If you operate a nonprofit organization, you may be eligible to apply for tax-exempt status, such as 501(c)(3) status. Learn what is 501(c)(3) status, types of 501(c)(3) organizations, and how to apply for 501(c)(3) status.

What is 501(c)(3) status?

Applying for 501(c)(3) status can be confusing for organizations. What is a 501(c)(3)?

Section 501(c)(3) of the U.S. Internal Revenue Code allows qualifying nonprofit or not-for-profit organizations to claim federal tax-exempt status. 501(c)(3) organizations are exempt from federal income tax.

Donations made to 501(c)(3)s are tax-deductible. Other benefits of 501(c)(3) status include possible exemption from state income, local income, sales, and property taxes. However, you may need to fill out separate applications for these additional exemptions.

To receive 501(c)(3) status, organizations must file an application with the IRS. And, the IRS must recognize the organization.

A 501(c)(3) organization cannot do the following:

- Use earnings to benefit private interest or individuals

- Overly participate in politics or political campaigns

- Influence legislation

501(c)(3) vs. 501(c)(4)

You may have heard of other types of nonprofit statuses, such as 501(c)(4) status. 501(c)(3) and 501(c)(4) organizations have many differences, including types of donations they accept, their purposes, and political participation.

Whereas 501(c)(3)s are nonprofits for charitable organizations, 501(c)(4)s are social welfare organizations. Unlike 501(c)(3) organizations, donations given to 501(c)(4)s are typically not tax-deductible.

501(c)(4) organizations can seek legislation and get involved in politics if it is necessary to the organization’s purpose. As mentioned, 501(c)(3)s cannot be overly involved in political activities.

Before applying, compare requirements to determine whether 501(c)(3) or 501(c)(4) status fits your organization.

Types of 501(c)(3) organizations

501(c)(3) organizations fall into two categories: public charities and private foundations.

A public charity is an organization that receives public support, supports other public charities, or completes testing for public safety.

A private foundation is an organization that does not receive funds from the general public. Many private foundations do not accept any donations. 501(c)(3)s are considered private foundations unless the organization falls into the public charity category.

