During day-to-day operations, you make transactions for your business. Knowing how to organize and review this information is key to long-term success. One way to keep track of transactions is to manage financial reports. What is financial reporting?

Financial reporting for small business

Financial reporting and analysis consists of the records you compile to track business funds. Use financial reports to see how well you manage money. Recognize items such as assets, liabilities, owner’s equity, income, and business expenses in your financial reporting standards.

Types of financial reports

Types of financial reports include:

- External statements

- Financial notes

- Quarterly and annual records

- Government reports

What are financial reports used for?

The purpose of financial reporting is to give you an in-depth analysis of your business’s performance. The reports help with business valuation, predicting future cash flow, and investment planning.

The transactions in your reports show the financial effects of your decisions. Some reports are for internal use while others are used by outside entities. Investors, lenders, and government agencies often look at your business’s financial reporting. You may need to implement internal controls over financial reporting for outside entities to ensure accuracy.

Use a consistent method for each report you prepare. That way, you can easily compare figures from different reports.

What is the difference between financial statements and financial reporting?

Financial reporting and financial statements are often used interchangeably. But in accounting, there are some differences between financial reporting and financial statements. Reporting is used to provide information for decision making.

Statements are the products of financial reporting and are more formal. Often, you use statements to communicate your financial health to outside entities. Prepare financial statements for each accounting period.

Small business financial statements examples

There are many kinds of financial statements. Here are three common statements small businesses use:

