In your everyday life, bad habits can cause problems. You might do things poorly or waste time. You might not do the best work that you can do.

The same is true for your business’s bookkeeping. Your bad habits can cause bookkeeping problems. You will do bookkeeping poorly and possibly have financial issues.

You need to eliminate your bookkeeping bad habits to avoid causing errors in accounting, but first you need to recognize what they are.

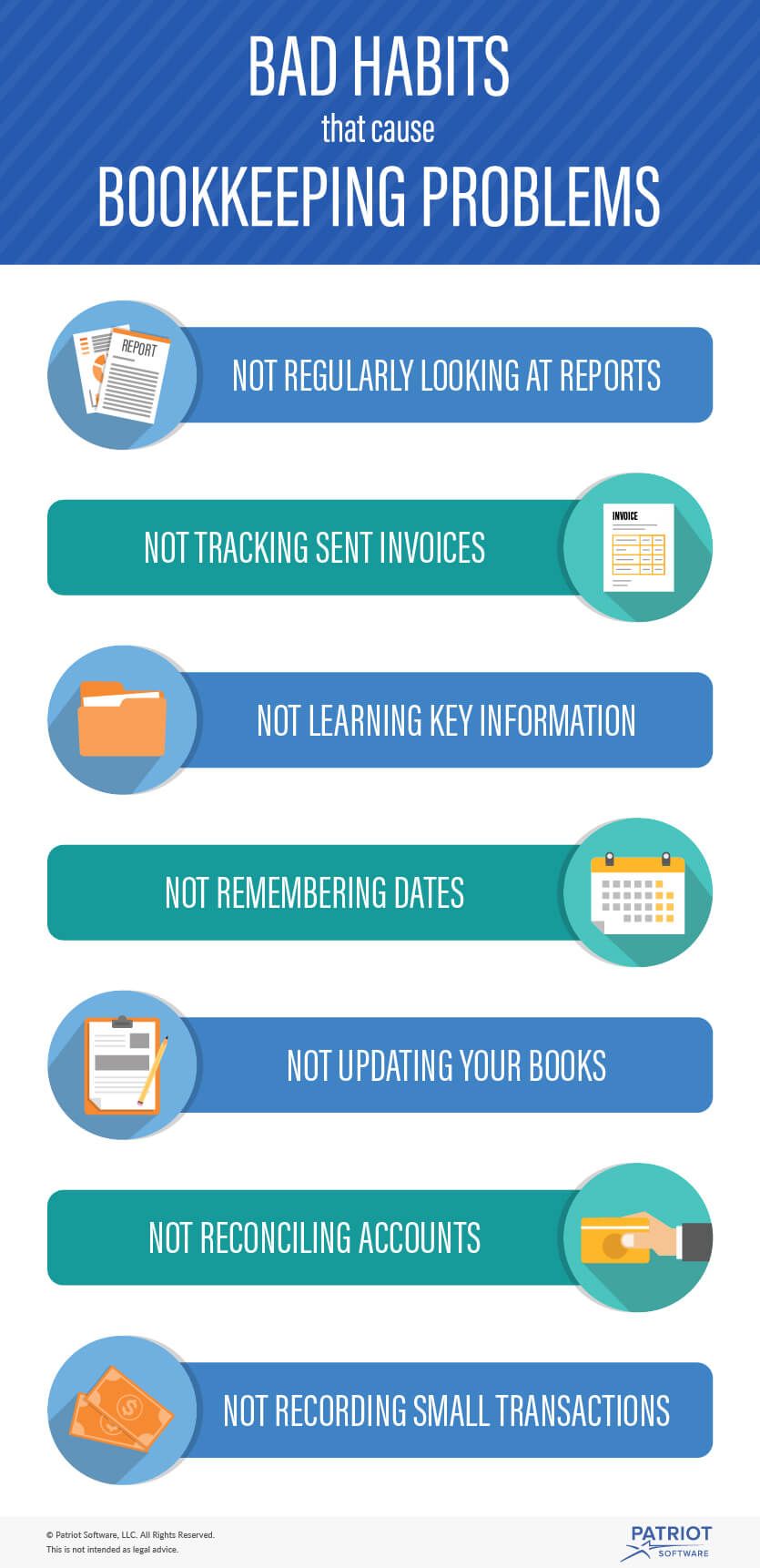

7 habits that cause bookkeeping problems

Removing bad habits will improve your business’s financial records. Let’s take a look at your potential bookkeeping problems and solutions.

