Every business owner must know if they have enough money to pay their business’s bills. Basically, your assets should be greater than your liabilities. But, knowing if you can pay your bills is a little more complex than seeing that your total assets are greater than your total liabilities. That’s why you should know how to calculate the quick ratio.

What is the quick ratio?

The quick ratio measures how well your business can meet its short-term financial liabilities. You need to have enough money to pay your accounts payable. The quick ratio shows you how many dollars of liquid assets you have available to pay your liabilities.

How to find quick ratio

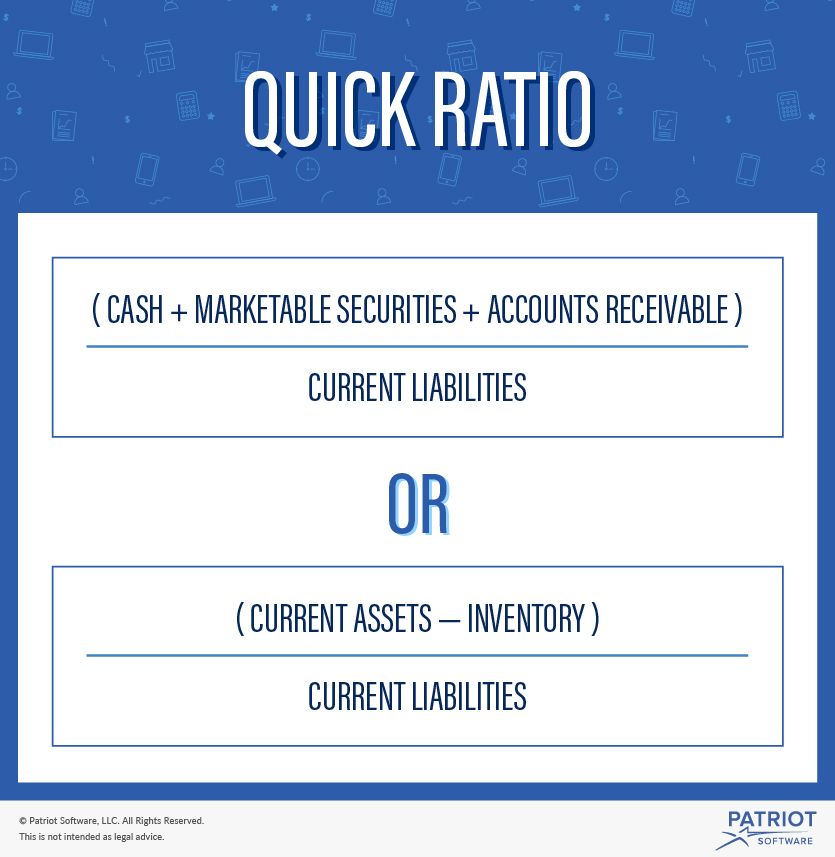

The quick ratio formula is:

(Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

An alternative formula for quick ratio is:

(Current Assets – Inventory) / Current Liabilities

You can find the information you need for the quick ratio formula on your business’s balance sheet.

Another name for quick ratio is the acid-test ratio. You might also hear it called the quick assets ratio.

Quick ratio vs. current ratio

The current ratio is another one of the many small business financial ratios you might calculate.

The quick ratio is similar to the current ratio. Both ratios compare your assets to your liabilities.

The quick ratio is more conservative than the current ratio. The quick ratio excludes non-liquid assets that cannot be easily turned into cash, such as inventory. These exclusions give a better picture of how well your business can pay back liabilities.

What does the quick ratio tell you?

Quick ratio interpretation can be difficult if you don’t know what the ending ratio means. A ratio of 1.0 means a business has $1 in liquid assets for every $1 of liabilities.

What’s a good quick ratio?

A good quick ratio is any number greater than 1.0. If your business has a quick ratio of 1.0 or greater, that typically means your business is healthy and can pay its liabilities. The greater the number, the better off your business is.

A high quick ratio means your business is financially secure in the short-term future. It also means your business has good growth and sales, and you are collecting your accounts receivable.

A low quick ratio can be concerning. It means your business has fewer liquid assets than liabilities. A low ratio might mean your business has slow sales, numerous bills, and poor collections for your accounts receivable. Keep your eye out for a decrease in quick ratio results, as that can signal a problem.

Quick ratio examples

Below are two examples of the quick ratio: one with a good ratio and one with a bad ratio.

Good quick ratio example

Here’s the balance sheet for Company ABC.

Company ABC

| Cash | $70,000 | Accounts Payable | $25,000 |

| Marketable Securities | $5,000 | Accrued Expenses | $20,000 |

| Accounts Receivable | $40,000 | Current Portion of Long-term Debt | $15,000 |

| Inventory | $60,000 | ||

| Total Current Assets | $175,000 | Total Current Liabilities | $60,000 |

Let’s use the main quick ratio formula: (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

($70,000 + $5,000 + $40,000) / $60,000 = 2.25

Company ABC has a quick ratio of 2.25, meaning the business has $2.25 of liquid assets for every dollar of liabilities. This business has a healthy quick ratio.

Bad quick ratio example

Here’s the balance sheet for Company XYZ.

Company XYZ

| Cash | $20,000 | Accounts Payable | $30,000 |

| Marketable Securities | $1,000 | Accrued Expenses | $25,000 |

| Accounts Receivable | $25,000 | Current Portion of Long-term Debt | $10,000 |

| Inventory | $50,000 | ||

| Total Current Assets | $96,000 | Total Current Liabilities | $65,000 |

Let’s use the alternative quick ratio formula: (Current Assets – Inventory) / Current Liabilities

($96,000 – $50,000) / $65,000 = 0.71

Company XYZ has a quick ratio of 0.71, meaning the business has $0.71 of liquid assets for every dollar of liabilities. The company might not have enough to pay its liabilities, especially if it has to do so quickly.

The downsides of the quick ratio

While the quick ratio is a good way to find out if your business can pay its liabilities, the ratio is not completely accurate for all businesses.

The quick ratio does not consider your invoice payment terms or how fast you can collect your receivables. The accounts receivable are less liquid at a business that gives customers 90 days to pay, as opposed to a business that only gives customers 30 days to pay.

The quick ratio also doesn’t account for losses. The quick ratio assumes you can collect all your receivables.

Your current cash flow affects your ability to pay liabilities too, but the quick ratio does not include that. Even if you have a lot of assets, a presently low cash flow might reduce your ability to pay off liabilities.

Even though the quick ratio can help you determine your business’s ability to pay liabilities, you should also look at your other financial numbers for a fuller picture.

Patriot Software’s accounting software will give you the reports you need to determine your business’s financial health. Start a free trial and begin viewing your reports today.