Whether you’re a startup or an established business, you need a consistent way to do your accounting. Take a look at the small business accounting checklist below to help you keep track of your financial tasks.

Starting your business

As a startup business, there are several tasks you must complete to begin operating.

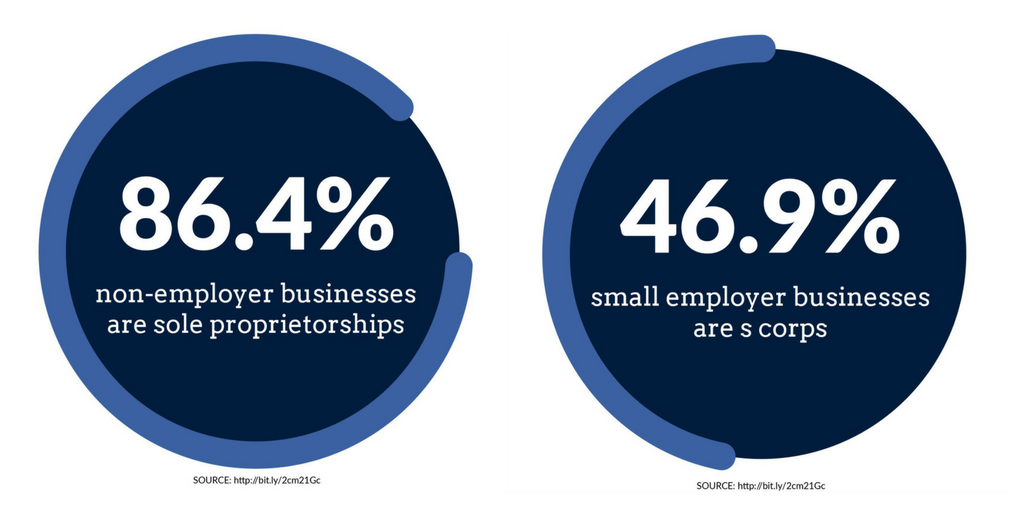

Choose a legal structure

Your legal structure determines many important factors for your company, including your tax liability. The following are the four major types of business structures to choose from:

Sole proprietorships are single-owner businesses. The owner and the business are considered the same legal entity. The owner must pay any business debts that the company can’t pay.

Partnerships have two or more owners. The owners are responsible for the business’s defaulted payments.

Corporations are considered separate legal entities from the owners. The owners are not personally liable for the business’s debt.

S Corporations separate the owners from the business, but only have one level of taxation.

Limited liability companies (LLCs) combine parts of corporations and partnerships. Owners are not personally responsible for business debts and share tax liabilities.

Get registrations and identification numbers

Depending on your location, you may need to register your business with your state. Contact your state’s department of revenue to find out if you need to register your business. Also, check for any business licenses or permits you must have for your industry or location.

You need to register your business for state and local taxes if applicable. After registering, mark down all deadlines for form and tax remittances.

You may need an Employer Identification Number (EIN) if you hire workers, withhold taxes, or run a corporation or partnership. These identification numbers are necessary for filing taxes. You can register for an EIN on the IRS’s website.

Select an accounting method

You need a to select a consistent method to do your accounting. There are two major accounting methods to choose from: cash-basis and accrual.

Cash-basis accounting is the simplest accounting method. You record all incoming funds when you receive money. You record all outgoing funds when you spend money. For example, you record revenue when a customer hands you cash for a product. You record an expense when you send a check to a vendor.

With accrual accounting, you record all incoming and outgoing funds when you incur them. For example, you record revenue when you invoice a customer. You record an expense when you receive an invoice from a supplier.

An easy way to record your business’s transactions is to use online accounting software. You can access the software program from anywhere with an internet connection. The software will compute totals for you and store your financial information.

Set up your business accounts

As a small business owner, it’s essential to separate your personal and business transactions. That way, you can avoid disorganized records, inaccurate tax filings, and overspending.

Open a separate business bank account that you only use for your company. Also, apply for a business credit card.

Your small business accounting checklist

Develop good accounting habits to keep your financial records on track. There are tasks you should complete daily, weekly, and monthly. Take a look at our small business accounting checklist to keep your finances in order.

Daily checklist

Review your cash. You should check the amount of cash you have on hand each day. Double-check each morning that you have enough to cover expenses.

Note transactions. Though you might not formally record transactions daily, you need to remember them. Keep your receipts for business expenses. Also, keep records for sales that you make.

Weekly checklist

Invoice customers. Make sure you send an invoice for every sale that requires one. Check for any unpaid invoices. If you have an overdue invoice, contact the customer or send an invoice collections letter.

Pay your invoices. Pay invoices and bills before their due dates. Follow the payment instructions on the invoice. If you have questions about the payment, contact your vendor. Pay attention to vendors who offer early payment discounts.

Pay your employees. If you have employees and it is payday, write employee checks. Withhold taxes and deductions from the paychecks. Deliver the paychecks to employees with a consistent method.

Record transactions. Throughout the week, keep copies of all your invoices, receipts, and payments. Record all incoming and outgoing money under the appropriate account in your books. Organize and file vendor information, new customer information, and payroll documents in your records.

Review your cash flow. Your cash flow measures the money coming into and leaving your business during a certain period. Project cash flow to ensure you can cover expenses the following week.

Monthly checklist

Balance your checkbook. At the end of each month, reconcile your bank statement with your accounting books. To do this, you match each line in your books to a line item on your bank statement. For example, your books say you paid the electric company $50. Make sure your bank statement shows a $50 withdrawal for the electric company.

Check your inventory. If you sell or use products at your business, count and record your inventory. Check for any damaged, expired, or missing inventory. If you need to, order more inventory.

Pay payroll taxes. You should pay payroll taxes on a monthly or semi-weekly schedule. You can use the IRS Publication 15 to determine your schedule. Remit tax payments to the appropriate government agency.

Review your financial statements. Your business’s financial statement can reveal a lot about your progress. Take a look at your reports to determine which parts of your operation are profitable and which slow you down. Statements include the profit and loss statement and balance sheet.

Other items to consider

You will also have accounting tasks to complete quarterly and at the end of the year. For example, you should close your books at the end of the year and pay quarterly taxes.

Review your financial statements each year to track progress and plan for the next year. The end of the year might be a good time to check in with your accountant.

| Year-end can creep up quickly. Download our FREE guide, Are Your Books Ready for Year-end?, to learn what to include on your year-end accounting to-do list! |

Do you need a simple solution for your small business accounting needs? Patriot’s online accounting software uses an easy cash-in, cash-out system. We offer free, U.S.-based support. Try it for free today.

This is not intended as legal advice; for more information, please click here.