- Balance sheet

- Income statement

- Cash flow statement

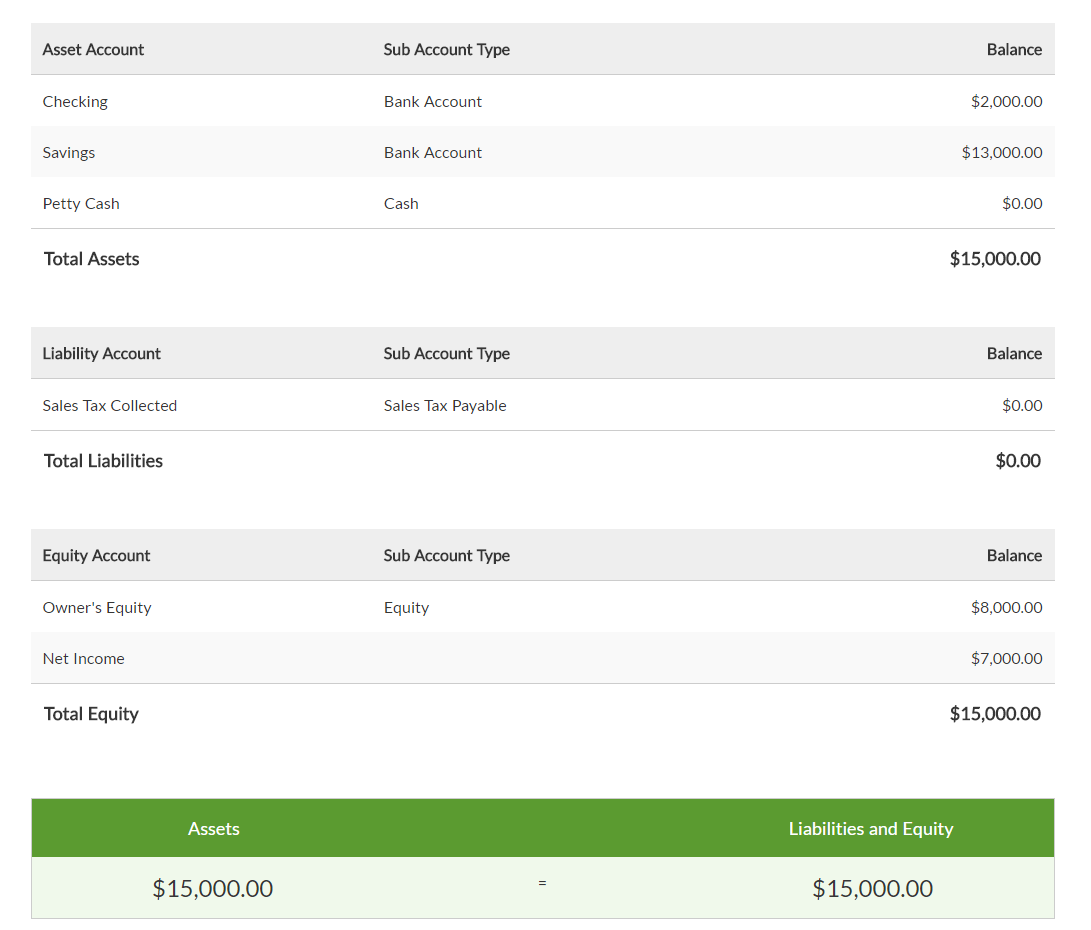

Balance sheet

The balance sheet gives a snapshot of your financial health for a specific period. You record assets, liabilities, and equity on the balance sheet. By looking at the balance sheet, you can see the net value of your business.

Income statement

The income statement measures performance over time. You record revenue, expenses, and net profit on the income statement. This statement tracks your business’s profitability.

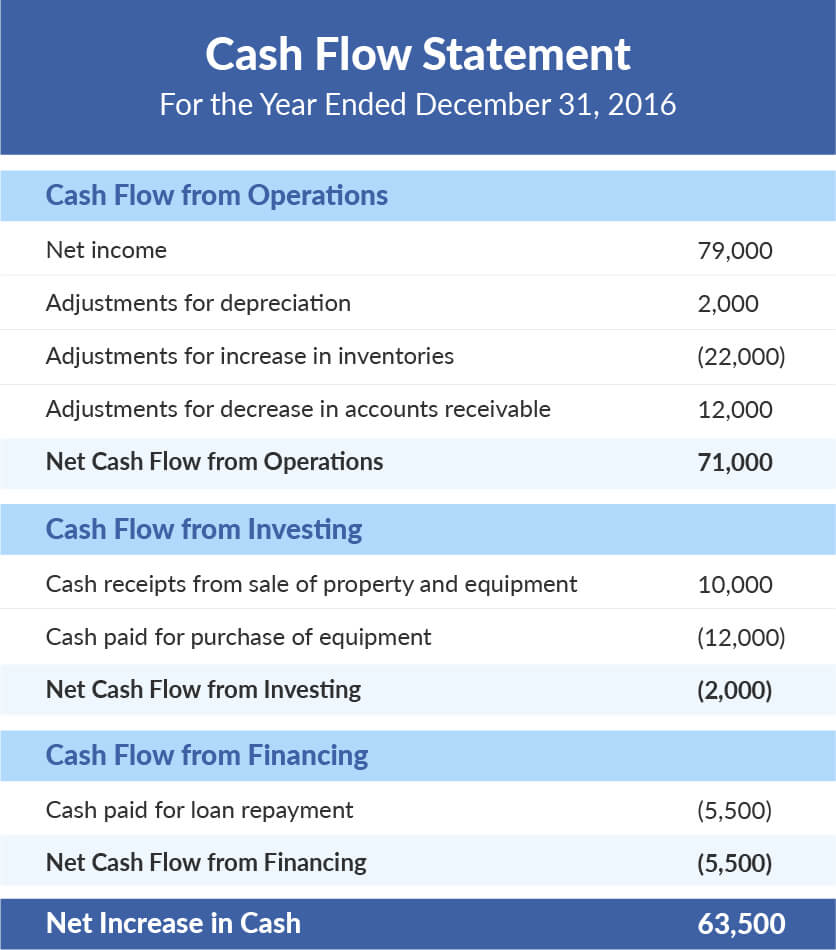

Cash flow statement

The cash flow statement shows how well you manage money. It reports incoming and outgoing cash as you receive payments and make purchases. Use the cash flow statement to make sure you have enough money on-hand to operate.