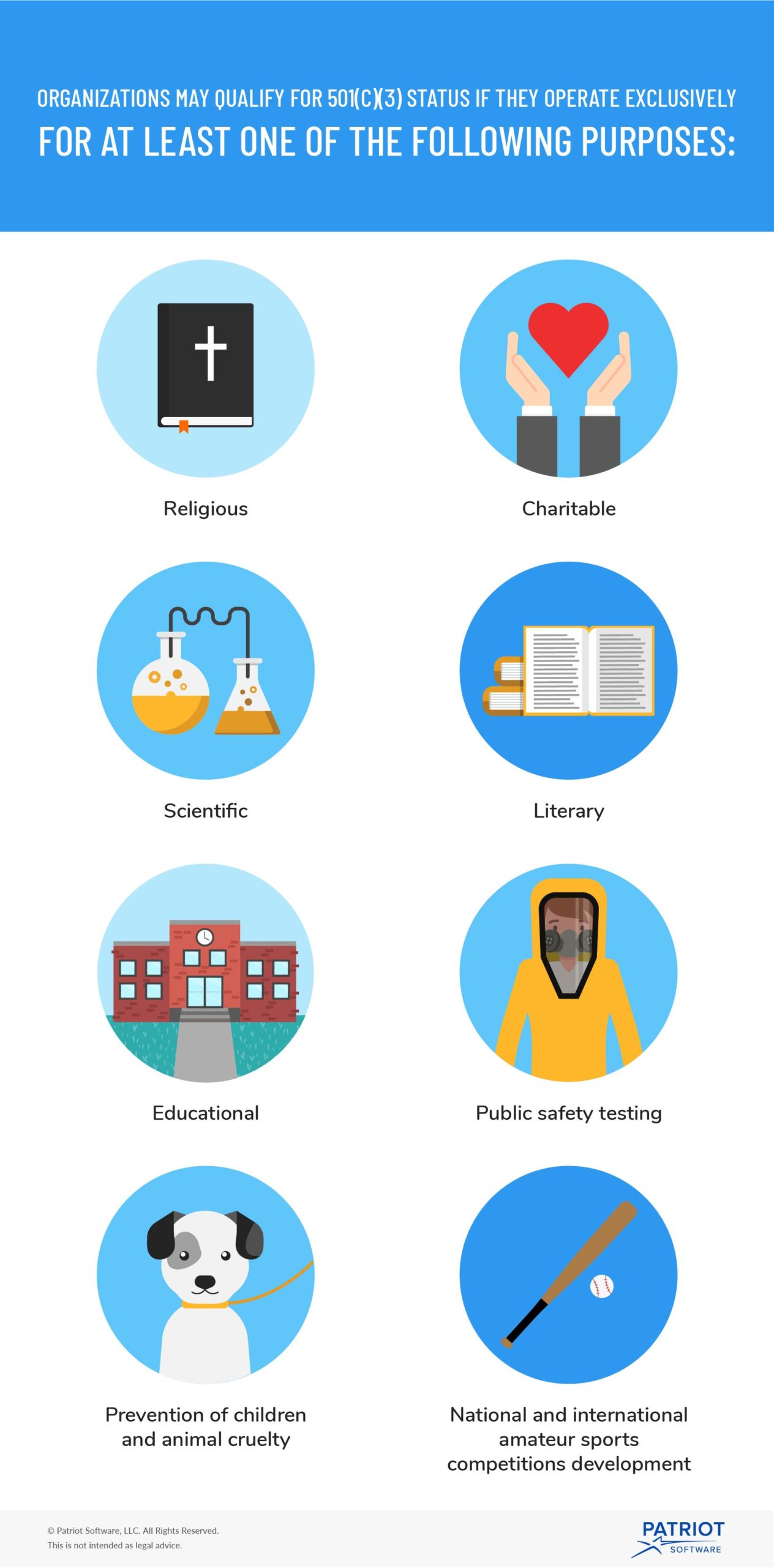

An organization may qualify for 501(c)(3) status if it operates exclusively for at least one of the following purposes:

- Religious

- Charitable

- Scientific

- Literary

- Educational

- Public safety testing

- Prevention of children and animal cruelty

- National and international amateur sports competitions development

Entities seeking 501(c)(3) status must also be a corporation, trust, community fund, or foundation.

Applying for 501(c)(3) status

You must complete a few steps to apply for 501(c)(3) status.

To apply for 501(c)(3) status, file Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. Smaller organizations may be eligible to file Form 1023-EZ instead.

Form 1023 must show that your organization only operates for at least one of the eligible purposes and meets IRS requirements.

When applying for 501(c)(3) status, include a copy of your articles of organization. Articles of organization may consist of your organization’s corporate charter or articles of association.

You must pay a fee to file Form 1023. Depending on the organization, the fee typically ranges from $400 to $750.

After filling out Form 1023, send it to the IRS. The approval process may take anywhere from two to 12 months. However, the IRS usually recognizes an organization as tax-exempt from the date of the postmark on their application.

To check the status of your application, contact the IRS directly.

Some organizations can have tax-exempt status without filing Form 1023 or Form 1023-EZ. These organizations include:

- Churches

- Church groups

- Organizations with less than $5,000 in annual gross receipts

Payroll taxes and 501(c)(3)

Typically, if an organization is exempt from federal income tax, it is also exempt from federal unemployment (FUTA) tax.

Although 501(c)(3) organizations do not have to pay federal income tax, they must still withhold federal income tax from employees’ wages.

A 501(c)(3) organization must withhold Social Security and Medicare taxes from an employee’s paycheck unless an employee is paid less than $100 in a calendar year.

Church or church-controlled organizations can apply for exemption from Social Security and Medicare taxes (FICA) using Form 8274. With Form 8274, qualified church organizations can opt not to pay the employer portion of FICA due to religious reasons.

Do you need a simple way to track your nonprofit’s transactions? Patriot’s online accounting software lets you easily record income and expenses. Try it for free today!

This article has been updated from its original publication date of August 4, 2015.

This is not intended as legal advice; for more information, please click here.