Whether you’re a startup or have been in business for years, you may be considering applying for outside funding. This could include receiving small business loans, obtaining investors, or applying for grants. Small business grant funding can be the most complex, but most desirable, option. So, what are small business grants, and what should you know before applying for one?

Keep reading to find out:

- What grants are

- Differences between grants and other types of funding

- Grant sources you can use

What are small business grants?

To understand small business grants, you need to know what grants are. A grant is money given to a person, organization, or business by another organization or the government for a specific purpose. You do not need to pay back grant funding, so many consider grants to be “free money.” Instead, think of a grant as a gift in the form of funding.

Because grants are free funds, you do not put your credit or assets at risk if you do not pay them back. Generally, grantors also do not check your personal or business credit.

Small business grants are funds given to small businesses for specific purposes (e.g., starting a business). The purpose of the grant varies based on the type of grant.

Some grants have specific rules regarding how you can use the funds and if you must report to the grantor how you use them. In rare cases, grantors may require you to repay the grant if you do not adhere to the rules of the grant.

What to keep in mind when looking for grants

Grants are unique funding opportunities for businesses. Before you commit to applying for a grant, gather together information about your business, including:

- Your business’s name, industry, and location

- Financial reports and documents

- Federal employer identification number (FEIN)*

- Project details

*If you do not have an FEIN, you may use your taxpayer identification number (TIN).

Some applications require more information than others. Review the requirements before beginning the application process. And, keep in mind that many grants have deadlines. Review the deadline and determine if you have the time to submit a grant application before applying.

If you decide to apply for small business grant funding, consider taking courses in grant writing or hiring a grant writer. Knowledge of how to write a grant application may increase your chances of getting the funding you need.

Who offers small business grants?

If you want to apply for grants, you have several options available. However, grants can be highly competitive and limited. How to get a small business grant may depend on meeting specific criteria, like being:

- A startup

- Woman-owned

- Minority-owned

- From a specific state or region

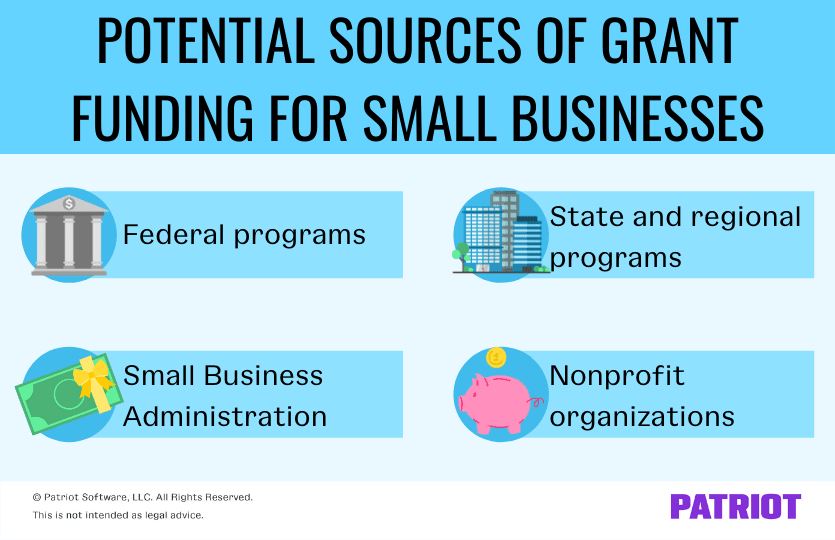

Potential grant funding opportunities for your business include:

- Federal programs

- Small Business Administration (SBA) grants

- State and regional programs

- Nonprofit organizations

Federal programs

The federal government offers various grants through different agencies, such as the Department of Commerce or Department of Agriculture. You must meet specific eligibility criteria to apply for federal business grants. Eligibility requirements vary by agency and grant.

In general, your business must not be classified as an SBA small business to apply for federal grants (and we’ll get to that in a minute). To check your eligibility, register with the federal Grants website. If you qualify, search through the available grants and select which grants meet your needs.

