One of your first choices as a business owner is your accounting method. Before making a decision, take some time to compare the cash-basis vs. accrual basis methods of accounting. Having to switch from cash-basis to accrual-basis after the fact can be difficult. The way you keep your books affects many aspects of your business, including taxes. One way you can record transactions is with the cash-basis method. What is cash-basis accounting?

Need a simple way to record your business’s transactions? Try Patriot’s online cash-basis accounting software so you can do your bookkeeping in a few simple steps. Start your free trial now!

What is cash-basis accounting?

Cash-basis is an accounting method you can use to track income and expenses. An advantage of cash-basis accounting is that it’s simple and usually doesn’t require extensive accounting knowledge. You report income when you actually receive it, and you report expenses when you pay them.

How it works: cash-basis accounting example

Like most tasks you do for your business, accounting requires some practice before getting the hang of it. But by using the cash-basis method, you can learn to record your books without a huge learning curve. Take a look at the following example of cash-basis accounting.

Bethany’s Flowers operates under the cash-basis accounting method. The shop receives roses from their vendor every Monday and is given an invoice for the amount due.The owner pays the invoice on Friday. That means the flowers received on Monday are not paid for until Friday. The expense is recorded on Friday since that is when cash was transferred.

Looking at income, a customer visits Bethany’s Flowers on Tuesday. They buy a dozen roses, which are to be delivered the following day.

He pays cash at the time of purchase. The business records the income on Tuesday since it was received that day. The day the flowers are delivered is not important.

