There are many unknowns of business. You won’t know exactly how much revenue you will bring in or how many hidden costs of running a business you will encounter. But, you should be prepared for the unknowns. With traditional budgeting, you can set goals for your business and predict your profits.

What is traditional budgeting?

Traditional budgeting is the process of projecting your business’s revenue and expenses for the upcoming year based on your previous budget. A budget is an accounting tool that helps you predict and analyze your business’s earnings and expenses. By looking at your previous budget, traditional budgeting gives you a template to justify your predictions.

Your business tries to stick to its budget as closely as possible and avoid overspending. Having fewer expenses and/or more sales than your predictions is a good sign for your company.

Traditional budgeting isn’t the only type of budget you can create for your company. You can also use create a zero-based budget.

Zero-based budgeting, means you make your budget from scratch each year. Traditional budgeting takes considerably less time than zero-based budgeting because you have a template from the previous year.

Traditional budgeting process

The traditional budgeting system revolves around projecting sales and revenue, estimating expenses, and predicting profits. If you are an established business, use your previous year’s budget and adjust for inflation and changes in your business.

You can start the traditional budgeting process by looking at your previous budget’s revenue. How did your business’s actual revenue compare to the budgeted revenue? Make changes based on your actual earnings as well as changes in your business pricing strategy.

Next, you need to determine your business’s expenses. Look at both your fixed and variable expenses. Fixed expenses (e.g., rent) are the same each month while variable expenses (e.g., supplies) change each month. Examine your previous year’s expenses and take into account any changes in your expenses.

Lastly, project your business’s profits. You can find your projected profit by subtracting your estimated expenses from your estimated revenue.

If you have multiple departments or divisions, you will have different budgets (e.g., marketing). Your managers are in charge of their individual department’s budget. And, you will have an overall budget for your business that includes the total for each section.

Track your outcomes monthly or quarterly and compare with your projections. This can help you make changes to your company’s spending for the rest of the year.

Traditional budgeting advantages and disadvantages

As a business owner, you need to be in charge of your finances. Creating a budget is one way to stay on top of your expenses. But, is traditional budgeting the right path for you? Compare the advantages and disadvantages.

Advantages of traditional budgeting

Traditional budgeting can greatly benefit your business.

A traditional budget helps with decision making. Because a budget makes it easier to spot issues, you can decide to make changes to your business. If you are exceeding your budgeted expenses, you can cut back and reduce business expenses that you deem unnecessary. Or, you can decide to look at other vendors for better prices. Basically, a traditional budget gives you a game plan for how to operate your business.

Traditional budgeting is also important if you try to obtain financing. Investors and lenders want to see your financial plans and projections before investing in your company or giving you a loan. With a traditional budget, you can show them your projections and back up your reasoning by referencing your previous year’s budget.

Disadvantages of traditional budgeting

There are also criticisms of traditional budgeting.

Traditional budgeting might be an inaccurate representation of goals you want to reach. Some managers or even business owners can manipulate the projections so the actual results look more attractive. Although this may boost spirits, this won’t help your business in the long-run.

Creating a traditional budget takes less time than a zero-based budget, but it is still time consuming. You need to pour time into analyzing your previous year’s budget and actual results. And, you need to determine changes you need to make within your new budget. This takes away from the time you need to spend running your business.

Traditional budgeting example

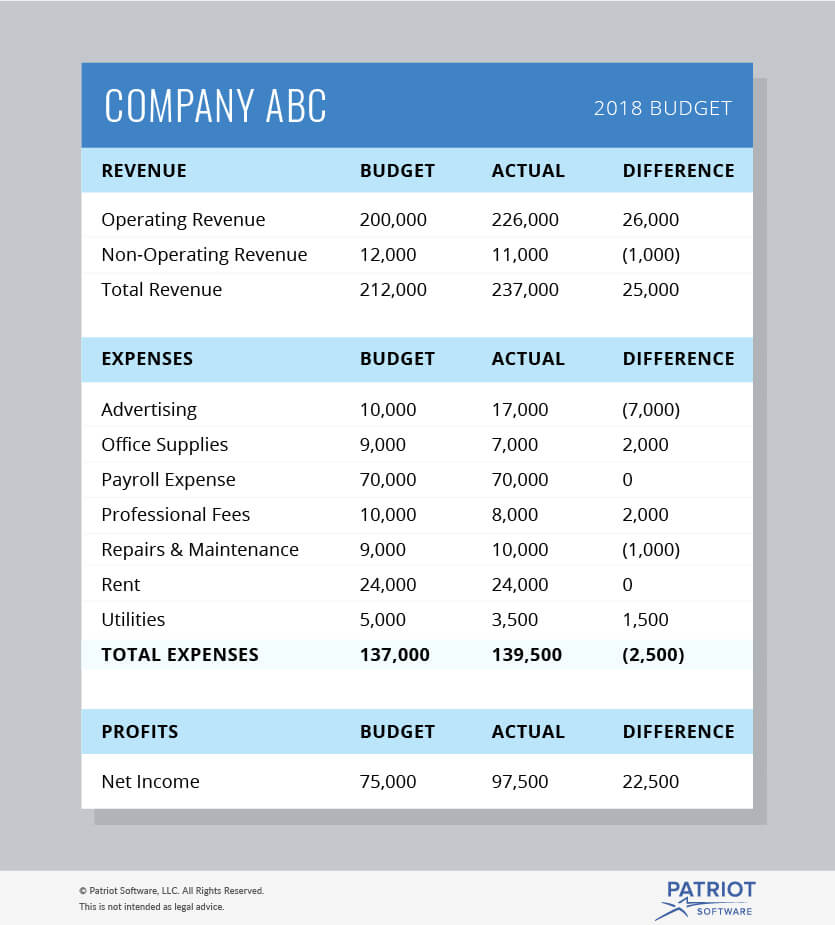

Here’s an example of a simple traditional budget:

Create your traditional budget by using data from software. Patriot’s online accounting software tracks your expenses and income. And, it’s made for the non-accountant. Get your free trial today!

This is not intended as legal advice; for more information, please click here.