If you’re becoming an employer or already have employees, you must learn how to do payroll. Handling payroll is an important employer responsibility with many steps. Familiarize yourself on how to do payroll by learning about what payroll information you need to gather and the steps you need to follow to pay employees.

Information to gather before learning how to do payroll

Before you can begin running payroll, gather some employee and employer information.

Employer information

As an employer, you are responsible for preparing your business to pay your employees. This includes things like applying for identification numbers and registering with your state.

Before running a payroll, you must:

- Apply for a Federal Employer Identification Number (FEIN)

- Register with your state

- Get an EFTPS account

- Set up workers’ compensation

- Create a new hire reporting account

FEIN

An FEIN, or EIN, is a taxpayer identification number used by businesses. If you have employees, you must apply for an EIN.

An EIN is formatted like this: XX-XXXXXXX.

Your EIN helps identify your small business. Typically, you list your EIN on Form W-2, Form 941, and business tax return forms.

You can apply for an EIN online on the IRS’s website. Or, you can mail or fax Form SS-4, Application for Employer Identification Number, to the IRS.

State and local registration

Every state has different laws employers must follow. Some states require that you register for additional account numbers before you can run a payroll.

Your city or locality may even require additional types of employment registration for things like local income tax or school district tax.

Before you run payroll, be sure to check out your local and state employer information for requirements.

EFTPS

Although not required, you can sign up for an Electronic Federal Tax Payment System (EFTPS) to pay your federal taxes.

You can also use EFTPS to review payment information (e.g., bank account) and previous payments.

Workers’ compensation

Workers’ compensation is insurance that provides wage replacement and medical benefits to employees who get sick or hurt at work.

Before you begin running payroll for employees, check into your options for workers’ compensation coverage.

New hire reporting

You must create an online account or contact your state to report new hires that you’re adding to your payroll.

Under federal law, you must report new hires within 20 days of hiring them. State laws for new hires can vary. Check with your state for more information on your timeframe and steps for new hire reporting.

Employee information

Before you can start running payroll, you must also determine employee information, such as worker classification, payment method, and if your employees will be salary or hourly.

You must also gather important new hire documents, such as:

- Form W-4

- State W-4 form (if applicable)

- Form I-9

Worker classification

Your employees can either be considered exempt or nonexempt. Worker classification impacts how you process payroll. Before running payroll, you need to correctly categorize your employees.

Exempt employees:

- Make at least $35,568 per year or $684 each week

- Are paid on a salary basis

- Have executive, administrative, or professional job duties

- Do not receive overtime pay

Nonexempt employees:

- Must be paid at least the federal minimum wage

- Receive overtime wages for any hours worked over 40 per week

- Have job duties that are not considered exempt (e.g., clerical workers)

Payment method

You need to determine how you want to pay employees. There are a few methods to choose from, including:

- Direct deposit

- Handwritten or printed paychecks

- Cash

- Pay cards

Weigh the pros and cons of each method before deciding how you want to pay your employees. Employers can opt to do a mixture of methods, too, such as giving employees the choice between receiving a check or direct deposit.

Some states have laws in place about payment methods. Check with your state for more information about laws about different payment methods (e.g., pay card laws by state).

Depending on your chosen method, you might need to collect bank account information from your employees before you can run payroll.

Hourly vs. salary

You can either pay your employees on an hourly or salaried basis.

With a salary, you pay employees a fixed amount each pay period. If you pay employees hourly wages, you must pay an hourly rate. An hourly employee’s total wages are based on the number of hours they work.

Form W-4

IRS Form W-4, Employee’s Withholding Certificate, is an IRS form new employees must fill out.

On Form W-4, employees can enter the information you’ll use to determine how much federal income tax to withhold from their wages.

State W-4 form

Many states have state income tax. If your employee works in a state that requires you to withhold state income tax, they must fill out a state W-4 form.

Check with your state to see if it requires your employees to fill out a state W-4.

Form I-9

Form I-9, Employment Eligibility Verification, is a form that confirms your employees are legally allowed to work in the United States.

Before you can authorize employment, you and your employee must complete Form I-9.

Your employee fills out the first section. Then, you need to fill out the second section. Your employee must also provide acceptable identification (e.g., passport) and documentation.

Use information from Form I-9, such as name, address, and Social Security number, to run payroll. Keep Form I-9 in your payroll records.

Choosing a payroll method

As an employer, you have a couple of ways you can handle payroll. You can opt to do manual payroll calculations by hand. Or, you can use payroll software to do the calculations for you.

Doing manual calculations can be time-consuming and leave room for errors. You must double and triple check to ensure your calculations are accurate. Even though it uses up more of your time, manual payroll allows you to cut down on costs when it comes to payroll.