SBA grants

Who offers federal small business grants? Government grants for small business are only available through the Small Business Administration. Size standards vary by industry, but the general range is:

- Between or below 50 and 1,500 employees AND

- Between or below $1 million and $41.5 million in gross receipts

SBA grants do not provide funding for starting or expanding businesses. If you need funding to start or grow your business, you cannot apply for an SBA grant.

SBA small business grants provide funding for:

- Scientific research and development*

- Providing management and technical assistance or guidance to eligible small businesses

- Nonprofits

- Resource partners

- Educational organizations that support entrepreneurship through counseling and training programs

*The SBA programs for scientific research and development are federal grants. The SBA grant application varies by program.

In 2021, Economic Injury Disaster Loans (EIDL) recipients may be eligible for the SBA EIDL grant worth up to $15,000. The EIDL grant 2021 is an advance payment similar to a grant but does not have the same requirements as a federal grant. And, the EIDL grant is different from the COVID-19 small business grant options that were available.

Check out the SBA’s grant funding information page for more information.

State and regional programs

Some grantors limit funding to specific states or regions. Eligibility requirements also vary by state or region.

You can search for community foundations in your area or your state’s grant or foundation directory. Also, consider checking your state’s website for funding opportunities.

Your state or region may have more strict requirements for funding. Read through the terms and conditions of the grant before applying, especially if you obtain other funding.

Nonprofit organizations

A popular choice for businesses seeking grant funding is a grant from a nonprofit organization. Why? Nonprofits may have more grant funding opportunities to meet your business’s specific needs.

For example, a nonprofit may have new business grants or funding specifically for business growth. If you’ve exhausted all other grantors, a nonprofit may allow you to apply for funding that you can use with fewer restrictions.

However, nonprofits may also require more work from you and your business. For example, nonprofits can require detailed post-grant information regarding how you use the funds. And, they can limit the amount of time you have to spend the funds.

Generally, you cannot ask for an extension on the length of time you have to use the funds. Some nonprofits may require you to return any unused funds to the organization.

Check out the Council of Foundations foundation locator tool to search for grant opportunities.

Differences between grants and other funding

As a business owner, you have a few options available when seeking funding for your business. Popular options include:

- Loans

- Venture capitalists

- Investors

Loans

When seeking small business funding, you may look into loan options. The biggest difference between grants and loans is that recipients must repay loan funding. Failure to repay the loan results in consequences such as:

- Decreased business credit scores

- Increased interest payments or other penalties

- The lender taking possession of items the business put up as collateral for the loan

- Payments being sent to collection agencies

- Denial of future loan applications

One of the biggest advantages of loans is that they are not as competitive as grants. The application process for loans involves lenders evaluating the trustworthiness of your business to determine if you will pay back the loan. Because loans are not very competitive, they are generally easier to get than grants.

Typically, you do not compete against other businesses for loan funding. However, there may be some competition depending on how much funding the lender has available for a specific loan program (e.g., Paycheck Protection Program funding).

Venture capitalists

A venture capitalist (VC) is an individual who offers funding for your business in exchange for a percentage of ownership. If you have a high-growth business, you may consider a venture capitalist. Keep in mind that VCs become limited partners in your business if you accept their funding and terms.

The biggest difference between grants and funding from a VC is that grant funders do not require any ownership in your business in exchange for the funds. An advantage to a VC is that you can negotiate the terms. Grantors tend to have strict rules and guidelines for using the funds, which means you cannot negotiate the terms.

Investors

Like with venture capitalists, investors give funding in exchange for a percentage of ownership in your business. Unlike VCs, the terms for investors tend to be lower-stake, including the percentage of ownership. And, you repay the investor with dividends as you earn a profit.

Investors can be individuals like:

- Family members

- Friends

- Community members

Grants and investors are both generally challenging to find and obtain. But, investors can be difficult because they use their personal funds to help your business. If you locate an investor, set clear terms that give the investor an exit strategy should anything happen to your business.

Are you applying for grants and need financial data for your application? Did you receive grant funding and need an easy way to account for how you spend the funds? Patriot’s online accounting software makes it easy to pull reports, enter data, and track your business’s spending. Try it free for 30 days today!

This is not intended as legal advice; for more information, please click here.