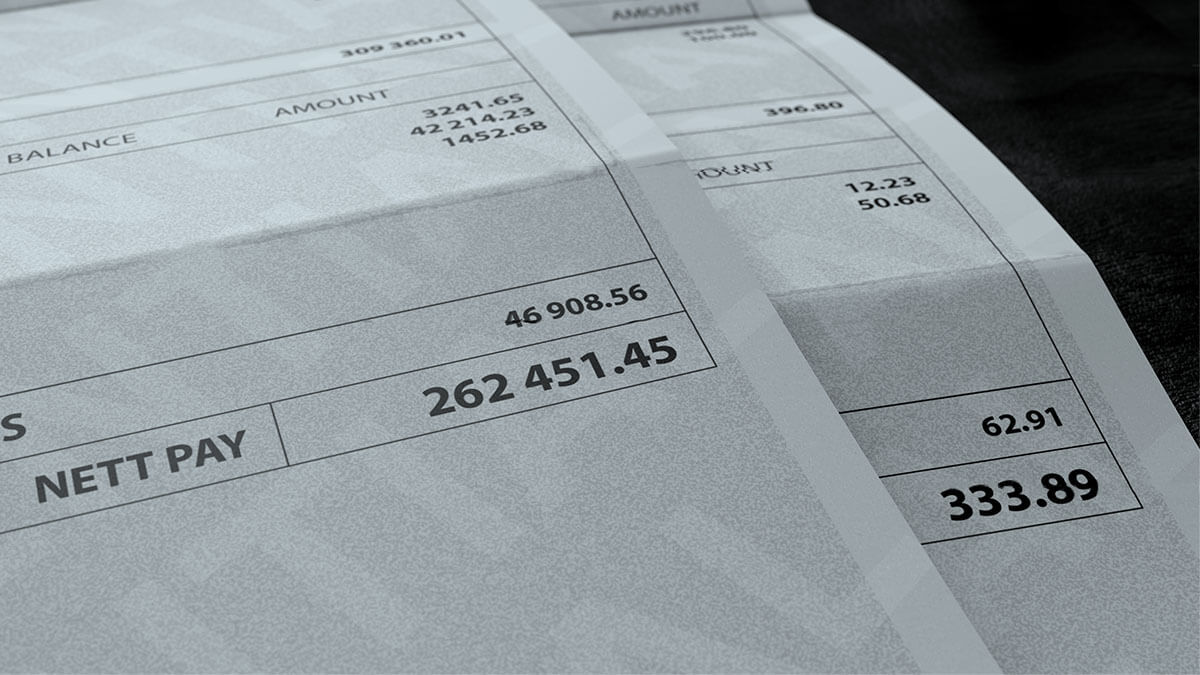

No matter when you cut your checks for your employees, paychecks usually come with a pay stub. A pay stub, or check stub, explains details about your employee’s pay.

Depending on where your business is located, you may also have to share information about the employee’s paid sick leave. This article will explain sick balance on paycheck requirements and list the states and cities that require this additional information.

What are pay stubs?

Pay stubs are summaries of an employee’s wages (gross and net pay) as well as their taxes and deductions. Pay stubs are either attached to the paycheck or come on a separate document presented with the paycheck. Paystubs generally detail:

- Gross wages

- Employee taxes

- Deductions

- Employer contributions

- Employer taxes

- Net pay

Do you have to show sick leave on payslip? Since there isn’t a federal law for pay stub requirements the answer isn’t straightforward. Pay stub requirements operate at the state or city level, creating a bunch of requirements depending on your location.

Some states and cities have sick balance on paycheck requirements, while others let you choose to include the information or not.

But before we get into the list of states and cities and their requirements, it may help to know the difference between paid time off (PTO) and paid sick leave.

Is there a difference between PTO and paid sick leave?

Both paid time off and paid sick leave offer employees ways to take time off from work while still getting paid for the qualified amount of hours. The two types of paid time off do have their differences. PTO covers a large array of paid time off such as vacation, sick leave, and personal leave. Think of PTO as a general bank of all the different reasons an employee may take time away from work while still getting paid.

Sick leave is specifically reserved for those days that an employee’s sick and shouldn’t come to work.

No federal law requires employers to offer paid sick leave to their employees. Like pay stub requirements, paid sick leave laws by state can differ.