After entering payroll information, payroll software handles the calculations for you. However, you need to make sure you input the information correctly. Because payroll software computes the payroll taxes for you, it helps you save time running payroll.

Before you begin doing payroll, you have to decide which method is best for your business.

How to do payroll

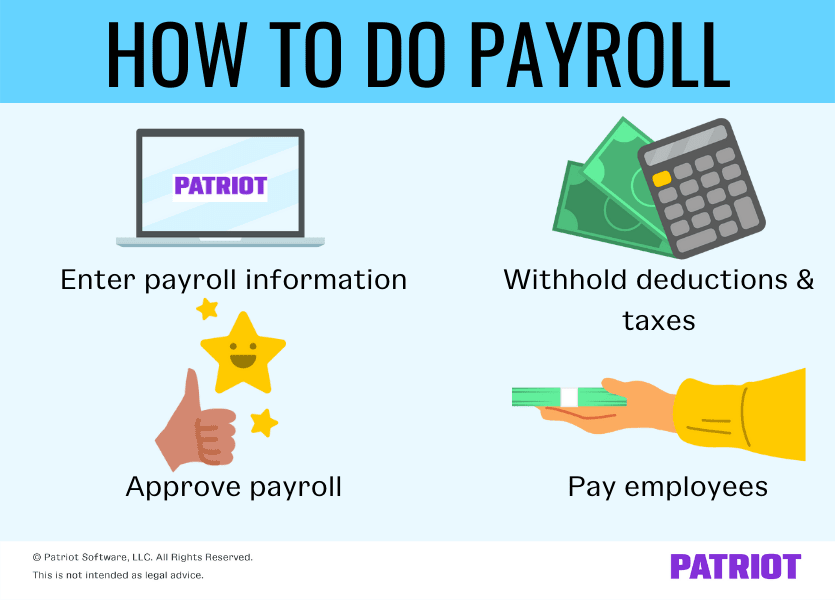

Now that you know what kind of information you need before running payroll, it’s time to learn how to run a payroll. Running a payroll can be broken down into four easy steps:

- Enter payroll information (e.g., employee information and wages)

- Deduct payroll and withholding taxes

- Approve payroll

- Pay employees

You might need to tweak the steps depending on whether you’re doing payroll by hand or using software. Dive into how to run payroll below.

1. Enter payroll information

If you’re using online payroll to determine employees’ payroll, you will need to enter payment information.

To start your payroll, you need to include some details, such as:

- Employee information (e.g., names)

- Pay period

- Hourly or salary rate

- Gross wages

- Overtime pay (if applicable)

If you use time cards or time and attendance software, you can collect payroll information for the pay period.

If you’re doing payroll by hand, be sure to gather employee time information and calculate gross wages.

Employee information

Use Forms I-9 and W-4 to input employee information. If you’re using payroll software, you should have a section where you can add employee information.

Pay period

When you pay employees, you must determine how frequently you would like to pay them. Usually, pay frequencies are weekly, biweekly, semi-monthly, or monthly.

Your frequency helps dictate when you pay your employees. For example, if you pay your employees biweekly, you pay them once every other week.

You must run payroll consistently and on a regular basis. That way, employees know how often you will be paying them.

When you do your payroll, make sure you indicate the pay period and pay date.

Hourly or salary

Next to your employee information, you should also include whether the employee is salary or hourly.

You can organize your payroll by salary vs. hourly to avoid confusing employees’ rates and frequencies.

Gross wages

You should also include the gross wages for both hourly and salaried employees.

Hourly

For hourly employees, you need the pay rate per hour and the number of regular and overtime hours worked. To find an hourly employee’s gross wages, multiply the number of hours worked by their hourly pay rate.

Hourly gross wages = Hours worked during pay period X Hourly pay rate

Say your biweekly employee makes $10 per hour. They work 32 hours during the pay period.

$320 = 32 hours X $10 per hour

The employee’s gross pay for this period would be $320.

Salary

Gross wages for salaried workers are a little different than hourly employees. For salary employees, you need their salary per pay period and hours worked.

If your salaried worker is nonexempt, keep track of their overtime hours, too.

To find salary per pay period, divide the employee’s annual salary by the number of pay periods in a year.

Say your salaried employee makes $52,000 annually. You pay the employee on a weekly basis.

Salary gross wages = Annual salary / Number of pay periods per year

$1,000 = $52,000 / 52

If you’re unsure about how many pay periods your salaried employee has per year, take a look at this chart:

Overtime pay

If your employees are eligible for overtime wages, you must also include that in your calculations. The overtime rate is an employee’s regular rate times one and a half. Overtime wages are separate from regular wages.

