As a small business owner, you must know which forms to file. And if you’re a sole proprietor or sole owner, you need to understand the ins and outs of Schedule C. So, what is a Schedule C?

What is a Schedule C form?

Schedule C, Profit or Loss from Business, shows a business’s income and deductible expenses for the tax year. Attach Schedule C to Form 1040, U.S. Individual Income Tax Return.

The purpose of Schedule C is to report how much money you made or lost in your business during the tax year.

A sole proprietor must file IRS Schedule C. Sole proprietors are individuals who own and operate their own business. If you are the sole owner of a limited liability company (LLC), you must also file a Schedule C tax form.

In most cases, sole proprietors and single-member LLCs must also fill out Schedule SE, Self-Employment Tax. Complete Schedule SE if your sole proprietorship or single-member LLC earns $400 or more in net profits during the tax year.

Information needed for Schedule C

Before you can fill out and file Schedule C, you must gather some information.

To complete your Schedule C, you need the following:

- Profit and loss statement

- Balance sheet for the tax year

- Statements that show purchases of assets during the year (e.g., vehicles and property)

- Inventory information for cost of goods sold (if applicable)

- Details on travel, vehicle, meals and entertainment, and home office expenses

Also, provide your business name, type of business, address, employer identification number (or Social Security number), and which accounting method you use.

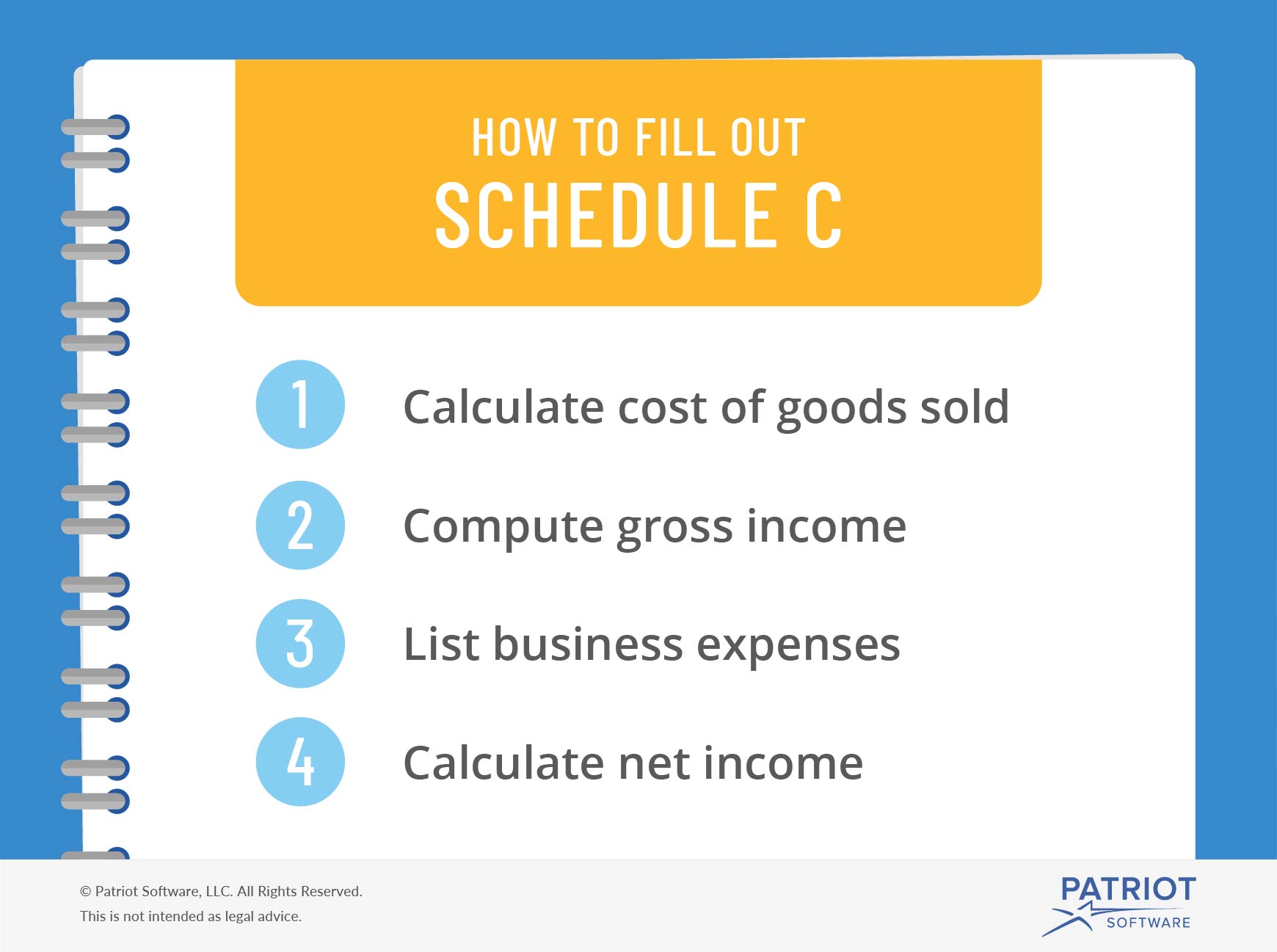

How to fill out Schedule C

Filling out Schedule C requires a few calculations and additional information about your business expenses. Use the following steps to help fill out Schedule C.

1. Calculate cost of goods sold

First, you must calculate your business’s cost of goods sold (COGS). To calculate COGS, you need your beginning inventory, purchases during the period, and ending inventory.

Calculate your COGS using the following formula:

COGS = Beginning Inventory + Purchases During the Period – Ending Inventory

2. Compute gross income

Along with calculating COGS, you must also calculate your gross income. To calculate gross income, use the following formula:

Gross Income= Revenue – COGS

3. List business expenses

Schedule C lists which business expenses you can deduct. Review which business expenses you had during the tax year.

Some expenses you can list include:

- Advertising

- Vehicle

- Employee benefits

- Interest on business debts

- Supplies

- Utilities

- Travel

- Home office

- Payroll expenses (e.g., wages, salaries, payroll taxes)

4. Calculate net income

Your final calculation for Schedule C is net income. To calculate your business’s net income, subtract total business expenses from gross income. Then, report net income on Schedule C.

Net Income= Gross Income – Total Business Expenses

How to file a Schedule C tax form

File Schedule C along with your individual tax return, Form 1040. And, don’t forget to calculate your self-employment tax based off your net income on Schedule C (if applicable).

You can mail Schedule C to the IRS. Or, you can e-File your Schedule C form.

If you make an error on Schedule C, you must correct it. Use Form 1040X to file an amended personal tax return after correcting your Schedule C form.

When to file Schedule C

The business tax return due date depends on your type of business structure.

Sole proprietors and single-member LLCs must file Schedule C by April 15 each year. Attach Schedule C to your individual tax return.

Check with the IRS for more questions regarding rules to follow while filing your Schedule C form.

Reduce the stress of filing Schedule C with updated and accurate books. Patriot’s accounting software makes it easy to record transactions, track expenses, and more. Start a free trial today!

This is not intended as legal advice; for more information, please click here.