As a small business owner, you have many accounting responsibilities, like tracking your business transactions, income, and expenses. And on top of juggling these tasks, you must also understand which basic accounting forms are relevant to your small business.

Basic accounting forms

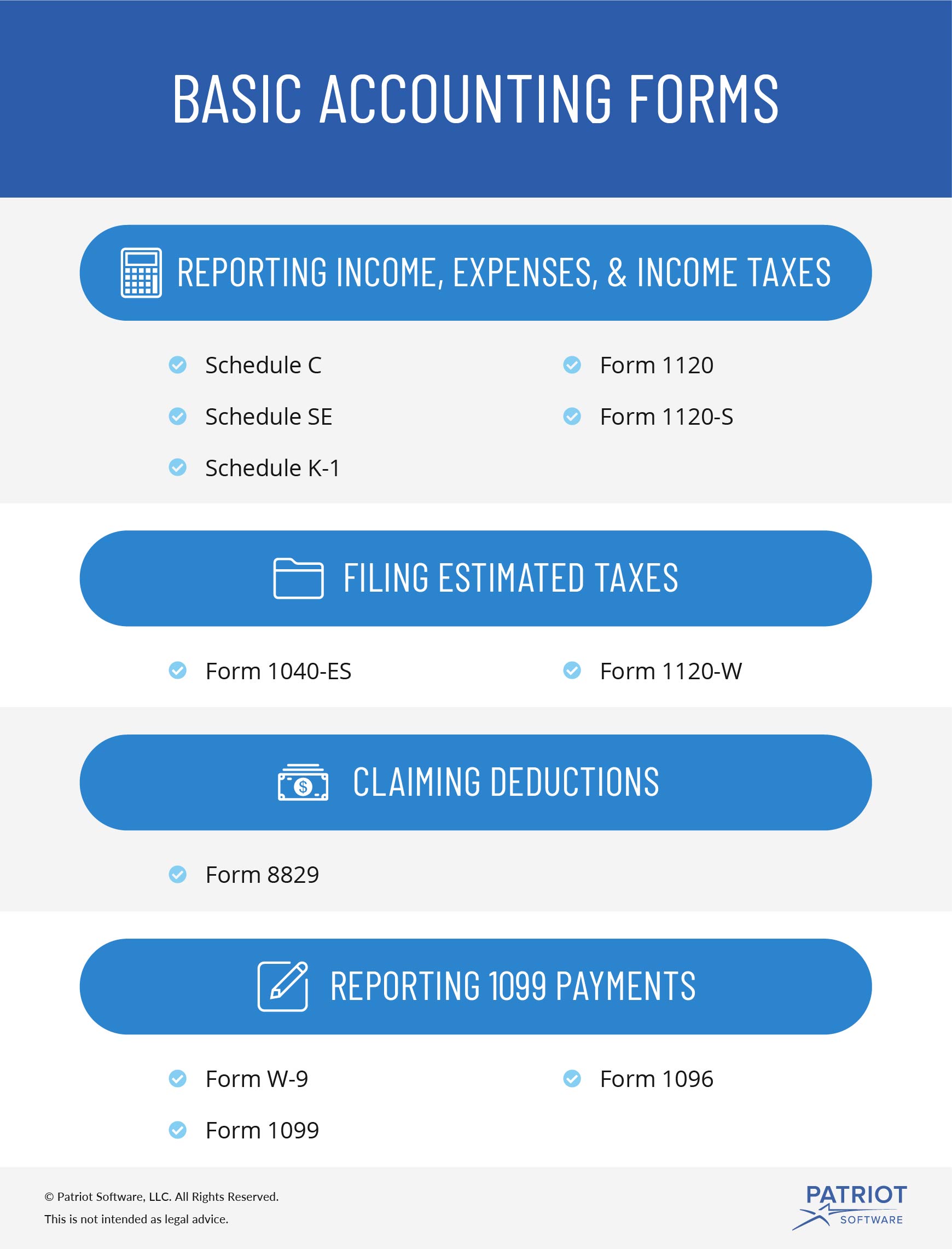

Small business accounting forms can be broken down into various categories. Some categories include reporting income and expenses, filing estimated taxes, claiming deductions, and reporting 1099 payments. Explore the different sections below and learn more about the different types of accounting forms.

Reporting income, expenses, and income taxes

When you do basic accounting, you need to file certain forms to report things like income taxes and how much your company earns and spends. Some forms you file vary depending on your type of business structure. Here are five forms for filing federal income tax returns.

Schedule C

Schedule C, Profit or Loss from Business, reports how much money your business made or lost during the tax year.

Sole proprietors who own and operate their business must file Schedule C. And if you’re the sole owner of a limited liability company (LLC), you must file a Schedule C, too.

To complete Schedule C, gather information such as your business’s balance sheet, profit and loss statement, inventory information, and expense details (e.g., travel).

Sole proprietors and single-member LLCs must file Schedule C by April 15 each year.

Attach Schedule C to Form 1040, U.S. Individual Income Tax Return.

Schedule SE

Along with Schedule C, sole proprietors and single-member LLCs typically must also fill out Schedule SE, Self-Employment Tax.

Use Schedule SE to calculate what you owe in self-employment tax, based on your Schedule C form.

You must file Schedule SE if you’re self-employed and earn $400 or more in net profits during the tax year.