Let’s take a look at calculating overtime pay. Say your employee makes $20 per hour. They worked five hours of overtime.

Overtime rate = Employee’s regular rate X 1.5

$30 = $20 X 1.5

Your employee’s overtime rate is $30 per overtime hour. Because your employee worked five hours of overtime, their gross overtime pay is $150 ($30 X 5 hours).

When handling payroll, be sure to calculate or input overtime wages for applicable employees.

2. Deduct payroll and withholding taxes

After you determine each employee’s pay period and gross wages, it’s time to calculate payroll taxes and deductions.

As an employer, you must pay, withhold and remit payroll taxes. You might also need to handle additional deductions, such as retirement plans and health insurance premiums. Before you finish payroll, be sure to account for any employee or employer contributions and deductions.

Depending on where your business and employees are located, you might have additional state and local taxes.

If you’re doing payroll by hand, you must calculate your payroll taxes. If you use payroll software, the system calculates taxes automatically.

Common payroll taxes include:

- Employee and employer portions of FICA tax (Social Security and Medicare)

- Federal income tax (FIT)

- FUTA tax

- SUTA tax

- State and local income taxes (if applicable)

FICA tax

The Federal Insurance Contributions Act (FICA) tax includes Social Security and Medicare taxes.

Social Security tax is 6.2% of each employee’s wages. You must withhold 6.2% of the employee’s pay from their wages.

As an employer, you must also contribute 6.2% for Social Security each paycheck. Social Security does have a wage base limit of $147,000 for 2022. This means that once an employee earns above this wage base, you and your employee must stop contributing to Social Security tax for the tax year.

Medicare tax is 1.45% of each employee’s wages. You must also contribute a matching 1.45% as an employer. Medicare tax does not have a wage base limit. However, you must withhold an additional 0.9% when an employee meets one of the following thresholds:

- $125,000: Married filing separately

- $200,000: Single

- $250,000: Married filing jointly

You do not need to contribute the additional 0.9% for Medicare tax— it is only for employees.

Altogether, FICA tax is 15.3% of your employees’ wages per paycheck, including both the employee and employer portion.

Federal income tax

FIT is different for every employee. The amount you withhold for an employee’s federal income tax depends on the employee’s Form W-4 withholding information.

You can calculate FIT by hand using IRS Publication 15. Or, you can use payroll software to calculate it for you.

Although employers don’t have to contribute to FIT, they are still responsible for withholding it from employees’ wages and giving it to the government.

FUTA tax

Federal Unemployment Tax Act (FUTA) tax is an employer tax. Do not withhold FUTA tax from employee wages.

You must pay FUTA tax if you:

- Paid $1,500 or more in wages during any calendar year

- Had at least one employee for part of a day in any 20 or more different weeks during the year

The FUTA tax rate is 6%. FUTA tax only applies to the first $7,000 you pay each employee in the calendar year. Stop paying FUTA tax on an employee’s wages once you pay the employee more than $7,000 for the year.

Employers can also receive a FUTA tax credit on their rate. The credit reduces your federal unemployment tax rate. The largest possible FUTA tax credit is 5.4%. Employers with the maximum credit only owe 0.6% on the first $7,000 of each employee’s wages annually (6% – 5.4% = 0.6%).

SUTA tax

State Unemployment Tax Act (SUTA) tax is state unemployment tax employers need to pay. Unless you are exempt (e.g., nonprofits), you must pay SUTA tax. Like FUTA tax, states set their own wage base limits (e.g., $7,000).

Each state has its own set of requirements and SUTA rates. Rates can vary depending on your industry, experience, and employee turnover.

State and local income taxes

Depending on your state and locality, you might need to withhold additional taxes from employee wages. Check with your local and state income tax departments for more information.

3. Finish or approve payroll

If you’re using payroll software, double check all of the information you have entered to make sure it’s correct. Misentering information can result in ongoing payroll problems. Once you’ve verified the information, you can approve your payroll.

If you’re handling payroll by hand, check over your calculations and payroll information.

Doing payroll by hand or using payroll software can both leave room for error. Because of this, it’s crucial to check your information before distributing wages.

4. Pay employees

After you approve or finish your payroll, distribute wages to your employees. As mentioned, you have multiple options for payment methods.

Regardless of your payment method, you should provide a pay stub to each of your employees. Pay stubs give employees a breakdown of their gross wages, withholdings, deductions, contributions, and more.

Ready to kick manual payroll to the curb? Patriot’s payroll software lets you streamline your payroll process. Pay employees with handwritten or printed checks. Or, take advantage of our free direct deposit. Get started with your self-guided demo today!

This article has been updated from its original publication date of April 14, 2017.

This is not intended as legal advice; for more information, please click here.