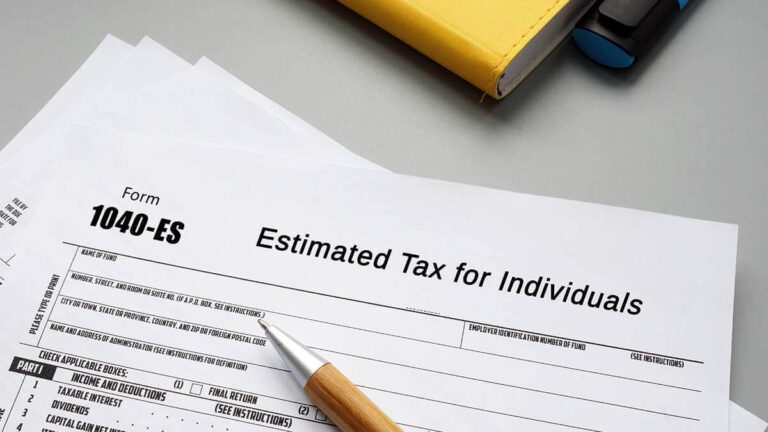

After the end of every year, you need to report your workers’ wages. You must send a form to the worker and governments. But, which form do you send? The form you use—Form 1099 vs. W-2—depends on if the worker was a contractor or an employee.

Read More Form 1099 vs. W-2: Which Should You Use?