1. Not regularly looking at reports

You can create many types of reports from your business’s financial information. But, your reports are useless if you don’t constantly look at them.

Make a habit of regularly looking at your small business financial reports. Set a schedule of how often you will look at them. For example, you might look at your income statement at the end of every month.

You should also consistently look at the same reports. Let’s say you look at your income statement every month. You shouldn’t all of a sudden stop looking at it and begin looking at a different report in its place.

Every report has different information and can help you make different decisions. You should examine the same reports over time to see how your business’s financial health is faring. If you don’t constantly look at the same reports, you could make decisions based on inaccurate knowledge.

2. Not tracking sent invoices

You must keep track of invoices. Your customers are how you get paid. If you aren’t paying attention to who paid you, your business will lose money and you’ll experience problems in accounting. You cannot ignore your invoices.

It’d be nice if every customer paid you as soon as they receive an invoice from you. But, unfortunately, they won’t. You will have to follow up with some of them.

That’s why you have an aging of accounts receivable report. The report will show you which invoices are paid, which are currently due, and which are past due. You can’t ignore your invoices and hope customers pay. You must actively track who has paid and reach out to those who still owe you money.

Start looking at your aging reports. On a regular basis, find out who still owes you money and follow up with them. Send them a reminder about their remaining balance.

3. Not learning key information

When it comes to accounting for small business owners, you have to grasp the core concepts. To do accounting, you must have a basic understanding of common terms, formulas, and reports. If you don’t understand these things, you might do your accounting incorrectly.

Doing your accounting in ignorance is a bad habit. Your accounting process will be slow and inaccurate.

Brush up on some accounting basics. Learn the most common accounting terms. Teach yourself how to use basic financial ratios. Look at financial statements and learn what to use them for. When you understand the parts of accounting, you can more successfully manage your own books.

4. Not remembering dates

Keeping track of dates is extremely important in business. You must know when to pay your bills and when a customer’s payment is overdue. You must also know when it’s time to review your financial statements.

Forgetting dates can lead to bookkeeping problems. If it helps you, write down the dates for your accounting tasks. Stick them on your calendar or set reminders on your computer. Include the dates that taxes are due and when you should examine certain reports.

5. Not updating your books regularly

Updating your books can take some time. But, it’s a task you shouldn’t put off. Not updating your books on a regular basis can lead to accounting problems.

If your books aren’t up to date, you cannot see your current numbers. You can’t see how much money your business actually has because the numbers are old.

Regularly set aside time to update your books. For the most accurate numbers, update your records every day.

6. Not reconciling accounts

Your books must be accurate, otherwise you will have accounting mistakes. You must record all your transactions to see the real picture of how your business is doing.

You should regularly reconcile your books. This means you cross check your books with other financial records to make sure everything matches. Compare your books to your bank statements, checks, receipts, invoices, and sales slips.

If you don’t reconcile your books, you might forget a transaction. Even missing one record will make your books inaccurate.

7. Not recording small transactions

You must record every transaction you make, no matter how small it is. Get into the habit of recording transactions soon after you make them so you don’t forget about them.

Those small transactions add up. Let’s say you spend $20 of petty cash one day and spend $10 another day. It’s easy to put those small cash amounts out of your mind. But, your business now has $30 less than it had before.

Even the smallest amounts can put your books out of balance. Over time, your business will be missing more and more money, but without any record of where the money is going. To completely know how your business is doing financially, you need a record of every cent that comes in or goes out.

For a simple way to do your accounting, try Patriot Software’s easy-to-use accounting software. You can enter all your numbers and view basic statements to see how your business is doing. Start your free trial now!