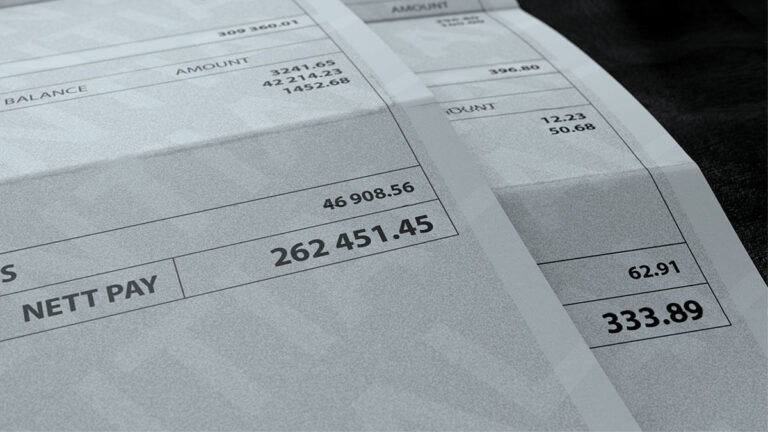

There are a lot of things to keep track of as a business owner, with payroll taxes being one of them. The IRS requires you to withhold payroll taxes on your employees’ earnings and also contribute payroll taxes. This process can be complicated if you aren’t prepared. Read on to learn the difference between income […]

Read More How to Pay Payroll Taxes: A Step-by-step Guide