You’ve finally come up with the perfect business. Now, it’s time to structure it. And if you’re torn between sole proprietorship vs. LLC (limited liability company) you might be wondering what business entity best fits your needs.

What is the difference between sole proprietor and LLC? This guide will explain the differences and what they mean for you and your business idea.

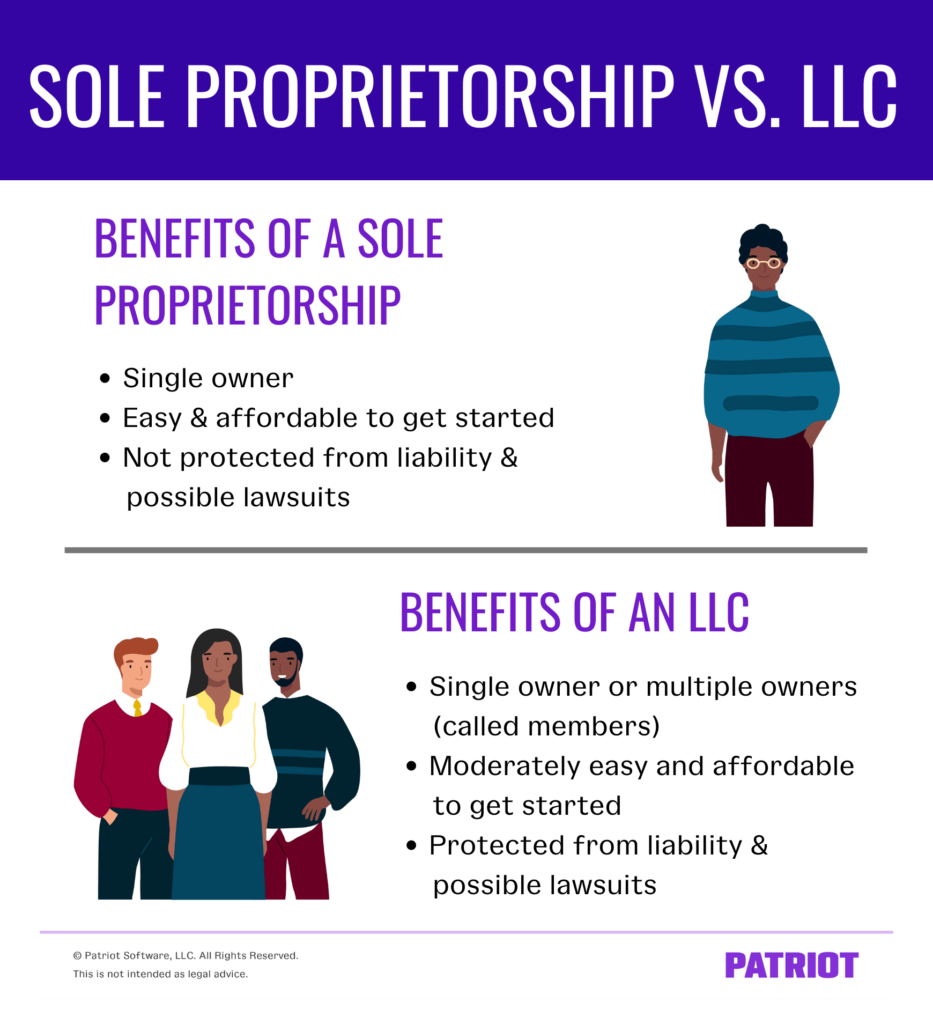

Sole proprietorship vs. LLC

The difference between sole proprietorship and an LLC can be difficult to understand. But, these differences can change the day-to-day operations of your business in big ways.

Some factors to consider before you choose between sole proprietorship and an LLC include:

- Startup costs

- Federal and state regulations and how they could impact you

- Liability protection

- Tax implications

- The future needs of your business

What is a sole proprietorship?

A sole proprietorship is a business owned and operated by one person. There is no difference between the business owner and the business with a sole proprietorship. Sole proprietorships are easier than LLCs to form and require the least amount of paperwork.

In fact, if you did absolutely nothing, you’d have a sole proprietorship by default, simply because you run a business.

Consider the following benefits of structuring as a sole proprietorship:

- There’s almost no paperwork, so it’s simple to get started.

