Have you ever seen that tiny box on a W-2 form for statutory employees? Have you wondered, What is a statutory employee?

If so, you’re not alone. Many employers without statutory employees aren’t entirely sure what this classification means. But at one point, you may need to hire a statutory employee.

Statutory employee definition

A statutory employee is an independent contractor who qualifies for employee treatment. Employers withhold the employee portion of Social Security tax and Medicare tax from a statutory employee’s wages. And, employers contribute the employer portion of Social Security and Medicare taxes. However, a statutory employee is technically an independent contractor who works for themselves.

Employers are not required to withhold federal, state, or local income taxes from a statutory employee’s wages.

As a brief recap, you do not handle payroll taxes for independent contractors. However, you do withhold and contribute payroll taxes for employees.

Independent contractors owe double what employees owe for Social Security and Medicare taxes. Independent contractors pay Social Security and Medicare taxes in the form of self-employment tax. Self-employment tax essentially covers both employee and employer portions of SS and Medicare taxes. Employees are only responsible for the employee portion of Social Security and Medicare taxes.

For all of you already confused by the independent contractor vs. employee classification, a statutory employee is just another curveball. To help, think of a statutory employee as a mix between an independent contractor and employee.

Statutory employees are independent contractors who are permitted to be treated as employees when it comes to payroll taxes.

Do you need to treat a worker as a statutory employee? To answer that question, you need to understand whether the worker qualifies.

Who is considered a statutory employee?

Now that you can answer what is a statutory employee, you need to know who qualifies for the classification. All statutory employees are independent contractors. But, not all independent contractors are statutory employees.

The IRS requires employers to classify a very specific group of independent contractors as statutory employees.

According to the IRS, independent contractors who qualify for statutory employee status include the following:

- Agent or commission-based drivers: A driver who either distributes non-milk beverages or meat, vegetables, fruit, or bakery products; OR picks up and delivers laundry or dry cleaning. The driver must be your agent or paid on commission.

- Life insurance sales agents: A full-time life insurance sales agent whose principal business activity is selling life insurance or annuity contracts (or both), primarily for one life insurance company.

- Home-based workers: An individual who works at home on materials or goods that you supply (e.g., piece work). The materials must be returned to you or to someone you select. And, you must dictate how the work should be done.

- Traveling or city salesperson: A full-time traveling or city salesperson whose principal business activity is working on your behalf. The salesperson turns in orders to you from wholesalers, retailers, contractors, or operators of hotels, restaurants, or other similar companies. And, the goods sold must be merchandise for resale or supplies for use in the buyer’s business operation.

You may notice a pattern in the types of workers above: many either earn commission pay or use your business’s resources.

Do employers have to pay unemployment tax for statutory employees? Sometimes.

Statutory employees who fall under traveling or city salesperson and agent or commission drivers are subject to federal unemployment tax (FUTA).

Do you have to withhold taxes?

Withhold Social Security and Medicare taxes from statutory employees’ wages if all three of the following are true:

- The service contract states or implies that the worker substantially and personally performs all the services.

- The statutory employee does not have a substantial investment in the equipment and property they use to perform the services (exception: transportation facilities).

- The statutory employee continually performs the services for the same employer

Again, you are not required to withhold income tax from a statutory employee’s wages.

Filling out Form W-2 for a statutory employee

Independent contractors receive Form 1099-MISC. Employees receive Form W-2. Statutory employees also receive Form W-2.

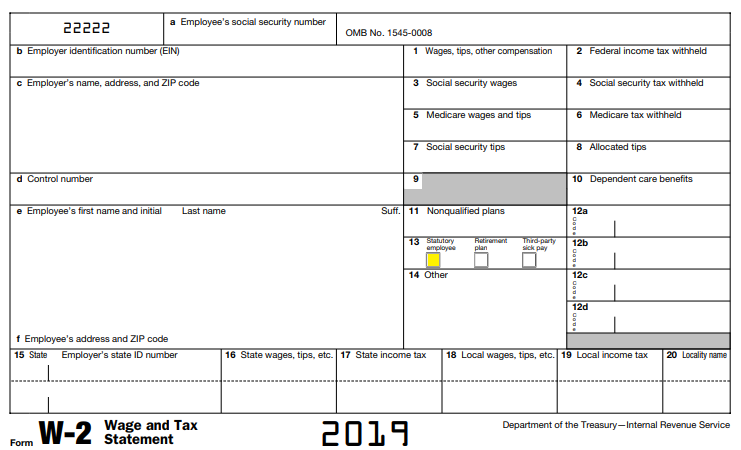

To fill out Form W-2 for a statutory employee, you must mark the small box under “statutory employee” in Box 13.

Statutory employee earnings are considered “other compensation.” Record the amount you paid the worker in Box 1.

Also enter the statutory employee’s wages that are subject to Social Security and Medicare taxes in Boxes 3 and 5. And, enter how much you withheld for these taxes.

Remember to send Forms W-2 to employees and statutory employees no later than January 31 each year.

After receiving their Form W-2, a statutory employee can complete their personal tax return. Statutory employees attach Schedule C, Profit or Loss from Business, to Form 1040. Unlike employees, statutory employees do not fill out Schedule A, Itemized Deductions.

Advantages of being a statutory employee

There are numerous statutory employee benefits for the worker. Statutory employees can reap both the benefits of being an employee as well as the advantages of being an independent contractor.

Statutory employees are only responsible for the employee portion of Social Security and Medicare taxes.

Because statutory employees file Schedule C instead of Schedule A, they are eligible for bigger tax deductions.

Some statutory employees may be eligible to receive unemployment insurance if they lose their jobs.

Whether you have employees, statutory employees, or both, you must run payroll. With Patriot’s online payroll software, you can print checks or use direct deposit, access expert support, and more. And if you opt for our Full Service payroll services, we’ll handle tax filings on your behalf. Ready to give our award-winning software a try?

This article has been updated from its original publication date of May 8, 2013.

This is not intended as legal advice; for more information, please click here.