Here’s a payroll question: How do you differentiate between employees and independent contractors? It all depends on the relationship between the employer and the worker.

It’s important to properly classify workers, but it can be tricky. Here’s an example:

Joe runs his own construction business. Joe has committed to more construction jobs than he can handle, so he needs help. Joe asks Frank to work on one job site. Frank and Joe agree on a payment for the entire job. Frank does not earn extra wages for any overtime he works.

Joe provides all the tools and other supplies Frank needs. Joe shows Frank exactly how he wants the job done. While Frank is at work, Joe stops by periodically to check on him. At one point, Joe makes Frank redo a wall he’s constructed.

When the job is complete, Joe writes Frank a check for the agreed amount. At the end of the year, Joe sends Frank a Form 1099-MISC. Form 1099-MISC shows how much an employer pays an independent contractor.

Is Frank an independent contractor or an employee?

How to classify a worker as an independent contractor vs. employee

To determine if a worker is an employee or a contractor, you should use the economic realities test. This employer/independent contractor relationship test has six parts.

1. Is the work an integral part of your business?

If the worker provides services that your business also provides, the worker is likely an employee. If the worker provides an unrelated service, the worker is probably a contractor.

In the case of Joe and Frank, Frank does work that Joe also provides to clients. This means Frank might be an employee.

2. Does the worker’s managerial skill affect the worker’s opportunity for profit or loss?

If a worker’s wages only increase by working overtime, the worker might be an employee. If the worker uses his management skills to generate work opportunities and profit, the worker might be a contractor.

Frank does not have the opportunity to increase his profit by purchasing supplies. Joe provides Frank with everything he needs. Frank is likely an employee.

3. How does the worker’s relative investment compare to your investment?

If you invest more money into business than the worker does, the worker is probably an employee. If the worker makes significant financial investments to support business outside of a single job, he or she is probably a contractor.

Frank does not have to invest money in the job. Since Joe provides Frank with all tools and supplies, Joe’s investment is greater. This means Frank is probably an employee.

4. Does the work performed require special skill and initiative?

Special skills and initiatives typically refers to business skills. If the worker uses his or her own business skills to create job opportunities, the worker might be a contractor. If the worker relies on your business skills and initiative to create work, the worker might be an employee.

Frank relied on Joe to find and set up the construction job. Frank did not use any of his own business skills or initiative to create work for himself. This means Frank might be an employee.

5. Is the relationship between you and the worker permanent or indefinite?

If the worker works repeatedly or long term for you, the worker is likely an employee. But if the worker only does short-term work for you, the worker might be a contractor.

Frank only worked on one construction job for Frank. This could mean Frank is a contractor.

6. What is the nature and degree of your control over the work and worker?

If you control how the work is done, the worker is probably an employee. If the worker has freedom over how the work is done, the worker is likely a contractor.

Joe gave Frank specific guidelines to follow on the construction project. Joe checked in on Frank. Joe also made Frank redo some of the work. Since Frank did not have freedom over his work, Frank is likely an employee.

When you use the economic realities test, no one part by itself can determine if a worker is an independent contractor or an employee. You should consider all parts of the test together.

For example, Frank is likely an employee for five parts of the test, and a contractor for one. All parts of the test need to be considered together to determine Frank’s classification.

Independent Contractor vs. Employee Checklist

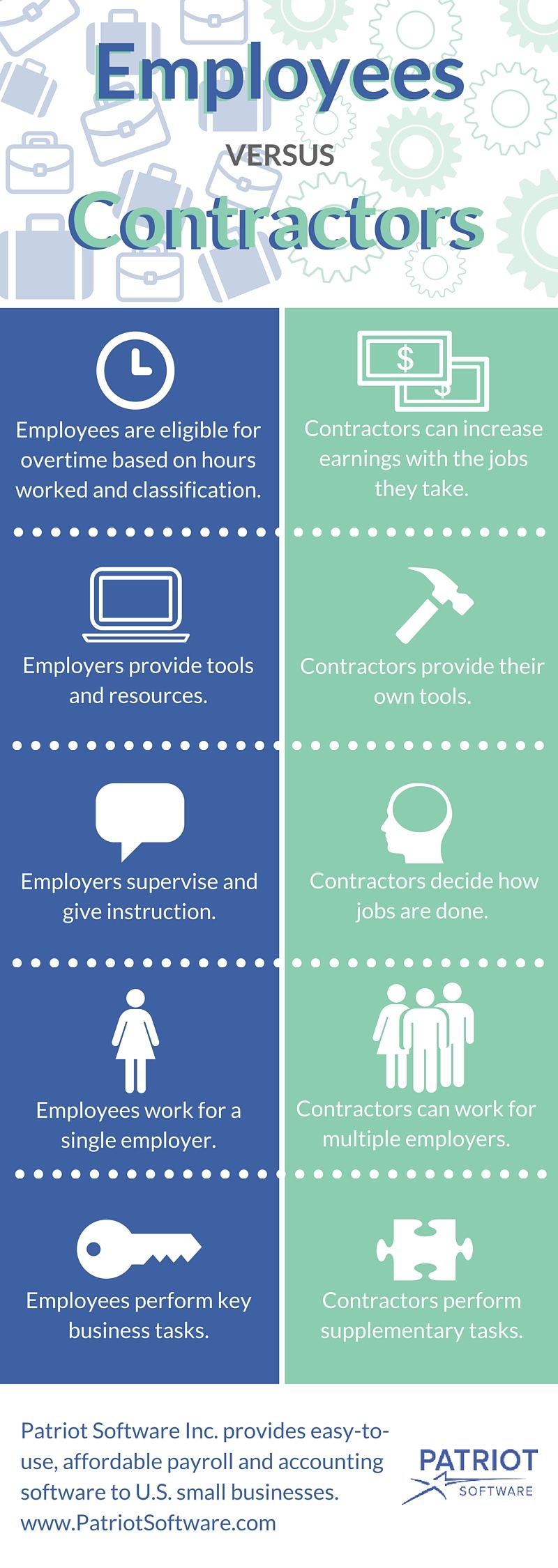

When it comes to independent contractors vs. employees, use this infographic to prevent worker misclassification.

Share Our Employees vs. Contractors Infographic on Your Site.

Why does classification matter?

If a worker is an employee, you are required to withhold payroll taxes from the employee’s paychecks. You must also deposit the payroll taxes. At the end of the year, you have to send the employee a Form W-2, which shows the employee’s wages and deductions for the entire year.

If a worker is an independent contractor, you do not have to withhold any payroll taxes from the contractor’s wages. The 1099 worker is responsible for sending in their independent contractor taxes. At the end of the year, you will send a Form 1099-MISC, which shows how much you paid the contractor during the year.

If you misclassify an employee as an independent contractor, you may end up owing back taxes and penalties.

Is Frank an employee or a contractor?

Joe should have set Frank up as an employee. Joe found the work, determined how it would be done, and provided tools and materials. Frank did work that Joe normally did.

When Joe ran payroll, he should have deducted payroll taxes from Joe’s wages. Also, Frank should have paid Joe for any overtime work. At the end of the year, Joe should have sent Frank a Form W-2, not a Form 1099-MISC.

Joe might be able to reclassify Frank through the Voluntary Classification Settlement Program (VCSP).

Need help running payroll for your employees? Try our payroll software. We’ll calculate payroll taxes for you. If you want, we’ll even make payroll tax deposits for you. Get a free trial today!

This article was updated on 11/19/2015 to reflect current information. (Original publish date: 5/27/2011.)