Recording transactions and keeping financial records are an essential part of owning a business. One way you can keep track of your finances is by using double-entry accounting. Read on to learn what is double-entry accounting and how it can benefit your books.

What is double-entry accounting?

Double-entry bookkeeping is an accounting method where you equally record a transaction in two or more accounts. A credit is made in at least one account, and a debit is made in at least one other account.

The double-entry bookkeeping method is based on the idea that every business transaction has equal and opposite effects on at least two accounts.

Double-entry accounting can help you:

- Make better financial decisions

- Catch and reduce bookkeeping errors

- See a clear snapshot of company finances

- Maintain accurate accounting records

Single vs. double-entry bookkeeping

Single-entry bookkeeping is very different from the double-entry method. Just like it sounds, you record one entry for every transaction with single-entry.

Single-entry accounting is less complex than double-entry accounting. With the single-entry system, you record cash disbursements and cash receipts. And, you record incoming and outgoing money in the cash book.

Cash-basis accounting uses the single-entry accounting method. Modified cash-basis and accrual accounting both use double-entry bookkeeping.

The general ledger and double-entry accounting

Post journal entries to your general ledger with the double-entry system of bookkeeping.

Your general ledger is a record that sorts and summarizes your business transactions. You can use your general ledger to see where money is coming from and where it is going. With a general ledger, you can also see the amount of cash you have on hand and how much debt your business has.

The general ledger organizes transactions into accounts. A company ledger typically has five major accounts, including:

- Assets: What your business owns

- Liabilities: What your business owes

- Equity: Assets minus liabilities

- Revenue: Money your business earns

- Expenses: Costs your business incurs during operations

You can also divide the major accounts in accounting into different sub-accounts. For example, you might use Petty Cash, Payroll Expense, and Inventory accounts to further organize your accounting records.

The general ledger reflects a two-column journal entry accounting system. Assets and expenses are on the left side of the ledger. Liabilities, equity, and revenue are on the right side. Both sides of the ledger should have equal balances.

Debits and credits

To balance your books, use debits and credits. Debits and credits are equal but opposite entries in your accounting books. If a debit decreases an account, you will increase the opposite account with a credit.

A debit is an entry made on the left side of an account while a credit is an entry on the right side.

Record credits and debits for each transaction that occurs. With double-entry in accounting, record two or more entries for every transaction.

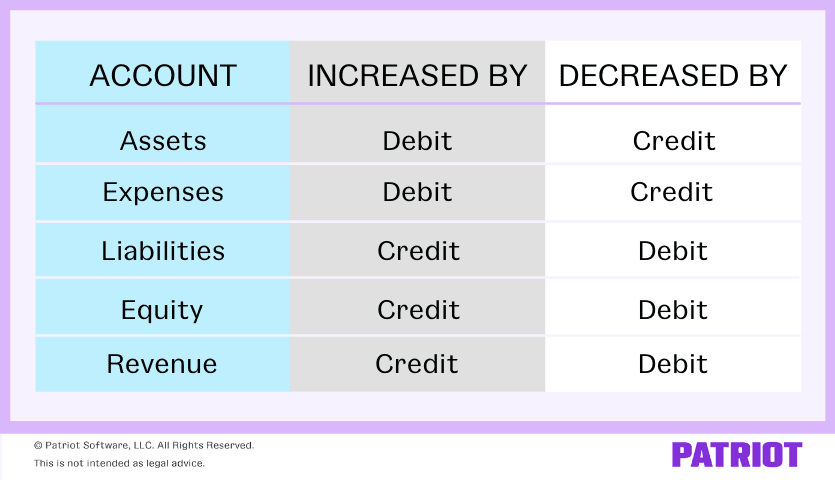

Credits and debits affect each account differently. Check out this chart to see how each type of account is impacted:

Keep in mind that debits and credits offset each other, and the sum of debits should be equal to the sum of credits.

Accounting equation

Use the accounting equation to ensure your transactions are always balanced in your books. The accounting equation shows that liabilities plus equity are equal to your assets. Here is the equation:

Assets = Liabilities + Equity

The entries in your books need to balance. If the two sides of the equation are unequal, you likely made some type of accounting error and need to find the mistake.

How to do double-entry bookkeeping

Dual entry accounting may seem intimidating at first. But with a little practice, you’ll be a pro at the double-entry accounting system in no time.

As you know, each time you record a transaction with double-entry bookkeeping, you need to create two entries.

When creating your two entries, determine which accounts are affected and how debits and credits affect them. Each time you record a new transaction, ask yourself questions like:

- Which accounts are affected?

- Is the account increasing or decreasing?

- Should I use a debit or a credit?

After you make all the entries for the transaction, check that your books are balanced.

Here’s a little cheat sheet to reference during your double-entry accounting duties:

| Debits | Credits |

|---|---|

| Always on the left side | Always on the right side |

| Increase assets | Increase liabilities |

| Increase expenses | Increase equity |

| Decrease liabilities | Increase revenue |

| Decrease equity | Decrease expense |

| Decrease revenue | Decrease assets |

Double-entry accounting examples

If you’re a visual learner, then boy oh boy do we have some great examples for you. Check out a few scenarios to see double-entry in action.

Example 1

Say you sell an item to a customer and the customer pays you in cash. The transactions impact your Inventory and Cash accounts. And, both accounts are assets.

Because your inventory is decreasing, credit your Inventory account to show a decrease in assets. Then, debit your Cash account to show an increase in cash.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Cash | Cash sale | X | |

| Inventory | X |

Example 2

For this next double-entry example, let’s say you bought inventory on credit. The inventory is an asset and the credit is a liability.

To record the transaction in your books, debit your Inventory account to show the increase in inventory and credit your Accounts Payable account.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Inventory | Purchased inventory on credit | X | |

| Accounts Payable | X |

Example 3

Say you buy a new computer with cash. Credit your Cash account to show a decrease in assets. And, debit your Technology account to account for the increase.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Cash | Purchase computer with cash | X | |

| Technology | X |

Does just the thought of recording transactions in your books stress you out? Well, stress no more. With Patriot’s easy-to-use and affordable accounting software, you can streamline the way you record income and expenses and get back to what matters most … your business! Try Patriot’s online accounting for free today!

This article has been updated from its original publication date of November 7, 2017.

This is not intended as legal advice; for more information, please click here.