Sick balance on paycheck requirements by state

So, does sick leave have to be shown on payslips? Again, because there is no federal law for pay stub requirements or sick leave, it can be tricky to know what your requirements are. You may have to offer sick leave or information concerning sick leave on employee pay stubs. To make it even more confusing, having sick leave laws doesn’t mean you also have sick balance on paycheck requirements.

To help clear up this confusion, we’ve made a list of states and cities that offer paid sick leave and require or allow employers to provide the appropriate pay stub information.

The following states either require or allow employers to present employee paid sick leave information on pay stubs. Each state has unique employer requirements regarding accrual rates, annual rollover of accrued paid sick time, and rules for informing employees of their rights. Please refer to your state’s department of labor for more details.

States that require sick leave information on pay stubs

Two states have strict sick balance on paycheck requirements.

Arizona

Under the Fair Wages and Healthy Family Act, your employee pay stubs must detail the amount of:

- Employee sick time for the current year

- Sick time used by the employee to date in the year

- Pay the employee has received as paid sick time

California

The Workplace Healthy Family Act of 2014 requires you to show the number of sick leave days available to the employee, either on a pay stub or on a document issued the same day as the paycheck.

States that allow sick leave information on pay stubs

A few states require you to present paid sick leave information to employees at different times during the year but don’t require that information on a pay stub. Although you don’t have to present the paid sick leave information on each pay stub, doing so satisfies the state requirement and can help you stay organized.

Oregon

The state legislature of Oregon requires that paid sick leave information be given to employees quarterly. While the state doesn’t require you to provide this information on an employee’s pay stub, you can. This information includes the amount of accrued and unused sick time.

New Mexico

The Healthy Workplaces Act requires you to provide employees with information about their paid sick leave every quarter. You don’t have to provide paid sick leave information on a pay stub, but you can.

If you offer paid sick leave information on a pay stub, make sure to present an accurate year-to-date summary of:

- Number of hours worked

- How much paid sick leave has accrued

- How much paid sick leave has been used

Washington

Initiative 1433 requires that you inform employees about their paid sick leave every month. You don’t have to provide paid sick leave information on a pay stub, but you can.

If you offer paid sick leave information on a pay stub, make sure you offer an accurate year-to-date summary of:

- How much paid sick leave has accrued

- How much paid sick leave has been used

- The amount of paid sick leave still available for use

Which cities have pay stub requirements for sick leave?

The following cities either require or allow paid sick leave information on pay stubs. Each city has unique employer requirements regarding accrual rates, annual rollover of accrued paid sick time, and rules for informing employees of their rights. Please refer to city ordinances for more information.

Cities that require paid sick leave information on pay stubs

A few cities require you to inform employees of the status of their paid sick leave when paychecks are issued. While you can provide this information through an online system (e.g., an employee portal), pay stubs are also a possibility.

NYC

New York City’s Paid Safe and Sick Leave requires you to provide the following information when a paycheck is issued:

- Paid sick leave the employee’s accrued

- Paid sick leave they’ve used

- How much paid sick leave is still available for use

Seattle

Seattle’s Paid and Sick Time Ordinance requires you to inform employees about their paid sick leave each time wages are paid. You should provide the following information:

- Paid sick leave they’ve accrued

- Paid sick leave they’ve used

- How much paid sick leave is still available for use

Cities that allow paid sick leave information on pay stubs

The following cities allow employers to print paid sick leave information on pay stubs, present it with employee paychecks, or provide it on demand.

Not all of these cities require you to provide employee-specific information. Instead, the information you provide may be general.

Chicago

Chicago’s Ordinance No. 02021-2182 amended the city’s Paid-Sick-Leave law. The new ordinance requires you to offer a printable notice to your employees with their first paycheck and with each annual paycheck printed on or following July 1.

The notice should be scaled to fit on an 8×11 piece of paper and presented with the employee’s paycheck. If paychecks are electronic, employers can deliver the notice through the usual electronic medium (e.g. email, Slack, etc.).

This notice is general and does not include any information about accrued, used, or remaining paid sick leave for an employee.

Minneapolis

Minneapolis’s Sick and Safe Time Ordinance requires you to record employee paid sick and safe time and offer this information to employees whenever requested. You can choose to offer sick and safe time information on each employee pay stub you issue.

You must provide the current amount of:

- Accrued sick and safe time available for use

- Used sick and safe time

Pittsburgh

Pittsburgh’s Paid Sick Days Act recommends that you provide the following information when you issue a paycheck:

- How much paid sick leave has accrued

- How much paid sick leave is available for use