Structuring your company is one of the first and most impactful decisions you will make when starting your business. But, deciding the best business structure for small business can be a challenge.

Before you randomly pick a business structure out of a hat, get to know how each type of entity can affect your small company. Gather all the information about business entities before deciding on the best business structure for your startup.

Legal structure of a small business options

You have a few choices when deciding on your business entity. According to the IRS, there are five business structures to choose from:

- Sole proprietorship

- Partnership (general, limited, or limited liability partnerships)

- Limited Liability Company (single-member or multi-member LLC)

- Corporation

- S Corporation

The structure you select impacts everything from your tax liability to your personal liability. You must choose a structure before you can register your business.

What is the best business structure for small business?

There are many factors to consider when choosing a form of business. Use the following eight questions to help you decide the best company structure for small business.

1. What are the most popular structures for small business?

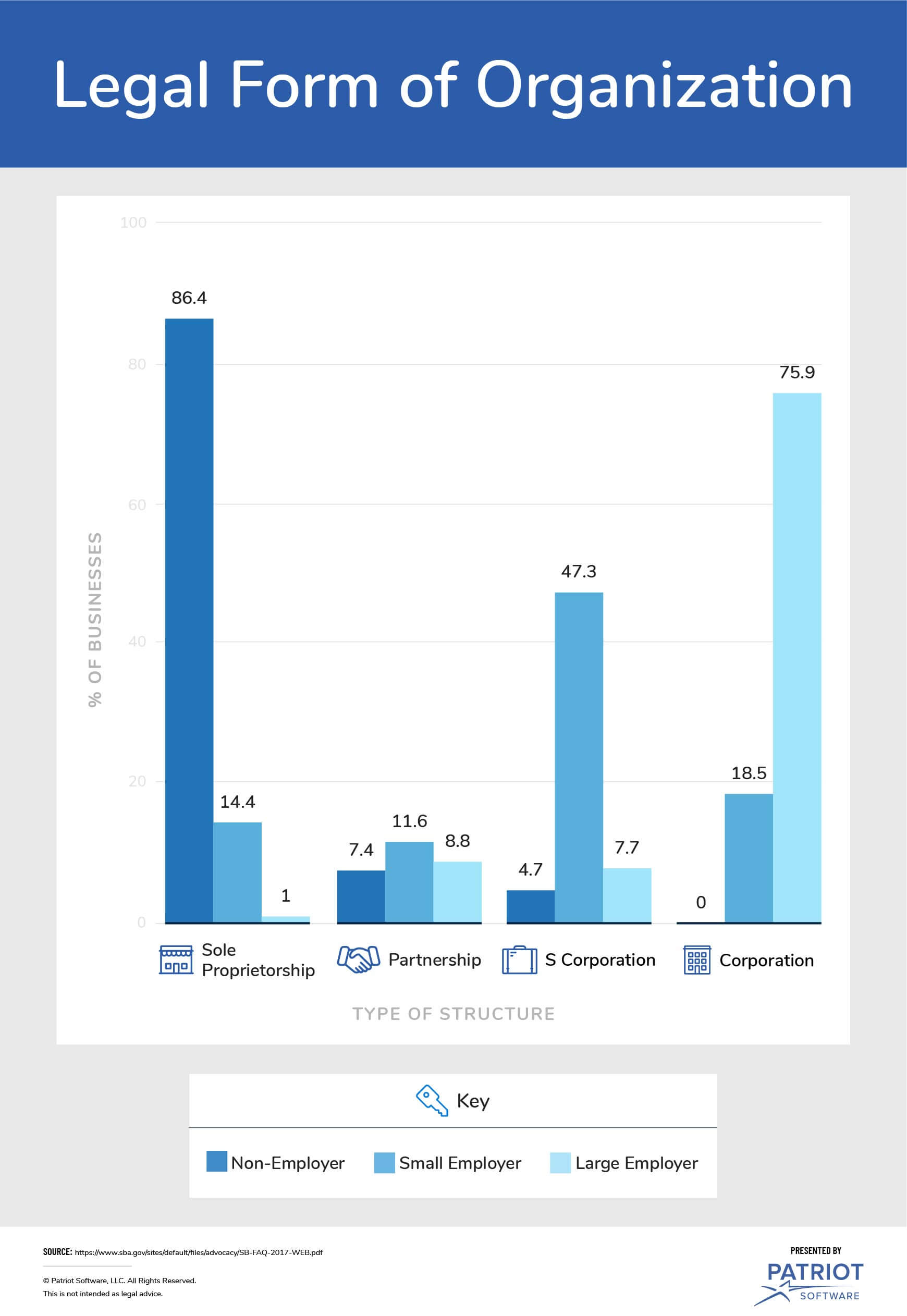

According to the Small Business Administration (SBA), business structure popularity varies based on how many, if any, employees you have.

The majority (86.4%) of non-employer businesses structure as sole proprietorships. Keep in mind that you can also be a sole proprietor with employees.

S Corps make up the majority (47.3%) of small employer businesses. Although the definition of small employer varies by industry, small employers are generally businesses with 500 employees or less. However, some companies can have up to 1,500 employees and still be considered small, according to the SBA.

When it comes to large employers, the majority structure as corporations (75.9%). Using the SBA size standards, large employer classification depends on the industry.