File Schedule SE annually with your individual income tax return, Form 1040. Schedule SE is also due by April 15 each year.

Schedule K-1

If you own a partnership or multi-member LLC, report income and expenses on Schedule K-1 (Form 1065), U.S. Return of Partnership Income.

Partnerships are considered pass-through entities. This means that the tax passes through to each of the business’s partners. Then, partners show their portion of the business’s income and expenses on their personal income tax form.

Each partner or member must file their own Schedule K-1. Attach Schedule K-1 to Form 1065 to report your share of the business’s income and expenses.

The deadline to file Schedule K-1 is April 15.

Form 1120

Corporations use Form 1120, U.S. Corporation Income Tax Return, to report income and expenses. Form 1120 is also used to calculate the business’s federal income taxes.

Corporation year-end dates can vary depending on what the business chooses.

Corporation tax returns are usually due on the 15th day of the fourth month after the end of the company’s fiscal year. This means that a business with a year-end date of December 31 must file and pay taxes by April 15.

However, if your company’s fiscal year ends June 30, you must file Form 1120 by the 15th day of the third month.

Form 1120-S

S Corporations, also known as S Corps, only pay taxes on personal income. S Corps must file Form 1120-S, U.S. Income Tax Return for an S Corporation.

Typically, an S Corp has a year-end date of December 31. The tax return due date for Form 1120-S is March 15.

Filing estimated taxes

Some businesses must pay estimated taxes on income that’s not subject to withholding. The form your business files depends on whether or not you’re self-employed.

Form 1040-ES

Self-employed individuals use Form 1040-ES, Estimated Tax for Individuals, to send estimated taxes to the IRS.

Use Form 1040-ES if your tax liability is $1,000 or more for the tax year. Do not make estimated payments if you do not owe more than $1,000 in taxes.

Form 1040-ES includes a worksheet to help you calculate your estimated taxes.

Pay your estimated tax by April 15 each year. Or, you can opt to pay them in four equal installments throughout the year. If you choose to pay using installments, your first payment is due when you file your return. And, your first payment should be 25% of your estimated tax total.

Form 1120-W

Corporations use Form 1120-W, Estimated Taxes for Corporations, to report estimated taxes. If you are a part of a corporation that has a tax liability of $500 or more for the tax year, file Form 1120-W.

Form 1120-W is due April 15 each year.

Claiming deductions

Your business may be able to claim deductions for expenses, such as supplies and home office expenses. In most cases, you must deduct certain business expenses on your tax form. However, you likely need to use a separate form also, like Form 8829.

Form 8829

Use Form 8829, Expenses for Business Use of Your Home, to report and claim a home office tax deduction. Self-employed individuals can use Form 8829.

If you have space in your home devoted solely to your business, file Form 8829.

Form 8829 helps you determine what business expenses you can deduct from your taxes. File Form 8829 with your annual tax return.

Reporting 1099 payments

If you have independent contractors who work for your business, report their wages as 1099 payments. Independent contractors are temporary workers and require different forms than employees.

There are a few forms you must be aware of if you pay independent contractors, including Forms W-9, 1099, and 1096.

Form W-9

Form W-9, Request for Taxpayer Identification Number and Certification, is like Form W-4, but for independent contractors. Provide Form W-9 to workers you classify as independent contractors. Use information from Form W-9 to accurately fill out Form 1099-NEC.

On Form W-9, independent contractors must provide their name, business entity (e.g., partnership), exemptions, address, and their Social Security number or Employer Identification Number.

Do not withhold payroll taxes from an independent contractor’s wages. However, you need to report nonemployee compensation to the IRS.

Form 1099

If you have independent contractors instead of employees, fill out Form 1099-NEC, Nonemployee Compensation. Use Form 1099-NEC to report payments made to nonemployees.

Fill out the form for independent contractors you paid $600 or more throughout the calendar year.

There are several copies of Form 1099-NEC, including Copies A, B, C, 1, and 2.

You must send Form 1099-NEC to contractors by January 31. Send Copy B to your contractors for their records. And, send Copy 2 so independent contractors can file their state income tax returns, if applicable.

Submit Copy A to the IRS by January 31. Keep Copy C for your records. If applicable, send Copy 1 to your state’s tax department.

You might also make miscellaneous payments, such as rent. If applicable, file Form 1099-MISC, Miscellaneous Information.

Form 1096

When you submit Form 1099-NEC to the IRS, also include Form 1096. Form 1096 is the summary of all Forms 1099-NEC you file. Include the total amount of contractor payments from Forms 1099-NEC on Form 1096.

Only send Form 1096 to the IRS. Form 1096 is due along with Forms 1099-NEC by January 31.

If you file Form 1099-MISC, also include Form 1096 to summarize all 1099-MISCs.

Basic business accounting forms rules

Keep in mind that business tax return due dates can vary depending on your type of business.

Be sure to file all your required IRS small business forms on time to avoid penalties. For more information about different accounting forms and regulations, visit the IRS’s website.

Looking for an easy way to organize your financial records and make filing your accounting forms a breeze? Patriot’s online accounting software streamlines your accounting process. And, our free, expert support is only a call, email, or chat away. Get started with your self-guided demo today!

This article has been updated from its original publication date of December 8, 2015.

This is not intended as legal advice; for more information, please click here.