Cash-basis accounting balance sheet example

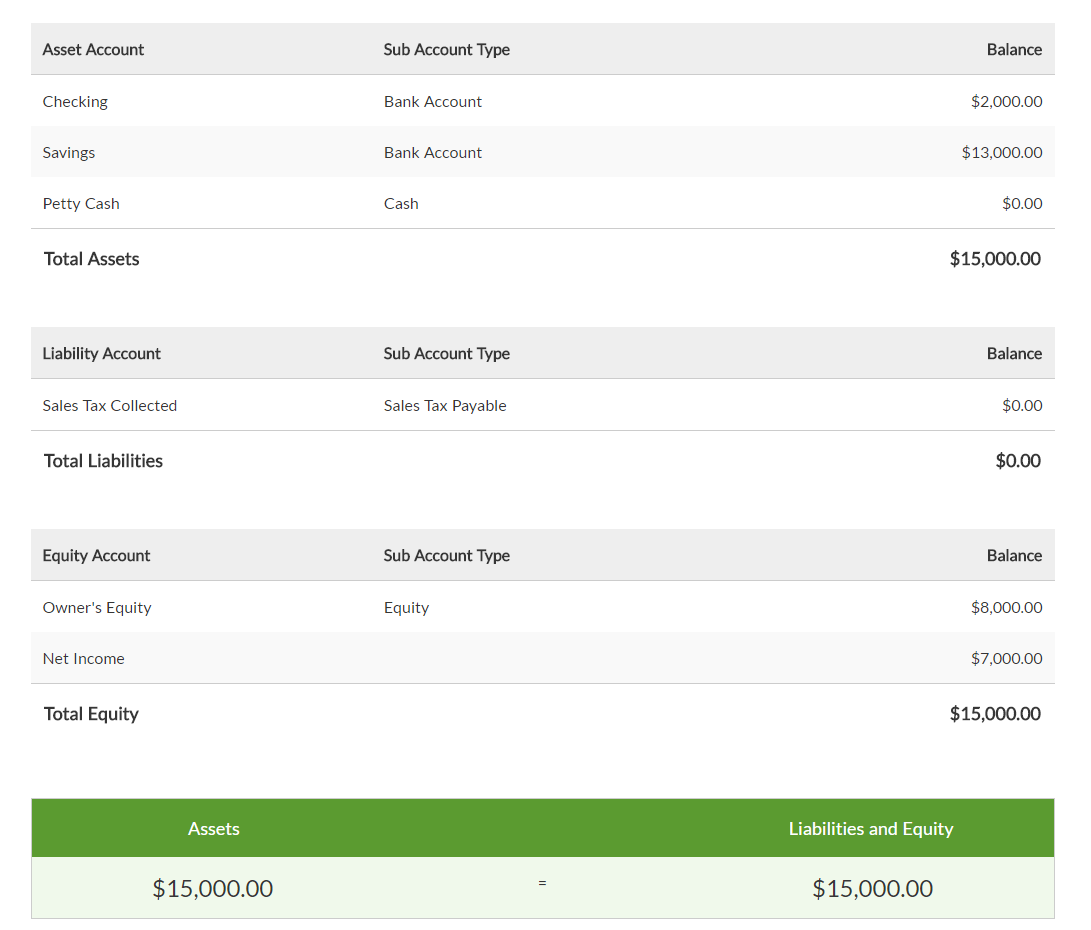

In accounting, you use financial statements to compile and review financial information. One important statement is the balance sheet. The balance sheet is a record of your business’s progress, giving you a snapshot of your financial condition.

When creating a balance sheet with cash-basis accounting, include three parts of your books: assets, liabilities, and equity.

Assets are items of value and include everything your business owns. You record assets on the left side of the balance sheet.

Liabilities include money your business owes. And, equity is what your business has left after paying debts. You can find out your equity by subtracting liabilities from assets. Liabilities and equity are recorded on the right side of the statement. The final balance of the assets should equal the total of the liabilities and equity.

If you use the cash-basis method, you will not record accounts payable, accounts receivable, or inventory on the balance sheet. That means unpaid invoices and expenses are not shown. You will need to record those items on separate documents.

Here is a cash-basis accounting balance sheet example:

Comparing accounting methods

Cash-basis is not the only method of accounting. Another major method of accounting is called the accrual method. When you’re filing small business taxes for the first time, the IRS is automatically informed of which method you will use.

Be sure to choose your method of accounting carefully. You need the IRS’s approval to change your accounting method. This request is made by completing Form 3115.

Accrual accounting

The accrual method is a little more difficult and time consuming than cash-basis. Accrual accounting differs from cash-basis because you record income and expenses at different times.

With accrual accounting, you record income when you incur it, not when you receive it. For example, you record income on the day you send an invoice to a customer. You might not receive the payment for 30 days, but the income is recorded in your books.

You record expenses when you incur them when using the accrual method. For example, you record an expense the day you receive an invoice from a vendor. Though it might be several weeks before the check is cashed, the expense is recorded.

Accrual accounting uses double-entry bookkeeping. You must record two offsetting entries for each business transaction you make. This is harder to do than cash-basis, which only requires one entry for each transaction.

Accounting methods and taxes

The method of accounting you use doesn’t just affect when you record transactions. It also affects your taxes.

At the end of the year, you might be able to defer income and make purchases to lower your tax burden. Depending on which accounting method you use, you might have to adjust your spending and invoicing.

With accrual accounting, a sale made on December 31 is income for that year, even if it’s paid the next year. That increases your taxable income for the year, making your tax liability higher.

With cash-basis accounting, you report income when you receive funds. In this case, you receive payment after December 31, so the income is reported on the following year’s tax return.

Why use cash-basis accounting?

Many small businesses benefit from using cash-basis accounting. Here are some advantages of the cash-basis method.

Cash-basis is less expensive

The costs of keeping your books with cash-basis are usually lower than other methods. You don’t need to buy expensive, complicated software or equipment to keep records. A simple, low-cost software program should work for recording transactions.

And, you don’t need to hire an in-house bookkeeper or pay expensive accountant fees. There is a small learning curve with cash-basis accounting, so you can easily record your books.

The cash method is designed for small businesses

Who can use cash-basis accounting? The IRS sets rules for which businesses can record with cash-basis. Larger businesses are not allowed to use the cash-basis method. You must have annual gross sales less than $5 million or less than $1 million in gross receipts for inventory sales to use cash-basis accounting.

You can see your cash available

As a small business owner, it’s crucial to know how much cash you have on hand. Since you record money as it enters or leaves your business, you get an accurate picture of your cash levels. This helps you track cash flow, avoid overspending, and plan for large purchases.

Need an easy way to record your business’s transactions? Patriot’s online accounting software uses a cash-in, cash-out system so you can do your bookkeeping in a few simple steps. We offer free, U.S.-based support. Try it for free today.