Key items to include in your financial reporting procedures

Getting into the habit of organizing financial reports is great. But, it doesn’t make sense to collect data and not use it. Calculate key financial ratios for small business and look at information on your reports to make decisions.

Ratios from your financial reporting system

The following are just a few insights you can get from financial reporting.

Operating Margin

The operating margin shows how much profit you take home compared to the total sales you make. In other words, it compares sales to net revenue.

Use the income statement to find your operating margin. Divide the operating income (before interest and tax expenses) by the net revenue (revenue minus expenses). Operating margin is shown as a percentage.

Debt-to-equity ratio

The debt-to-equity ratio compares how much you owe to how much you own. Use the balance sheet to find the debt-to-equity ratio. Divide liabilities by equity to see how much debt you have vs. how much equity you have. You want more equity than debt.

Working capital

Working capital is the amount of money you have after paying short-term debts. You use working capital to pay for daily operations. Use the balance sheet to find working capital by subtracting current liabilities from current assets. Another related and helpful ratio is the quick ratio. The purpose of quick ratio is to determine how easily your business can meet your short term debts.

How to create financial reports

The way you create financial reports depends on the kind of report you need. For all financial reporting, your first must decide the time frame you want to look at. And, you need to locate the appropriate information in your ledger.

Creating a balance sheet

Follow these steps to make a balance sheet:

#1. List the assets on the left side. Start with the current assets, or items that are converted into cash within one year. Then, list the non-current assets, which are items that take longer to convert into cash. At the bottom, add all the assets together.

#2. List the liabilities on the right side. First, list the current liabilities that will be paid within one year. Then, write the non-current liabilities, which take longer than one year to pay. Add the liabilities together and note the total.

#3. Under the liabilities, list the equity. Write down any stock or retained earnings you have. Add the liabilities and equity on the bottom right hand side. The sum of the liabilities and equity should equal the total assets.

Income statement

Follow these steps to make an income statement:

#1. List the revenues. This includes all your sales and the amount your business has before any deductions.

#2. List the cost of goods sold (COGS). The cost of goods sold includes expenses that go directly into your product or service.

#3. Note the gross profit. Subtract the COGS from the revenue to find the gross profit.

#4. List the operating expenses. These costs include things like payroll and overhead. Add these items together.

#5. List the amount paid in interest and taxes.

#6. Note the net profit as the bottom line. Subtract all expenses from the gross revenue to find the net profit.

Cash flow statement

Follow these steps to make a cash flow statement:

#1. List the operating activities. Operating activities include the income and expenses directly related to operating your business. Find the subtotal and list the amount as the net cash provided by operating activities.

#2. List the investing activities. Investing activities include cash paid or received from investments. Write the total of this section as the net cash provided by investing activities.

#3. List the financing activities. Financial activities include the inflows and outflows of cash from securities and debt issued by an organization. Call the total of this category net cash provided by financing activities.

#4. Sum up each section. Label each total as an increase or decrease in cash.

Financial reporting tools

You can use financial reporting tools to make statement creation easier. Basic accounting software compiles information from your books and generate accurate statements for you. If you use an online solution, you can access your reports from anywhere with an internet connection.

You can also use a simple spreadsheet to create financial reports. But, this could be more time consuming. And, using a spreadsheet raises the chance of errors on your financial reports.

What is financial reporting going to do for your small business?

Financial reporting gives you a clear view of performance. It creates transparency, which gives an accurate understanding of your business’s health.

You should be able to answer the following questions with financial reporting:

- Are your prices effective?

- Is your business growing (earning more than in the past)?

- Which customers spend the most?

Bookkeeping is not the most exciting part of owning a business. But, since you have to record transactions, why not take advantage of financial reporting? Set aside time each month to compile and review financial reports, and use what you learn to make smart decisions for your business.

Need a simple way to record your business transactions? Patriot’s online accounting software is easy-to-use and generates financial statements for you. We offer free, U.S.-based support. Try it for free today.