- There are no upfront costs.

- It’s just you at the top (no need to ask anyone for permission).

However, the simplicity of this type of business entity comes with some risks:

- You are personally responsible for any business debts, which can put your personal assets at risk.

- It can be difficult to raise capital because there are no incentives to help lure outside investors.

- You can be sued directly because of your business’ or employees’ actions.

What is a limited liability company?

A limited liability company is different from sole proprietorship in many ways, including setup and the flexibility it allows your business. The most important difference is that an LLC gives you liability protection—you aren’t personally responsible for any debt or other liabilities.

An LLC is more difficult to set up than a sole proprietorship, but the benefits may outweigh these complications:

- LLCs allow for multiple members, with different shares in the company.

- Structuring as an LLC protects you from liability and possible lawsuits.

- You decide the management structure of the business.

- You can choose to become an S corporation.

Possible drawbacks with an LLC:

- Limited liability protections can change if your company fails to comply with state regulations, maintain proper records, or maintain the proper separation of personal and business assets.

- It can be difficult to lure investors. Depending on how you’ve structured your business, some investors may feel that there isn’t enough accountability.

- Pass-through taxation may be an issue if dividends aren’t distributed to members of the LLC—they’ll have to pay taxes in proportion to the profits and losses regardless.

Which is best for you: LLC vs. sole proprietorship?

So now that you know the basics, let’s see how the two compare when it comes to:

- Taxes

- Compliance

LLC vs. sole proprietorship taxes

Sole proprietorship and a single-member LLC are similar when it comes to taxes. Neither pays income tax because they are “pass-through” entities. The taxes “pass through” to the owner and their personal tax return. To report the business’s income, attach Schedule C to your personal tax return.

LLCs with multiple members share the burden of taxes in some ways. The taxes still “pass through” to individual members according to their share of the business’s income. A multi-member LLC must file Form 1065, U.S. Return of Partnership Income, with the IRS. And, individual members must also attach a Schedule K to their personal tax return, showing their share of the business’s income.

Both of these business entities pay the general taxes of running a business. You’ll need to pay payroll taxes for your employees. If you sell taxable goods or services, you’ll need to collect state and local sales tax. And because you’re self-employed, you must pay self-employment taxes to the IRS.

Compliance: Sole proprietorship vs. LLC

As mentioned earlier, a sole proprietorship is extremely easy to get off the ground when it comes to paperwork.

Depending on the services that you offer, you’ll need to apply for business permits and licenses as well. These can be at the federal, state, county, and/or city levels. For instance, you need a federal license to open a bar. States generally regulate a more diverse set of business activities, from vending machine sales to operating an auction. For more information on licenses and permits, check out the Small Business Administration’s website.

The paperwork to start your LLC can be a little intimidating. Depending on your state, LLCs may have to file annual reports.

If your LLC has multiple members, you may need to:

- Draft an operating agreement

- Issue membership units (similar to stock shares)

- Keep track of transfers of ownership and hold member meetings

These actions will help keep your LLC active so everyone involved can keep enjoying liability protections.

Requirements for LLCs can vary state by state, so make sure to visit your Secretary of State’s website.

Getting started setting up your business entity

Now you’re ready to take the plunge. Here’s what you need to know to set up the business entity that suits your needs.

How to set up a sole proprietorship

If you choose to set up a sole proprietorship, there is no need to file entity formation papers with the state. But again, you may need to obtain the proper licenses and permits, which can vary by industry, locality, or state.

If you plan to run your business under your own name (e.g. Arnold Palmer) you don’t have to file any new paperwork. But if you want to operate under a more creative name (e.g. Birdie’s soft drinks), you must file for a DBA (“doing business as”) in your state of operations.

How to set up a limited liability company

Sure, setting up an LLC is more complicated than a sole proprietorship, but it isn’t rocket science.

To get started, you must:

- Decide on a unique business name

- Get a copy of your state’s LLC Article of Organization Form

- Prepare the LLC Article of Organization form and file

- Create an operating agreement

- Designate a registered agent to receive official or legal documents

- Keep your LLC active

Because an LLC has to register its name with the state, you won’t need to file a separate DBA.

This is not intended as legal advice; for more information, please click here.