Here’s a payroll question: How do you differentiate between employees and independent contractors? It all depends on the relationship between the employer and the worker. It’s important to properly classify workers, but it can be tricky. Here’s an example: Joe runs his own construction business. Joe has committed to more construction jobs than he can handle, […]

Read More Independent Contractor vs. Employee Classification [With Infographic]Kaylee DeWitt

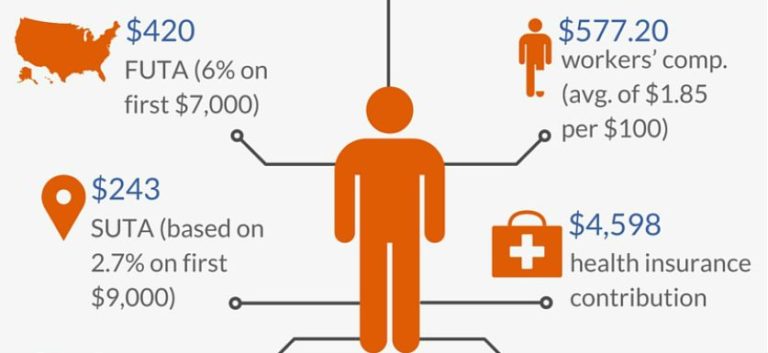

How Much Does an Employee Cost? Find Out on This Infographic.

The greatest expense for small business owners is often payroll. There can be a lot of additional hidden costs of running a business as well. Did you know that when you hire employees, you have to pay more than just their wages? Before hiring your first employee or otherwise adding to your staff, it is important […]

Read More How Much Does an Employee Cost? Find Out on This Infographic.

Basic Payroll Tips for Handling Holiday Gifts to Your Employees

It’s the holiday season. Depending on your business, you might be in the midst of holiday sales and special offers. You might have decked your office or retail space with festive decorations to show holiday spirit to customers. But, what about your employees? You want to show them some holiday cheer, too. Perhaps you organize […]

Read More Basic Payroll Tips for Handling Holiday Gifts to Your Employees

How to Calculate Overtime Pay for Salaried Employees

Even if you pay an employee a salary, you might owe them overtime wages. When are salaried employees eligible for overtime pay? There are two types of employees: exempt and nonexempt. These classifications refer to whether an employee is exempt from overtime wages or not. You must pay overtime wages to nonexempt employees. You do […]

Read More How to Calculate Overtime Pay for Salaried Employees

Small Employer Redefined Under ACA

President Obama recently signed the Protecting Affordable Coverage for Employees (PACE) Act. PACE changes the Affordable Care Act’s (ACA) definition of a “small employer.” News was released in December of 2015 that ACA deadlines will be extended. Businesses with 51-100 full-time employees were supposed to move into the small group market on January 1, 2016. […]

Read More Small Employer Redefined Under ACA

Patriot Software CEO Interviewed for FitSmallBusiness.com

Mike Kappel, CEO of Patriot Software, LLC, was interviewed for a FitSmallBusiness.com article that discusses the implications of the U.S. Department of Labor (DOL) notice on small business owners. In July 2015, the DOL issued a notice that included a clearer test to determine which workers are employees and which workers are independent contractors. Kappel believes […]

Read More Patriot Software CEO Interviewed for FitSmallBusiness.com

Independent Contractor Taxes: What You Need to Know

Are you an employee, or independent contractor? There’s a very big difference when it comes to taxes. Unlike employees, independent contractors do not have taxes taken out of their wages. Instead, you have to remit taxes yourselves. Forms and pre-work requirements Before you do any work, you may need to obtain a tax registration certificate […]

Read More Independent Contractor Taxes: What You Need to Know