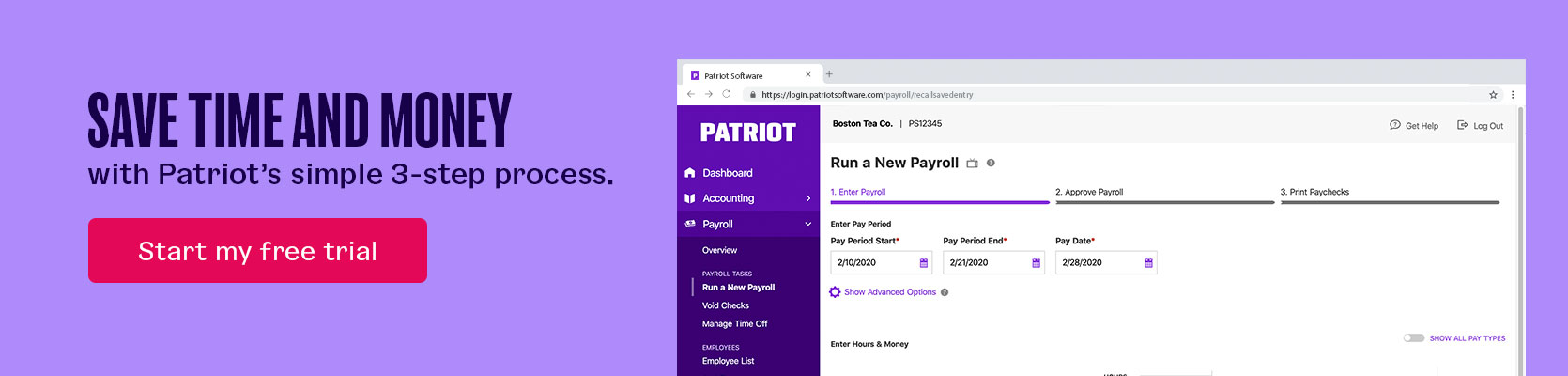

When you have a business, you need a way to identify it. That way, you can submit payroll forms or tax returns, open a business bank account, establish a retirement plan, and more. So, how do you identify your business? You need a taxpayer identification number (TIN). Read on to learn what is a taxpayer […]

Read More What Is a Taxpayer Identification Number?