As a small employer, you have all sorts of payroll taxes to worry about: income taxes, Medicare tax, and Social Security tax. But, what about unemployment taxes? Do employers have to pay unemployment taxes?

Do employers have to pay unemployment taxes?

In general, all employers have to pay unemployment taxes. Some exemptions exist, which are discussed later. Employers need to know about federal and state unemployment taxes.

Federal unemployment tax is mandated by the Federal Unemployment Tax Act (FUTA). FUTA tax pays for the federal government’s oversight of each state’s unemployment insurance program.

You must also pay for state unemployment insurance (SUI). State unemployment insurance pays out benefits to unemployed workers in your state. You also pay a tax for this, called SUTA tax or SUI tax.

Do all employers have to pay unemployment insurance?

Some exceptions might allow employers to disregard unemployment taxes.

For federal unemployment, you only need to pay FUTA taxes if:

- you paid wages of $1,500 or more during any calendar quarter during the current or previous year

- you had one or more employees for at least part of the day in 20 or more different weeks during the current or previous year

Organizations with section 501(c)3 status are exempt from FUTA tax. If you employ your parent or spouse, their wages are exempt from FUTA tax. And, if you hire your child, their wages are exempt until age 21.

Some businesses might be exempt from paying state unemployment tax. Each state sets its own exemptions, so make sure you check your state laws for details. States might exempt nonprofits, businesses that only have employees for a few weeks per year, and businesses with a handful of employees.

How much do employers pay for unemployment insurance?

Federal and state unemployment taxes have different tax rates.

How much is FUTA tax?

FUTA tax is only paid by the employer. Do not withhold the tax from employee wages.

The FUTA tax rate is 6% (0.06). Most employers receive the maximum FUTA tax credit of 5.4% (0.054) which reduces the tax rate to 0.6% (0.006).

FUTA tax is only paid on the first $7,000 each employee earns per year. This $7,000 mark is called the wage base. You do not owe any FUTA tax on employee earnings beyond $7,000 in a year.

If you have the maximum FUTA tax credit, your maximum tax payment per employee is $42 ($7,000 x 0.6%).

Some employers live in credit reduction states. This means your state borrowed money from the federal government to cover unemployment benefits, and the state hasn’t paid back the loan after two years. The credit reduction reduces the FUTA tax credit for all employers in the applicable states.

For example, if your state receives a credit reduction of 0.3%, your credit will become 5.1% (5.4% – 0.3%). This results in a FUTA tax rate of 0.9%. Because the tax credit is reduced, you must pay increased FUTA taxes.

To learn more about FUTA tax rates and credit reduction states, see the Instructions for Form 940 and Schedule A (Form 940).

How much is SUTA tax?

SUTA tax, like FUTA tax, is (generally) only paid by the employer. You should not withhold anything from employee wages for state unemployment insurance.

When you hire your first employee, you must register for an account with your state unemployment agency.

New employers start with an introductory unemployment tax rate. The new employer rates last for a set period, determined by your state.

After your introductory rate, your state will update your tax rate on an annual basis. Your SUTA tax rate depends on your state. Each state uses different methods to determine rates. The state will likely consider your industry and the number of unemployment claims your former employees filed.

Each state also has a wage base. This is the maximum amount of wages per employee that the SUTA tax is based on. For example, if the wage base is $10,000 for your state, only calculate the unemployment tax on the first $10,000 each employee earns per year.

If you have employees in multiple states, you must pay the unemployment taxes for each employees’ respective state. For example, if you have an employee who works in Maryland, you must register and pay unemployment taxes with Maryland. If you also have an employee who works in Virginia, you must also register and pay unemployment taxes with Virginia.

Do employees pay into unemployment insurance?

Most employees do not pay unemployment taxes. Do not withhold employee wages to put toward unemployment insurance.

However, employees in Alaska, New Jersey, and Pennsylvania are subject to state unemployment taxes. In these states, you will withhold the unemployment taxes and pay them to the state on behalf of your employees.

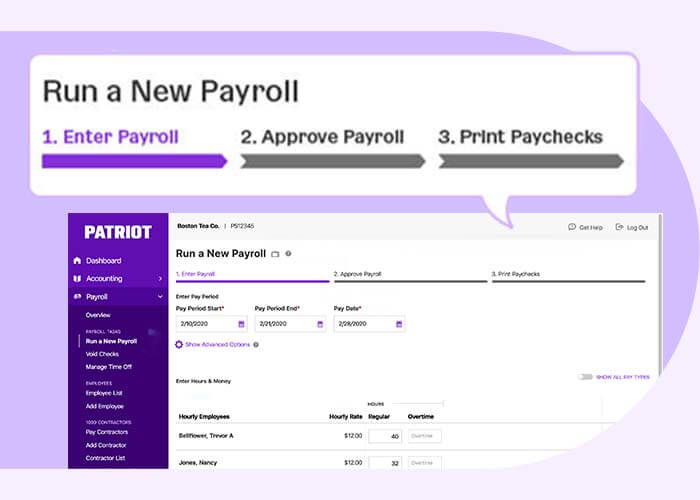

Want someone to handle all of this for you? Use Patriot’s online payroll services. After you give us your tax rates, we’ll calculate and remit your federal and state unemployment taxes. Start your free trial now.

This article has been updated from its original publication date of September 18, 2017.

This is not intended as legal advice; for more information, please click here.