With the passage of the Healthy Delaware Families Act (the Act), Delaware became the 11th state to guarantee paid parental, medical, and military leave for employees. Delaware paid family leave (PFL) touches the lives of both employees and their employers. While the Act won’t go into effect until 2025, there are a number of things you need to know as an employer.

This article will explain the finer details of the law—who it covers, who pays, and what the new law means for employers in the state of Delaware.

Getting to know the Healthy Delaware Families Act

The Healthy Delaware Families Act provides statewide paid parental, medical, and military leave for eligible Delaware workers. Eligible workers can get up to 12 weeks of paid family or medical leave to:

- Bond with a new child

- Care for a serious health condition

- Care for a family member (i.e., spouse, parent, or child) with a serious health condition

Eligible employees can also get up to six weeks of paid military leave to address the impact of a family member’s military deployment.

The Federal Medical Leave Act (FMLA), is a federal law similar to the Act. But there’s one key difference: FMLA offers 12 weeks of unpaid leave. Delaware paid family leave goes further to financially help eligible Delaware employees.

How much do employees receive?

Beginning in 2026, eligible employees on leave can receive 80% of their weekly wages, with a minimum of $100* a week and a maximum of $900 for 2026 and 2027.

After 2027, the state will adjust the weekly maximum for inflation each year.

*If an employee’s average weekly wage is less than $100 a week, the weekly benefit will be the same as the full weekly wage.

Which employees are covered?

For an employee to be covered, they must work:

- Mainly in Delaware

- For a covered employer at least 12 months

- At least 1,250 hours for the covered employer in the preceding 12 months

The 1,250 hours may be a bit confusing. Here’s an example to explain how this might work. Let’s say your employee works mainly in the state of Delaware and has been with your company for two years. But during the last year, your employee had to drastically reduce their hours. They can still be eligible for the Act if they worked at least 24 hours per week for the preceding 12 months or worked full time for a little over 32 weeks.

There are, of course, any number of scenarios for how your employee can work “at least” 1,250 hours for the year. Keep this in mind if your employees decide to expand their family or suddenly become ill—even though they reduced their hours before applying for leave, they can still benefit from the Act.

If your employee primarily works outside the state, they are not entitled to benefits.

Word to the wise: Make sure your employees know how critical it is that they accurately fill out their applications for leave—they can’t fudge any of the information. If anything is incorrect, or worse, seems willfully misleading, employees may be accountable for fraud. If that happens, they can be subject to penalties, forced to make repayments, and disqualified from benefits for three years.

Understanding the 12-week maximum

Regardless of the reason for an employee’s leave, 12 weeks per year is the maximum amount of paid leave covered by the Act. In other words, an employee can use family and military leave during the year, as long as it doesn’t exceed the 12-week maximum.

The same type of reasoning applies if you employ two members of the same family that want to take their leave during the year. If this happens, you can choose to limit the total number of weeks the two take together to not exceed 12 weeks total. The two employees could then split the 12-week total between themselves however they saw fit.

Which employers are covered?

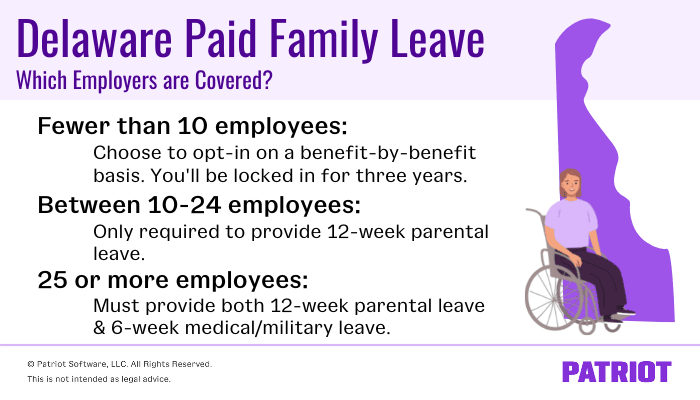

The act doesn’t cover all employers. You must pay into the Delaware PFL if you have 10 or more employees. But because the Act has a headcount requirement, the number of employees you have during the preceding 12-month period impacts your leave requirements. If you have:

- Fewer than 10 employees: You can choose to opt-in on a benefit-by-benefit basis, but doing so will lock you in for three years.

- Between 10 to 24 employees: You are only required to provide 12-week parental leave.

- 25 or more employees: You must provide both 12-week parental leave and 6-week medical/military leave.

There are some notable exceptions:

- If you’re a covered employer who has your own approved leave benefit plan, you may be exempt from the requirements of the Act.

- Seasonal and part-time employees (working less than 1,250 hours for the year) don’t count toward the overall headcount requirement.

- If your business is completely closed for at least 30 consecutive days in the year, you are exempt from the Act.

How much are contributions?

Delaware PFL is both an employer and employee tax. However, employers can choose to cover the entire tax.

The total contribution amount, split between employers and employees, is 0.8%. This 0.8% goes a long way:

- 0.32% goes to parental leave

- 0.40% goes to personal medical leave

- 0.08% goes to caregivers and military leave

You can deduct up to half of this 0.8% total from employee wages (i.e., up to 0.4%).

This tax doesn’t go into effect until January 1, 2025, a full year before your employees can benefit from the Act in 2026.

When the time comes, employers must remit their quarterly contributions to Delaware’s Department of Labor or face a penalty of at least $1,000 for each violation.

What do employers need to know?

As a qualifying Delaware employer, you need to take care of a few things to comply with the law. Make sure you provide written notices (e.g. a poster in a conspicuous place) to employees explaining the benefits of the law, their rights according to the law, and your duties as described in the law. The Delaware Department of Labor can provide a poster for you to use.

Also, provide the information to employees when:

- You hire them

- They request covered leave

- You learn that an employee may request leave

When an employee makes a request for leave, you need to act quickly. Approve or deny it within five days. If you deny it, you must offer a reason to your employee. If you approve it, let the Delaware Department of Labor know within three business days.

What happens if you don’t follow the law?

As a business owner, it may sometimes feel inconvenient if an employee needs to take three months off. How do you cover their hours and make sure that their projects are taken care of? What if the whole thing falls apart? Relax, take a deep breath, and help your employees live their lives.

If you don’t, the Act has anti-retaliation provisions that you may get to learn about in great detail. Covered employees who exercise their right to leave are entitled to their previous position or one with equivalent seniority, status, pay, and benefits once they return to work. If you violate this obligation, you’re liable for any:

- Wages or benefits denied or lost to the employee

- Monetary losses sustained by the employee such as the cost of providing care equal to 12 weeks of wages

So when your employee asks for and is eligible for leave, wish them luck. And when they come back to work, you can:

- Ask them about their new family member (are there pictures?)

- Ask them how they’re feeling

- Thank them for their service

- Simply welcome them back to the team

Final thoughts

2025 may seem like a long way away. But, it’s closer than you think. Use this time to prepare for how the law is going to affect your business. If you have employees who work mainly outside of Delaware, you’ll probably have to comply with multiple (federal or state) family leave laws. FMLA only applies to businesses with 50 or more employees, but different paid family and medical leave laws may cover smaller employers, offer different reasons for leave, and cover a wider (or smaller) range of family members. Maryland’s Time to Care Act is a good example—it covers leave to care for grandparents and grandchildren. The Healthy Delaware Families Act doesn’t cover grandparents or grandchildren (only spouses, parents, and children).

Spend this time to make sure you’ve got everything covered. And then when the time comes, you and your employees will have less to worry about.

If you’re a legal nut and want to dive into the details, take a look at the finalized legislation.

This is not intended as legal advice; for more information, please click here.