Having workers’ compensation insurance isn’t only a smart business move—in most cases, it’s a required one, too. But doling out lump sum payments for workers’ compensation premiums can take its toll on your business. Instead, opt for pay as you go workers’ comp.

Workers’ compensation insurance basics

What is workers’ compensation? Workers’ compensation is a state-mandated insurance that protects your business if an employee gets sick or injured on the job. An injured or sick employee receives workers’ compensation benefits to cover expenses like medical bills, job retraining, and pay while away from work.

The majority of states require that businesses have workers’ comp insurance. However, some states allow businesses with a certain number of employees to elect coverage.

Many states offer workers’ compensation insurance through a state-operated fund. And, there are many private providers who offer workers’ compensation coverage.

Generally, employers can purchase workers’ compensation insurance from any provider they want (state or private). However, employers in North Dakota, Ohio, Washington, and Wyoming are required to purchase insurance directly from the state. These four states are known as monopolistic states.

What is pay as you go workers’ comp?

Pay as you go workers’ compensation allows you to make premium payments each time you run payroll. Your workers’ comp insurance liability is spread out throughout the year.

Traditional workers’ comp plans require large lump sum payments to cover the estimated cost of your liability. But with pay as you go workers’ comp, the amount you pay is based on each payroll you run. If you add or lose employees, your premium liability will change.

Some policy providers choose to offer pay as you go as an alternative to traditional workers’ comp. Unless you live in a monopolistic state, you can enjoy pay as you go workers’ comp.

Benefits of pay as you go insurance

For many business owners, pay as you go workers’ comp is a good alternative to traditional lump sum payments. Here are some of the benefits of pay as you go workers’ comp.

1. Eliminate lump sum payments

Making hefty annual payments can put a strain on your business budget and harm business cash flow management.

Depending on factors like your business locality, industry, and how many employees you have, workers’ compensation can add up. Coverage rates range from $0.74 – $2.74 per $100 in employee wages.

Let’s say your coverage costs $0.80 per $100 in employee wages. You have five employees who will earn a combined total of $225,000. Divide the total wages by $100 to get $2,250. Then, multiply $2,250 by the workers’ comp rate to get $1,800.

Rather than paying the $1,800 at one time, you could make incremental payments each time you run payroll to ease your financial burden.

2. Pay accurate premium amounts

Traditional workers’ compensation insurance premiums are based on estimates. You must project what your payroll will be for the year and pay it upfront. At the end of the year, your insurance provider either refunds you the difference or requests further payment.

With pay as you go workers’ comp insurance, your payments are not estimates. Instead, you pay the money you owe based on your payroll. This lets you pay accurate premium amounts and avoid over- or under-estimating.

Knowing exactly how much your workers’ comp should be is difficult to predict. You might decide to hire or let go of some employees, which can affect your rate. With pay as you go workers’ compensation, you pay the amount you owe for each payroll you run.

Because of accurate premium amounts instead of estimates, you can enjoy a simplified audit process.

3. Automate workers’ comp payments

You have a million and one things to do. Though necessary, remembering to make payments can slip your mind.

But with pay as you go workers’ compensation, your policy provider can automatically collect your premiums each payroll. Each time you run payroll, your policy provider will debit your bank account.

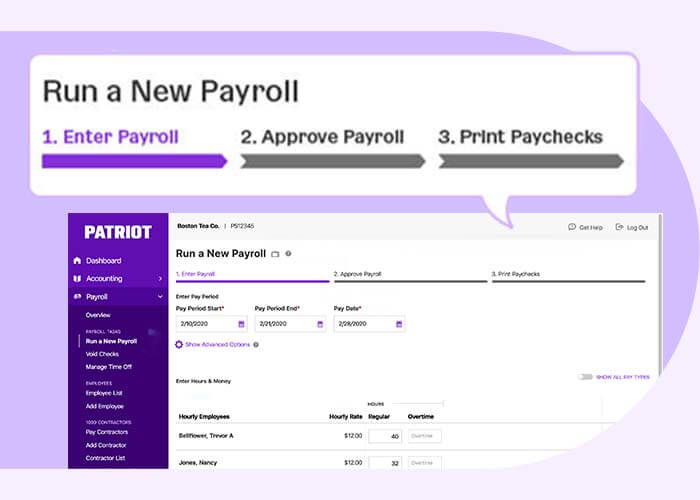

Simplify your employer responsibilities with pay as you go workers’ comp. Patriot Software is fully integrated with pay as you go workers’ compensation premiums. As an online payroll software customer, you can enjoy all the benefits pay as you go workers’ comp has to offer. Try it for free today!

This article has been updated from its original publication date of April 18, 2018.

This is not intended as legal advice; for more information, please click here.