For more business structure statistics, check out this small business structure chart:

2. Are you starting your business with someone else?

Whether you are co-founding your business or not impacts the structure you choose.

If you are starting your business on your own, you can structure as a sole proprietor, single-member LLC, corporation, or S corporation.

If you are starting your business with someone else, you can structure as a partnership, multi-member LLC, corporation, or S corporation.

3. How important is limited liability to you?

Depending on the business structure you choose, your personal assets could be at risk if your business cannot pay debts.

To protect yourself and your personal assets, you might consider choosing a business structure that offers limited liability. Companies that have limited liability protection are seen as separate from their owners, meaning your personal assets (e.g., car, house) are not on the line. Generally, the extent of your financial liability is the amount you invested in your business. Creditors cannot come after your personal assets if your business is sued or cannot pay its debts.

If you choose a business structure that does not limit liability, your personal assets are not protected. However, you can obtain different types of insurance to help manage the risk of having no liability protection.

So, which business structures offer limited liability, and which don’t?

LLCs, corporations, and S corporations offer limited liability. Limited partners in limited partnerships and limited liability partnerships also enjoy limited liability protection.

Sole proprietorships and general partners in partnerships have no liability protection.

4. What kind of tax responsibilities do you want?

The type of structure you form impacts how you’re taxed and what tax returns you file. As a small business owner, you are responsible for paying taxes on business income. So, what is the best business structure for taxes?

Sole proprietors, partners, LLC members, and S Corp shareholders enjoy pass-through taxation. Pass-through taxation means your business does not pay taxes. Tax liability passes through your business, and you pay taxes at the personal level.

Because regular corporations are considered separate legal entities, you are typically taxed twice, owing personal taxes as well as corporate income taxes.

5. How do you want to pay yourself?

Understanding how to pay yourself from your business comes down to what structure you choose. As a small business owner, you will not receive a salary unless your business is incorporated. If you are not incorporated, you will receive a draw.

Unlike salaries, employee taxes are not withheld from draws. As a result, you are responsible for paying self-employment tax to cover Social Security and Medicare taxes. And, you pay estimated taxes.

If your business is incorporated and you are actively working in it, you will receive a salary. If you are not actively working in your corporation, you receive dividends. If your business is structured as an S Corp, you can receive both a salary and distributions.

6. What kind of control do you want?

The level of control you have over your business depends on the structure you choose.

Sole proprietors and single-member LLCs have complete control over how their businesses run. The general partner in a limited partnership might also have complete control.

If you co-found a business, you must share control with other partners, members, or shareholders according to your founders’ or partnership agreement.

7. Do you have the time and money to handle a complex structure?

Sole proprietorships are the easiest business structure to form. And, they have the least amount of government regulation.

Partnerships are also relatively easy to form. You can start a partnership with as little as a handshake. However, you should also draft a partnership agreement.

To form an LLC, you must file articles of organization with your state. You will likely pay a filing fee as well. And, you may need to fulfill other state-specific requirements, such as publishing an announcement in a local paper.

Corporations are the most time consuming to form. To form a C Corp, you must appoint directors and officers, file articles of incorporation, and issue stock certificates, among other things. And, you must pay fees.

To form an S Corp, you need to take an additional step after structuring as a corporation or LLC. You can elect S Corp status by filing Form 2553, Election by a Small Business Corporation, after incorporating.

8. What does your business vision look like?

Starting out, it’s easy to have tunnel vision. But when choosing a business entity, you must consider the future of your company. Otherwise, you may need to frequently switch business structures, which can be complicated or even restricted.

If you plan on major business expansion, a corporation might be the way to go. Although you can expand with other business structures, you may have more investors as a corporation.

Think about what you want to do with your business after you retire. Does your small business exit strategy involve transferring your company to someone else or closing your doors?

Generally, partnerships and sole proprietorships dissolve if the owners leave. But because LLCs and corporations are considered separate legal entities, the business continues even after you leave it. If you want your partnership or sole proprietorship to continue after you leave the business, consider selling your business.

Which business structure should you choose?

Every company is different, so there isn’t a standard best business structure for small business. Consider the above factors before deciding.

At a glance, here are the pros and cons of each filing structure:

Becoming a sole proprietor might be the right choice if you are going into small business ownership by yourself and want a simple business structure. Although you can enjoy pass-through taxation, keep in mind that you do not have limited liability.

If you are starting a business with at least one other person, you may opt for a partnership. Partnerships are similar to sole proprietorships in that they are easy to form, have pass-through taxation, and do not have limited liability.

For limited liability protection and pass-through taxation, you might decide to form an LLC or S corporation. Forming an LLC or S corporation requires more paperwork and startup fees, so be prepared to carve out a little more time and money for these structures.

Generally, larger businesses structure as C corporations. Under a C Corp structure, you can enjoy limited liability protection and a business that continues after you leave, but you are also subject to more complicated tax, filing, and management requirements.

This article does not constitute legal advice. You should consult a small business lawyer before structuring your company. A lawyer can help you select the structure that will best benefit your small business.

Regardless of how you structure your business, you need a reliable way to track transactions. With Patriot’s online accounting software, you can easily record income and expenses. Get your free trial today!

This is not intended as legal advice; for more information, please click here.